In my next few articles, my aim is to guide readers through typical investment decisions and options, hopefully shedding some light on interesting angles and ways to increase your returns.

The buy-to-let market is currently a difficult place. There are numerous tax headwinds, making life especially difficult for higher tax rate earners so it has become even more critical to purchase the right investment. In this article I am not going to focus on the taxation issues but simply the overall gross returns, the investment’s fundamentals.

In past years residential investment was relatively straightforward, especially in London and the South East. Even if you made a poor decision (e.g. paid too much, or bought in the wrong area), huge capital value increases usually helped carry you through to make a decent overall return in the medium/long term. Many people made staggering returns doing properties up and selling them on, even simply ‘flipping’ properties between exchange and completion. With today’s higher and additional stamp duty rates, these ‘easy money’ days have gone – investors will simply have to hold the properties for a longer duration to make sensible returns. Just like the rest of the investment world, quantitative easing has crushed the investment return. Residential property has long been viewed as both a capital and an income play but, with very subdued capital growth going forward, the income element has now become critically important.

Most residential investors though are looking at property as a long-term investment rather than a quick, short-term gain. It is often viewed by many of them as a quasi-pension for later life income or a nest egg for their children/grandchildren but, rather like choosing the right fund to invest in, you have to pick your properties very carefully.

The simple, but costly, mistake most investors make is picking a property in an area that they would like to live in (usually investors are 50+ years old) compared to one in an area the tenants (mostly under 35s) would love to live in. The second key error is brushing over the actual net income generated. Professional investors in stocks and shares focus meticulously on dividend yield and income growth. Property investors need to adopt a similarly disciplined and rigorous approach.

Professional investors in stocks and shares focus meticulously on dividend yield and income growth. Property investors need to adopt a similarly disciplined and rigorous approach.

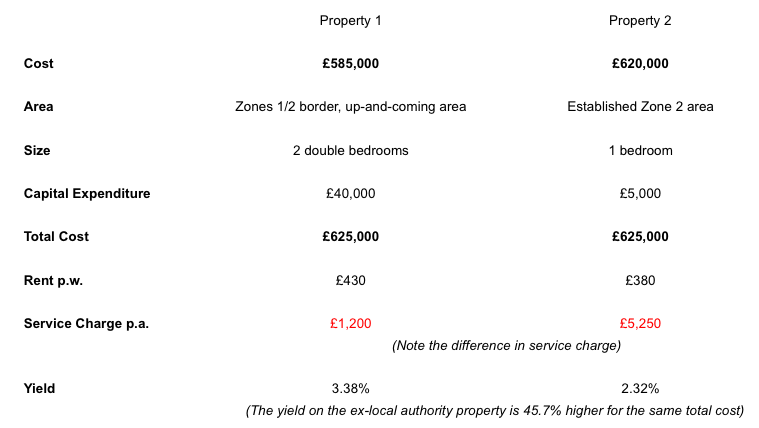

I am using the example below of an investor looking within London, in Zones 1 and 2, with a total budget of £625,000. I am using current examples to try and produce a realistic feel for today’s values and returns. These are all simple gross figures to help make the examples easier to understand – I have therefore not included borrowing, letting/management and stamp duty costs.

Scenario

Property 1 – an ex-local authority two double bedroom flat in an up-and-coming area on the boundary of Zones 1 and 2. It is located on a small low-rise, brick-built estate. The immediate area is undergoing a transport-led regeneration; it is very well served with Tube stations only a few minutes away. The approximate size is 675 square feet and it needs modernising throughout (£40,000 budget to refurbish).

Property 2 – a one double bedroom flat in a modern block built five years ago with a porter, lift and landscaped gardens in an established area of Zone 2. Approximate size is 585 square feet. The property is in good condition (£5000 budget to refresh). It is 12 minutes’ walk to the nearest Tube station.

Both properties are held on long leases with negligible ground rents.

The chart below sets out the basic figures – note the much higher service charge for the flat in the modern, privately-owned block. This is paid by the investor out of their income and eats significantly into the net yield received.

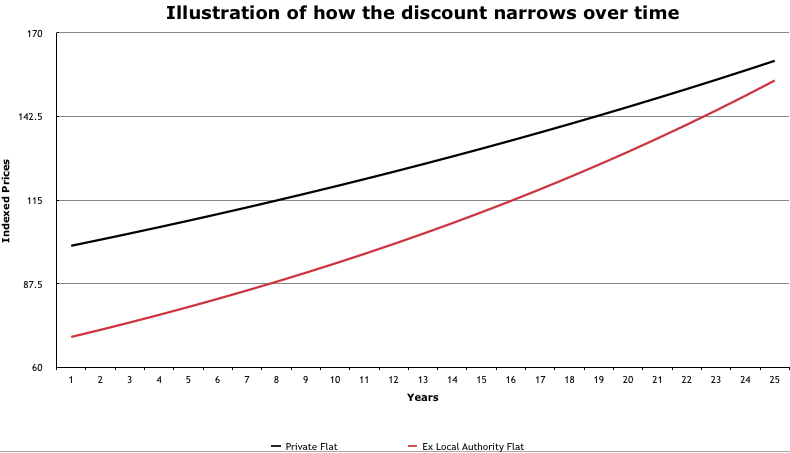

The small local authority estate is in good condition and brick-built so has low maintenance costs. Private ownership currently comprises 50% of the estate and this percentage is growing as the tenants’ Right to Buy option is continually being exercised, but also the local authority is selling stock when the existing tenancies expire. At current rates, the estate will be c.90-95% privately owned in 25 years’ time. As this trend continues, the increase in the capital growth of the flat will outperform the local market’s growth rate as shown below. The discount applied to local properties’ values will narrow effectively from c.30% to c.10%.

The ex-local authority flat also has the benefit of being in a rapidly gentrifying area with enhanced transport links along with new bars, cafes and a shopping centre. This will boost values in the local area by an estimated 0.5% per annum over the long term.

The ex-local authority will therefore grow in capital value by an estimated 3% per annum, whereas the private flat will grow at the market average rate of 2% per annum.

Being well connected, in an improving area, it has greater potential for enhanced rental growth – we would also estimate 2.0% annual growth compared to the general market assumption of 1.5% per annum growth going forward as it becomes increasingly a more desirable place to live.

In 25 years’ time (2042):

Property 1 has increased by 103% and is worth an estimated £1.27 million

Property 2 has increased by 62% and is worth an estimated £1.01 million

Property 1 has generated £692,000 in rent over the period 2017-42, whereas Property 2 has generated just £436,000.

From the same starting investment of £625,000, you therefore are effectively £500,000+ better off in choosing Property 1.

As you can see the out-performance in income and capital growth is only small when analysing an individual year, but over a 25 year period with compounded growth, it makes an incredible difference in both the overall income received and capital gain.

Naturally the above is very much a simple analysis, but hopefully sheds light on the importance of being really thorough in your approach to property investment to maximise your overall return. Small percentage gains when compounded can turn into fabulous long-term out-performance. By targeting select higher-yielding properties in up-and-coming areas, investors can massively out-perform the general market over the longer term.