Since the time of Noah, demographics has always been a friend of real estate. The English economist Malthus made a name for himself by postulating that while food supplies grow arithmetically, population expands exponentially, ultimately leading to food shortages, political strife, and war. While wars, disease, and other obstacles did occasionally slow down population growth, they turned out to be nothing more than temporary roadblocks to Malthus’ commoditization of demographics. For example, over the last 100 years, the world’s population has exploded from 2 billion to 8 billion people, and with it, strains on global resources soon followed. However, the new headline is that world population growth will likely peak at 10 billion some 40 – 50 years from now and with it the beginning of the end for Malthus and his minions. The cause is quite simple: we will not be reproducing fast enough to support current population levels. Maintaining steady state population requires a replacement rate of 2.1 births for every woman of childbearing age. Currently, the birth rate is rapidly trending downward, and a growing number of developed and emerging economies are already below this magical threshold. For example, the U.S. birth rate has fallen to 1.66 children per childbearing women. In Europe the rate is 1.5 and in Latin American America it is 1.9. Even China has seen two straight years of population declines and India’s birth rate is quickly approaching 2.0. In fact, the only global regions with a regional birth rate above 2.1 are the Middle East and Africa and those rates are also on a downward trend as female labour force participation rates, education, and income levels rise.

It is not premature to see how this “deficit” is causing economic and social strains. For example, Japan’s population peaked in 2010 and has fallen every year since. In a country dependent on multigenerational living arrangements, there is a growing elderly care crisis given the country’s rather limited social services net. Even in America, slowing population growth, and in turn labour force growth, will be straining the Social Security Trust Fund as the ratio of Social Security participants to beneficiaries continues to decline.

Figure 1

| BIRTH RATES BY REGION: < 2.1 IMPLIES LONG-TERM POPULATION LOSSES | ||

| REGION | 1990 | 2021 |

| World | 3.3 | 2.3 |

| East Asia & Pacific | 2.6 | 1.5 |

| Europe & Central Asia | 2 | 1.7 |

| Latin America & Caribbean | 3.3 | 1.9 |

| Middle East & North Africa | 4.9 | 2.6 |

| North America | 2.1 | 1.6 |

| South Asia | 4.3 | 2.2 |

| Sub-Saharan Africa | 6.3 | 4.6 |

| Low income | 6.5 | 4.6 |

| Lower middle income | 4.5 | 2.6 |

| Upper middle income | 2.7 | 1.6 |

| High income | 1.9 | 1.5 |

| Source: The World Bank |

In fact, under these conditions, the Social Security Trust Fund will be in a negative cashflow position by the mid-2030s. Solutions such as higher withholding and ending salary caps on contributions are potential solutions, but that does not change the long-term reality that U.S. population levels will be on the decline without new immigrants.

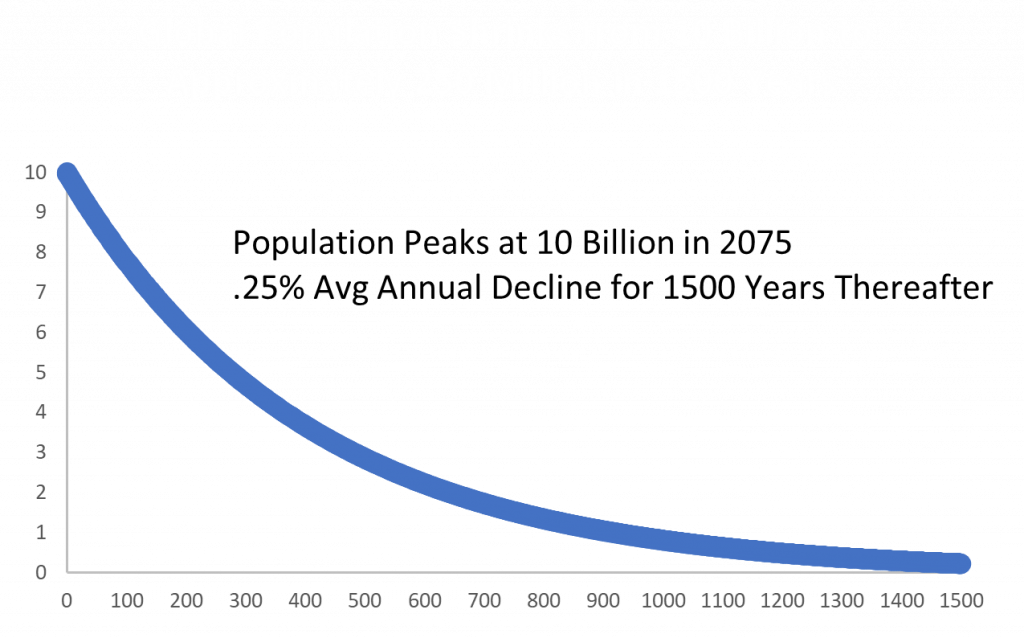

Figure 2

It is now estimated that over the next 1,500 years, global population levels will fall from a peak of 10 billion to approximately 225 million. Obviously, 1,500 years is well beyond the investment horizon of any institutional investor. Even Methuselah lived only 969 years, making global population decline something of a theoretical problem for anyone alive today. However, that macro perspective ignores region specific conditions across the globe. For example, limited job creation in rural Japan, Italy, and France have led to an exodus of younger workers to urban areas. In rural Japan, approximately one third of all rural homes are vacant and in Italy homes are being sold for as little as one Euro on the hope that the new owners will renovate and become residents. While helping urban real estate owners and investors, this migration is not a “free” good since it has led to increased government subsidies in order to keep rural locations economically afloat while simultaneously straining urban infrastructures.

The Basic Math

In its simplest form, the math behind this outlook would be familiar to most 7th graders:

Equation 1

Populationt = Populationt-1 + Birthst – Deathst + Immigrationt ± ɛt

where births in the current period are a function of the fertility rate of child-bearing women. Since immigration is zero at the global level, if births are less than deaths, then by construction, population levels fall. In practical terms, this means that the net replacement rate must be 2.1 or greater to account for the reasons cited previously. Recognizing that birth and death rates can vary year to year, an error term is introduced which over the long-run approaches zero.

Figure 2 illustrates the impact of an average yearly population decline of .25% per annum for the next 1,500 years starting in 2075 when world population peaks at 10 billion. At that rate, global population falls to 230 million at the end of the period. However, this may be an overestimation since any population “shrinkage” rate needs to be locationally optimized. That is, every child-bearing woman who wants to have a child can find a mate or has access to other means such as IVF. A woman in rural China will likely have more difficulty in becoming fertile than one in London because, the probability of finding a mate or clinical help is lower. Of course, it is also possible that scientific advances may significantly reduce infertility rates or bans on “Matrix-like” baby farms are lifted, thereby slowing down these projections.

“What me worry?”

Why does a 1500-year forecast matter today? Even though global population growth continues, location specific population does not. Outmigration of younger workers who cannot find employment or educational opportunities is not confined to China, Europe, and Latin America. The city of Detroit’s population peaked in 1950 at 1.85 million and has fallen steadily since then and is now hovering around .65 million. Although a significant percentage of that decline can be attributed to suburban flight, the outflow has painfully transformed the region’s real estate market as many investors can attest. The New Orleans metropolitan area’s population is lower than it was in 1980 and was in decline well before hurricane Katrina’s devastating effects. Pittsburgh is now the same size as it was in 1955.

In contrast there are locations which continue to grab the lion’s share of growth. Southern and Western states have benefitted from legal and illegal immigration, corporate relocations, and households seeking a lower cost of living. However, even these hot spots are beginning to lose their lustre. For the first time since statehood, California is losing population. Although higher death rates from Covid and housing affordability are factors, the state’s aging population and declining birth rates are not receiving the press they deserve. Global warming and water shortages make Phoenix and Las Vegas less desirable and even Florida can expect population growth to slow, since it tends to attract older migrants over families of child-bearing age.

When examined through the lens of a real estate investor, population trends over the next 10 -25 years carry the early signs of what is to come:

- Western nations will not see significant population gains and a number will experience actual declines, making immigration the only solution.

- Employment growth will slow as the production function increasingly relies increasingly on capital. As a result, AI, and other advances will likely redefine the current occupation/employment matrix:

- Occupational demand shifts as fewer mid-level employees are needed in industries ranging from finance, engineering, and manufacturing, leaving many once employable individuals behind.

- With labour inefficiently distributed, outmigration accelerates from “losing” to “winning” markets for those who cannot find remote work opportunities.

- Office demand will likely be the hardest hit. Already, remote working has wreaked havoc for investors as transaction prices tumble in the face of dropping demand and high interest rates take their toll.

- Since buildings are “durable” goods, oversupply will linger as the building stock slowly depreciates and the demand curve shifts inward. Markets will become more exposed to excess construction levels making building cycles longer and deeper.

- As demand stalls, lenders will become more cautious demanding additional preleasing from higher quality tenants, guarantees, and shorter mortgage durations to offset increasing market risk for both construction and mortgage loans.

- The relative volatility of institutional real estate funds and public vehicles such as REITs may likely increase as systemic risk increases. Private equity real estate indices’ reliance on appraisals and its option not to sell will continue to make institutionally-owned properties more stable than they appear, thereby dampening return volatility.

Summary

While it is difficult to forecast, especially the future, recent demographic data suggests that Malthusian prophecies, or the dystopian world of the 1973 movie Soylent Green, are becoming less likely. In fact, it would appear that population levels will begin to steadily decline starting sometime in the last quarter of this century. The good news is that declining population combined with scientific advancements will make the world more verdant, productive, and efficient, all else being equal. The other side of the coin is that “location, location, location” will become harder to define. Technological advances and the ever increasing competition between countries, cities and even submarkets for human capital will change the investment landscape. It seems that even social policy cannot “buy” more children as family incomes and education levels rise and female labour force participation rates climb. For example, Norway tried to reverse its declining fertility rate through government policy. While increasing births in the short run, Norway’s fertility rate soon retreated to its long-term trend line. In the face of declining birth rates winners will be countries that attract immigrants.

The good news is that if the world’s population does fall significantly less than a billion people by 3500, buying a beach front property in Malibu will be much easier. That is, unless the “Big One” hits and moves the shoreline eastward. Assuming current trends hold, real estate investors with an investment horizon greater than 10-15 years may find that the next few years a suitable time to consider formulating a more defensive investment strategy.

About Northfield Information Services, Inc.

Northfield is a premier portfolio management analytics provider and thought leader. Renowned for in-depth research and unparalleled expertise in risk management and quantitative analysis, Northfield delivers state-of-the-art risk management solutions that provide investment decision-makers with actionable insights. Founded in 1985, Northfield delivers solutions to over 200 clients worldwide. Headquartered in Boston, with offices in London, Tokyo, and Sydney. For more information, please visit: www.northinfo.com.