Re-alignment in a post-Covid world

Despite successful vaccination programmes and economic support policies, Covid-19 continues to impact our real estate markets. As the pandemic posts its latest resurgence, most European governments have been able to successfully limit its economic impact. This is offering a different environment for real estate as well, triggering the question how real estate investors can best re-align their investment strategy in a post-Covid world.

Inflation hits the headlines

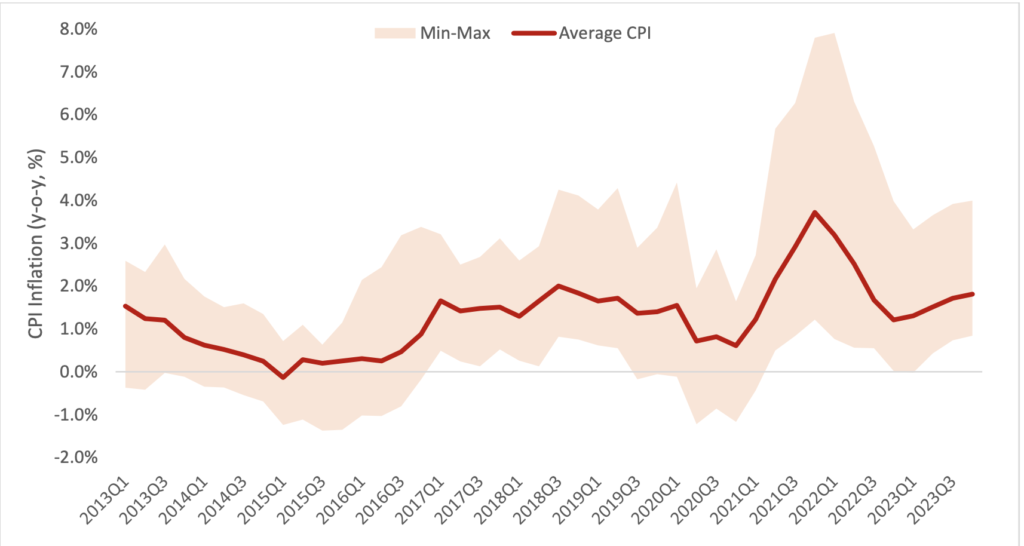

The post-Covid rebound has surprised on the upside, as vaccinations and economic supports were successfully rolled out, leaving unemployment largely unchanged. However, stronger than expected GDP growth combined with supply chain disruptions and associated shortages have triggered higher inflation. In the past few months of 2021 there has been much debate about the drivers of inflation, with much focus on the short term, particularly the news flow of shipping and energy costs. The danger of enduring above-target inflation poses a new policy dilemma for central banks, as recent consensus assumed transitionary inflation. However, investors have priced in rate hikes and tapering. As a result, we consider the impact of a new inflation scenario besides our lower-for-longer base case.

Inflation

However, there are still some solid reasons why inflation in the medium term will be lower. In the long term, global trade reduces costs for consumer goods and once resumed should bring down inflation. An elevated output gap in most European economies should allow for increased production once bottlenecks are resolved. Inflation will be higher for longer only if wage growth accelerates. Although this is now actually starting to happen with the newly formed German coalition government planning to increase the minimum wage level. Finally, Europe’s ageing populations will not directly spend any increased earnings as their required pension saving will keep the velocity of increased money supply at modest levels. Based on these we assume that the probability of a prolonged period of high inflation is currently still just below 50%. If the evidence of elevated inflation keeps coming in than we might have to shift our base case to this higher for longer inflation scenario.

Occupier markets already re-aligning

Across occupier markets, the impact of Covid-19 has been very different per property type. Logistics has benefitted during the extended Covid-19 related lockdowns as the rapid increase in e-commerce spending pushed European logistics take-up across the eight key European markets to achieve a record year-to-date 2021 after a robust 2020. This strong take-up momentum has brought the vacancy rate down to 3%, a record low, on average in Europe.

For offices, the Covid impact has been more challenging, as the share of office employees working (sometimes or usually) from home (WFH) more than doubled, from 28% in 2018 to 67% in July 2020 across the EU 27 region. The immediate impact was a 40% reduction in office take-up from 2019 to 2020 and a projected increase in vacancy to 8.2% for year-end 2021 from the record low of 5.8% as of year-end 2019. But we expect the long-term WFH impact on office space demand will be muted, as employees will still be attending the office more than half of the time.

The sector most impacted by Covid-19 was retail. After a strong growth before 2018, prime shopping centre rental growth turned negative pre-Covid as they were hit harder by the growing share of online sales, as most retailers shifted from high quantity to high quality of outlets. As e-commerce penetration stepped up significantly during the lockdowns in 2020, prime rents were hit hard for both high street retail (-16%) and shopping centres (-20%). Most retailers’ revenues dropped in 2020 with many forced to ‘right size’ their store footprints and some going out of business. As the Covid-19 crisis is resolved, we expect re-openings to improve cash rent collections, a revival of credit quality among tenants and a stabilisation of prime headline rents.

As far as residential markets are concerned, our pan-European forecasts focus on new-built apartments, which are exempt of rent control mechanisms. Due to the long-term imbalance between limited supply and solid demand, prime residential rental growth is expected at 2.6% pa on average between 2022 and 2026. This is the highest rental growth of any sector over the period. However, it is a bit lower than the 3.5% pa on average over the past five years.

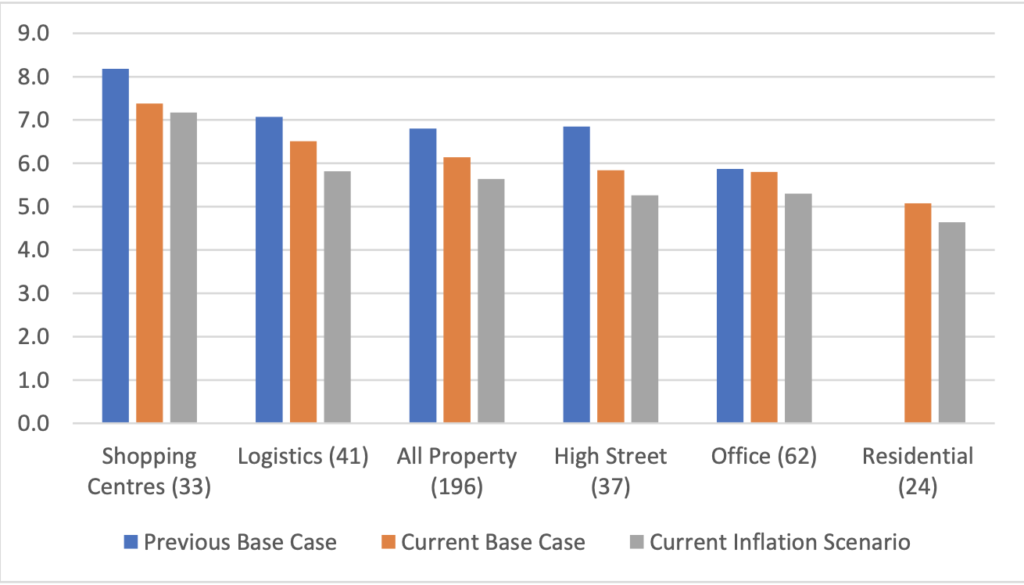

Investors might want to go shopping again

Investment market volumes are recovering, led by large portfolio logistics and corporate residential transactions. Yield compression continued in 2021, with logistics yields tightening to new record lows. Crucially for our total returns and yield outlook, prime shopping centre yields did actually widen by 120 bps since 2018, due to the poor sentiment surrounding e-commerce growth. The more recent Covid-related re-pricing did not differentiate between prime and average quality. As a result, we expect prime yields to compress by 30 bps by 2026 to reflect the resilience of the best assets. Prime shopping centres are therefore projected to have the highest returns (7.4% pa) of any sector in the next five years, due to their attractive current initial yields and projected yield tightening. Prime logistics returns come in second place at 6.5% pa over the next five years. Office returns incorporate the long-term impact from home working on rental growth, as well as the expected future yield widening. Finally, our inflation scenario assumes higher bond and property yields, with a negative impact of 50 bps pa on total returns across all property types for the next five years.

Total returns

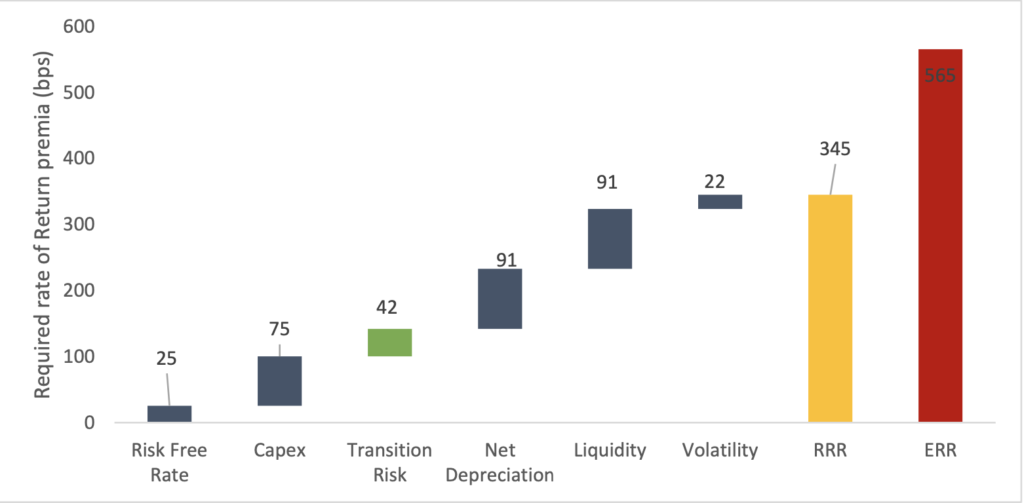

Climate risk is added in our relative value framework

Despite adding a new climate-related transition risk premium, our risk-adjusted return approach shows an average positive excess spread (of the expected rate of return exceeding the required rate of return) of 220 bps for all our 168 European markets covered. By comparing the expected rate of return (ERR) with the required rate of return (RRR), we can also classify each of the 168 covered European markets as attractive, neutral or less attractive.

Climate change

Since we have now done this analysis for three years, we consider the sector-level results across Europe in our base case over time. The most improved sector in our framework is definitively retail. Fifty-six of the 64 covered retail markets covered in our framework are classified attractive. In our latest 2022 assessment, 27 out of 37 logistics markets covered are still classified as attractive, despite record low yields. Finally, the office sector is impacted as more markets are classified as neutral. This is due to the impact of a significant amount of new developments on rental growth expectations on several markets. More details of our results are available in our 2022 Market Outlook, available on AEW website.