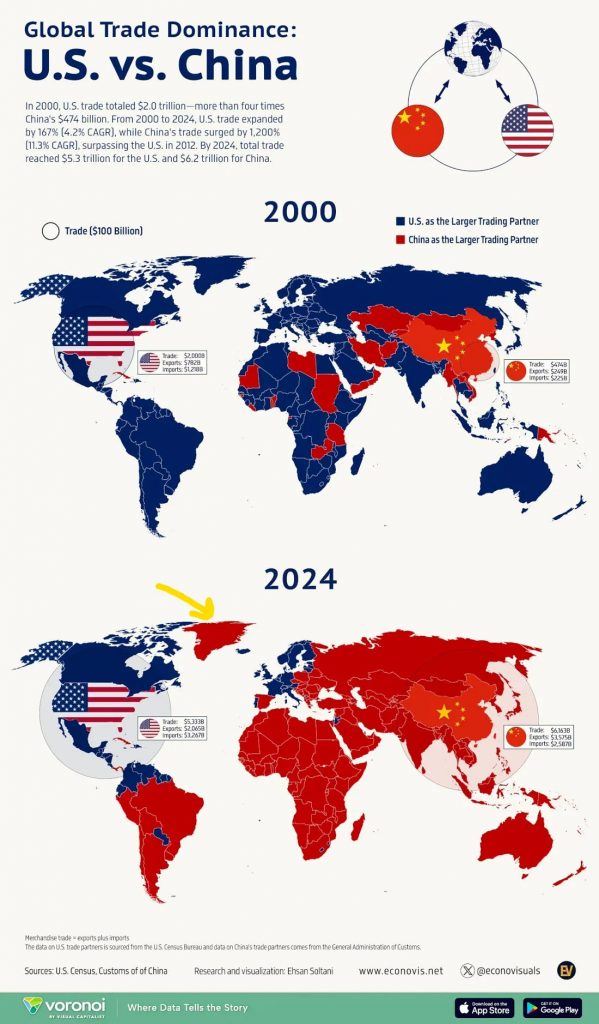

In case you missed it, Trump put the screws to China, while giving the rest of the world another 90 days to negotiate.

Negotiate what? Unclear, but Random Walk thinks it’s some combination of buying more stuff from the US (or investing in the US); buying less stuff from China; and/or lending the Federal Government at below-market rates.

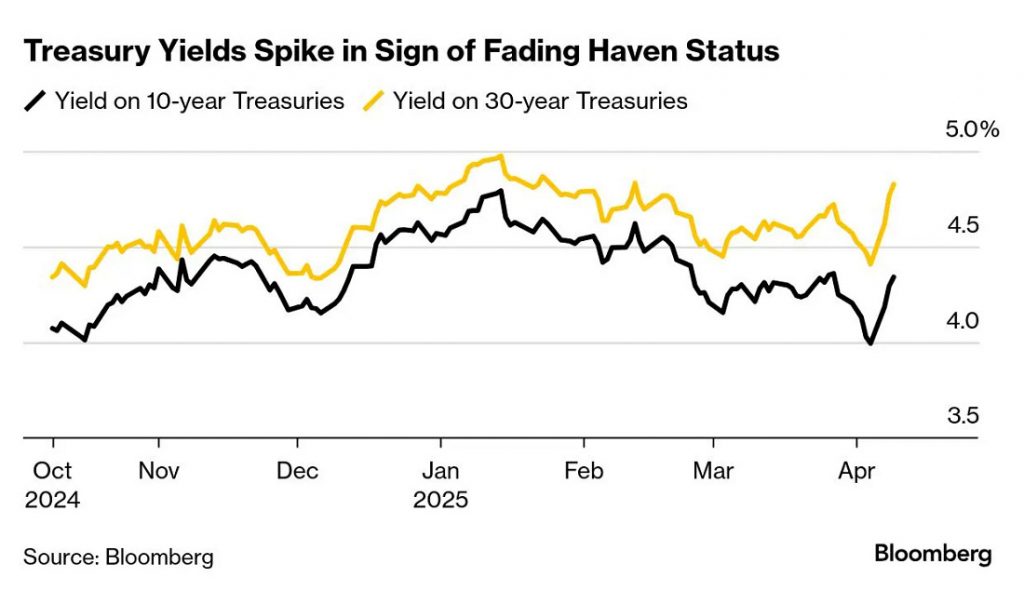

Anyways, two Random Walkian ideas are playing out (for now). (1) These are China tariffs, in the main; and (2) the world’s primary leverage is its willingness to buy our biggest export: Treasuries.

Also, we totally do need to conquer Greenland:

China has turned Greenland into a colony, right on our doorstep!

Actually, I know nothing about Greenland, but it’s now a net-importer from China too, and well, I still know nothing about Greenland. But I have questions.

Trade embargo on UST

Yields spiked 9 April as someone (perhaps Japan) was dumping a lot of Treasuries:

China’s leverage

China can’t ‘cozy up’ to all the countries we’ve ‘slighted,’ because it needs to sell, so it can’t be a replacement buyer.

So no, tariffs aren’t ‘pushing anyone into China’s orbit.’

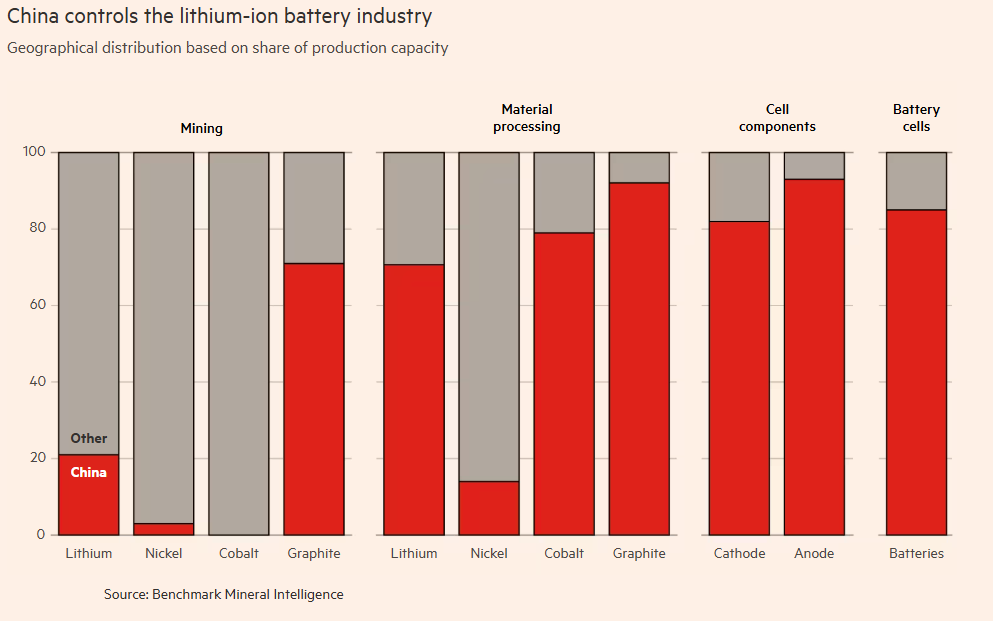

What China can do is take all the rare metals and batteries:

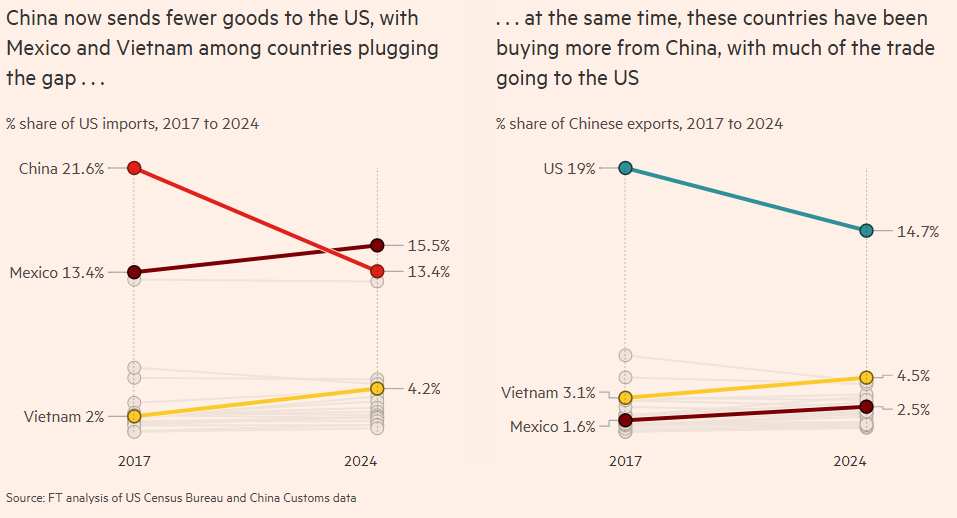

China’s got all the metals and all the patents to make the batteries that we need for the electrification of everything. The other thing that China can do (other than cutting deep sea cables, and all that), is it can route its goods through places like Vietnam and Mexico:

China sends more goods to Vietnam and Mexico (and less to the US), while Vietnam and Mexico send a corresponding increase to the US.

It’s highly unlikely that that is a coincidence.

Imports do appear to have slowed

And finally, because Random Walk was careful to note that, despite all the false headlines about the Great Tariff Uncertainty Crisis, there was little to no actual evidence of any slowdown . . . there is finally some evidence of a slowdown.

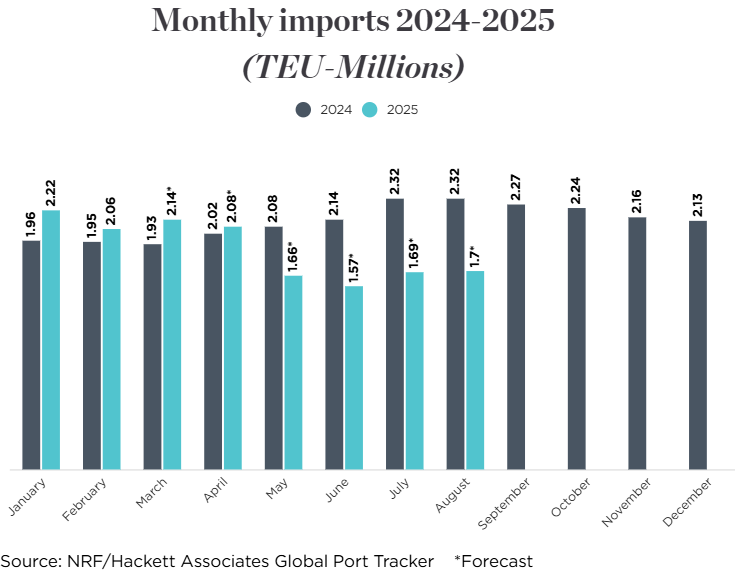

Estimated imports most definitely dropped off when the big news hit:

Ports have not yet reported March’s numbers, but Global Port Tracker projected the month at 2.14 million TEU, up 11.1% year over year. April – which includes cargo shipped before the new tariffs were announced – is forecast at 2.08 million TEU, up 3.1% year over year.

But May is expected to end 19 consecutive months of year-over-year growth, dropping sharply to 1.66 million TEU, down 20.5% from the same time last year. June is forecast at 1.57 million TEU, the lowest volume since February 2023 and a 26.6% drop year over year. July is forecast at 1.69 million TEU, down 27% year over year, and August at 1.7 million TEU, down 26.8%.

To be fair, I don’t really know how they make these estimates, but 20% YoY decline ain’t nothing.

This article was originally published on Random Walk.