If food waste were a country, it would be the third-largest emitter of greenhouse gases (8% of annual global greenhouse gases come from food waste).1

One-third of all food produced globally is wasted, representing a total value of about $940 billion per annum.2 Food waste therefore poses an enormous challenge for our planet and society – and this is likely to intensify, given that the world’s population is projected to grow significantly.

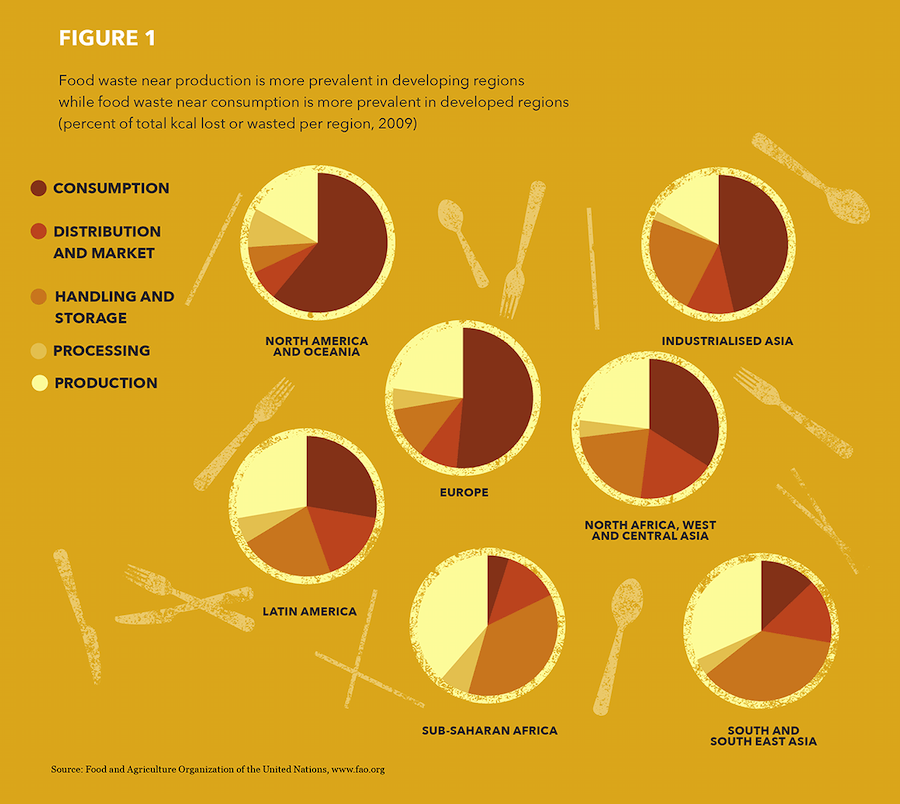

Tackling the problem requires different approaches in developed and developing regions: in developing regions, food waste is more prevalent near agricultural production and in post- harvest handling and storage; in developed countries, more food is wasted near consumption (see figure 1).

Given the breadth of these issues, food waste has been incorporated into the twelfth United Nations Sustainable Development Goal (SDG): Goal 12.3 aims to ‘halve per capita global food waste by 2030 at the retail and consumer levels and reduce food waste along production and supply chains, including post-harvest losses.’

Reducing food waste has been described as a ‘triple win’: for the economy, for food security and for the environment. Champions 12.3, which is a global food-waste reduction initiative, states that reducing food waste ‘can help feed more people, it can save more money for farmers, companies and households, while creating new business opportunities… and reductions can alleviate pressure on climate, water and land resources.’3 For investors, it is therefore important to understand the benefits to companies that can accrue from reducing food wastage so they can engage and encourage organisations to turn this challenge into an opportunity.

THE FINANCIAL CASE FOR REDUCING FOOD WASTE

The financial opportunity from reducing food waste has been highlighted in a study conducted by the World Resources Institute (WRI) and the Waste and Resources Action Programme (WRAP), which found an overwhelming financial incentive to tackle food waste. In the 700 companies analysed, for every $1 invested in food-waste reduction, the median company realised $14 – a return on investment of 1,300%.4 Companies that operated ‘closer to the fork’ generally showed a larger increase in returns than those operating ‘closer to the farm’ for each $1 invested in food waste reduction. This is often because food retailers and food manufacturers are better able to match forecasts of supply and demand, as well as make changes to food packaging and labelling to cut surplus food and increase its longevity.

It’s worth pointing out that the study focused on firms ‘closer to the fork’ in developed countries. This was because of the lack of historical food-waste data available for companies involved in the agricultural production, storage and processing stages of the supply chain, and the lack of data from developing countries. In addition, there is at present an overreliance on the WRI/WRAP study. To assess fully the financial case for reducing food waste, more data and research is needed.

NON-FINANCIAL BENEFITS

There are also several non-financial benefits to reducing food waste. Doing so means that more people can be fed from a given level of agricultural resource, which improves food security. Given that food waste can be greatest in developing countries at farm level, improving the efficiency of harvests can also have a significant positive effect on the livelihoods of farmers and local communities.

Reducing food waste also curtails unnecessary greenhouse gas emissions, water consumption, fertiliser and pesticide use and means that land can be used for other purposes. In addition, given that food waste accounts for around 8% of all global greenhouse gas emissions, large- scale reductions can help combat climate change.5

At the company level, organisations have the opportunity to bolster their brand, aid customer retention and attract more environmentally-minded customers because food-waste reduction efforts tend to be viewed favourably by the media and consumers.

THE ROLE OF INVESTORS

With the financial and non-financial benefits of reducing food waste so evident, it is important that investors encourage companies to respond to this opportunity and publish their performance data and future targets. UK companies can sign up to the Food Waste Reduction Roadmap, which guides companies on setting reduction targets, measuring food waste and acting to reduce it under the banner of ‘Target, Measure and Act’. The initiative covers the entire food supply chain, with the aim of halving food waste by 2030. Tesco and Ocado have both signed up.

Tesco

Supermarkets have a central role in efforts to reduce food waste along the whole supply chain. Tesco is the industry’s UK pioneer for measuring and publishing its food waste, having started in 2013.6 For context, of the total food waste from Tesco’s upstream manufacturing, midstream retail operations and downstream households, domestic food waste contributed 77% of the total. Tesco’s retail operations, on the other hand, contributed just under 3%. Therefore, it is of vital importance that Tesco and other food retailers work with the whole supply chain in efforts to cut wastage.

Tesco has committed to SDG 12.3 by aiming to halve food waste in its operations by 2030. It has also set a target that no food safe for human consumption will be wasted in UK operations and has donated more than 60 million meals to community food banks and charities. It has not sent any food to landfill since 2009. Tesco has also encouraged its partners to publish food-waste data and to sign up to ‘Target, Measure and Act’. Tesco has done other work with its suppliers, such as launching the ‘Perfectly Imperfect’ range of ‘wonky’ fruit and vegetables in 2016. This helps to reduce food waste and allows Tesco to sell these products at a lower price, benefitting consumers.

Ocado

The online grocery retailer’s centralised and technology-driven customer fulfilment centre (CFC) model gives it an advantage in terms of reducing food waste over store-reliant retailers, because it can gauge supply and demand more accurately.7 In addition, products can be out for delivery to customers within five hours. As a result, Ocado currently wastes only one in 6,000 – or less than 0.02% – of its food items and is working to reduce this further. For example, Ocado is using machine learning and artificial intelligence in its forecasting to try to predict demand accurately for each product. It has also introduced a product-life guarantee to inform online customers how many days each item can be kept. Ocado, through its work with WRAP, is ensuring its product labelling follows best practice guidelines. This includes placing a snowflake logo on nearly all its chilled ranges to show they are suitable for freezing, even milk.

CONCLUSION

Tackling food waste has huge potential benefits, both financial and non-financial. Tesco and Ocado have shown how food retailers can reduce their food waste and it is vital that all retailers work with their supply chains on this issue. The lack of food-waste data ‘closer to the farm’ and particularly in developing countries presents a major challenge to efforts to reduce food waste – and hence for investors. It is therefore of the utmost importance to engage with companies who operate in the food supply chain to encourage those that have not committed to SDG 12.3 to do so, as well as joining relevant initiatives. Those companies that commit to acting on reducing food waste and who work with producers, suppliers, consumers and other stakeholders can turn this challenge into a triple win opportunity.

Footnotes:

- Food and Agriculture Organization of the United Nations, www.fao.org

- Champions 123 (2017), The Business Case for Reducing Food Loss and Waste

- WRI, www.wri.org

- WRI, www.wri.org

- FAO, Food wastage footprint and climate change report

- All data for Tesco from Tesco (2019), Tesco ESG Day Report

- All data for Ocado from Forbes (2019), How Ocado is using machine learning to reduce food waste and feed the hungry.

* Henry left Ruffer in January 2020

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment. The information is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision.

Previously published by Ruffer – reproduced with their kind permission.