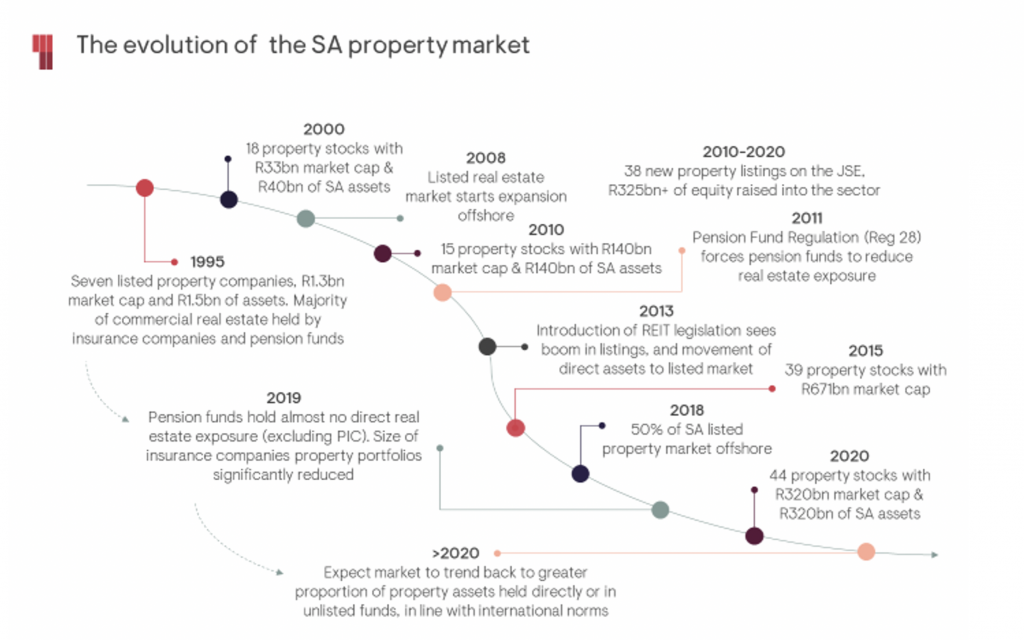

In the 1990s, the South African property market was largely directly owned and managed by insurance companies and pension funds, while the listed market was in its infancy at the time. But over the last two-and-a-half decades, the landscape has shifted 180 degrees. The listed market has ballooned from owning R1.5bn of South African property assets in 1995, to R320bn at present. Although there has been some growth in property values, the expansion can largely be attributed to the shift of property assets from the direct market to the listed space.

The introduction of Regulation 28 of the Pension Funds Act meant that retirement funds had to downweight their direct property portfolio (a regulatory limit of 15% for direct property and 25% for listed and direct real estate combined). Real estate investment trust (REIT) legislation, which was introduced in 2013, also helped to encourage the shift from direct assets to the listed market. In fact, South Africa now has one of the highest proportions of its professionally managed commercial real estate market listed on the stock exchange.

The listed property market boomed for a decade up until the end of 2017, fuelled by combined equity raises of R325bn and 38 new listings. It transformed from simple businesses owning South African property, to highly complicated businesses spanning multiple geographies, invested in numerous other listed property companies. Unfortunately, complex structures resulted in many property portfolios becoming unfocused. In addition, governance issues and high debt levels have been material headwinds for the sector in recent times. These factors, together with elevated levels of volatility for listed property, have sparked renewed interest in direct property as an asset class.

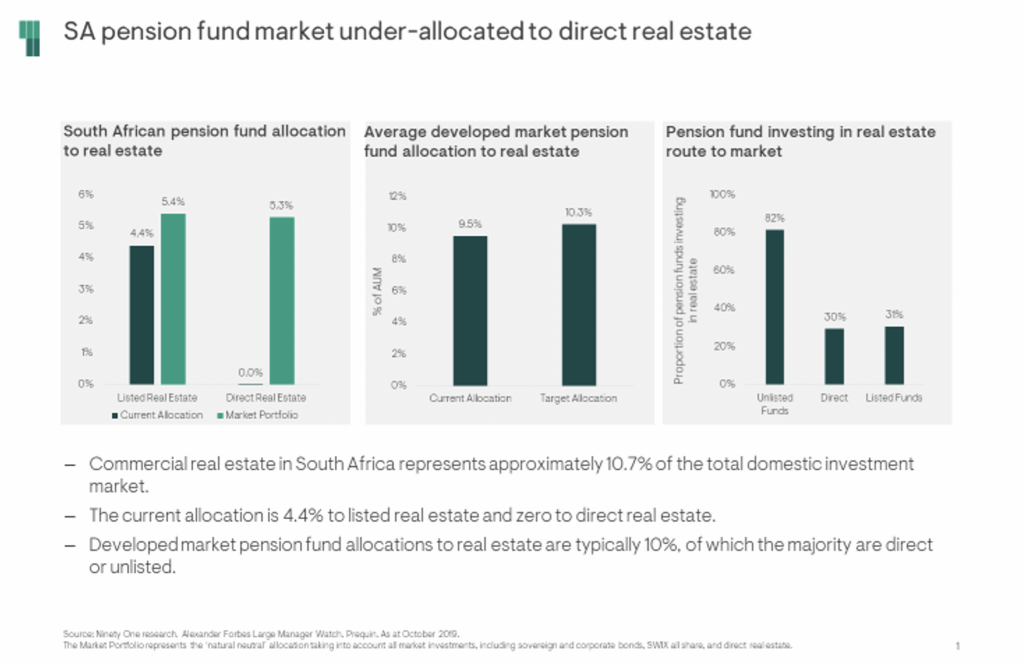

Allocation trends to real estate

Having exited direct property more than a decade ago, South African retirement funds now find themselves largely with no direct property exposure (excluding the Public Investment Corporation). Calculating the South African market portfolio reveals that investable direct real estate represents 5.3% and listed real estate accounts for 5.4% (at December 2019). The pension fund industry has largely neglected the asset class with an allocation at virtually zero. This is in stark contrast to the market portfolio – and even more so when compared with global pension funds that on average have 9.3% exposure to real estate (largely through unlisted funds). Developed market pension funds have consistently been increasing their real estate allocations, which are expected to rise above 10% in the coming year.

South African retirement funds have lacked the scale and specialised expertise to individually tap into direct real estate opportunities. In addition, efficient structures have not existed to pool investor capital to access portfolios of assets. This is, however, changing as investment managers are coming up with tax-efficient solutions that provide exposure to high-quality assets diversified across sectors with conservative leverage. The market is expected to open up further when REIT legislation is extended to unlisted property companies.

Investment case

The investment case for direct property is particularly attractive for pension fund capital, given its generally long-term investment horizon. Key compelling factors include:

- Attractive returns – the sustainable return profile is underpinned by income and income growth which are dependable over the long term.

- Inflation hedge – rental growth provides consistent growth over time.

- Income underpin – income-based returns are visible and supported by contractual leases.

- Low volatility – the unlisted nature means net asset value (NAV) is tied to the underlying fundamentals and not the noise of the equity market.

- Diversification – hybrid investment characteristics provide potential for both income and capital growth with low correlation to equity and fixed-income markets.

- Portfolio enhancement – exposure to direct property serves to improve the overall portfolio risk-adjusted returns, and the risk-return profile is well suited to asset-liability management of pension fund markets.

The one downside of direct real estate is the often large investment size and the lack of liquidity. The UK’s open-ended unlisted property funds offer some valuable lessons for South Africa, but the industry has also gained key insights from other structures used abroad. To this end, investment managers are devising innovative solutions that provide structured liquidity in unitised products.

Lack of liquidity in the REIT market provides an opportunity for unlisted players to get access to the asset class at decent entry points

The reliability of appraised direct property valuations is another issue that is often raised. The valuation methodology is well established and has proved to be reliable – particularly in respect of longer-term investments. In fact, South Africa had the smallest differential of appraised values relative to transacted values in 2019, when using the MSCI global universe as a comparison (MSCI South Africa Annual Property Index).

Current environment presents opportunities

Real estate has been at the epicentre of the covid-19 crisis. Hospitality, leisure and retail have been the hardest hit, while the office sector is expected to face increased challenges as more people work from home. Notwithstanding these difficulties, real estate is a tangible asset and has a strong value underpin. Although trends may change, real estate is essential to the functioning of any economy – be it providing a space to live, shop, manufacture and store items, work, entertain or store data. Key to this is the ability of real estate assets to generate income which will remain an enduring characteristic. What has complicated the covid-19 crisis has been the highly structured, debt-laden REITs. The long-term prospects of direct property assets remain compelling in many sectors, particularly now as valuations have become more appealing.

Lack of liquidity in the REIT market provides an opportunity for unlisted players to get access to the asset class at decent entry points. We expect the market to start returning to where it was more than two decades ago. This ‘back to the future’ scenario should give rise to simpler structures, more focused businesses and a greater proportion of real estate in private markets, as well as increased allocations from pension funds to direct real estate.

The information contained in this viewpoint is intended primarily for journalists and should not be relied upon by private investors or any other persons to make financial decisions. All of the views expressed about the markets, securities or companies in this press comment accurately reflect the personal views of the individual fund manager (or team) named. While opinions stated are honestly held, they are not guarantees and should not be relied on. Ninety One in the normal course of its activities as an international investment manager may already hold or intend to purchase or sell the stocks mentioned on behalf of its clients. The information or opinions provided should not be taken as specific advice on the merits of any investment decision. Telephone calls may be recorded for training and quality assurance purposes. Ninety One SA (Pty) Ltd is an authorised financial services provider.