Further to last month’s article I am following this with specific local factors to look out for when investing in residential property.

Once you’ve done your homework on the precise area you are targeting and the amount you can invest, these are some golden rules to follow that apply regardless of the type of property or location.

I am referring here to making an investment in the mainstream buy-to-let market and one where you are looking to attract tenants who are in stable, full-time employment. This is the most sensible strategy for smaller, amateur landlords. Specialist niches exist such as letting to students or to those receiving social security, but these as a general rule are best left to full-time professional landlords.

1. Proximity to transport, shops, restaurants

I touched on this in my last article, but I cannot stress the importance of being close to good transport connections and amenities/facilities.

Convenience is the watchword. Tenants are usually young and are predominantly looking for access to shops, cafes/bars/restaurants, gyms and cinemas. An easy walk to a good bus route or train/tube station is a major attraction. You might love living in the middle of nowhere, but your tenants almost certainly won’t!

2. Target gentrifying areas

Is the area you are investing in improving? It’s a very simple question, but a crucial one to focus on. Yes, there are many signs of gentrification to look out for, including the clichéd coffee shop, but fundamentally is the local area on the up? Are more professionals moving to the area? Are the shops being spruced up and new bars, cafes and restaurants appearing?

Talk to people in the area, especially local estate agents and shopkeepers.

The area may currently be run down, but if a new railway or tube station is coming soon, you can be sure new retail and leisure development will soon follow.

It is major investment you are making, so it is also always worth a trip to the local planning office to have a look at the local plan. You will often be able to access a lot of useful information and leads online too.

3. Buy the crap in a good area – never buy the good in a crap area

Something those who know me well know I religiously adhere to! Why? Well, if you buy the most expensive property in a rundown street or area, you will see no or very limited price growth over the medium/long term. The local neighbourhood and its poor reputation/image will simply hold you back. Tenants too will look elsewhere.

On the other hand buying an unloved property in a smart, improving or rapidly gentrifying area means the neighbourhood will simply lift your property‘s value – almost drag you higher, whether you like it or not. Tenants aspire to live in as smart an area as possible with property flaws or inadequacies often overlooked.

4. Avoid newbuild properties

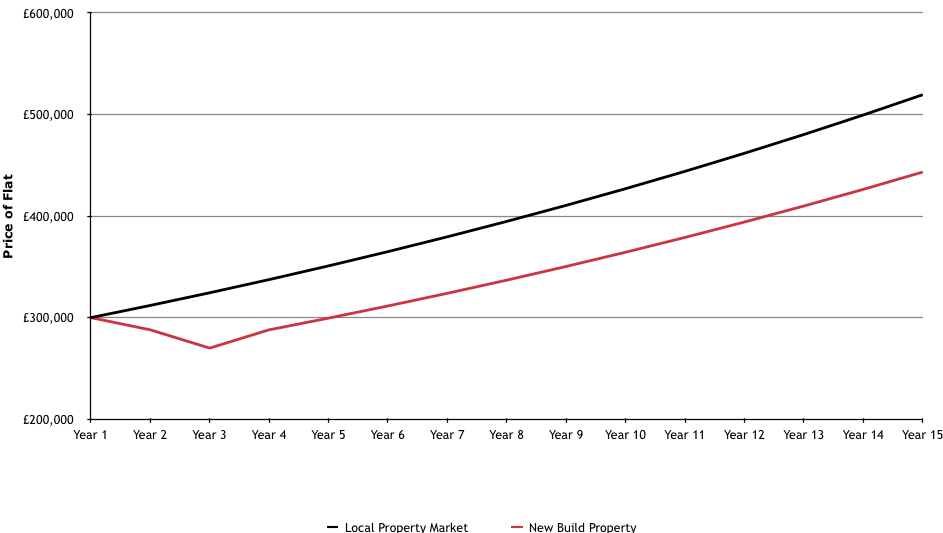

The “Nike tick” effect as I liken it. If you buy a newbuild property, you are simply paying a premium (i.e. the developer’s profit) on top of the property’s true worth. This will effectively create a long-term drag on its capital value – a few years into ownership, your flat simply won’t be new and in the short-term therefore is very likely to underperform local property market.

It’s rather like buying a new car from a garage – you lose thousands of pounds the moment you drive it off the forecourt.

Developers are very clever at making the whole purchasing process easy for you as an investor – glitzy marketing, easy paperwork, and help in arranging finance. Just don’t fall for it all! Do your homework, work a bit harder, refurbish an existing property and you will be tens (or more) of thousands of pounds better off in the long run.

The only caveat to this is that when the property market is in the depths of a recession and developments end up in receivership, then new build properties are often sold rapidly and heavily discounted. They then can become a relative bargain compared to the rest of the market, but only during this rare window. Manchester in 2009-10 springs to mind where there was a severe oversupply of new build, which led to receiverships and forced sales. There were some bargain bucket prices for savvy investors.

The chart below shows how the premium proves a drag on your long-term capital growth compared to a local ‘second hand’ property with the same purchase price (£300,000):

5. Look for properties that can be added to or improved in time

If you buy a house try and look for one which has the potential to either add loft space, be extended at the rear or create a side return. In higher value areas of London, there may be potential to add a basement too (although planning permission is currently getting much tighter for this in the central boroughs). As an area or street improves, people will look to add increasingly valuable space. Over recent years the government has made the planning procedure a lot less cumbersome via permitted development rights for such works.

Even if you don’t do the works yourself, when you come to sell the property, you can highlight the potential to do the work. If an area is on the up, people will pay much more accordingly for the opportunity to add/extend.

Flats too have potential – ground floor flats in converted houses can often provide extension opportunities (side return, rear additions). Top floor flats are a particular favourite of mine when they have cavernous loft space above.

Always see what neighbouring properties have done as a guide to what you can potentially do.

I hope the above article helps as a useful checklist when looking for a residential investment. It’s not designed to be all-encompassing, but a good general discipline on how to approach a residential investment.