Environmental, social and governance (ESG) considerations among global real estate investors and their stakeholders have gained traction over the past few years due to the increasing attention on climate change, heightened by the Covid-19 pandemic. While profit remains a crucial factor in real estate investing, ESG has played an increasingly significant role in the investment decision-making process.

In mitigating climate change impacts, many countries have announced their aim for carbon neutrality, with nearly 200 countries committed to the Paris Climate Agreement. The property sector, which accounts for approximately 38% of global carbon emissions, has received its fair share of attention. Countries have adopted many different green regulations and policies to help reduce buildings’ carbon emissions. International organisations, such as the United Nations, have also published data on real estate sustainability to help investors incorporate ESG factors into their investment decision-making and portfolio management.

The increase in the importance of environmental accountability among investors and tenants has raised green building certifications among asset managers and developers globally. According to the International Green Building Adoption Index, 18.6% of space in 10 markets across Australia, Canada and Europe was certified ‘green’ in 2018, compared to 6.4% in 2007.

Growing body of supportive evidence:

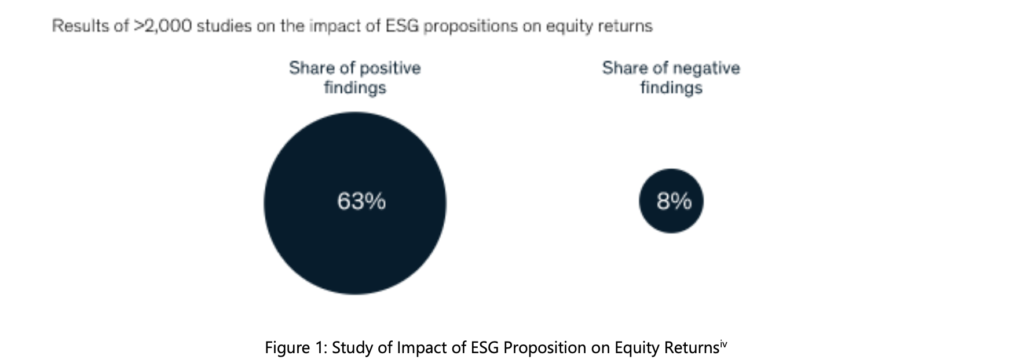

Data indicates that incorporating ESG considerations into a portfolio strategy improves reputational, financial and operational performance for asset owners (Figure 1).

Globally, interest and demand for responsible investing have increased across all real estate asset groups, elevated by the Covid-19 pandemic. Data from PERE News and McKinsey shows an expanding group of investors expecting significant ESG components as part of their investments.

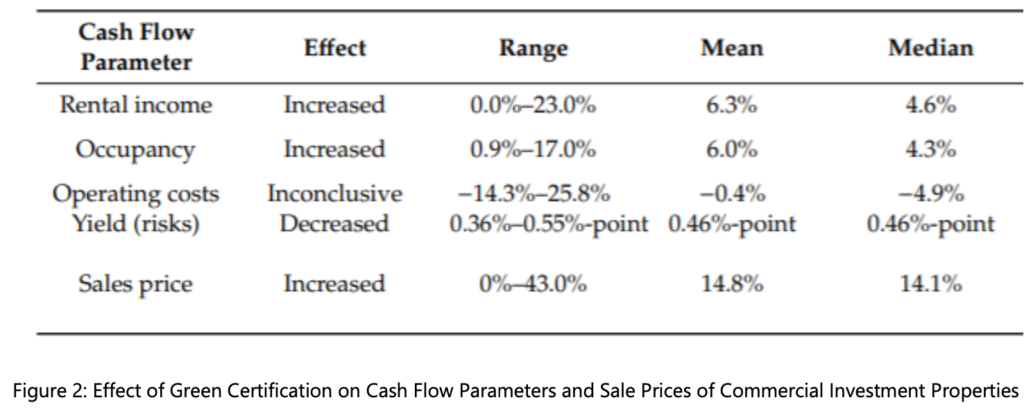

Financially, green-certified commercial properties command a premium over their non-green counterparts in terms of capital, rental and vacancy rates (figure 2). A strong ESG position also increases employee satisfaction and productivity, which eventually enhances shareholder returns.

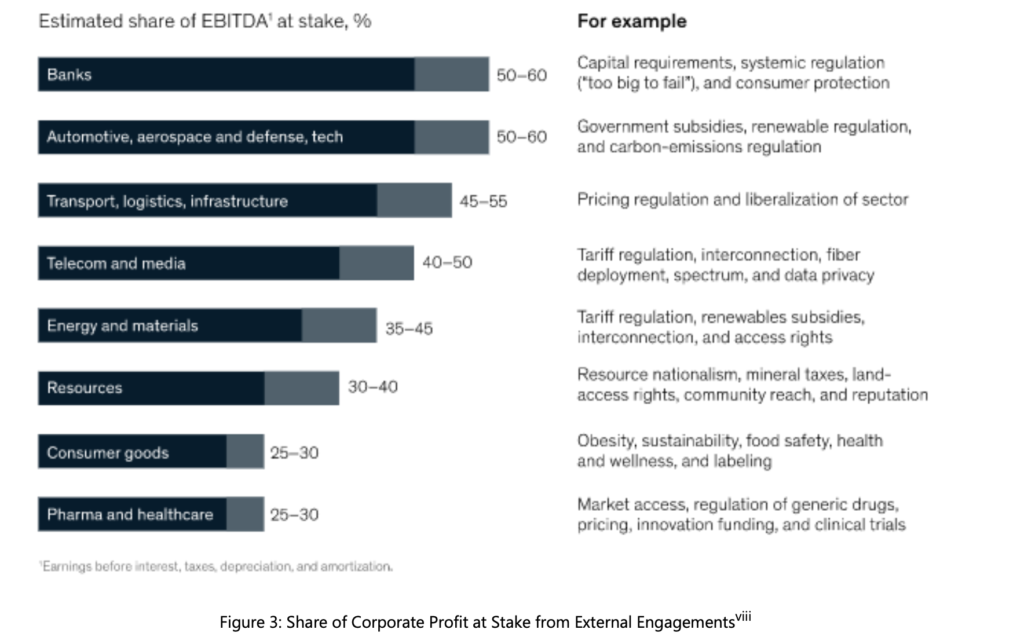

Green buildings also effectively reduce short-term operating costs, lower vacancy rates and rent escalations. Having a robust ESG program in place further reduces the risk of adverse government interventions, especially in countries that are increasingly stringent with their sustainability policies for the built environment (figure 3).

Further room for growth

While the level of awareness and significance of ESG have increased globally, inconsistency among benchmarks and methodology across geography and asset types raises data collection cost, preventing relevant comparisons of investments for meaningful insights and performance tracking. Current ESG reporting schemes for infrastructure investors also do not sufficiently capture financial risks.

At present, ESG-scoring firms’ regulations are considerably laxer and have less standardisation than regular credit rating firms. This inherent weakness increases the risk of corporate greenwashing, misleading stakeholders about their organisations’ environmental soundness.

Measures have been taken to improve the issue. One example is the introduction of the UE taxonomy for the classification of sustainable activities in July 2020. Touted as the world’s first comprehensive, science-based classification system, it provides the foundation for consolidating taxonomies and regulations in the future.

Ultimately, the relationship between ESG and value is synergistic. The importance and demand for ESG look set to increase over time, with both private and governmental pressures intensifying. Asset owners and managers that continue to disregard ESG considerations are at risk of leaving themselves behind. While there are considerable gaps in current metrics used to measure ESG, consolidation and improvements of such schemes will accelerate, driven by the growing urgency of climate change and the growing importance of ESG.