A stable market is at the root of its appeal.

Originally published September 2021.

Japan’s relative stability and favourable funding conditions continue to attract international capital. This trend is even more apparent in the increasing uncertainty in the world due to the pandemic. Moreover, geopolitical risks are likely to lean more into the spotlight once the Covid-19 situation comes under better control.

Japan’s position as a safe haven in an uncertain world is thus becoming more obvious to investors searching for stability. Meanwhile, more Japanese corporations are starting to dispose of corporate real estate in order to alleviate economic damage from the pandemic as well as to increase capital efficiency, leading to eagerly awaited investment opportunities. Recent headlines include Japanese advertising giant Dentsu planning to sell its headquarters in Tokyo for US$2.5b. Furthermore, large foreign investment firms BentallGreenOak and PAG have decided to invest US$10b and US$8b respectively in Japanese assets over the next few years. Furthermore, the recently expedited rollout of vaccines is likely to hasten the opening of the economy, contributing to corporate activity levels, and more active leasing and sales markets.

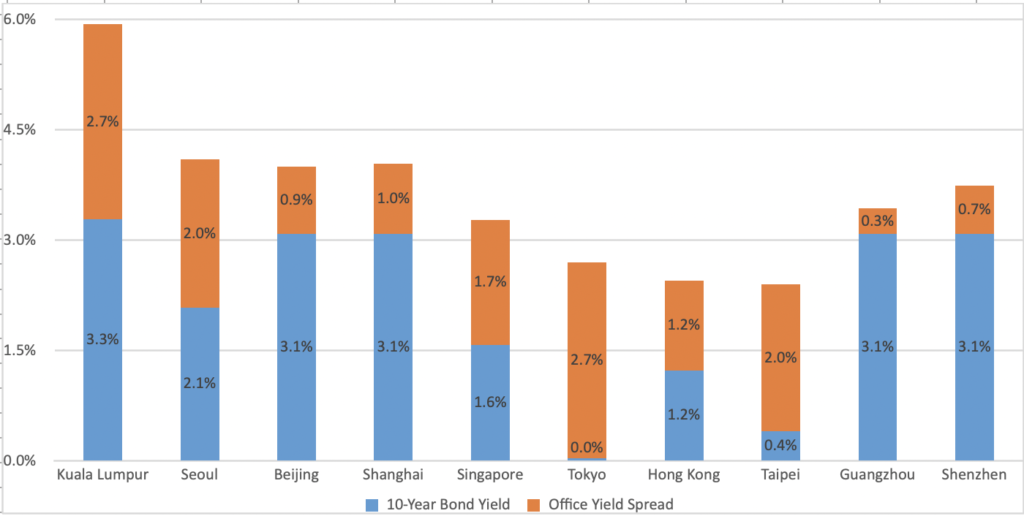

Japan is able to offer appealing returns to those looking for secure investments. Looking at Graph 1, Japanese government bond yields have remained at virtually zero, making the relatively stable real estate market in Tokyo an attractive investment. Tokyo is also likely to garner the attention of overseas investors as the favourable spread between high-grade office yields and 10-year bond yields is highest there when compared to its peers in the Asia Pacific region, standing at 2.7%. Other major cities in Japan, like Osaka, Nagoya and Fukuoka, are able to offer slightly higher yields, although their markets are admittedly not as strong as Tokyo’s.

“From a political standpoint, Japan has established itself as a stable democracy”

As one of the developed nations, the Japanese market is well known for its even keel. From a political standpoint, Japan has established itself as a stable democracy, currently governed by the Liberal Democratic Party. While the party will hold a presidential election in September this year, no major changes are expected. Moreover, the government is fortunate to preside over a society with minimal political and social divisions. Japan has seen steady, albeit mild, economic growth over the past decade, ranging between 0 to 2%, barring external shocks. Furthermore, cap rates of offices, the largest property sector, have remained stable while gently compressing over the years. The sector has also seen notable rental growth since the global financial crisis. Furthermore, despite increased worldwide advocation that offices were no longer necessary due to the pandemic, the Japan office sector has remained stable.

The solid office and property markets are based on sound corporate activities. Japanese corporate performance has seen a strong rebound from the sharp declines of mid-2020 and corporations have seen gains of over 20% YoY in recurring profits in Q1/2021. A third of listed companies in Japan have announced plans to increase dividends this fiscal period. In addition, the recently accelerated vaccine rollout has heightened economic prospects.

The Japanese labour market has been steady and the unemployment rate has stayed at around 3.0%, while the job-to-applicant ratio has remained at 1.1. This significantly contributes to very stable performance in the residential market. Meanwhile, the Bank of Japan’s Tankan Survey has confirmed continued positive sentiment, especially for large manufacturing enterprises that look to reap the benefits of the improving world economy and increasing demand for manufactured goods.

“The hospitality and retail sectors have been active, led by domestic corporate disposals intended to strengthen balance sheets”

As demonstrated by the multiple large transactions seen this quarter, opportunities in the office sector remain sought after despite softening rental levels. The hospitality and retail sectors have been active, led by domestic corporate disposals intended to strengthen balance sheets. Although assets in these sectors have been struggling, they have attracted the attention of investors optimistic about rapid economic recovery. The logistics and multifamily sectors continue to be regarded as essential components of pandemic-proof real estate strategies, although multifamily has shown signs of a slight softening. There have been multiple announcements on data centre developments recently, demonstrating the robust interest in this emerging sector. Overseas investor appetite remains strong due to the attractive funding options and stability that Japan has to offer, and Goldman Sachs announced in May that it hopes to double its yearly Japanese property allocations to about JPY250b. Multiple investors have announced their increasing interest and larger investment target in the Japan market, leading to even fiercer acquisition competition.

The strong real estate market has been supported by central banks across the globe. By taking steps to keep interest rates low, the BOJ has maintained its loose monetary policies following a policy review in mid-June. That said, with Japan’s strong equity and bond markets, the BOJ has accelerated the tapering of its asset purchase programme, which will help keep interest rates low for a longer period of time.

The office still remains the largest asset class in the Japan investment market, accounting for approximately 40% of all transactions. Within the Tokyo central five wards, the Grade A office market has continued to soften, with a rental contraction of 1.7% QoQ and 7.1% YoY to JPY35,000 per tsubo (3.3 sq m or 35.6 sq ft) in Q2/2021. Rents have faced downward pressure derived not only from the pandemic, but also from the new office supply in 2020, which has resulted in vacancy created in older buildings when current tenants move to newly built offices. Specifically, vacancy saw an uptick of 0.6 ppts QoQ and 1.4 ppts YoY to 1.8%. Fortunately, a majority of the supply in 2021 has been filled or pre-leased, and the limited supply expected in 2022 should give the market some breathing space before the substantial volume of completions forecast for 2023.

Overall, the Japanese real estate market has remained sound even during the pandemic, strengthening demand from the international investment community. Indeed, the prominence that Japan has gained is demonstrated in the fact that international investors accounted for less than 10% of investments in Japan during the global financial crisis, but have increased to over 30% in recent years. Going forward, Japan looks to keep its position as an attractive avenue for global investors looking for stable assets.

Graph 1: Grade A office spreads in the Asia Pacific Region, Q1/2021.