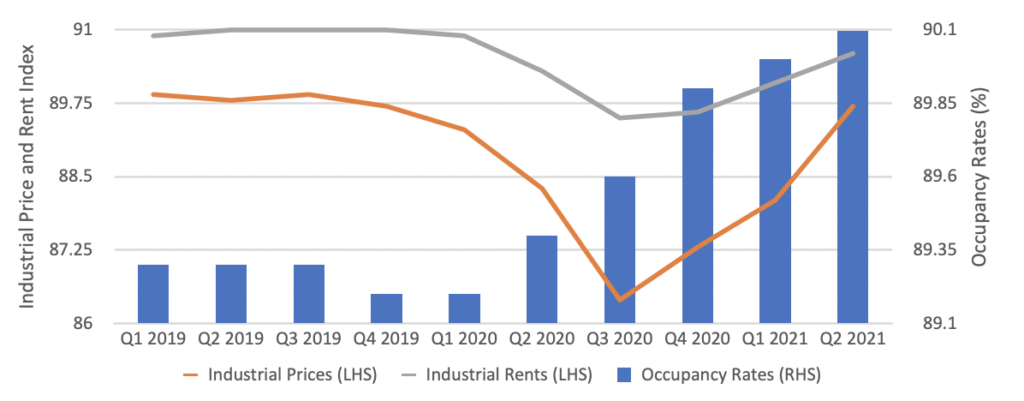

Singapore’s GDP growth is expected to reach 6-7% in 2021 and return to pre-Covid levels. The country’s strong economic performance was underpinned by the manufacturing sector, which expanded 17.7% y-o-y in Q2 2021. Amid strong economic growth, the Singapore industrial market is on its recovery trajectory as according to the official statistics, overall industrial rents and prices continued to rise in Q2 2021 for the third consecutive quarter. Growth was underpinned by relatively healthy overall occupancy rates across the board.

Singapore industrial prices, rents and occupancy rates

As the broad industrial market recovers, let’s look at the prevailing market megatrends and opportunities in the Singapore industrial market.

Close-to-city logistics and food-related factories to see growth

The pandemic has accelerated significant shifts in consumer behaviour towards online shopping. Hence the adoption of e-commerce that will continue to stay and become the ‘new normal’. Average e-commerce adoption in Singapore as indicated by the proportion of online sales to total retail sales have more than doubled to 13.9% in 1H 2021 compared to 6.1% in 2019 pre-pandemic.

Additionally, the Food & Beverage (F&B) and groceries market has made strong inroads into e-commerce. Growth in the online F&B and groceries market was supported by powerful network effects caused by more consumers switching to online channels to order food and groceries, and more merchants going digital to mitigate lower retail footfalls amid remote working arrangements and safe distancing measures. While the roll-out of vaccines would facilitate the city-state’s reopening plan and may moderate online shopping activities, it is likely that the long-term behaviour of many consumers has been permanently altered.

Nonetheless, while the potential market has grown, competition for consumers is high and key e-commerce players will need to increase their differentiation to meet growing consumer expectations as the e-commerce arena heats up. Their playing field will evolve to q-commerce (quick-commerce), where delivery speed is key.

As such, prime logistics properties and food factories will see sustained demand and occupier’s real estate strategy will be driven by proximity to consumers. As q-commerce gains traction, speed to customer is of critical importance and industrial clusters which are in proximity to the city centre would be poised for growth.

Due to the recent boom in the online groceries market, there is a huge undersupply for cold chain last-mile logistics. Undersupply is expected to persist over the short to medium term given high barriers of entry for cold chain logistics due to deep operational know-how and high capital expenditure. Additionally, challenges from retrofitting any conventional warehouse into cold chain warehouses remain due to power grid constraints. Cold chain logistics is energy intensive and cold chain warehouses require a continuous supply of power and back-up energy systems for refrigeration. Given the limitations in conversions and new supply amid high investor interest, we expect to see sale-and-leaseback dominate this space.

Biomedical lab spaces to see sustained demand

The biomedical sciences (BMS) industry has been a key and growing pillar of Singapore’s economy and Singapore has emerged as an ideal location for biomedical manufacturing, bolstered by its vibrant Research & Development (R&D) community. Industry leaders including Pfizer, Novartis, Sanofi, AbbVie and Amgen are siting their manufacturing hubs in Singapore for a wide range of pharmaceutical products. Most recently, vaccine-maker BioNTech has designated Singapore as its regional headquarters for Southeast Asia and will set up an mRNA manufacturing facility here. The prospects for Singapore’s BMS industry remain favourable, supported by a thriving pro-business environment, research infrastructure and talent, strong intellectual property laws, world-class manufacturing capabilities and strategic location in Asia.

To buffer against supply disruptions, Singapore recently announced a ’30 by 30’ food production goal – producing 30% of its nutritional needs locally by 2030. This is an ambitious target, given that Singapore imports more than 90% of its food supply. Given Singapore’s land scarcity, there will be an intensified focus on research and food science. As such, Singapore is transforming itself into the food tech hub of Asia and is seeking to attract multinational corporations and startups to establish their facilities and operations here. To drive this effort, A*STAR, Singapore’s lead public sector R&D agency, launched the Singapore Institute of Food and Biotechnology Innovation, a new research institute focusing on research in food structure engineering, biotechnology, agri-food technology and food safety in 2020.

In view of the aforementioned developments, there will be healthy interest for biomedical lab spaces in Singapore. BMS lab spaces are concentrated at near-to-city business parks such as one-north and Science Park. These lab spaces have enjoyed strong occupancy rates throughout the pandemic and average occupancy rates hover over 90% as of 1H 2021. Supply remains limited and conversion of existing industrial space to lab space are not straight forward as lab spaces require specialised provisions such as dedicated exhaust shafts and chilled water supply. The next substantial supply of BMS lab space will only come from Elementum, a new business park development at one-north, which will only come to market in 2023. Amid heightened investor interest and limited supply, investment activities will pick up in this niche asset.

Digitalisation drives demand for data centres and high-tech factories

Higher adoption of e-commerce, business digital transformation, penetration of smart buildings as well as the use of 5G technologies, artificial intelligence and IoT technologies have led to exponential growth in data volumes. This in turn has resulted in a demand surge for data storage solutions and electronics.

There is red hot demand for data centres (DC) in Singapore. However, near term future DC supply in Singapore remains tight following a moratorium on new data centres since 2019. Amid heightened demand and limited supply, DC rates are likely to rise by at least 10% to 15% in 2021. Singapore is already a hot favourite among DC investors and ranks 5th place globally among other matured DC markets, according to Cushman & Wakefield’s 2021 Data Center Global Market Comparison report.

Besides DCs, high-tech factories which cater to the semiconductor sector and their supporting services will see sustained demand as semiconductor companies are expected to invest more and expand capacity amidst the global chip shortage. This trend is already underway with GlobalFoundries committing to invest USD4 billion to expand production capacity in Singapore.

Cool to be green

One silver lining of the pandemic is its potentially long-lasting positive impact on Environmental, Sustainability and Governance (ESG) investing. The pandemic has led to an increased focus on ESG and more companies are incorporating ESG practises into their business processes. As buildings account for over a third of global carbon emissions, more tenants and investors are looking for ‘green and sustainable’ buildings, to improve their ESG metrics.

This aligns with the recently refreshed Singapore Green Building Masterplan, which aims to have at least 80% of buildings (by GFA) to be green by 2030. To optimise the efficiency of green building features, building owners will have to integrate smart facility management technologies.

Given growing investment demand for sustainable buildings as the ESG focus gains momentum, there could be a wave of redevelopment to ‘green’ ageing industrial buildings, making them institutional grade and sustainable. Buildings with longer tenures will be in higher demand as the cost of revamping needs to be amortised and to reap long term benefits.

A flight to stability

In a world full of uncertainty, investors are pursuing a flight to stability. According to RCA data, Singapore topped the list of cross-border investment destinations in APAC for 1H 2021. With one of the highest vaccination rates globally and a fast recovering economy, Singapore is positioned to leverage on the ‘stability premium’ and emerge as the leading manufacturing hub in Southeast Asia, one of the fastest growing regions in the world. In fact, Singapore’s fixed-asset investments reached SGD17.2 billion (approx USD12.6 billion) in 2020, a 12-year high, driven by investments in electronics, chemicals and R&D.

With a wall of capital chasing limited assets, further yield compression is expected, and investors should act swiftly to secure deals before capital values start running away further.