The student housing market

Global demand for tertiary education has been on a rising trend, underpinned by a need for more skilled labour to support growing economies and socio-demographic trends of an increasing university-aged population and rising incomes. These trends have been most prominent in the Asia Pacific region (APAC) as compared to others. Transport connectivity between countries has improved with globalisation, encouraging international travel. Demand for student housing has also grown on the back of greater willingness and ability to travel internationally for quality education. While global mobility of students has been restricted due to the Covid-19 pandemic, it is likely to rebound once the situation stabilises and international travel restrictions are relaxed, giving resilience to the student housing sector.

Before the pandemic, student housing had been an increasingly popular alternative investment asset class, reaching a record US$18bn in 2019 (Australian student accommodation 2020 report [2020], Savills, savills.com.au.research_articles/167771/198722-0). Despite initial concerns about Covid-19’s impact on demand for shared spaces, the asset class has proved resilient in the face of the pandemic and the resulting economic downturn, especially in markets where borders were more porous.

Positive demand and supply dynamics underpin the student housing market

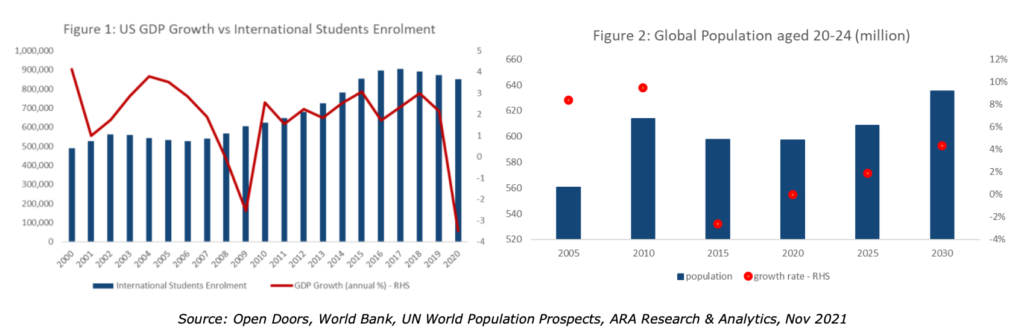

Based on US data, student housing has a limited correlation with the wider economic trends (Figure 1). Its demand is often supported by longer-term fundamentals such as demography and aspirational want of higher education. University-aged cohorts (aged 20 to 24) are expected to increase from 597 million to 635 million between 2020 and 2030, a growth of over 0.5% per annum (Fiure 2) globally. The rise in the global middle-class population also supports higher education participation rate, as the middle class typically invests a more significant proportion of their income on their children’s education (H Kharas [2017]. ‘The unprecedented expansion of the global middle class’, Brookings, pg 2). The middle-class growth is expected to be the fastest in APAC compared to Europe and the Americas, rising from 2 billion in 2020 to an estimated 3.5 billion by 2030 (This chart shows the rise of the Asian Middle Class. (2020). World Economic Forum, weforum.org/agenda/2020/07/the-rise-of-the-asian-middle-class).

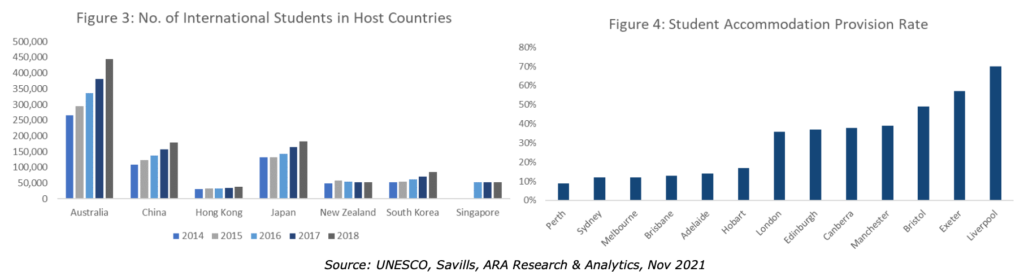

Inbound international students in APAC have risen recently, especially in Australia and China (Figure 3). The average annual growth of inbound international students between 2014 to 2018 in Australia and China is 13.7% and 13.3% respectively, exceeding the global rate of 5.5%. Other student housing markets in APAC also saw increasing demand, including Japan (+8.5%) and South Korea (+12.9%). Comparatively, the international student growth rates are more stable in mature markets of the UK (+1.3%) and the US (+4.1%).

In recent years, the demand far outweighs the supply of student accommodation in many global markets, particularly in Australia. Bed provision rates in major Australian cities such as Sydney and Melbourne are at 12%, in contrast to the 36% in London (Figure 4). Construction delay arising from the pandemic has further aggravated this supply crunch. The imbalance could become more pronounced, especially when the entry restrictions on international students are eventually lifted. Australia has recently opened its borders with Singapore, allowing fully vaccinated individuals to travel between the two countries without quarantine. Arrangements are also being made with Japan and South Korea to lift restrictions before the year’s end (‘Scott Morrison says quarantine-free travel soon on the cards for Korea, Japan’ [2021], AU News. news.com.au/travel/travel-updates/scott-morrison-says-quarantinefree-travel-soon-on-the-cards-for-korea- japan/news-story/73d239f353f76ddead2b0dc0311c62a4).

Student housing proves its resilience

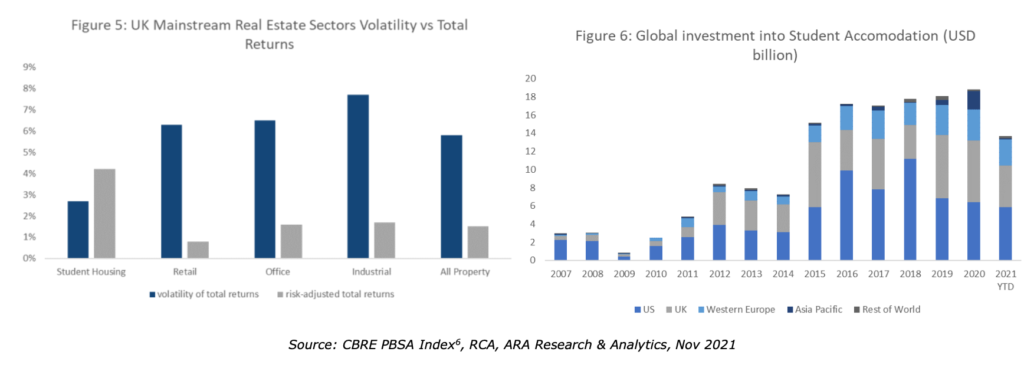

A recent report by the CBRE suggests that student housing has a higher return with lower volatility than other asset classes (Figure 5). In the UK, student housing has also outperformed the mainstream property market over the one, five and 10-year period (CBRE [2020]. CBRE PBSA index: 10 years of strong performance). Total returns for student housing were 4.9% in the one year to September 2020, while its five and 10-year returns are 9.4% pa and 10.8% pa respectively. Additionally, the student housing sector in the UK has also consistently outranked the returns from the traditional office, retail and industrial assets for the majority of the time.

Investors’ confidence in the sector remained strong in the face of the pandemic. Based on RCA data, global investment volumes for student housing reached US$18.9bn in 2020, a 4% increase y-o-y. Across the regions, APAC saw the most significant growth for the period, with a 260% increase y-o-y to $2bn. Of these, the lion’s share of US$1.7bn was recorded in Australia. In 2021, Australia’s YTD investment volume remained modest at some US$14m. The strict lockdowns in Australia have impacted investment activity and we expect a rebound when border restrictions are further eased by mid-2022.

A brighter future is in store

As border restrictions slowly lift on the back of rising vaccination rates and in-person learning resumes, demand for overseas studies is expected to return. Approximately 43% of responding US institutions indicated an increase in their application numbers from 2020 (‘Mapping Covid-19’s impact on global student mobility’ [2021], ICEF monitor. monitor.icef.com/2021/09/mapping-covid-19s-impact-on-global-student-mobility/). UK institutions reported a similar proportion of increased application numbers for autumn 2021.

Prospective students still favour in-person learning compared to online studies, with 83% of respondents from a 2021 QS survey strongly preferring the former. Rather than abandoning their overseas education plan, most students prefer to delay for a year (47%) or choose a different country to study in (16%) (Global International Student Survey 2021 [2021]. ‘Navigating a complex global higher education climate amidst crisis’, QS, pg 10).

The global outlook for student housing remains bright. The long-term demand for student housing should resume post-pandemic. High-quality assets close to prestigious institutions will remain popular.

With a rising middle-class population and strong inbound international students, tertiary education is underpinned by strong external and internal demand drivers, notably in APAC. Student housing, especially in Australia, will likely be the key beneficiary. Australia offers the most mature and highly reputable higher education institutions in APAC.

Asset owners and investors should also take note of the changing trends to improve the competitiveness of their assets with greater emphasis on hygiene and digital connectivity (‘What’s behind the pandemic resilience of student housing’ [2021], wealthprofessional.ca/news/industry- news/whats-behind-the-pandemic-resilience-of-student-housing/359034).