- FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increased from 827.88 to 864.41 (4.41%) compared to the last month update. The Singapore REIT index rebounded off from the support level at 807 three times, broke the 836 resistance turned support level and is now trading between the 836-890 range.

- Yield spread (in reference to the 10-year Singapore government bond of 2.37% as of 3 April 2022) tightened significantly from 4.14% to 3.49%. The S-REIT Average Yield remained almost the same, but with an increase in Singapore Government Bond Yields from 1.84% to 2.37%, Yield Spread tightened.

- The risk premium has dropped, but still remains attractive (compared to other asset classes) to accumulate Singapore REITs in stages to lock in the current price and to benefit from long-term yield after the recovery, especially since the S-REIT Market is still at a fair value. Moving forward, it is expected that DPU will continue to increase due to the recovery of the global economy, as seen in the previous few earning updates, especially for Hospitality REITs. NAV is expected to be adjusted upward due to revaluation of the portfolio.

- Technically the FTSE ST REIT index has started a short term trend with the eye of the next crucial resistance at 890 to break. Breaking this resistance will wake up the bull for the Singapore REITs sector.

Technical analysis

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increased from 827.88 to 864.41 (4.41%) compared to the last month update. The Singapore REIT index rebounded off from the support level at 807 three times, broke the 836 resistance turned support level and is now trading between the 836-890 range.

- Support Lines: Blue

- Resistance Lines: Red

- Short-term direction: Upwards

- Medium-term direction: Sideways

- Long-term direction: Sideways

- Immediate Support at 836, followed by 807.

- Immediate Resistance at 890.

The REIT Index traded between 807 and 836 for much of March, before breaking the 836 resistance on March 17. It has entered a short-term uptrend since then, reaching 864.41 as of now.

Price/NAV Ratios Overview

- Price/NAV increased to 1.00.

- Changed from 0.97 from March 2022.

- Singapore Overall REIT sector is at fair value now.

- Take note that NAV is adjusted downward for most REITs due to drop in rental income during the pandemic (Property valuation is done using DCF model or comparative model).

- Most overvalued REITs (based on Price/NAV).

- Parkway Life REIT (Price/NAV = 2.03).

- Keppel DC REIT (Price/NAV = 1.69).

- Mapletree Industrial Trust (Price/NAV = 1.50).

- Mapletree Logistics Trust (Price/NAV = 1.36).

- Digital Core REIT (Price/NAV = 1.33).

- ARA LOGOS Logistics Trust (Price/NAV = 1.26).

- No change in the top six constituents compared to last month (6 March 2022 update).

- Most undervalued REITs (based on Price/NAV).

- Lippo Malls Indonesia Retail Trust (Price/NAV = 0.56).

- BHG Retail REIT (Price/NAV = 0.62).

- ARA US Hospitality Trust (Price/NAV = 0.71)

- OUE Commercial REIT (Price/NAV = 0.74)

- Starhill Global REIT (Price/NAV = 0.76)

- Far East Hospitality Trust (Price/NAV = 0.76).

Distribution Yields Overview

- TTM Distribution Yield decreased to 5.86%.

- Decreased from 6.00% in March 2022.

- 14 of 40 Singapore REITs have distribution yields of above 7%.

- Do take note that these yield numbers are based on current prices taking into account the delayed distribution/dividend cuts due to COVID-19, and economic recovery.

- Highest Distribution Yield REITs (ttm).

- United Hampshire REIT (9.38%).

- Prime US REIT (9.04%).

- Keppel Pacific Oak US REIT (8.68%).

- EC World REIT (8.64%).

- First REIT (8.56%).

- Elite Commercial REIT (8.42%).

- Reminder that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to COVID-19.

- Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.

- A High Yield should not be the sole ratio to look for when choosing a REIT to invest in.

- Yield Spread decreased to 3.49%.

- Decreased from 4.14% in March 2022.

Gearing Ratios Overview

- Gearing Ratio remained similar at 37.03%.

- Decreased from 37.04% in March 2022.

- Gearing Ratios are updated quarterly. Only SPH REIT has its gearing ratio updated compared to last month.

- In general, Singapore REITs sector gearing ratio is healthy but increased due to the reduction of the valuation of portfolios and an increase in borrowing due to Covid-19.

- Highest Gearing Ratio REITs.

- ARA Hospitality Trust (44.3%).

- Suntec REIT (43.7%).

- Manulife US REIT (42.8%).

- Frasers Hospitality Trust (42.5%).

- Lippo Malls Retail Trust (42.5%).

- Elite Commercial REIT (42.4%).

- No Change compared to last month’s update.

Market Capitalisation Overview

- Total Singapore REIT Market Capitalisation increased by 4.71% to S$111.89bn.

- Increased from S$106.86bn in February 2022.

- Biggest Market Capitalisation REITs:

- Capitaland Integrated Commercial Trust ($15.07bn)

- Ascendas REIT ($12.37bn)

- Mapletree Logistics Trust ($8.69bn)

- Mapletree Industrial Trust ($7.18bn)

- Mapletree Commercial Trust ($6.28bn)

- Frasers Logistics & Commercial Trust ($5.46bn)

- No change in top five rankings since August 2021.

- Smallest Market Capitalisation REITs:

- BHG Retail REIT ($292m).

- ARA US Hospitality Trust ($381m).

- Lippo Malls Indonesia Retail Trust ($407m).

- United Hampshire REIT ($440m).

- First REIT ($490m).

- Sabana REIT ($503m).

- No change in top six rankings compared to last month’s update.

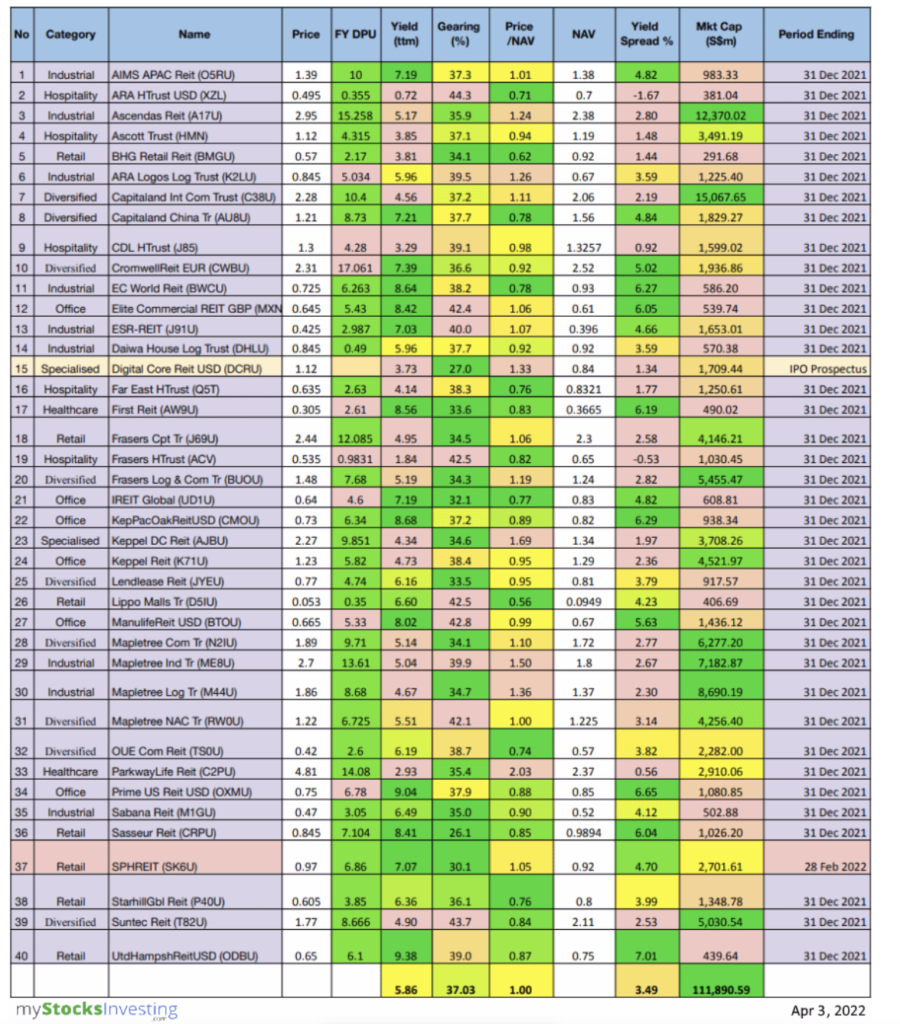

Fundamental analysis of 40 Singapore REITs

The following is the compilation of 40 Singapore REITs with colour coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio.

- The Financial Ratios are based on past data and there are lagging indicators.

- This REIT table takes into account the dividend cuts due to the Covid-19 outbreak. Yield is calculated trailing 12 months (ttm), therefore REITs with delayed payouts might have lower displayed yields, thus yield displayed might be lower for more affected REITs.

- All REITs are now updated with the Q4 2021 business updates/earnings. SPH REIT has the latest Q1 2022 business updates/earnings.

- Digital Core REIT has recently IPOed in December (highlighted in yellow) and have their values extracted from IPO Prospectuses. Yield is calculated based on *Estimated DPU (calculated from the prospectus)/current price.

What does each column mean?

- FY DPU: If green, FY DPU for the recent four quarters is higher than that of the preceding four quarters. If lower, it is red.

- Most REITs are green since it is compared to 2020 as the base (during the pandemic)

- Yield (ttm): Yield, calculated by DPU (trailing 12 months) and current price as of 2 April 2022.

- Digital Core REIT: Yield calculated from IPO prospectus.

- Gearing (%): Leverage Ratio.

- Price/NAV: Price to Book Value. Formula: Current Price (as of 2 April 2022) over Net Asset Value per Unit.

- Yield Spread (%): REIT yield (ttm) reference to Gov Bond Yields. REITs trading in USD is referenced to US Gov Bond Yield, everything else is referenced to SG Gov Bond Yield.