Fund structures being used by REITS.

Most readers are, I’m sure, aware of the convergence between funds and REITs. Increasingly, listed REITs are adopting the style and structure of unlisted funds, but with the added provision of liquidity, to capitalise on investor demand for the latest emerging sectors where they find it difficult to obtain exposure. The asset managers of the REITs find it easier and quicker to raise equity capital via the IPO route and are obviously hoping that they will command valuation premium (to NAV), enabling them to issue more equity on an accretive basis, thus aggregating a portfolio of critical mass efficiently. The two most recent examples in the UK are Life Sciences REIT and Co-Living REIT. The distinction between Funds and REITs is therefore more blurred.

REITs no longer have to be public

Similarly, it is not a secret that from 1 April 2022 the requirement that a REIT has to be listed on a recognised exchange is to be lifted. The rationale being that this should alleviate administrative burdens and enhance institutional attractiveness. Personally, I do not see how that will have a negative impact on potential REIT IPOs, merely an alternative structure for unlisted Funds. However, the fact we will now have, like the US, traded and non-traded REITs, does mean that the clear demarcation between public and private structures is less obvious.

Defining real and virtual: adventures into

a new world

However, I find that the most interesting convergence currently occurring is between the traditional and virtual real estate worlds. I must thank one of my students for highlighting this to me. Each year they must choose a dissertation topic.

“The metaverse is defined as “a virtual-reality space in which users can interact with a computer-generated environment and other users”

“I would like to do mine on the metaverse and in particular the Metaverse REIT IPO,” she said. While broadly aware of the topic, and the jargon I must admit (partly because I’m not under 35, which seems to be the dividing line between knowledge and ignorance on this topic) that I was sceptical, so I vowed to take a closer look. Also, having listened to the marvellous BBC podcasts about Dr Ruja and OneCoin, I had some reservations (spoiler alert: it was a Ponzi scheme, not a cryptocurrency). For those not aware, the metaverse is defined as “a virtual-reality space in which users can interact with a computer-generated environment and other users”. It is accessed via the internet, combines virtual and augmented reality, and has been described as Web 3.0.

Metaverse REIT IPO

What particularly piqued my interest was the idea of a virtual REIT. The Metaverse REIT was set up, “for traditional real estate investors to diversify in the virtual real estate world”. It was listed on an exchange, not the LSE, but a decentralised exchange called Pancake Swap, and it is not quoted in US$ or euros. You must purchase it using ethereum (a cryptocurrency). The founder states that, “By 2022, we’ll have partnerships with leading real estate developers, architects, influencers, and brokers to bring MREIT to the forefront of the metaverse. We’ll be announcing an NFT and staking platform by mid-2022 which will attract AAA tenants to secure long-term profitability for our token holders.” Sounds not dissimilar in tone and language to a standard real estate fund/company pitchbook to me.

The Manchester City virtual stadium

At this stage I was still struggling with the applications of the whole concept, but as luck would have it ,the next day Manchester City announced that they were teaming up with Sony to build a virtual reality football stadium where fans can watch live games and meet their superstars.

A spokesman said, “You can recreate a game, you could watch the game live, you’re part of the action in a different way through different angles and you can fill the stadium as much as you want, because it’s unlimited, it’s completely virtual.”

Now this I could understand. At Arsenal, we have been operating with a virtual defence for a long while, so the transition to a virtual stadium was an easy one. I then looked at the efforts that Microsoft, Google and Meta (Facebook in old money) had put into it and decided that it was worth continued investigation.

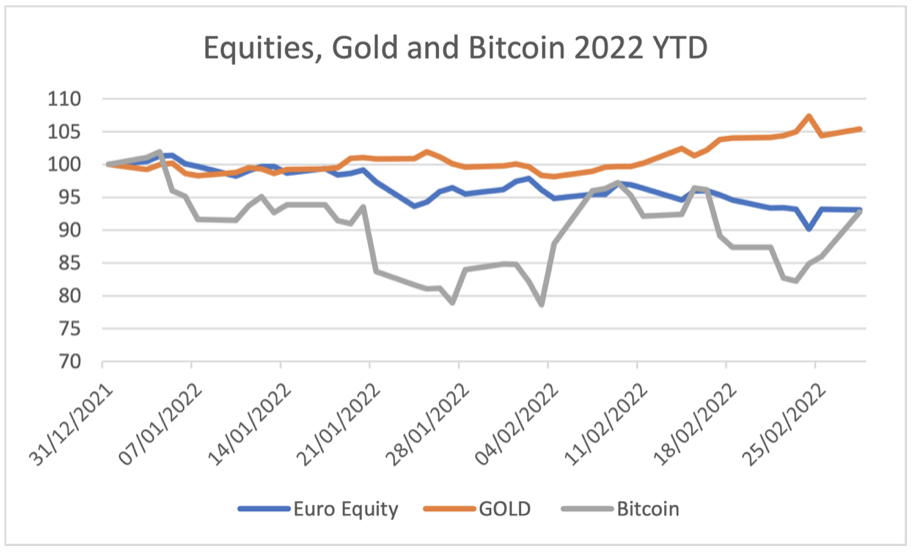

Real or virtual performance?

To conclude on a tangible note, I wanted to link back to the topic of a previous article, the emergence of bitcoin ETFs to see how they had performed since their inception in Q4 2022. In particular, given world events, to see if they offered any diversification against equities or indeed were seen as a similar safe haven to gold? From the chart below, it can be seen that it appears to act independently of both, as would be hoped. As a result, we will now be monitoring cryptocurrencies as part of our work on asset class performance, as well as keeping track of events in both the real and virtual world.