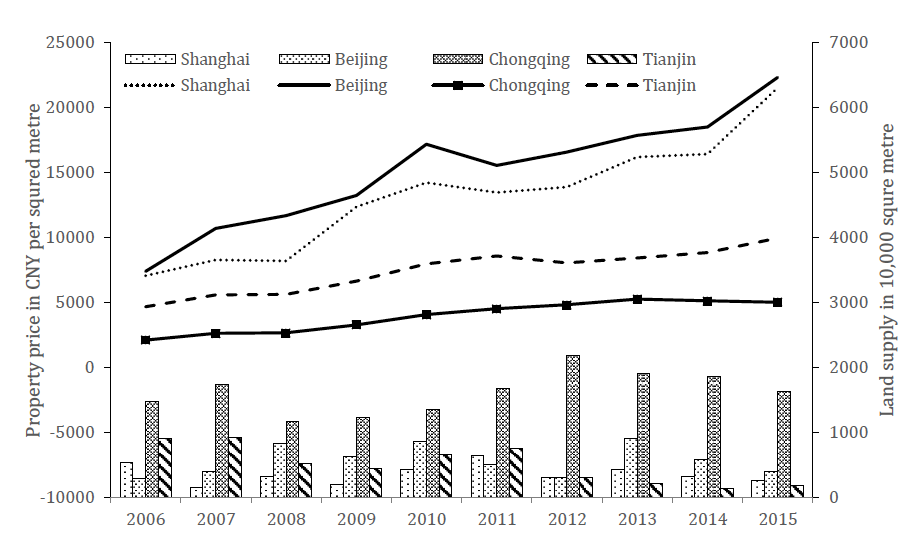

Property prices have been rising at an alarming speed in many Chinese cities in the last ten years. For instance, official statistics show that house prices in Shanghai and Beijing more than tripled between 2006 and 2016 (see Figure 1). If this trend continues, housing affordability will be a real issue. At the 19th National Congress in October 2017, the central government sent out clear signals that measures will be taken to curb house prices effectively. There have been heated debates about how to get this done. Will property tax help? Should we keep an even tighter leash on second-home purchases? Chinese leaders have been very good at conducting experiments to test the effectiveness of alternative policies before rolling them out nationwide. However, housing policies often take a long time to show effects, and the effects are almost inevitably to be confounded by other factors that have changed in the same period of time. It is very difficult to get a clear answer from such experiments.

Figure 1: House prices and land supply in the four provincial level cities in China

Lines represent house prices and are shown on the left axis. Bars represent land supply on the right axis.

Source: China Statistics Yearbook 2007-2016

However, there is one city in China that seems to have the answer already, through a natural experiment by accident. Chongqing was designated as the fourth provincial level city in China in 1997 (the other three are Beijing, Tianjin, and Shanghai). The city had become a leading economic centre for the upper part of the Yangtze River region and a focal point for the experiment of coordinated urban rural development. Starting from 2002, Chongqing has maintained double-digit GDP annual growth rate. Between 2009 and 2015 Chongqing became the fastest growing city in China with GDP growth averaging over 15% per year. Meanwhile, property prices in Chongqing have risen modestly while those in other cities soared. For example, average selling price of residential property is around 6,000 CNY (1GBP = 8.8 CNY) per m2, compared with over 30,000 yuan per m2 in Shanghai and Beijing. The former mayor of Chongqing, Qifan Huang, has been adding more land supply (relative to the other three provincial level cities) to prevent developers from price gouging. This is supported by the large amount of land in Chongqing which was taken over by the government at a very low price during 1998-2002. Moreover, land auctions are carefully managed, and bidders are required to put down large deposits before taking part. This has prevented developers from winning land auctions with sky-high bids (i.e. ‘land kings’) and then borrowing against inflated land values. When land price was under control, house price remained stable. Unfortunately, house prices skyrocketed in 2016 since Qifang Huang left Chongqing and the new mayor lifted the control over land auction and developers. Within months, several ‘land kings’ mushroomed in Chongqing; the property prices almost doubled within a year.

There are two lessons that we can learn from the Chongqing example. First, housing supply in general, and land supply in particular, is the key to curb house prices in China. Most importantly, this is almost entirely under the control of local government. Secondly, and more importantly, low land price and property price have not slowed down economic development in Chongqing, whist all other Chinese cities saw local GDP growth and house prices go side by side. Local governments in China are very reluctant to reduce land price, because they rely heavily on income form land auctions for local finance. Increasing land supply to reduce land price is equivalent to cutting off the blood supply for economic development. However, the Chongqing model demonstrated that affordable and stable house prices created an attractive environment for talents to come, and fostered a strong sense of social belonging. The city benefited from this forward-looking strategy greatly. Perhaps it’s the time for Chinese local government to take a brave step to wean themselves from land finance (i.e. financing local development through land related incomes). At least it worked in Chongqing.