- FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreased from 807.47 to 828.74 (2.63%) compared to last month’s update. The REIT Index has reversed to a short-term uptrend, with the 20-day and 50-day Simple Moving Average (20 SMA and 50 SMA) now on an uptrend. The 200 SMA has acted as a resistance for the past 10 days. However, these are small changes as the REIT Index is still moving on a sideways direction in the long-term (see 2nd chart below).

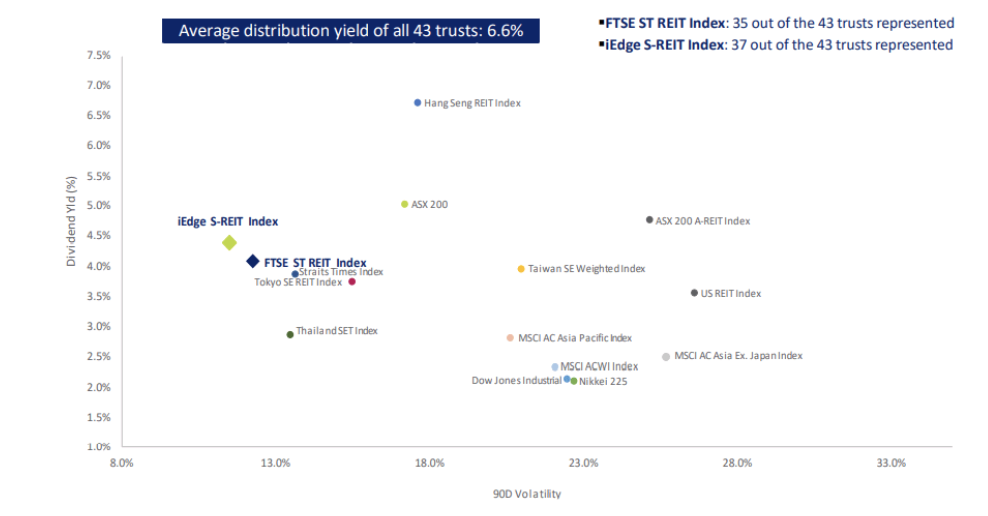

- Yield spread (in reference to the 10 year Singapore government bond of 2.63% as of 7th August 2022) widened from 3.47% to 3.67%. The S-REIT Average Yield increased slightly from6.30% to 6.32%,while the decrease in the Government Bond Yields more than offsets this Average S-REIT Yield increase. This resulted in the widening of yield spread. The yield of the REITs sector needs to increase to maintain the average yield spread of 4%. S-REITs have been resilient and have one of the highest risk-adjusted dividend yields compared to other stock exchanges.

SREITS offer one of the highest dividend yields and lower volatility

Technical analysis

- Technically, FTSE ST REIT Index has started a short term uptrend but is currently testing the 200 SMA resistance. Longer term wise the REIT index is still trading in a sideways consolidation range between 800 and 890. The index has to break the 890 resistance convincingly before declaring the “The Returning of the Bull in S-REITs”.Support Lines: Blue

- Resistance Lines: Red

- Short-term direction: Up

- Medium-term direction: Sideways

- Long-term direction: Sideways

- Immediate Support at 800, 20 SMA, 50 SMA

- Immediate Resistance at 200 SMA

Fundamental Analysis of 38 Singapore REITs

The following is the compilation of 38 Singapore REITs with colour-coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio.

Price/NAV Ratios Overview

- Price/NAV increased to 0.94.

- Increased from 0.92 from July 2022.

- Singapore Overall REIT sector is undervalued now.

- Take note that NAV is adjusted upwards for some REITs due to pandemic recovery.

- Most overvalued REITs (based on Price/NAV)

- Parkway Life REIT (Price/NAV = 2.01)

- Keppel DC REIT (Price/NAV = 1.44)

- Mapletree Industrial Trust (Price/NAV = 1.43)

- Ascendas REIT (Price/NAV = 1. 26)

- Mapletree Logistics Trust (Price/NAV = 1.20)

- ESR-LOGOS REIT (Price/NAV = 1.12)

- No change to the Top 3 compared to the March to July updates.

- Most undervalued REITs (based on Price/NAV)

- Lippo Malls Indonesia Retail Trust (Price/NAV=0.54)

- BHG Retail REIT (Price/NAV = 0.57)

- EC World REIT (Price/NAV = 0.59)

- ARA Hospitality Trust (Price/NAV = 0.63)

- OUE Commercial REIT (Price/NAV = 0.66)

- IREIT Global (Price/NAV = 0.73)

Distribution Yields Overview

- TTM Distribution Yield decreased to 6.32%

- Decreased from 6.45% in July 2022.

- 14 of 40 Singapore REITs have distribution yields of above 7%. (2 less than last month’s update)

- Do take note that these yield numbers are based on current prices taking into account the delayed distribution/dividend cuts due to COVID-19, and economic recovery.

- Highest Distribution Yield REITs (ttm)

- EC World REIT (11.12%)

- United Hampshire REIT (9.84%)

- Prime US REIT (9.75%)

- First REIT (9.56%)

- Sasseur REIT (9.19%)

- Keppel Pacific Oak US REIT (9.12%)

- Reminder that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to COVID-19.

- Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.

- A High Yield should not be the sole ratio to look for when choosing a REIT to invest in.

- Yield Spread widened to 3.67%.

- Increased from 3.54% in July 2022.

Gearing Ratios Overview

- Gearing Ratio decreased to 36.52%.

- Decreased from 36.83% in July 2022.

- Gearing Ratios are updated quarterly. Therefore some of the following REITs have updated gearing ratios compared to last month (those with Q2 2022 updates)

- Highest Gearing Ratio REITs

- ARA Hospitality Trust (43.5%)

- Suntec REIT (43.1%)

- Lippo Malls Indonesia Retail Trust (42.9%)

- Manulife US REIT (42.4%)

- Elite Commercial REIT (41.9%)

- ESR-LOGOS REIT (40.6%)

- No change to the Top 3 compared to the April to July updates.

Market Capitalisation Overview

- Total Singapore REIT Market Capitalisation increased by 3.48%to S$108.6 Billion.

- Increased from S$104.95 Billion in July 2022.

- Biggest Market Capitalisation REITs:

- Capitaland Integrated Commercial Trust ($14.12B)

- Ascendas REIT ($12.59B)

- Mapletree Pan Asia Commercial Trust ($10.05B)

- Mapletree Logistics Trust ($8.48B)

- Mapletree Industrial Trust ($7.20B)

- Frasers Logistics & Commercial Trust ($5.28B)

- MPACT (formerly MCT) moved from 5th to 3rd rank since its merger with MNACT.

- Smallest Market Capitalisation REITs:

- BHG Retail REIT ($267M)

- ARA US Hospitality Trust ($357M)

- Lippo Malls Indonesia Retail Trust ($377M)

- First Trust ($444M)

- EC World REIT ($445M)

- United Hampshire REIT ($477M)

38 Singapore REITs at a glance: REIT Table

- The Financial Ratios are based on past data and there are lagging indicators.

- The Financial Ratios are based on past data and there are lagging indicators.

- This REIT table takes into account the dividend cuts due to the COVID-19 outbreak. Yield is calculated trailing twelve months (ttm), therefore REITs with delayed payouts might have lower displayed yields, thus yield displayed might be lower for more affected REITs.

- REITs are updated with the latestQ2 2022 business updates/earnings are highlighted in blue, the rest are updated with Q1 2022 business updates/earning.

- Since MPACT started trading, values shown below (except price and market cap) are of MCT.

- MNACT has been delisted, but values are shown below for reference.

What does each Column mean?

- FY DPU: If Green, FY DPU for the recent 4 Quarters is higher than that of the preceding 4 Quarters.If Lower, it isRed.

- Most REITs are green since it is compared to FY20/21 as the base (during the pandemic)

- Yield (ttm): Yield, calculated by DPU (trailing twelve months) and Current Price as of August 6th, 2022

- Digital Core REIT: Yield calculated from IPO Prospectus.

- Daiwa House Logistics Trust: Yield calculated from trailing six months distribution.

- Gearing (%): Leverage Ratio.

- Price/NAV: Price to Book Value. Formula: Current Price (as of August 6th, 2022) over Net Asset Value per Unit.

- Yield spread (%): REIT yield (ttm) reference to Gov Bond Yields. REITs trading in USD is referenced to US Gov Bond Yield, everything else is referenced to SG Gov Bond Yield.