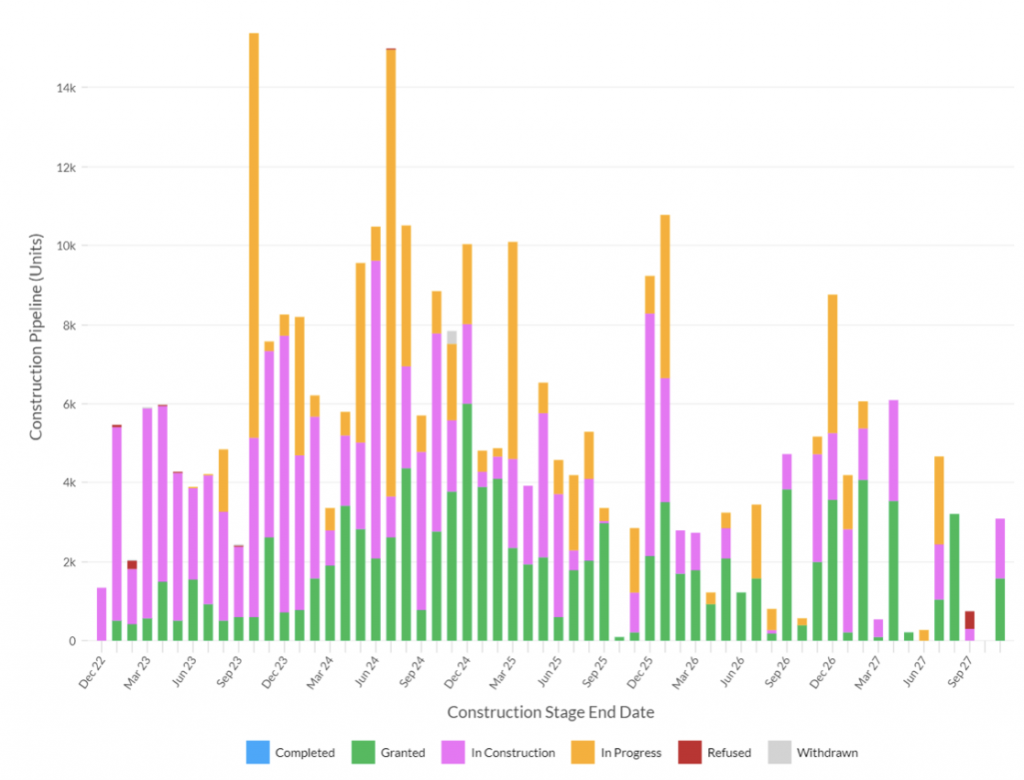

Below is a graph showing the total number of residential units by estimated completion date and stage of development across London. It is, of course, a ‘best guess’, particularly when you consider that some developments are still planning ‘in progress’. However, it shows that developers across the capital are expecting a significant number of completions between Q3 2023 and Q3 2024.

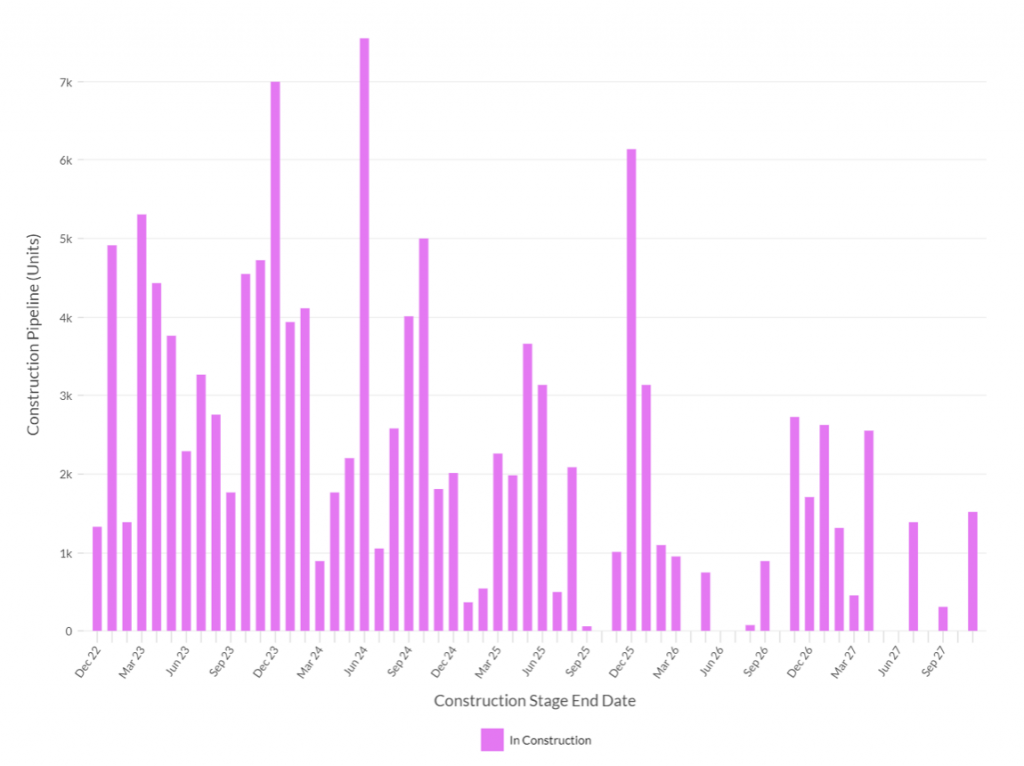

Narrowing in on just those projects that are already in construction shows the main bulk of construction work is due to complete at the end of this year.

Of course, this isn’t distributed evenly across the city. Some areas, such as Acton, have multiple major construction projects underway, while others, such as around Hammersmith, have virtually nothing.

With all the recent volatility in the market, and concerns about house prices and interest rates, you might think that those clusters of developments could be in for a bit of an over-supply shock.

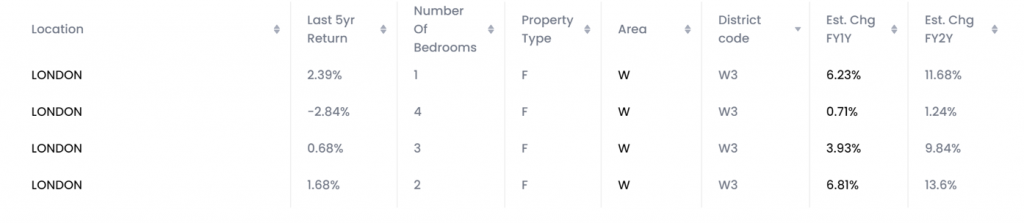

However, looking at our latest forecast models, it seems that the majority of developers have been quite astute in choosing where to build. In each of the handful of clusters that we looked at across London, we found that the expected price change over the next 12 months was generally higher than the London average. The example below is of flats in the Acton area, showing on average a 5%-6% YoY expected price change (column second to the right in the image below). While an oversupply could greatly chip away at this, it does give the developers a bit more leeway.

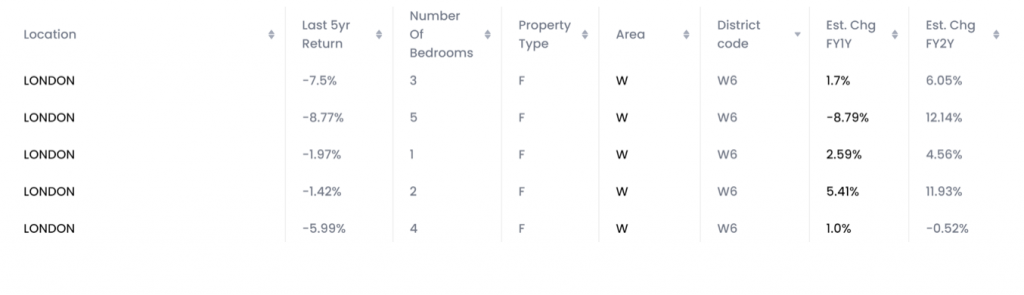

Conversely, around Hammersmith (image below), where there isn’t much construction, we found an average of 2%-3% expected price changes one year ahead, excluding five-bedroom flats from that average, as they are quite uncommon.

So, from a market perspective, it appears that these developments are likely to be OK. However, what might cause more issues are the financing costs with higher interest rates, both the re-financing for the developer/investor and the financing costs of a mortgage, given that when these projects were initiated rates were significantly lower.

Let’s see what happens!