Originally published November 2017.

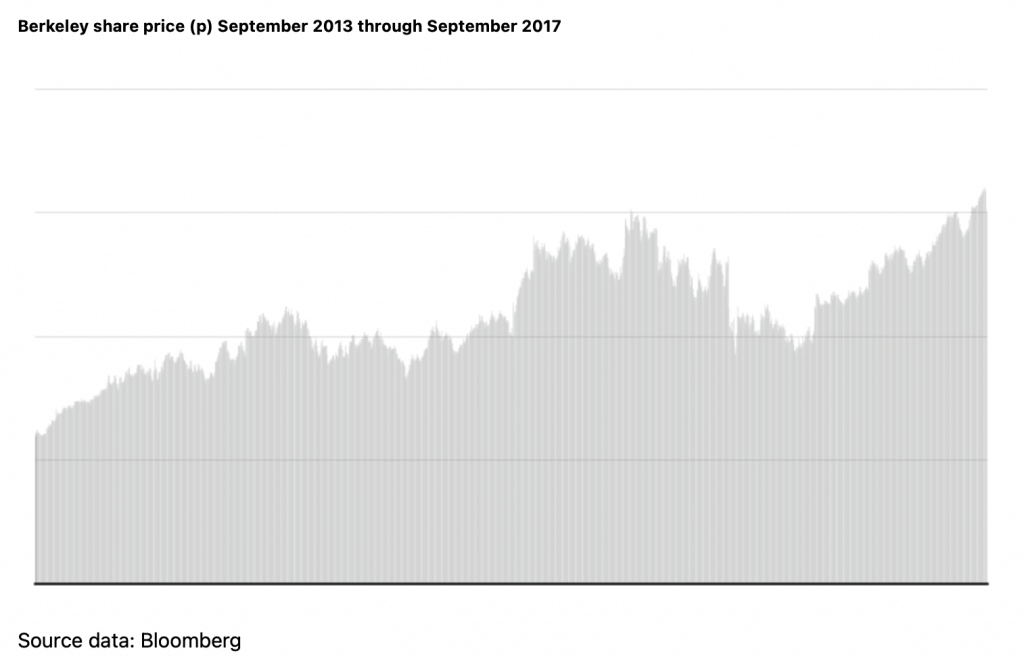

Veritable housing soothsayer Tony Pidgley turned 70 in August, and in September, Berkeley was re-admitted to the FTSE 100 for the second time – its share price hitting a new all-time high. Mr Pidgley’s 2017 fiscal pay packet was £26.9 million and in recent weeks he has sold two tranches of 750,000 Berkeley shares each time (which raised twice that amount). But “I’m not stopping any time soon,” he says, “there is still so much need, so much to do, so much to build” and “we have land everywhere”. Tony Pidgley talks to Tony Williams, and they have known each other for 33 years.

1976 was the year of the hot summer, Berkeley’s provenance and the emergence of Tony Pidgley. In the intervening 41 years all three have become soused in folklore, myth and legend. Apocryphal or not, what is real is the growth, nimbleness and ultimate pre-eminence of Berkeley in its chosen industry; and it is still led by Tony, who is Executive Chairman and a CBE.

The company was floated on the USM (Unlisted Securities Market) in 1984 and joined the main market in 1985 with a market capitalisation of some £67 million. Since then, the company has more than doubled in value in each of its 32 years as a fully listed company (i.e. +221% per annum). Put another way, Berkeley’s market value has squared (officially at £4.5 billion) and then some i.e. this month (October 2017) it bounced off £40 per share and a £5.4 billion market capitalisation. In September, Berkeley was also readmitted to the FTSE 100.

The Berkeley Group key points

- At its last balance sheet date, Berkeley held net cash of £285.5 million

- Profit before tax has grown at 32% per annum over five years to clear £800 million

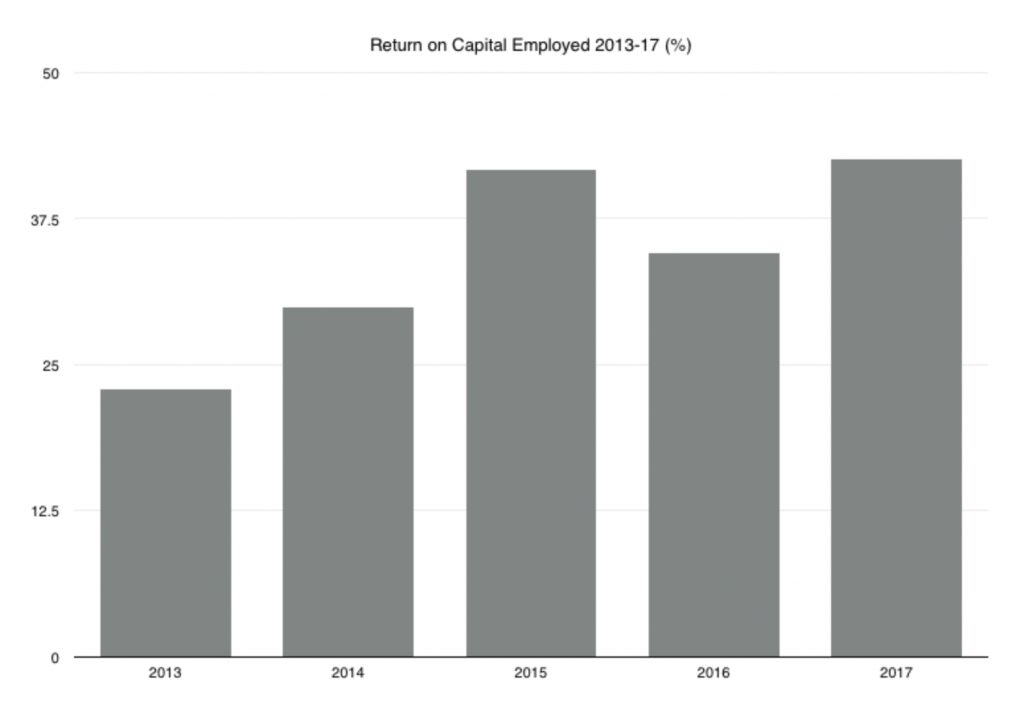

- Return on capital employed has averaged 34.3% per annum 2013-17

- 19,000 houses built in the past five years

- Berkeley delivers over 10% of London’s new affordable and private homes

- £6.4 billion gross margin on land holdings

- 30,000 jobs supported

- £2.3 billion contribution to UK Treasury

- £11.2 million to over 100 charities

- Aims to be the UK’s first carbon positive housebuilder

- Group motto is “Suscipere et Finire” i.e. to undertake and to accomplish

It is also true that Mr Pidgley appears to have a sixth sense which tells him when the property market is going up and when it is going down. This started almost before it all began, when in the year (and pretty much the month) that Berkeley joined the USM i.e. July 1984, the base rate (aka the minimum lending rate) rose 200 basis points in a single leap to 12%. This had only happened previously in the dog days that were the second half of the 1970s. The float went ahead anyway, albeit less money was asked for, because Tony could see through the mist realising that this was simply a blip not a trend.

Empirical proof came again, early doors, in the financial storm of the late 1980s/early 1990s when interest rates doubled in 12 months and mortgage rates did the same with many homeowners (and more mature readers) paying a rate north of 15%. And who went liquid in advance of this debacle?

Similarly, who remembers Trencherwood which also floated on the USM in 1984? It hit the buffers in 1992 when it was also forced into a penal debt for equity swap before being absorbed in 1996 by Wilson Bowden (now part of Barratt). This recession and its aftermath changed the face of the UK industry and led to the wide scale exit of contractors from housebuilding (save for Luddites such as Galliford Try and Kier).

Same again, too, in the global financial crisis (GFC) which started in 2008 and ran through 2012. Berkeley was the sole UK listed housebuilder not to write down its assets. In the three calendar years 2008 through 2010, companies comprising the publicly listed UK housebuilding sector wrote off £5.2 billion in provisions against asset carrying values i.e. this was 41% of the starting price of £12.8 billion in Net Asset Value (NAV). The sector also raised some £1.7 billion of fresh dosh from its shareholders during this period. Once again, who was buying land when Lehman’s went bust? And the group’s performance is still benefitting from this investment – almost 10 years on.

As the late, great Carwyn James once said: some players sniff the wind, others create it. Mr James was coach of British and Irish Lions on their tour of New Zealand in 1971 and this is still the only Lions side ever to win a series against the All Blacks. He said: “I love an inner calm, a coolness, a detachment; a brilliance and insouciance which is devastating”.

1984

I was a cub building analyst in 1984 at Grieveson Grant which was absorbed by Kleinwort Benson a year later which, in turn, was bought by Dresdner Bank in 1995 which then disappeared into Commerzbank in 2008…

In any event, Grieveson Grant, or ‘GG’ as it was affectionately known, was still a partnership (pre-1986s Big Bang) and one of the partners summoned me to his desk one day to ask about the privately-owned Berkeley Group. “Williams, I have just bought a super new house down in Surrey from this outfit called Berkeley. I think the company might be worth a look. I think they might float. You should go and see them.”

And so, as ‘recommended’, I took the train to Weybridge and met Tony Pidgley and then-CFO Paul Read, and I was collected from the station by Paul in Tony’s Rolls Royce (the boy had style from the get-go). They were both very nice people and self-deprecating to the extent that they said “we have a lot to learn”. But even then, no one was building houses like Berkeley.

As is lodged in folklore, too, the company was named after Berkeley Square in the West End. “Why not?” they said at the time. And: “Who knows, too, we might have an office there one day.” Okay, the latter is one of the few things that didn’t come true.

Strategy and style

Berkeley is not simply a common or garden housebuilder, it is a creator of communities on both a diminutive and massive scale – and often in initially unprepossessing locations. It is probably the best at it in the UK (its sole marketplace). “Above all else, enhancing property value is about having time. This is afforded to Berkeley by its strategy of taking low financial risk through a combination of matching production to demand, selling forward and only gearing when there is sufficient visibility of future cash flow.”

“Berkeley’s strategy has been developed for a cyclical market. Residential development is not about individual reporting periods. It is about creating value over the long-term and this requires financial discipline and balance sheet strength. Berkeley acquires land differently to others. The primary focus is on adding value through its development expertise, for which we have an excellent record.”

The Berkeley Group also comprises six autonomous companies: St George, St James, Berkeley, St Edward, St William (working with National Grid), and St Joseph (based in Birmingham).

It has also adopted a formal business strategy called ‘Our Vision’. It focuses on five key areas and 10 commitments to be delivered between 2016 and 2018; and, through this framework, “the Group aims to become a world class business generating long-term value by creating successful, sustainable places where people aspire to live”:

- Customers – providing exceptional service to all customers, engaging with them and putting them at the heart of all decisions; and it boasts a 98% buyer ‘recommendation-to-a-friend’ (Institute of Customer Service).

- Homes – developing individually designed, high quality homes with low environmental impact, smart technology – and an eye to climate change. For example, in May 2016, in a landmark announcement for the housing industry, Berkeley committed to becoming the first major housebuilder in Britain to be carbon positive.

- Places – creating great places where residents enjoy a good quality of life, now and in the future – with a net biodiversity gain.

- Operations – making the right long term decisions whilst running the business efficiently and working with the supply chain. This includes reducing operational carbon emissions intensity by 10% and a programme to become carbon positive; plus at least 1,500 people across both the direct and indirect workforce undertake an apprenticeship or vocational training.

- People – developing a highly skilled workforce which runs autonomous businesses, operates in a safe and supportive environment and contributes to wider society.

And, by way of pudding proof, Berkeley was voted one of Britain’s Most Admired Companies across all industries from 2012 to 2016 – and Housebuilder of the Year in 2015 at The Building Awards. In 2014, it won the Queens Award for Enterprise and in 2015, the Group was the first housebuilder in the UK to have 500 sites registered by the Considerate Constructors Scheme. And, finally, The Berkeley Foundation was set up in 2011 and has so far committed £11.2 million to more than 100 charities and worthy causes.

True to its word, too, the Group (and it uses ‘The’, the article, in its title) has adopted the Latin motto “Suscipere et Finire” i.e. “to undertake and to accomplish”. Say no more.

Performance metrics

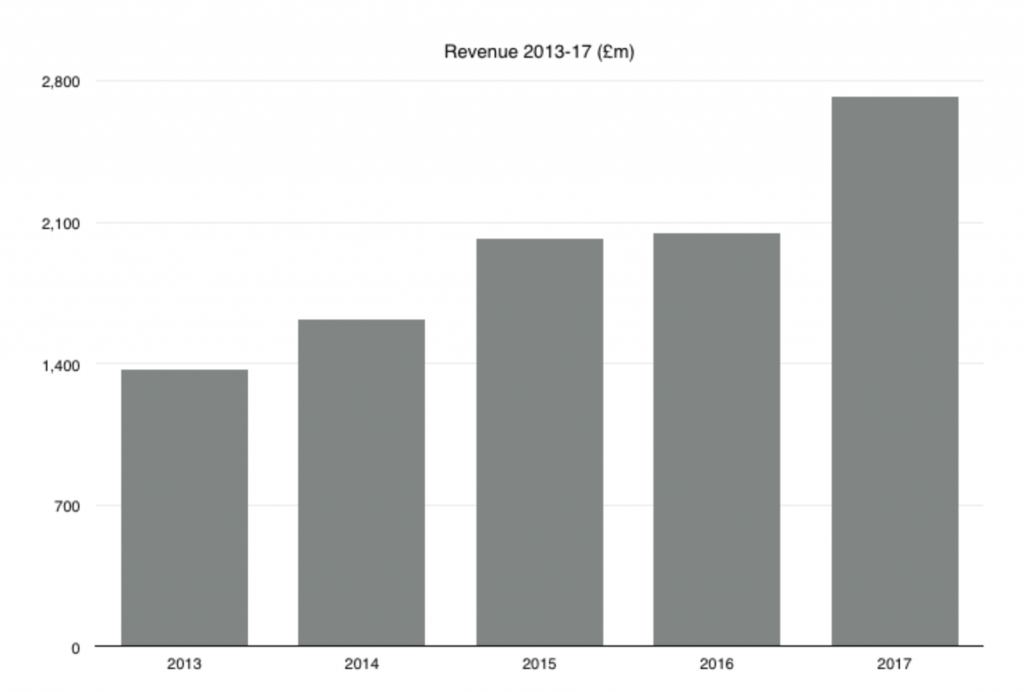

In the five fiscal years through 30 April 2017, Berkeley has more than doubled revenue to £2.7 billion which means a 22% per annum gain over the period.

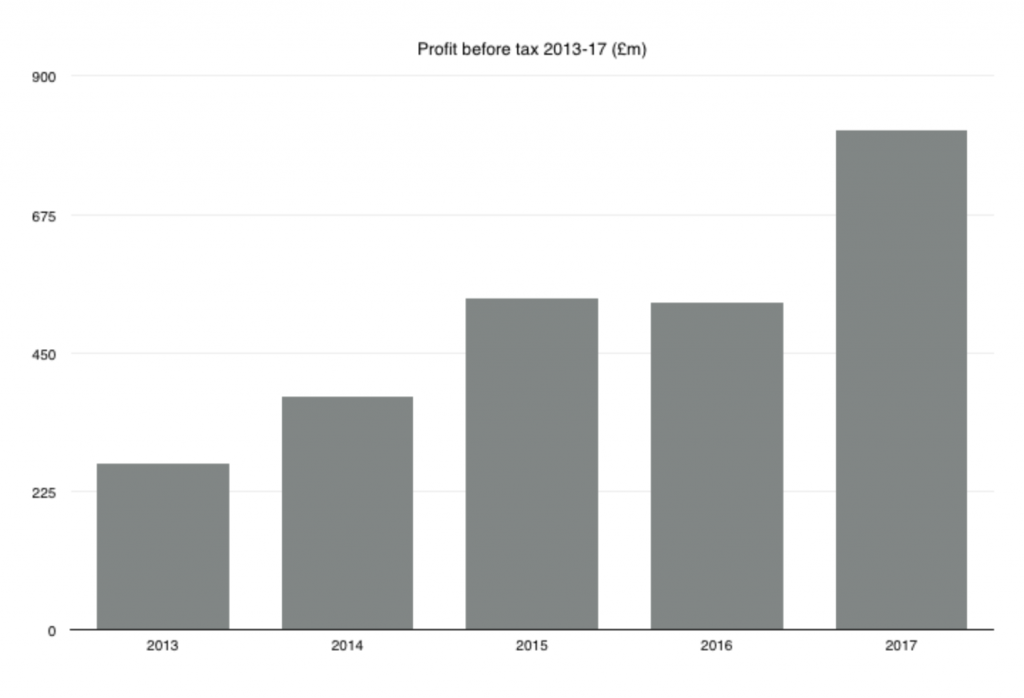

At the same time profit before tax has grown at 32% per annum over five years to clear £800 million.

Finally, the Group has averaged a return on capital employed of 34.3% in the half decade from 2013 through 2017 (as defined and published by Berkeley).

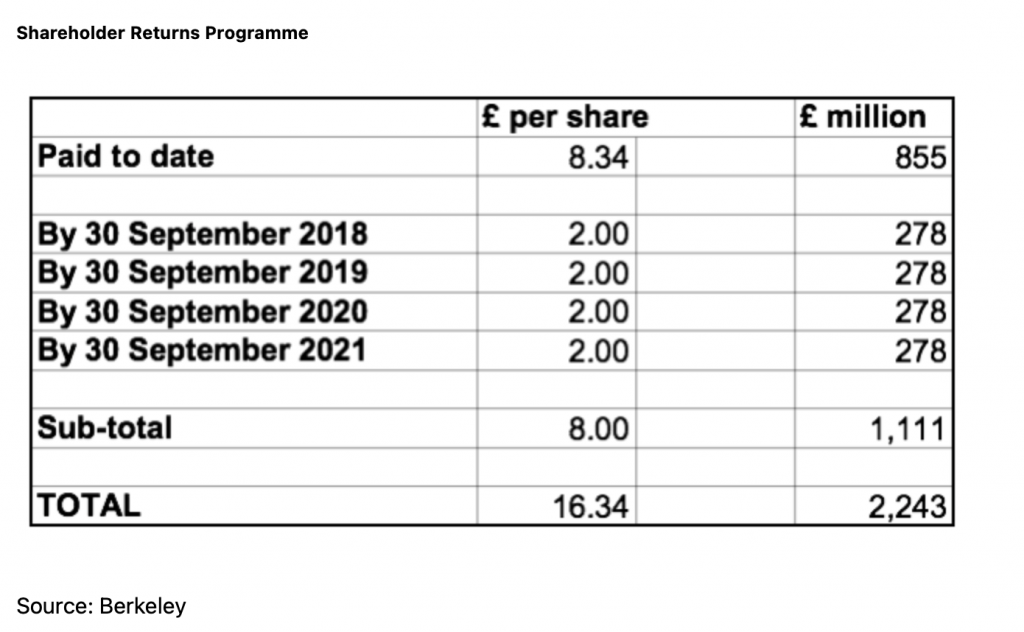

Since 2011, too, Berkeley has also been operating a return of cash to shareholders scheme which through September this year had produced £8.34 per share or £855 million. This will continue through 2021 when the total will have risen to £16.34 and more than £2 billion.

It should also be noted that since the Brexit vote in June 2016, Berkeley has bought back 5.1 million shares at a total cost of £157.3 million. This equates to £30.74 per share against a current share price of £35.65; nice arithmetic. Note, too, that at the last balance sheet date 30 April 2017, Berkeley still held net cash of £285.5 million.

Berkeley AGM statement: 6 September 2017

“In the first four months of the year Berkeley has continued to trade in line with Management’s expectations, with sales prices achieved remaining above business plan levels. This, coupled with the Group’s strong forward sales position and unrivalled land bank, provides the Board with the confidence to reaffirm its guidance that Berkeley is on track to deliver at least £3.0 billion of pre-tax profit in the five years ending 30 April 2021, with profits for the current year anticipated to be at least as strong as 2016-17.

While Berkeley is in excellent shape, the London market continues to be adversely impacted by both, uncertainty around the terms and implications of Brexit and, the changes in recent years to SDLT and mortgage interest deductibility. This has been partly offset by good availability of mortgage finance at low interest rates, favourable currency exchange rates and the quality of Berkeley’s well-presented and well-located homes.

On the supply side, the planning environment remains challenging with the multiple requirements of Affordable Housing, CIL and Section 106 requirements, still yet to reflect the current market conditions. As a consequence, new construction starts in London remain some 30% lower than 2015.

With cash balances forecast to be higher at the half year than at the start of the year, the visibility of earnings and financial strength of the Group underpin Berkeley’s Shareholder Returns Programme, under which in excess of £2.2 billion (£16.34 per share) is being returned through a combination of dividends and share buy-backs by 2021 on a six-monthly basis. The returns initially equated to £2 per annum but this has increased to £2.04 per annum following share buy-backs undertaken since January 2017.

As announced on 17 August 2017 a dividend of £70.4 million, or 51.76 pence per share will be paid to shareholders on 15 September 2017 with the remainder of the £138.8 million of the return for the 6 months ending 30 September 2017 having been satisfied through share buy-backs of £68.5 million. The Company also announced that the next six-monthly return of £138.9 million will be made by 31 March 2018, with the amount to be paid as dividend to be announced in February 2018, taking account of any share buy-backs in the intervening period. Share buy-backs will be undertaken to the extent the Board believes these are in the best interests of all shareholders and not only when the shares are materially under-valued.

In total, by 30 September 2017, Berkeley will have returned £8.34 of the £16.34 target.

With its strong balance sheet, forward sales, high quality land bank and leading brand and customer service, Berkeley is well positioned to deliver its earnings guidance and optimise shareholder returns in the current market conditions, whilst retaining sufficient capital to be flexible should suitable new investment opportunities arise.”

An audience

Nestled in its gargantuan Battersea development, just over Chelsea Bridge and next to the Power Station, Berkeley has retained a luxury suite of corporate offices (named “Hawker”) for meetings and the like; including the board. As an outsider visiting there, though, it is a bit like taking a number and waiting. Tony Pidgley is always busy (and he loves it). I call such meetings ‘audiences’.

As the doors revolve who should emerge from the inner sanctum but Ollie Phillips, the former England Rugby Sevens Captain and now a director at PwC, writer and pundit. He was there with his show home magazine hat on. Tony being Tony introduced us and straight away I said, “I know you from Sky TV’s rugby coverage”. Ollie and I then embarked on an animated discussion about the game. Tony was loving it.

Tony also told Ollie that I had floated Charles Church (now part of Persimmon) back in 1987. He said that he and I had had a rare falling out over the relative merits and de-merits of Charles Church in 1987 – and its valuation; Berkeley being an arch competitor. Happily, we kissed and made up. But the eponymous Charles Church was not a success as a listed company and was taken private in an indecently short period after it floated. Tragically, Mr Church, the owner, died in a Spitfire crash not long after that in 1989. The company was absorbed by RBS in 2009 and then sold to Beazer and eventually Persimmon and it continues to trade as Charles Church. This is another example of the Pidgley prescience.

Tony Pidgley turned 70 in August although he does not look it. Pointing to his head, too, he said, “I don’t feel any different here either”. He is also slimmer that he has been in years, and is regularly a home gym attendee. But he fits this in around the business and says he is busier than ever, and “no, I am not stopping any time soon”.

No, I am not stopping any time soon

“Look at my phone,” he said. “My first SMS of the day was sent at 4 am, and that’s normal. After this meeting with you, I have a board meeting here and then I am out for dinner with a client. Take this coming weekend too. After the gym on Saturday, I am in Cambridge and then on Sunday, I have business meetings from lunch onwards; and these people come to the house”.

Tony is also very happy with the health of Berkeley (historically he used to call it “she”, like a ship) and “the current performance is built on a large number of huge sites bought 10 years or so ago”.

“We have land everywhere and no one knows we have it. Remember, though, the promotion of big sites [through planning and the like] can cost £3 million each – and if you have 10 sites, you need 20% of them to come off. I have no illusions either that it will go on without me. Perrins [the Group CEO] has Berkeley in his DNA. We also have 27 Managing Directors throughout the Group – many of them with 20 and 30 years’ experience. And, no, we are not blind to succession planning.”

September also saw Berkeley re-enter the FTSE 100; and it has been here before (and it seems to like September). Indeed, it made the cut in the ninth month of 2015 only to drop out again in the wake of the Brexit vote in September 2016. At one stage in the wake of the Brexit vote (26 July 2016), the UK housebuilding sector had fallen 38%, and Berkeley bounced off £20.15 in July 2016.

The sector recovered palpably and during 2017 to date it has broken new ground on a number of occasions most recently on 24 October set yet another new all-time high of £43.6 billion (spread over 16 stocks). At the same time, Berkeley cleared £40 per share which means it doubled in the 16 months following the Brexit vote.

The Actor’s Studio

These 10 questions originally came from a French series, ‘Bouillon de Culture’ hosted by Bernard Pivot. They are better known as the questions which James Lipton asks every guest at the end of ‘Inside the Actor’s Studio’ TV show.

1. What is your favourite word?

Berkeley

2. What is your least favourite word?

Unhappy

3. What turns you on creatively, spiritually or emotionally?

Running the business well and efficiently; great people

4. What turns you off?

Bad behaviour

5. What is your favourite curse word?

“F**k you”

6. What sound or noise do you love?

Moon River, because when I was sleeping rough under a bridge I could hear it playing many times from a nearby house – and I thought to myself I want to be ‘crossing you in style someday’

7. What sound or noise do you hate?

Buzzing in my ear

8. What profession other than your own would you like to attempt?

Something creative, art, brochures or the like

9. What profession would you not like to do?

Prostitute

10. If Heaven exists, what would you like to hear God say when you arrive at the Pearly Gates?

I’ll do what you say, Tony

Tony is not fixated about the FTSE 100 and is in fact sanguine in extremis. “It is really no place for us or any other housebuilder. We are too cyclical and it will always be in and out. I would prefer to be excluded.”

[The FTSE 100] is really no place for us or any other housebuilder

Inevitably, we talked about the other housebuilders and I said, “Berkeley could do with a sector of its own.” Tony didn’t disagree and took the opportunity to lay out his own blueprint. He said you need to be in touch with the market and “on the pace”. Respect for the product and the customer is also key. Management? “Some companies have it and some don’t. We do.” Don’t be exclusively a “financial wizard” either, he continued. Get the basics right and the financial performance will follow. Building a board is also vital. And “you have to be good” at what you do.

Get the basics right and the financial performance will follow

Nor is he tempted by a second geographical market. “UK and UK only,” he says. “There is still so much need, so much to do, so much to build. And we will have to continue going higher. The government is also on side. But I can’t just double my output and I don’t believe anyone – in the public or private sectors – who says they can.”

During our time together, jacketless Tony spent a lot of time walking around the office. He also took the one or two calls which “I have to take”. One was from a senior official at a planning department. In order to blend in, I had taken my jacket off only for Tony to admonish me for having my initials embroidered on my shirt…

At the end, I asked, “Will it be Sir Tony or Sir Anthony?” To which he responded, “It’s not going to happen. It doesn’t happen to people like me. And there is no courting of it.”

Vital signs

Born: 6 August 1947

Status: married, with two girls aged 10 and 12. Tony also has a grown-up girl and boy from a previous marriage – and, the latter, Tony Jr is MD of the privately-owned bespoke housebuilder, Langham Homes, in which Tony Snr has invested from time to time. Nor is this Tony Jr’s first venture. He successfully created Thirlstone Homes which he later sold to Berkeley in 1998 for £15 million and joined the Berkeley Board. But he left in 2001 to do his own thing again and even had a misguided pop at taking over Berkeley along the way.

School: “not really”

First job: McDonald’s Fisheries (‘Mac Fish’) in Bridge Road, Hampton Court. He delivered fish by bicycle with a big basket on the front and was paid £4 per week. After hours, he used the same bike and basket to carry fresh turf which he laid in gardens in the evenings.

Pay: £26.9 million in fiscal 2016-17 (£21.5 million 2015-16)

Shareholding in Berkeley: 3.04%

Homes: Windsor and central London

Car: Bentley (two), “but I don’t know what types”

Books: “I like books on business and famous autobiographies. And I have just read Tony Blair’s.”

Last film: Jason Bourne

Favourite music: Moon River (see Actor’s Studio)

Gadget: Smart phone (“but I am not technology minded”)

Last holiday: Sardinia

Charity: a range of them for multiple sclerosis

Advice to a youngster: “Use common sense. Believe. Work hard.”