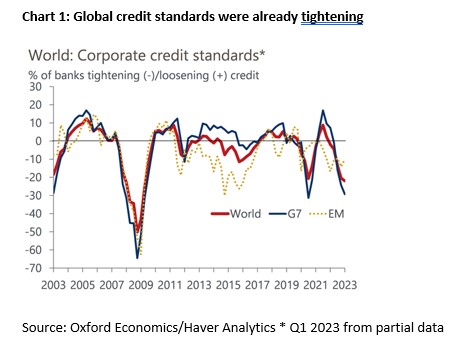

Global credit standards are set to tighten further in response to the recent bank funding turmoil, as suggested by movements in bank share prices and financial conditions during the aftermath of the Silicon Valley Bank (SVB) collapse and Credit Suisse takeover. The Oxford Economics indicator of global bank credit standards was the tightest reading in Q1 2023 since 2009, but was still well short of that seen at the worst point in the global financial crisis (Chart 1), implying that actual credit flows would turn negative in early 2024.

Under the Basel III framework, commercial real estate (CRE) loans typically hold higher risk weighting ratios than other segments of bank lending, which exposes the sector to a more marked pullback in lending should banks capital adequacy come under pressure. Given the poor market conditions, falling real estate values, and higher debt servicing costs, many CRE loans are likely to be reclassified with even higher risk weightings moving forward. This will require banks to hold more equity against the loans, both diminishing returns and disincentivising banks from providing additional credit to the sector, particularly as loan quality deteriorates, further exacerbating the tightening in credit to CRE.

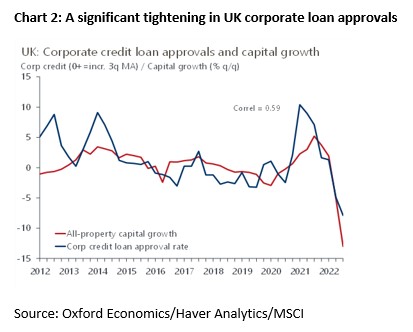

There is a strong relationship between changes in credit conditions and CRE capital value movement in the eurozone, the UK, and the US, albeit with variations in how credit conditions are measured. There has already been a significant tightening in corporate credit loan approvals within the UK since Q3 2021 (Chart 2). Indeed, data for Q4 2022 showed a negative 16.7 reading, the largest since the series began in 2012, and corroborating the 13% q/q drop in all-property capital values, the steepest since Q4 2008.

The cost of liquidity increases in a risk-off environment. This makes private markets less attractive as yield can be gained in fixed income without the uncertainty of pricing real estate illiquidity. The pool of buyers shrinks and an aversion to risk dominates, resulting in a tighter definition of a prime asset as lenders and investors shy away from unquantifiable unknowns. This has prompted us to lower our global baseline forecast for CRE values over 2023-2024.

The US looks particularly exposed due to the importance of regional banks in real estate financing and the role of leveraged non-bank lenders. Consequently, we now forecast a peak-to-trough slump in US all property capital values of 15%. That would make the current downturn just under half the decline in 2008-2009 but significantly worse than the 4% correction during the dotcom bust.

UK banks’ loan exposure to CRE is generally low, in contrast to the US. UK and eurozone banks have reduced their CRE exposure since the GFC due to regulatory changes. Nonetheless, given the interconnectedness of global capital markets, any problem stemming from US regional bank lending activity is likely to have spill-over effects elsewhere in CRE, not least in transaction volumes and capital raising activity.

A risk-off environment will also be bad news for the office and retail sectors where the combination of tighter credit standards, poor capital performance over the past few years, coupled with lower income relative to debt payments, could accelerate forced sales this year. Industrial looks more insulated going forwards as there is more upside in a recovery. The energy transition and near-shoring/friend-shoring will supplement ecommerce demand while the sector is easier to align with net-zero targets. We therefore still expect healthy medium-term performance for industrial.

Non-bank lending also represents a risk. Non-bank lending to CRE has increased significantly over the last cycle, partly in response to the impact of regulatory changes post-GFC. The Bayes UK CRE lending survey reported that non-bank lending had increased for 15 successive years to 2022, representing 38% of lending last year, with debt funds accounting for 25%. This has offered diversity of capital, but much of the lending falls outside of regulatory oversight, so the risks are much more opaque.

CRE default risk looks elevated for private equity and private debt. We know that CRE default risk increases as interest rates rise, as the risk premium for CRE loans widen, and as LTVs move higher. Bayes reported in their 2021 survey that debt funds issued 58% of loans at an LTV of 60% or above, with 22% above a 70% LTV – much higher than the wider market where LTVs have been restrained to generally around 50% on average. We have also reported previously that private equity LTVs appear much higher at around 70%-80%, based on Preqin data for the US. In our view, this is an unwelcome mix during the current period of bank funding turmoil and could exacerbate capital value decline.