Prof. Dr. Tobias Just (FRICS) and Dr. Marian Dietzel

Given the current demand for housing, the number of residential completions in Germany is too low: Since the last census in 2011, the number of inhabitants in Germany has risen by around four million, while about three million new apartments were completed during this period. This is not enough, as buildings are pulled down every year, and – what is more important – beyond immigration from abroad, internal migration to metropolitan areas creates additional demand for housing. In none of the last few years has the target of 400,000 completed housing units as set out by the German government’s current coalition agreement been reached.

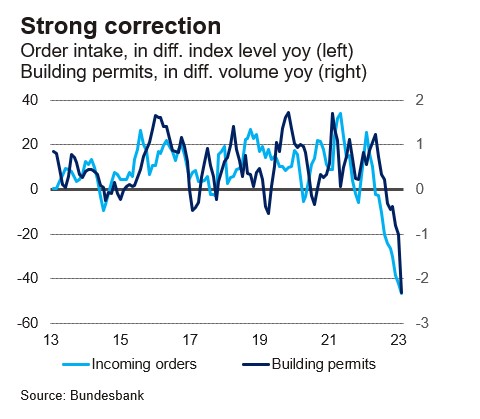

As a result of this divergence, over the past few years residential rents in Germany have risen and continue to rise sharply, especially in metropolitan areas. But in recent months, new orders and building permits for residential construction have plummeted as a cocktail of rising mortgage rates, rising construction costs, geopolitical risks and a regulatory environment that at times appears erratic have made residential construction more expensive and caused more uncertainty among private and institutional investors. This will exacerbate the situation for residential tenants, and these dynamics are also likely to leave strong macroeconomic skid marks (Just, 2023a; Just, 2023b).

Precisely because the construction industry is accounting for more than 11% of Germany’s Gross Domestic Product, and because the leading indicators of new orders and building permits are only published with a time lag, it is important to map developments in this sector in real time at best. In addition to survey-based sentiment indicators such as the ifo business climate index, analysts have started to eye search volumes generated on the Google search platform[1] and traceable via Google Trends in recent years, because the purchase of real estate is usually preceded by an extensive procurement of information via the internet. Indeed, in recent years, numerous studies have been able to show that there is a leading relationship between search volume on Google and real estate industry indicators (Hohenstatt et al. (2011); Wu and Brynjolfsson (2015); Dietzel (2016)).

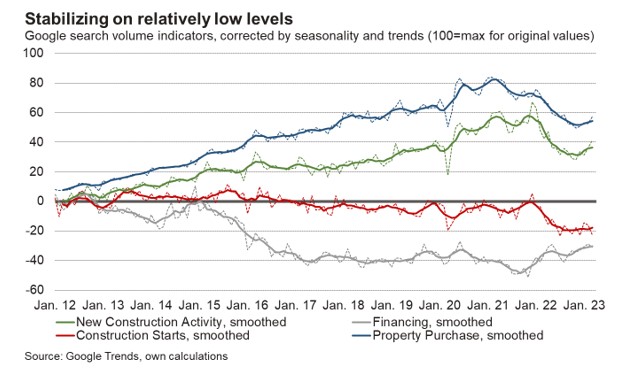

For this article, we have designed four different search indices, each based on a group of specific search terms: The “new construction” index for example summarizes search terms precisely on the topic of new construction activity (e.g., “new construction” plus “apartment”). Similarly, the “financing” index is based on typical real estate financing search terms, the “construction start” index summarizes terms that might be more relevant for a contractor’s perspective (e.g., “construction company” or “excavation”), and the final “property purchase” index contains search terms related to real estate acquisition (e.g., “buying a house”). The following figure illustrates the evolution of these four Google search volume indices for the German housing market. We have adjusted the original data for seasonality and trend components; deviations from the trend can then also result in negative values.

It can be seen that the decline in the category of property purchases in particular already began before the turnaround in mortgage rates, but that the downward trend in search volume happened throughout the year 2022. At the current edge, at least two search volume groups (Property Purchase and New Construction Activity) are showing a slight upward trend again; the financing category appear to have recovered from a low level for a few weeks. The indicator Financing has been rising for some months, however, from extremely low levels, and this specific financing indicator proved comparatively bad in leading the real estate cycle in the past, i.e correlation with real estate market indicators has been comparatively low.

Of course, some of the search indices are highly correlated with each other, but at the same time it is also evident that the specific selection of search terms can lead to very different results. It is advisable not to look at a single index when seeking conclusions about future developments of the construction activity.

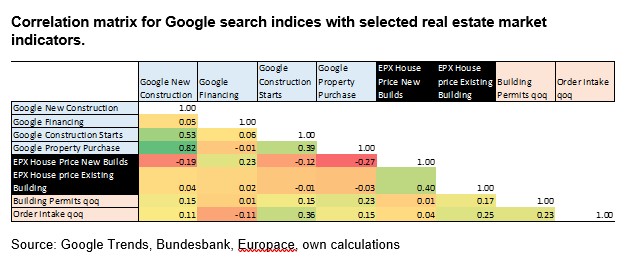

In a next step, we correlated the absolute quarterly changes in the search indices with the absolute quarterly changes of selected real estate market parameters, here, order intake, the number of building permits and the EPX house price index for both new and existing housing units from Europace.[2] We can show that our search indices for new construction, for construction starts and for property purchases correlate with both changes in new orders and with the change in numbers of building permits. No similarly high correlation can be found for the “financing” index. For the relationships with housing prices, there are inconsistent signals from the Google indicators. No lags were taken into account for this correlation matrix; however, since new orders and permits data in particular are published with a lag, such a nowcast would have a quasi-forecast quality at the current margin.

If lag structures are additionally taken into account, not only can the correlation relationship be improved, but an actual lead even emerges. We have calculated that lead structures between two and five months emerge between our isolated search volume indices and the change of orders or building permits. Thus, we can develop early-bird indices for the typical early-bird indices.

Five messages can be derived from this brief analysis:

- Google search behavior can be used for both the construction and the real estate markets in Germany. A certain lead time can be identified, at least with regards to the reporting time.

- The modest recovery at the current edge in search volumes could accordingly be interpreted as a weak signal that the downturn in order intake and permit numbers may soon have reached its cyclical low, however, starting from a low level.

- A comparatively close relationship between search volumes and market indicators was found for the two search indices new construction and property purchase. These tend to capture real interest, so they are more likely to run ahead of the business- and financing-related indices.

- Caution is advised, of course, because the “trend reversal” is still very recent and the search indices are sometimes subject to heavy fluctuations. Moreover, the current discussion about obligatory energy refurbishments of apartments is likely not yet included in the data.

- For this paper, a simplified bivariate approach was chosen to illustrate possible relationships. For a thorough analysis and forecast more factors need to be controlled for. Our point here was that Google search volume data can be used as an additional leading indicator, but not as the sole indicator.

Literature:

Dietzel, Marian Alexander (2016). Sentiment-based predictions of housing market turning points with Google trends. In: International Journal of Housing Markets and Analysis 9(1), pp. 108-136. .

Hohenstatt, Ralf, Manuel Käsbauer, and Wolfgang Schäfers (2011). “Geco” and its potential for real estate research: Evidence from the US housing market. In: Journal of Real Estate Research 33(4), pp. 471-506.

Just, Tobias (2023a). Upswing over: Interest rates weigh heavily on housing construction. In: Wirtschaftsdienst 103(1), pp. 20-23.

Just, Tobias (2023b). All building construction segments under pressure – some also in the longer term. Construction industry: Is a crash looming in the construction sector? In: ifo schnelldienst 76 (1), pp. 10-13.

Wu, Lynn, and Erik Brynjolfsson (2015). The future of prediction: How Google searches foreshadow housing prices and sales. In Goldfarb, A. Shane, M. Greenstein, and Catherine E. Tucker [Eds.]. Economic analysis of the digital economy. University of Chicago Press, pp. 89-118.

[1] This search interest can be recorded with the help of Google Trends. It is important to note that no absolute search volumes are published, but only a search index that reflects the interest in specific search terms in relation to the total search query via Google. The respective point in time with the highest search interest is assigned the value 100. The search index can thus only assume values between zero and 100. Note that we have detrended the series and controlled for seasonality, thus negative values can occur.

[2] Specifically, the following data were used: Building permits by estimated cost of construction for residential and non-residential buildings; New orders in Germany as a whole for residential construction; New orders for residential construction; Europace Hedonic House Price Index EPX Overall Index.