Growing interest in a blue ocean of opportunities in the luxury ryokan segment.

Ryokan is a type of accommodation considered to be unique to Japan, with many designed, constructed, and equipped in a typically traditional Japanese style. The notable lack of five-star hotels in Japan is partly attributed to the significant role that upscale ryokan have played in the luxury market. The Hotel Business Act classifies ryokan businesses and hotel businesses differently, and sets different standards for their construction and facilities, accordingly. However, since there are no restrictions on naming, even accommodations with the name “hotel” may effectively operate as a ryokan.

Ryokan have several unique characteristics that distinguish them from western-style hotels. Guest rooms are designed in a Japanese style, with tatami mat flooring, and are arranged for two or more guests. Indeed, many upscale ryokan, in particular, operate on the premise that a room will be shared by two or more guests, and do not allow single guests to stay in many cases. Although this practice has changed to accommodate solo travellers, prices will be significantly elevated in such cases.

Following a period of stagnation, the luxury ryokan market seems to have regained its lustre among wealthy domestic guests, and looks to attract greater attention from inbound visitors. The overall ryokan market is vast, but fragmented, with numerous small and independent operators, many of whom are experiencing financial or succession issues. There are numerous prime locations for ryokan in major onsen towns, resorts, and urban areas across Japan. Overall, there also appear to be an abundance of value-add opportunities in the market that have potential for robust growth for well-researched players with deep pockets and operating acumen. The ryokan segment appears to be undergoing a transformation from a product of the past into one of the future.

Recent movements.

The inbound tourism boom over the past decade has brought more spotlight on traditional ryokan, with many international tourists looking to gain a more authentic experience while traveling in Japan. Meanwhile, the pandemic significantly limited access to international travel, and upscale ryokan were able to capture a significant proportion of luxury demand from wealthy Japanese travellers in recent years. A renewed interest in ryokan has encouraged players in the hospitality sector to look to the segment for strong returns, and many are aiming to make entries in the near future.

On top of established and growing domestic players, major international players have also been drawn to the ryokan segment. Hyatt Group, which has a long-established presence in the luxury hotel sector in Japan, recently announced its collaboration with hotel and ryokan operator Kiraku, to develop its upscale ryokan brand ATONA. The venture is Hyatt’s response to the shockwaves caused by the pandemic, and the company aims to cater to the growing demand for authentic Japanese experiences through modern onsen ryokan. Although specific development plans remain undisclosed, their first facility is slated for completion in 2025. Overall, we believe there are many more international players that are seriously considering entering and expanding in the market.

Luxury ryokan financials.

Luxury ryokan properties have relatively high average cap rates of around 4% to 5%, suggesting that yields and profitability are reasonably high in comparison to other hotels. Regarding acquisitions, luxury ryokan usually have prices of over JPY100 million per key, and most luxury ryokan are moderate in size with up to 50 guestrooms.

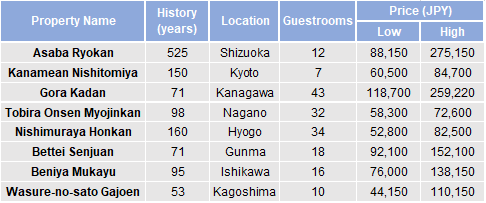

The luxury ryokan segment has been notably resilient throughout the pandemic. Also, they enjoy very high ADRs. For instance, Relais & Chateaux, an international association of individually owned and operated luxury hotels and restaurants features eight independent luxury ryokan as members, which are all located in different regions across Japan, endorses this view. As Table 1 demonstrates, daily prices for individual guests are very high even on weekdays, reaching over JPY250,000 for the most expensive guestrooms.

Table 1: Relais & Chateaux affiliated ryokan daily guestroom rates*

Savills Japan Research & Consultancy

*Guestroom price per person for 1 night stay on October 31, 2023 (Tuesday). Prices as of June 1, 2023

Outlook.

Sentiment is high in the ryokan segment, and it appears that many established players are making moves to capitalize on the plentiful opportunities in the market. Luxury ryokan have adeptly captured demand for high-end travel in Japan throughout the pandemic, as demonstrated by notably elevated occupancy rates, and look to be popular among domestic and inbound guests looking for a more authentic Japanese experience. Furthermore, average ADRs for modern ryokan are also significantly higher than hotels, and guestrooms at luxury ryokan are in a similar price bracket as five-star hotels.

The segment is vast but very fragmented, and business continuity and financial difficulties remain an issue for the many small and independent operators that comprise the market. Against this backdrop, the strategy of acquisitions and value-add initiatives to underperforming properties in prime locations looks to be a viable option for well-researched players. Indeed, an abundance of opportunities exist, namely in many onsen towns and resorts that offer privacy to guests looking to get away from large urban areas. Moreover, these destinations are traditionally popular among Japanese tourists, and are also growing in popularity among repeat inbound travellers. Hence, demand will likely remain elevated, which should support stable returns.

Although labour shortages remain a prominent issue, especially in more remote areas, luxury ryokan should have a greater capacity to pay more attractive wages to ensure an adequate number of staff. By acquiring and consolidating multiple properties in the same area and recruiting and retaining local workers, successful ryokan operators will be able to achieve strategic dominance in their target area. As inbound tourism continues to pick up, we predict a further expansion of the luxury ryokan segment. In addition, observers may see more urban developments that offer similar amenities to traditional onsen ryokan in urban environments, which will be positioned to compete with conventional luxury hotels. Given the vast array of opportunities and the notable lack of competitors, many players are likely planning to make forays into the market in the near future, and an expansion in supply will likely create further demand in this rare blue ocean market to capture unmet demand among affluent guests. Overall, the ryokan segment appears to be undergoing a transformation from a product of the past into a product of the future.