One of the trickiest aspects of asset management is identifying potential alpha and beta in terms of future company performance. Despite assertions to the contrary, the answer is not always that positive alpha is a result of manager genius, whilst negative alpha is the result of bad luck! Similarly, one of the hardest concepts to explain to newcomers is how to structure a process which will quantify and incorporate their qualitative view of a management team into a company valuation. Identifying these quantitative aspects is difficult, as the relevant factors change according to the market cycle. However, as we enter the next phase of the cycle, identifying key qualitative factors is particularly relevant in current market conditions, gradually adjusting to market equilibrium as inflation and interest rates hopefully peak.

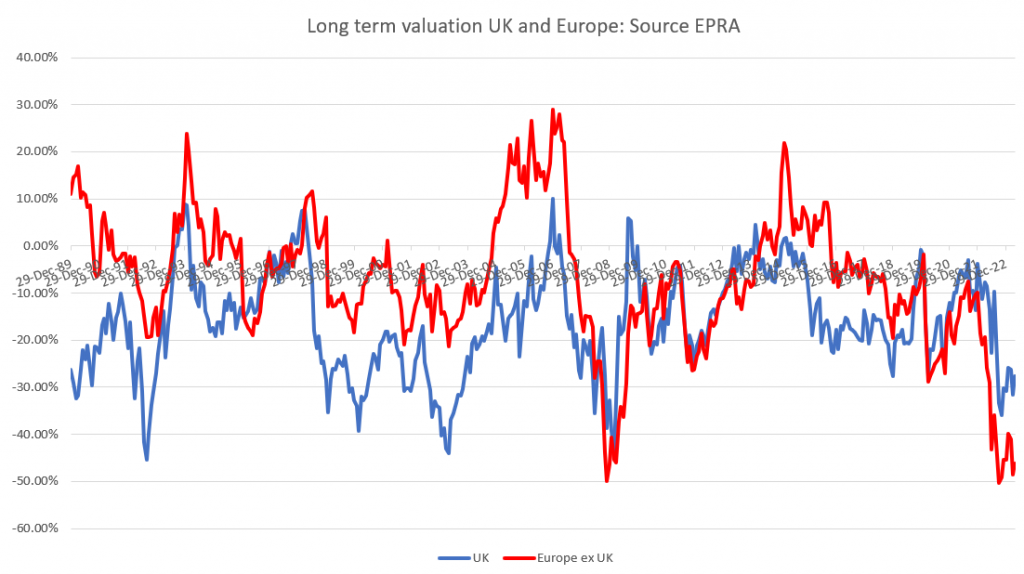

As a starting point, it is worth noting that European valuations are now at their lowest point since the GFC. Meanwhile, UK valuations have improved, predominantly due to reductions in property valuations recognised in H2 22 and Q1 23.

Whilst there are some optimists out there who are anticipating a reduction in interest rates this year which would clearly give the overall sector a boost (beta), let us assume only that market conditions broadly stabilise; this is still likely to involve continuous real estate value falls during 2023. There may only be a gradual narrowing of the bid offer valuation spread between buyers and sellers, and little in the way of short-term easing of credit conditions.

Against that background of little beta, what are the management attributes (alpha) that investors will reward with higher valuations, and perhaps even access to equity capital? In my view there are six – in addition to the perennials of sound asset and liability management – that can be identified at this stage:

- Identifying your investment solution: Active generalist investors and passive funds hold the key to price setting, valuations, access to capital, and – as a result – growth in the sector. Therefore, the ability to understand and clearly articulate the investment solution that your company offers is key. This could be inflation protection, benefits from demographic trends, high and growing yield, capital growth, participation in market recovery, and so on. Several generalists suggest that real estate companies don’t focus on this enough relative to other equity sectors.

- Vision: The ability to put the sector market conditions into context and to demonstrate how the company’s strategy will deliver results against that background; this is in sharp contrast to a static state level of inertia that some generalists believe is prevalent in certain parts of the sector.

- Flexibility: In the absence of equity or debt capital how can a company grow? The answer lies in recycling and tapping into alternative sources of finance such as JVs and Fund Management.

- Branding: Unlike other equity sectors, most of the assets owned or produced by a company are not branded. The sectors that do have branding – self-storage, healthcare, student accommodation, etc. – can justify a premium rating in terms of intangibles/goodwill over and above the property valuation.

- Growing your Own: In the absence of market opportunities, the ability to (re)develop assets to maintain as future proof as possible a portfolio will be critical.

- Alignment of interest: Increasingly investors are rewarding those management teams who have private equity-style investment in the business and penalising those teams who regard share options as merely a cash bonus rather than an investment. If a management team cashes out at the first available opportunity why would investors want to remain shareholders?

Companies who can demonstrate these six attributes should command a premium rating to their peers, and be in the best position to enter the next phase of the cycle.