When Larry Fink, the head of BlackRock, announced “I don’t use the word ESG anymore, because it’s been entirely weaponised […] by the far left and weaponised by the far right,” some interpreted it as a signal that investors had lost interest, considering ESG as a passing trend. On the contrary, I believe that the fundamental drivers of ESG are stronger than ever, and as millennials, we are only beginning to make our mark.

Having spent my childhood in Sweden, I became accustomed to the constant presence of cold and snowy winters. However, during a recent visit to remote corners of the country, the impact of climate change was evident. Islands once accessible via winter roads formed by thick ice now require boat transportation. In Jersey, Channel Islands, we grapple with rising sea levels, another consequence of warmer temperatures and melting ice.

The real estate industry is responsible for approximately 40% of worldwide greenhouse gas emissions, emerging as the second-largest contributor after the oil and gas sector. This substantial environmental impact underscores the critical need for ESG in real estate investments. Anyone involved in property investment cannot afford to overlook the implications of ESG factors. Recognising and integrating sustainable practices in real estate not only aligns with responsible environmental stewardship but also positions investors to navigate the evolving landscape of regulations.

Occupiers are also becoming increasingly discerning in their choices. The modern occupier is not only concerned with the physical aspects of a property but also how sustainable their office is. There is a growing emphasis on amenities and companies are seeking greater transparency from property managers. They are increasingly requesting information on their environmental impact, questioning the extent of energy consumption and the quantity of water used in order to align with their own ESG policies. This shift is influencing leasing decisions and compelling property developers to integrate sustainable practices to remain competitive.

It is not merely a matter of financial considerations anymore; the dynamics of the real estate industry are undergoing a profound transformation where ESG impact holds a significant sway. Socially and environmentally conscious approaches are shaping and influencing the decision-making processes within the realms of real estate.

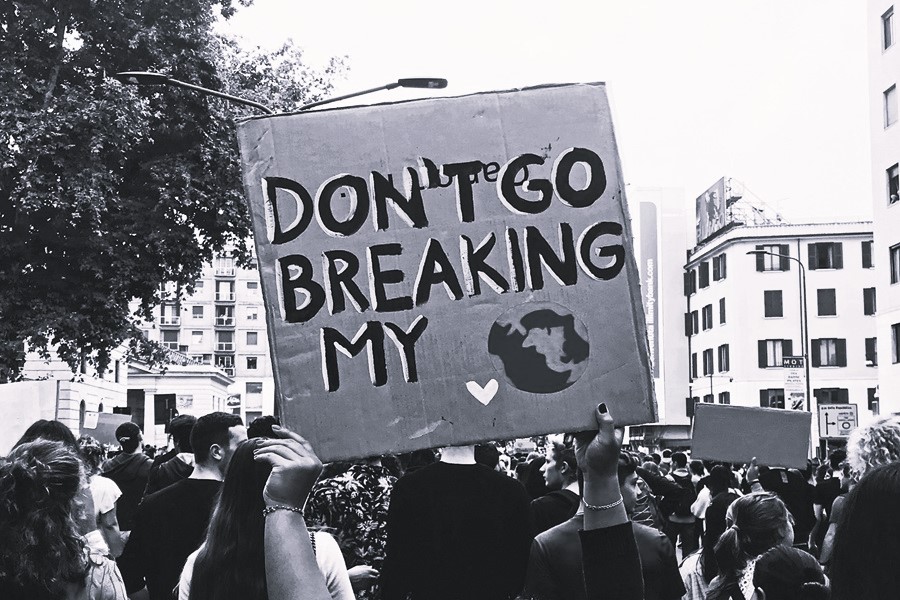

ESG is not merely a trend; it signifies a fundamental change reflecting our generation’s values, driven by necessity rather than choice.