You could buy a skyscraper for a million bucks.

I still remember that, probably always will. A friend of mine, well connected in Detroit real estate, telling me how bad things had gotten. Telling me that I could buy an entire skyscraper in downtown Detroit for one million dollars.

Things were bleak in Detroit. For the city, and for the city’s real estate. Things were bleak.

But things would not stay bleak for long. Detroit has provided a blueprint for how to turn a struggling city around.

Home prices in Detroit are up 40% since 2020. The downtown is beautiful, and home to some great finance companies, including a few of my favorites: Signal Advisors, Benzinga, Tidal’s ETF trading & operations. There is an emerging startup culture – recently ranked as the top emerging startup ecosystem in the country. There are cranes and development and optimism in the air.

And, you may have seen, Detroit smashed the record for NFL draft attendance, with 750,000 people coming to downtown Detroit for the event.

You can’t buy a skyscraper for a million bucks anymore. Not in Detroit.

“Be fearful when others are greedy, and greedy when others are fearful.” ~Warren Buffett

Detroit investors who were greedy when others got fearful have done well, while CRE investors who were greedy while others were greedy are turning fearful at breakneck speed.

Office building valuations were over-extended before COVID, and before interest rate hikes. Covid, the proliferation of work-from-home, and the eerie decline of many downtowns was a serious blow to office buildings. Rising interest rates and refinancing costs were an even more serious blow.

The results were predictable, and the recent headlines are shocking. One of the tallest towers in St. Louis that sold for $205 million in 2006 just sold again – for $3.6 million.

And this is no isolated incident. Distressed office buildings in Chicago are selling at an 80% discount to their previous transactions. A hotel in Washington DC sold at an 80% discount to it’s debt owed. In NYC, Blackstone took an office building they bought for $605 million in 2014 and after years of investing in renovations, they sold it for $185 million last week. And in San Francisco, a building that sold for 62 million in 2018 just sold for 6.5m, almost hitting a 90% drop.

This is fear. This is what a fearful market looks like.

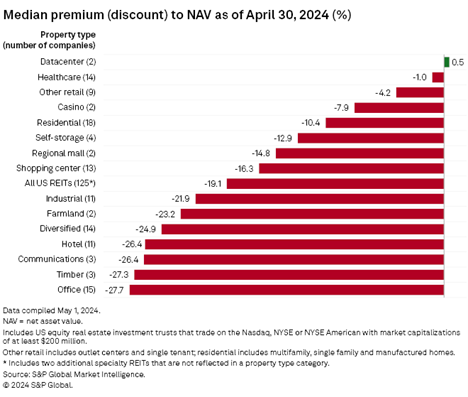

The public markets are better, but only marginally so. According to SP Global, office REITs are trading at a 27.7 discount to NAV.

When you dig in, it get’s even crazier. Let’s take Boston Properties (BXP). It is currently trading at a $27 Billion enterprise value. With 73 million office square footage, that comes to $370 per square foot. This is prime, premium, top-of-the-market Class A office space in gateway cities. If we use SP Global’s NAV assumptions, they should be worth $528 per square foot.

I mean, let’s just look at the General Motors building on 5th Ave. You’ve seen it, it’s the one with the glass cube Apple store out front. It has a 94% occupancy rate. From CMBS data we know that the building’s NOI was $192 million in 2023. Let’s be super conservative and put an 8% cap rate on it. That means that its value is $2.4 Billion. The building has 1.9 million square feet – at an 8-cap it is worth $827 per square foot. Compare that to the market rate of $370 (across all properties).

And sure, not all of their properties are the GM building, but these are still incredible buildings. These aren’t the distressed deals I posted above, selling at 80-90% discounts in the bargain-bin. You can’t just go out and find these types of properties at $370 per square foot. See for yourself: https://www.bxp.com/properties

The market is fearful and it’s almost time to be greedy. The office building apocalypse is here, but it is also temporary. Remember, these aren’t stocks. While a company can go to zero, a building still stands.

Cities will rebound, policies will course-correct, and companies are slowly returning to the office. Office building valuations will one day rebound too.

It will soon be time to get greedy before the office building market is no longer fearful.

Phil Bak is the CEO of Armada Investors, a quantitative REIT asset manager. You can learn more about Armada at armadainvestors.com and you can follow Phil’s writing at philbak.substack.com.