$120,000 for a banana. This was December, 2019, at Art Basel in Miami. An Italian artist duct taped a banana to the wall. It sold for $120,000. The state of modern art, ladies and gentlemen.

It’s easy to laugh at the decadence of the art world. It’s not as easy to laugh at the broader financial markets. And while it might sound insane that someone in the art world would set the market price for a banana at 120k, an increasing majority of financial market investors believe that market prices are the most efficient way to invest.

What I am saying is that passive index investors would have bought banana shares at 120k, because that’s where the market was.

Index investing, passive investing and market cap weighted indexing are all synonyms. I like to call it Cap Weight, as the strategy is essentially a factor strategy just like hundreds of other factors. It’s a factor, and it’s a story.

A good story becomes a narrative, and then narratives drive flows, and flows drive performance.

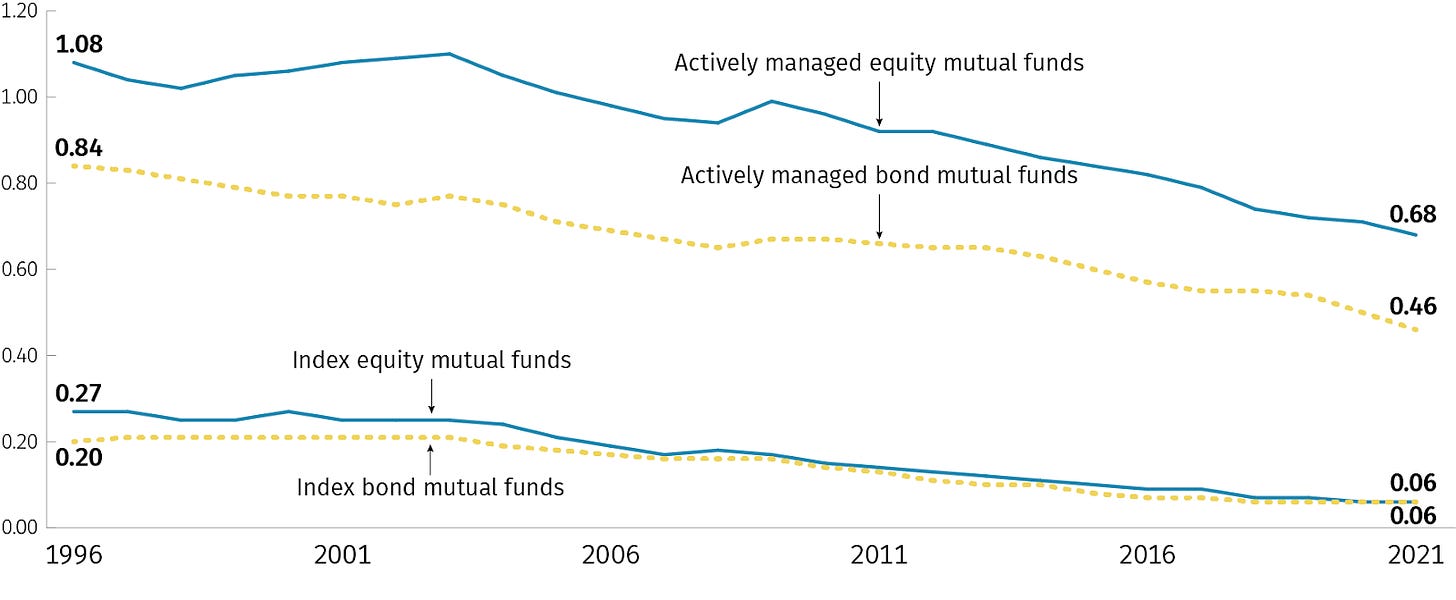

The story behind Cap Weight was phenomenal. It put Wall Street fees on one side, and trading efficiency on the other. Let’s go back to the early days of Vanguard: when a mutual fund made a trade they had to pay high brokerage commissions on each trade, not to mention spillage on executions that put money into the pockets of human market makers on exchanges. Cap Weight optimized trading and kept those costs down.

Things have changed. Those internal fund trading costs are de minimis now. And the spread between active and passive fund fees was also a lot higher than it is today – that gap is rapidly closing.

But the story was still great. It is still great. Although the story has changed. The story today is more about performance.

Narratives did drive flows, and flows did drive performance, and the Cap Weight performance has been phenomenal.

But not quite as phenomenal as it could be.

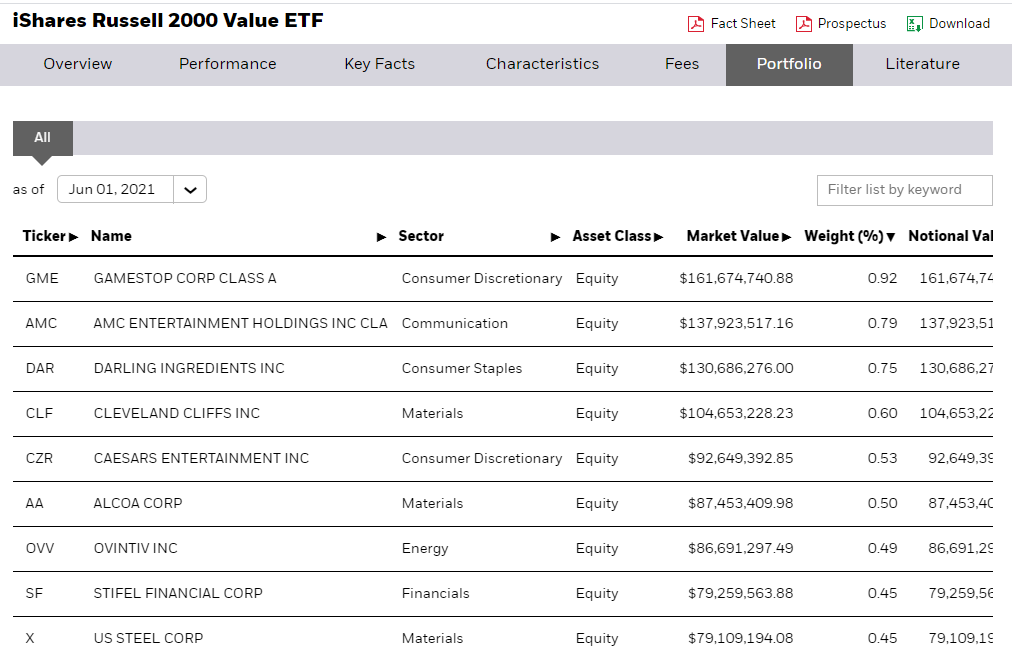

Let’s revisit the meme stocks, shall we? I think it’s worth revisiting. Remember those congressional hearings? Everyone was apoplectic, everyone wanted to point the finger, and nobody knew who to point the finger at. Good times!

You can believe in the tooth fairy and the power of the Reddit investor if you want to. You can believe in a confused morality tale where greed is sin if you’re successful, and greed is a virtue if you’re not. Where the stock pumps are spontaneous, organic and grass roots. But it’s all horseshit.

Let’s stay in the real world. In the real world it takes deep pockets and deep sophistication to gamma-squeeze a stock. And, it takes deep pockets and the opposite of sophistication to provide exit liquidity for those gamma-squeezers.

So who provided exit liquidity? You guessed it. Index investors did, and they haven’t lodged a single complaint about it either. The perfect bagholder. The willing bagholder. They’ll buy your banana for 120k and they’ll buy your gamma-squeezed GME stock at whatever price it gets pumped up to, and they won’t say a single word about it.

As market structure games rather than underlying company performance continue to rule markets, it is becoming more and more important to understand these games. Over the past week GME has round-tripped from $20 to $65 and back to $20. And again, if you think this was the result of individual investor sentiment I’d love an explanation about how that reconciles with the actual trading activity in the stock:

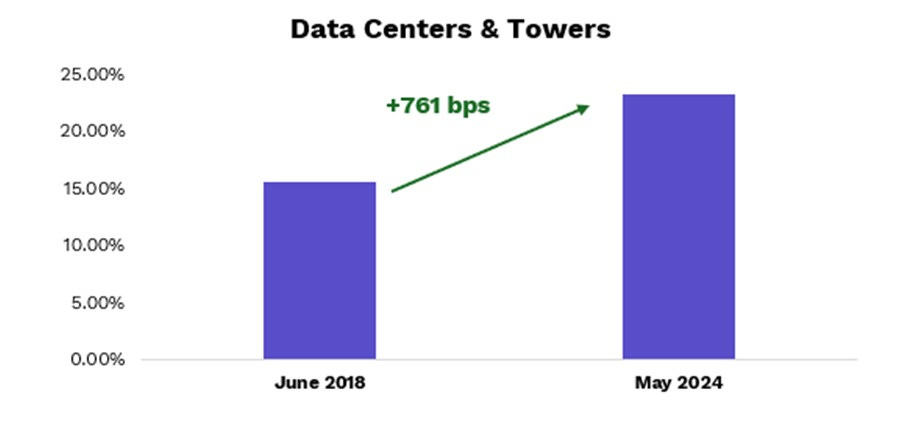

I’m going to bring this all back to REITs with an upcoming post about valuations for data center REITs. I’ve wanted to get that post out for a few weeks now. Wish I had more time to write. When you are running an asset manager these things become the stuff you get to do in between the regulatory and compliance busywork. But here is the key takeaway:

Any time an asset is over-bid, market cap weighted index investors are the ones buying high to the last tick. That’s how the strategy works. So when data center REITs become overbid thanks to narrative and momentum, it is market cap weighted investors holding the bag. It is market cap weighted investors oblivious to capex costs and technology obsolescence and punishing competition and any other harbinger.

As the saying goes, if you can’t spot the sucker at the table, you’re it. And index investors can’t spot anything other than the expense ratio.

This article was originally published in BakStack and is republished here with permission.