There has been an understandably high level of attention directed toward the environmental footprint of the built environment over recent years. As we have heard ad nauseam, the built environment is responsible for 37–43% of global greenhouse gas (GHG) emissions – depending on your source of choice – including the operation of residential and commercial buildings, their construction, and the greenhouse gases emitted in the process of producing construction materials that comprise them. But what other challenges are on the horizon, and are they receiving the attention they deserve?

Natural environment recap: Paris and 2050

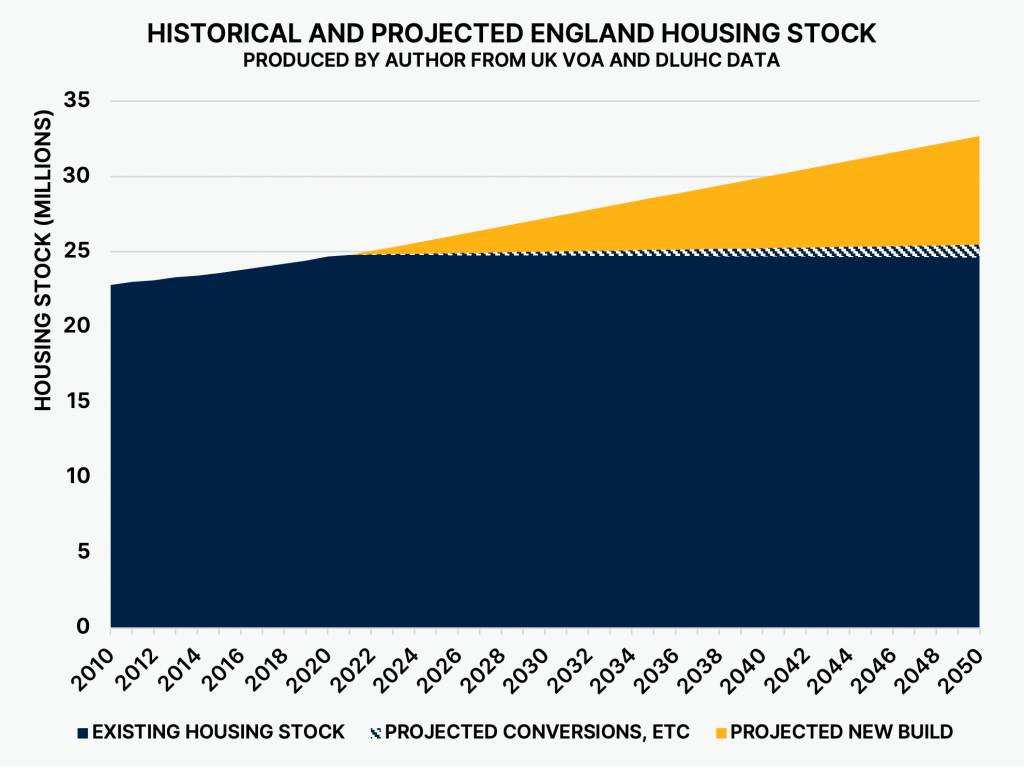

Real estate’s environmental transition is spearheaded by the Paris Agreement, enshrining into law commitments for signatories to reach net zero GHG emissions by 2050. The challenge cited by a number of entities including McKinsey, the UK Government and the UK Green Building Council is that 80% of 2050’s buildings have already been built, prompting green retrofits to become a hot button topic. I did some investigating into this figure and wasn’t overly inspired by the methodology used to ascertain it, so I conducted my own calculation based on data available on England’s housing stock: as of 2024, approximately 72% of the UK’s 2050 housing stock has already been built (Figure 1). Not wildly dissimilar to 80%, but still a gap that represents billions of pounds of real estate. It is reasonable to assume that less developed countries with a shorter tail of large-scale urban development will be less than this, further distancing the global average from the 80% estimate. Aligned with my suspicions, IEA and the UN expect the world’s gross floor area to increase by around 57% between 2025 and 2050, meaning we face more than just a retrofit challenge. Beyond carbon, we are also seeing biodiversity taken more seriously, with a growing number of initiatives, including a requirement for 10% biodiversity net gain on developments in the UK from 1 January 2024.

Figure 1

Societal peak?

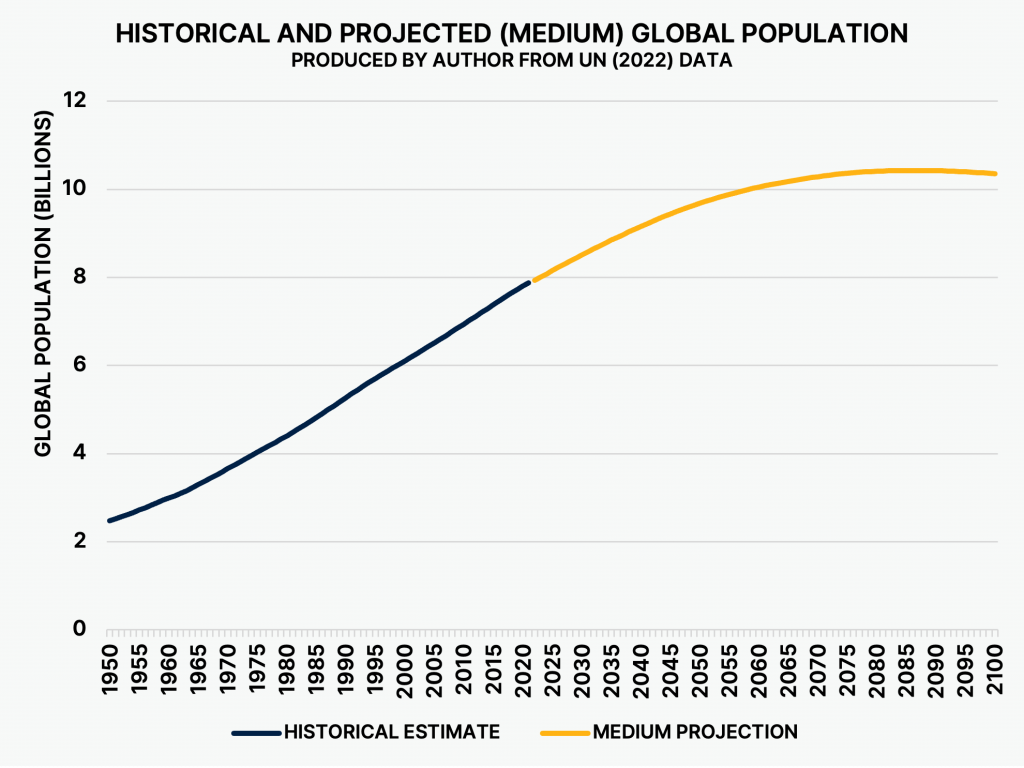

2050 sure has received a workout by forecasters; alongside the aforementioned Paris Agreement targets and building forecasts, it is also when the global population is expected to approach almost 10 billion. This population growth is largely expected to come from natural increase in Africa and South Asia, offsetting natural decrease in historically higher-income areas in Europe and North America. The global population of 2050 and beyond is also expected to be remarkably older on average and might end up a whole lot older than we expect if “biohacking” makes more progress than has been anticipated. By 2086 – the year of my newborn’s 63rd birthday – current UN “medium” projections have the global population peaking at 10.43 billion, then steadily diminishing (Figure 2). Europe and North America’s peak is expected much sooner, with their combined population to max out at 1.13 billion in 2038, a mere 14 years from now. If this eventuates, we’re going to end up in a situation where a whole lot of buildings meet an untimely end-of-use, given the 100–150-year design life of steel and concrete structures. Immigration may stem the bleeding for a time, but as elements of Brexit and other populist movements have taught us, immigration is not unconditionally embraced.

Figure 2

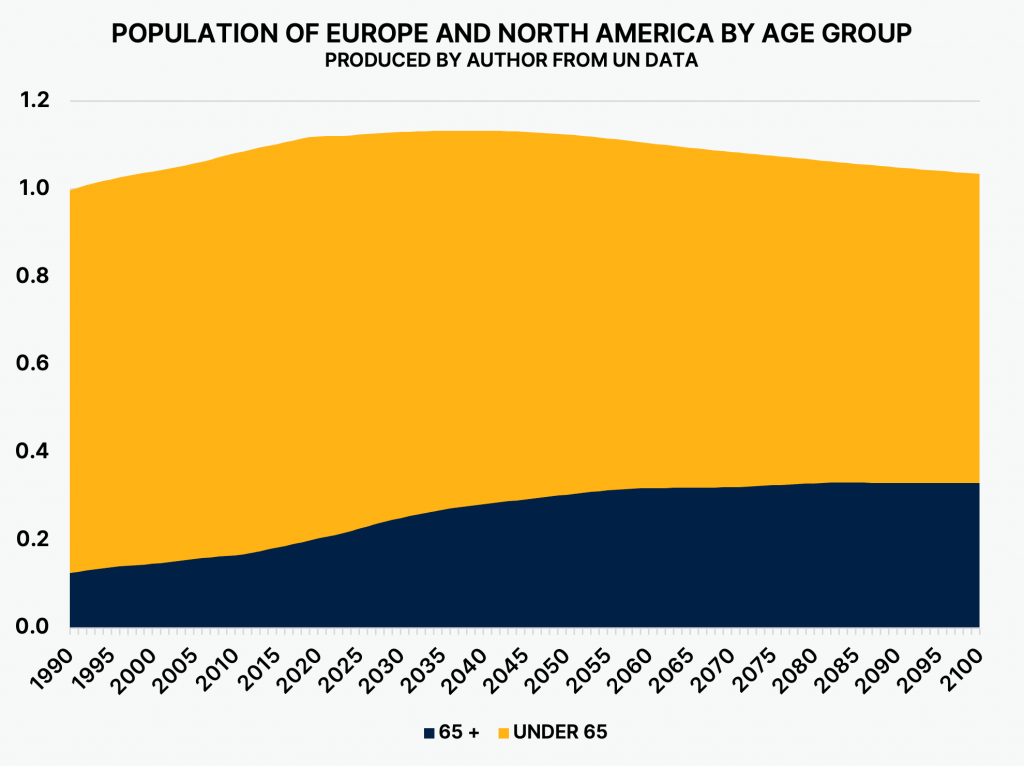

Figure 3

Exogenous technology

From the advent of web 2.0 and real estate listing platforms, to the ecommerce-induced “retail apocalypse,” to the impact of cloud computing and teleconferencing on the demand for office space, real estate has already fought on multiple fronts when it comes to exogenous technology. There are countless other innovations in the works which could further disrupt the way we interact with buildings. How, for example, will AI continue to change the way we work? What role will brain-computer interfaces, biohacking and robotics have on the ability for us to mitigate many of the effects of aging, allowing us to continue working long into our 70s, 80s, 90s and beyond? What does this mean for investment and career timeframes? Will 60 become the new 30?

Insight at the intersections

The coming century’s challenges are interesting enough on their own, but I believe a lot of the magic exists where they overlap. At the intersection of the natural environment and society we have the oft-debated question of how rapidly developing countries are going to build the requisite infrastructure without a carbon footprint that blows away any hope of achieving the Paris targets. Another is the conversation around future energy systems, and what impact hydrogen and fusion energy could have on the operational carbon of buildings. However, the one that has really caught my attention lately is at the intersection of exogenous technology and society. As of 2024, the world’s combined population aged 65 and over is 832.9 million. By 2100, this is expected to increase threefold to 2.49 billion, by which time this age group is already a decade into its decline in places like Europe and North America. Things look worse for under-65s, a group which has apparently been in decline since 2016 (Figure 3). If, over the coming decades, we’re building highly specialised real estate to meet the demands of today’s demographics, what exactly do we do with these buildings as demand steadily wanes? What then of the billion-dollar hospitals and other infrastructure? What of their embodied carbon?

Built-in adaptability

There is evidently a wider number of demand-side shifts coming for the built environment, several of which are already well underway. It is for this reason I believe we should rethink the concept of “adaptive reuse” (post-hoc adaptability) and instead opt for adaptability-by-design (ante-hoc adaptability). This means the trillions of dollars and tons of GHG emissions worth of steel, glass, timber and concrete can continue to be put to good use throughout their life over the coming century and beyond, rather than being rendered stranded or relegated to landfill. The question is: how could such adaptability influence net present value, and with it, investor incentive?