The zeitgeist feels gloomy, but there is cheer from commercial real estate: the bottom is near (maybe)

- foreclosures rising . . . and that’s good

- ending a losing streak

- if you’re in a hole, stop digging

- it’s good to be prime

- feeling industrious is the Bay Area

Commercial Real estate: a case for optimism

There’s a lot of negativity in the air for reasons one can only speculate.

Consumers are being more cautious, the labor market is increasingly stagnant, and the ISM manufacturing index came in cold. The jobs release will disappointed.

None of this is new information however—all of these trends have been running for the better part of the year—but perhaps it’s taken longer to sink in? Is it the carry trade unwind? Or maybe the big sell off is driven by other things entirely.

Anyways, when the zeitgeist zigs, Random Walk zags, so we’ll end the week with a bit of hopeful data: good news from commercial real estate.

Has commercial real estate finally hit bottom? Random Walk isn’t sure, but there’s definitely some signs.

Foreclosures rising . . . and that’s good

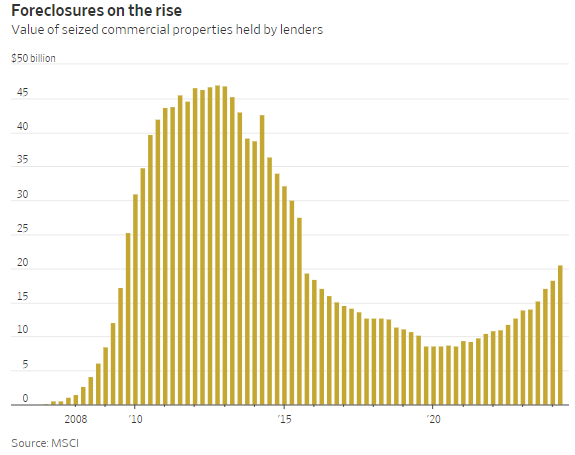

The WSJ actually just ran a story Surge in Commercial Property Foreclosures Suggests Bottom is Near, so we’ll start with that.

Normally, you’d see a chart like this and say “ahh, the sky is falling!”

Foreclosures are on a steep upward decline.

Banks and other lenders are seizing control of distressed commercial properties at the highest rate in nearly a decade, a sign that the sector’s punishing downturn is entering its next phase and approaching a bottom. In the second quarter, portfolios of foreclosed and seized office buildings, apartments and other commercial property reached $20.5 billion, according to data provider MSCI. That is a 13% increase from the first quarter and the highest quarterly figure since 2015 . . .

So why exactly is a parabolic increase in foreclosure activity a good thing?

The WSJ explains:

Until recently, though, many lenders have been reluctant to take over properties in hopes of a recovery and to avoid the expense and losses of foreclosure actions . . . [But eventually] lenders conclude that obsolete office buildings won’t recover their former value, even when interest rates decline. That is leading to sales of foreclosed properties and distressed mortgages. It is also bringing an increase in short sales, where lenders and borrowers work together to unload troubled property for whatever they can get . . . in previous downturns, comparable surges in foreclosure activity has signaled the approach of a market bottom. Once lenders seize a property, they are typically quick to sell it, a process that helps determine values of properties

The idea here is that banks won’t foreclose, if they think there is still some chance that values will recover.

Once they do foreclose, yes, it means that lenders have given up hope, but it also means they tend to sell soon after, and that leads to price discovery, and that leads to inkling of a price floor.

See, hope abounds.

So is there a price floor?

Maybe, could be, according to MSCI:

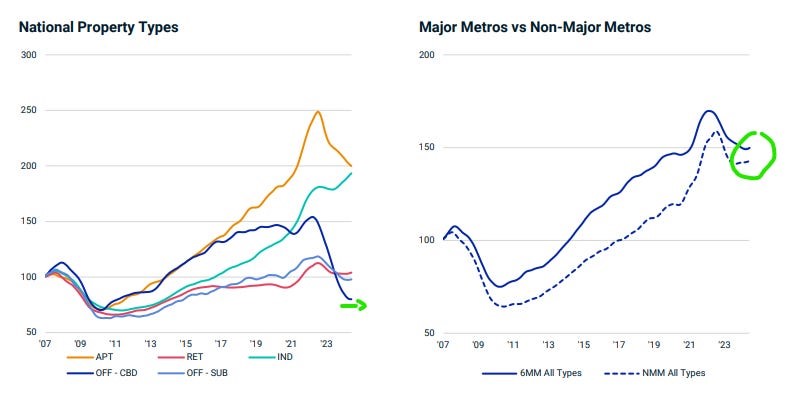

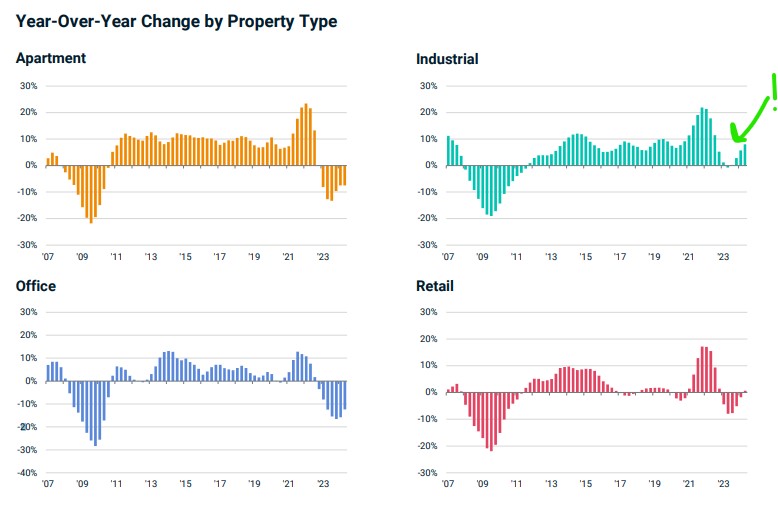

MSCI’s price index said June 2024 was not actually negative for Office real estate.

YoY changes also show moderation in losses, and both Industrial and Retail have been making price gains:

Industrial prices are up almost 10% yoy (more on that below).

So, to bring it all together, if lenders are increasingly going to foreclosure-and-then-short-sale, and prices do not appear to be getting any lower (or they are getting less-lower), then we may indeed have found the floor (or close to it).¹

The hole is not getting deeper

But wait, there’s more!

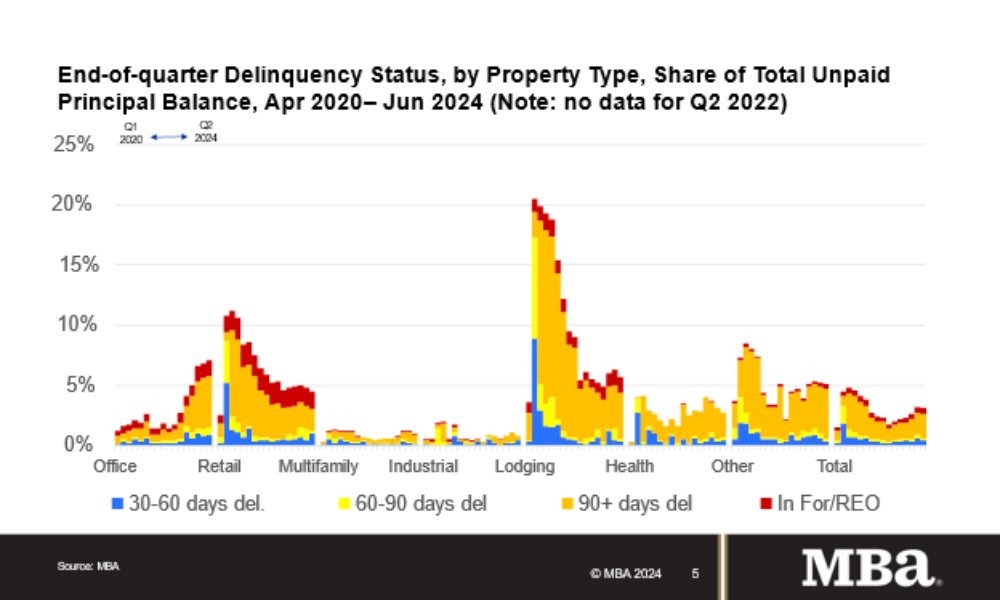

Delinquency status (by % of unpaid balance) seems pretty steady or steadying across all asset classes, as well:

The hole does not appear to be getting any bigger (for now).²

So firesale prices aren’t getting much worse, and delinquency holes aren’t getting much bigger—that’s two points for “commercial real estate has found bottom.”

What else?

It’s good to be in your prime

Well, this is something that Random Walk has alluded to in the past, but there is a pretty substantial dispersion when it comes to the “pain” in office real estate, in particular.

As per the MSCI charts above, suburban office is not nearly as bad as downtown “central business district” office.

But what’s really worth pointing out is that some office is actually good.

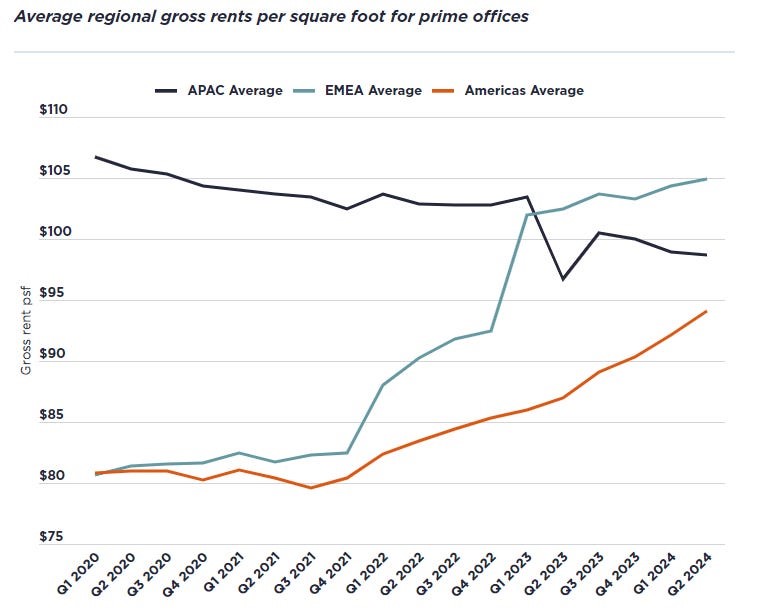

“Prime” Class A office space, i.e. the brand new shiny office buildings in choice locations are in high demand. It’s a “flight to quality” phenomenon (of sorts), where demand for office space generally has contracted, but the demand that’s left, all wants the very best NYC has to offer.

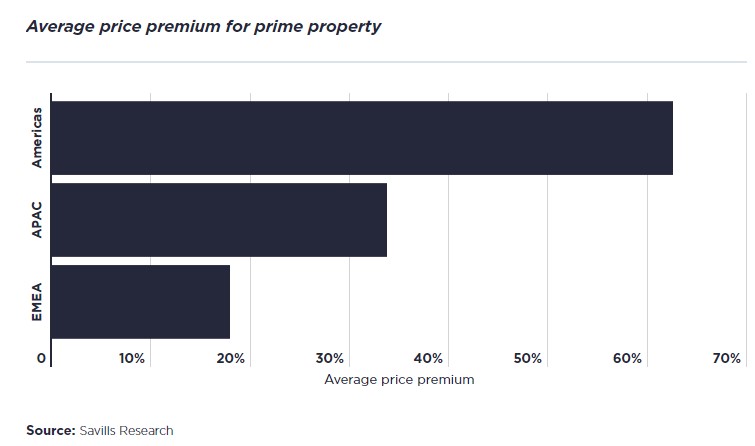

- There is a 60% price premium for the “prime” Class A inventory, relative to other Class A space:

- Average per square foot rents for “prime” Class A office have increased ~20% since 2021:

The point is that it’s not all doom n’ gloom in office.

If you’ve got brand new Class A office space, in prime locations, you’re feeling pretty sharpish (but if you’ve got anything else, you’re hoping the bottom is finally near).

Feeling industrious

One last thing, and it’s a double-whammy of silver linings.

Good news for commercial real estate and the Bay Area.

You may have heard a thing or two about this “AI” thing and how it’s fostering all kinds of investment in hardware, manufacturing, and industrial space. Gotta build chips, and fabs, and data centers, and coolants, and batteries, and reactors—it’s the new industrial renaissance, atoms > bits n’ bites.

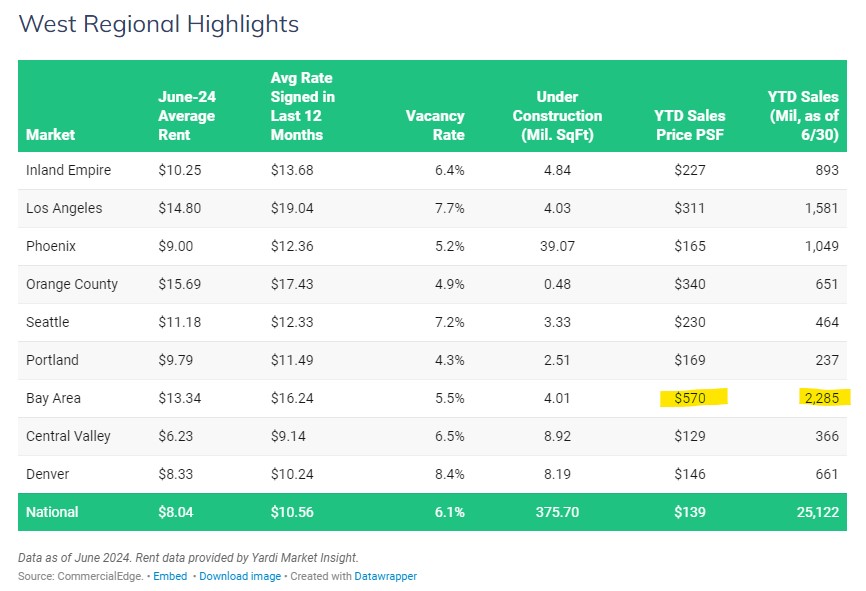

Anyways, if there’s one asset class that’s cooking in the Bay Area, it’s industrial, or more specifically, manufacturing. The Bay Area leads the West in total sales and PSF for industrial space:

$2.3B in transaction value for Bay Area industrial space is ~60% more than the next closest region (SoCal).

The headline transaction was Supermicro’s $80M purchase of space in San Jose to expand its server business, but apparently roughly half of the industrial space under development is “tagged for advanced manufacturing,” which have more power and higher ceilings (i.e. the stuff you need for making chips and EVs and the like) than regular manufacturing, I guess. So while manufacturing jobs are declining everywhere else in the country, the Bay Area is just getting started.³

This article was originally published in Random Walk and is republished here with permission.

1 There is, of course, more to come, however.

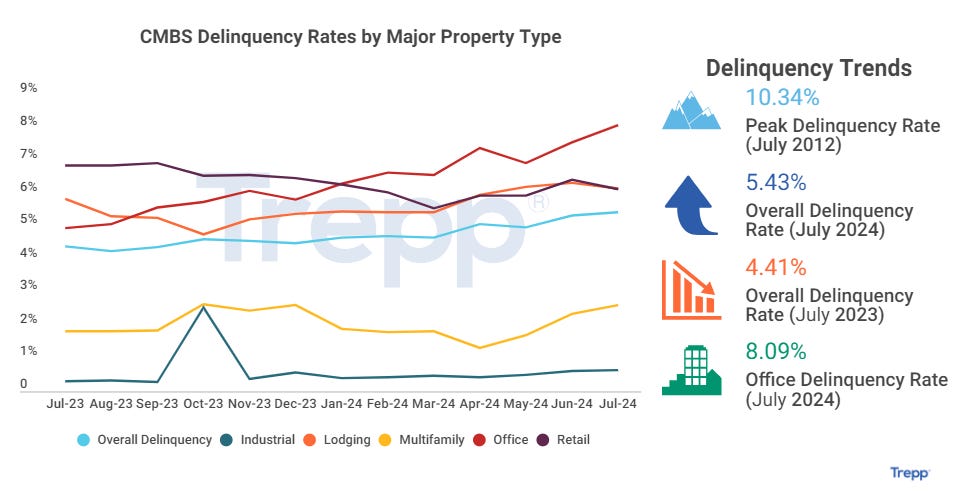

2 To be fair, CMBS delinquency rates do however, appear, to be increasing:

CMBS delinquency rates for both multifamily and office both creep upwards, but CMBS is only one part of the overall lending market.

3 Now, if only the Bay Area could figure out how to pull-off an industrial-style IPO, they’d really be cooking with gas. Sure, everyone has heard of large language models, but have you heard of cold storage warehouses?