How build-to-rent communities are changing the US housing market

For generations, Americans have celebrated the benefits of owning a single family home. More than just a place to live, homeownership offered us:

- An appreciating investment with tax benefits;

- A forced savings tool (via a mortgage);

- Access to a local community of peers (a.k.a., neighbors); and

- Social proof of financial stability.

But the landscape has changed. Young Americans today aren’t saving. They’re making less, burdened with student loans, and investing spare change in travels and experiences.

And single family homes are not a no-brainer investment. Institutional buyers have created increased competition, financing is expensive, and appreciation in many markets is uncertain.

So what does a young family do when they still want to experience—but can’t afford to buy—the white picket fence, two-car garage, and the pack of neighborhood kids?

They rent it, ideally in a community of other renters.

Which is why “build-to-rent” (sometimes called “build-for-rent”) communities have become one of the fastest growing real estate investment verticals over the past few years. In the US, build-to-rent communities are ground-up, master-planned developments of single family homes with a focus on community-centric amenities (e.g., clubhouses, fitness centers, playgrounds, etc.) and professional management, offering families a rental experience that rivals homeownership.

Today, the rise of single-family build-to-rent communities, covering:

- Trends driving millennial Americans to rent instead of own;

- Why BTR’s value prop beats “scattered site” SFR for renters and investors;

- Active institutional investors in BTR and their recent investments;

- The largest and fastest-growing BTR markets today;

- What the BTR market might look like by 2030 and beyond.

Trends driving millennial Americans to rent instead of own

The past decade offered an ideal environment for the emergence of the single family rental sector with four macro trends driving demand: delayed “adult” commitments, student loan debt, high interest rates, and institutional investment.

Putting off “adult” commitments

Millennials change jobs three times more often than any other generation. They marry and start families later. They use travel & experiences to define their social status (not the ability to afford a home). And they’re now prioritizing remote roles, giving them the flexibility to work from anywhere.

So sinking their life savings into a home they might move out of in two years—coupled with the logistical burdens of buying, improving and selling a home in that time period—does not make sense for many millennials.

Student loan debt

Speaking of savings, the average millennial carries about $30,000 in student loans.

This burden of monthly interest and principal payments—which millennials must prioritize over saving for a home—coupled with stagnant wage growth and rising home prices, makes saving for a down payment difficult, particularly when the median home price in the US is $390,000 (vs. $120,000 in 2000).

As a result, renting has become the most viable and immediate housing solution for millennials without access to $100,000 or more for a down payment.

High interest rates

Today, the average 30-year fixed mortgage rate hovers around 7% versus the historical lows of 3% seen in the early 2020s.

While this increases a borrower’s monthly payments, it also creates near-term paralysis for potential homebuyers who think pricing might come down in the future. So for millennials—and anyone else—who can afford to buy a single family home today, renting may still be a better option—at least until interest rates come down and/or stabilize.

Institutional investment

Over the past decade, large institutional investors have increasingly turned their attention to the single-family rental market, buying more than 90,000 homes in 2021 alone. This accounted for over 20% of all single-family home purchases in some markets.

Institutional interest has created increased competition in the market for homebuyers—competition that has access to cheaper debt, can value homes on a cap rate basis (allowing them to outbid individuals), and can pay “all cash” (then refinance later).

Thus, as institutional investment continues, home prices will continue to rise.

Coupling this with changing lifestyle and personal savings trends creates a bleak long term picture for homeownership such that renting a home will likely be the preferred (or only) option for many Americans—even if interest rates do trend downwards in the coming years.

Why BTR’s value prop beats “scattered site” SFR for renters and investors

If someone decides to rent instead of buy a single family home for any of the above reasons, he or she has two general options: a “scattered site” SFR home, or a home in a build-to-rent community.

Scattered site SFR refers to portfolios of investor-owned single family homes in existing neighborhoods, i.e., “scattered” and mixed with owner-occupied homes. While some scattered site SFR owners are mom-and-pop operators or even accidental landlords, institutional investors also purchase many one-off single-family properties.

Build-to-rent (BTR), on the other hand, describes the strategy of buying land and building a neighborhood of homes from scratch specifically for renting. While rarer, BTR communities have a few major advantages over scattered site SFR:

More inclusivity and amenities for renters

Renting a scattered site SFR home, means living amongst neighbors who primarily own their homes. And for some, that can feel like being an “outsider.”

BTR renters, on the other hand, are living amongst neighbors who are also renting, making the rental experience feel more communal and connected, with shared experiences and a stronger sense of belonging. And because BTR communities are designed for renters—and must compete with other nearby BTR projects—developers are increasingly investing in community amenities to differentiate themselves.

Operating efficiencies, ESG benefits, and exit optionality for investors

Similarly, the BTR model offers investors several advantages over a scattered site SFR strategy.

First, BTR communities provide to investors the same benefits of single-family-rentals but leverage the efficiencies of apartment building operations. Unlike scattered site SFR properties, BTR communities centralize maintenance and management. This enables bulk purchasing for maintenance and repairs, and reduces the need for extensive travel and coordination across multiple sites.

BTR communities also provide investors an opportunity to achieve certain ESG mandates at scale. Adding solar panels, energy-efficient appliances, and water conservation systems into these developments not only lowers costs and improves the offerings to renters, but helps meet ESG regulatory requirements for larger, institutional investors.

In addition, BTR presents less headline or political risk for institutional investors, as the media in recent years has frowned upon Wall Street competing with the everyday American to purchase a single family home.

Lastly, BTR communities offer multiple exit scenarios that scattered site SFR properties do not. Investors can choose to sell the entire community to another institutional investor, providing a seamless transaction and potentially higher valuations due to the scale and efficiency of the asset. Alternatively, they can sell individual homes to owner-occupiers or smaller investors, offering flexibility and liquidity. Or just sell the lots after they’ve been entitled and before homes are built.

These benefits—both to the renter and investor—explain why BTR’s popularity has outpaced scattered site SFR for institutional investors in the current market environment.

The Build-To-Rent Market Today

While the BTR sector is relatively nascent, it has already emerged as one of the fastest-growing niche real estate verticals—alongside data centers and self storage—over the past few years.

Data from the National Rental Home Council shows BTR developments have ballooned 270% since 2019. In 2023, delivered developments increased 62% from the year prior to nearly 25,000 units, most of which had been focused across the Sunbelt.

Sunbelt domination

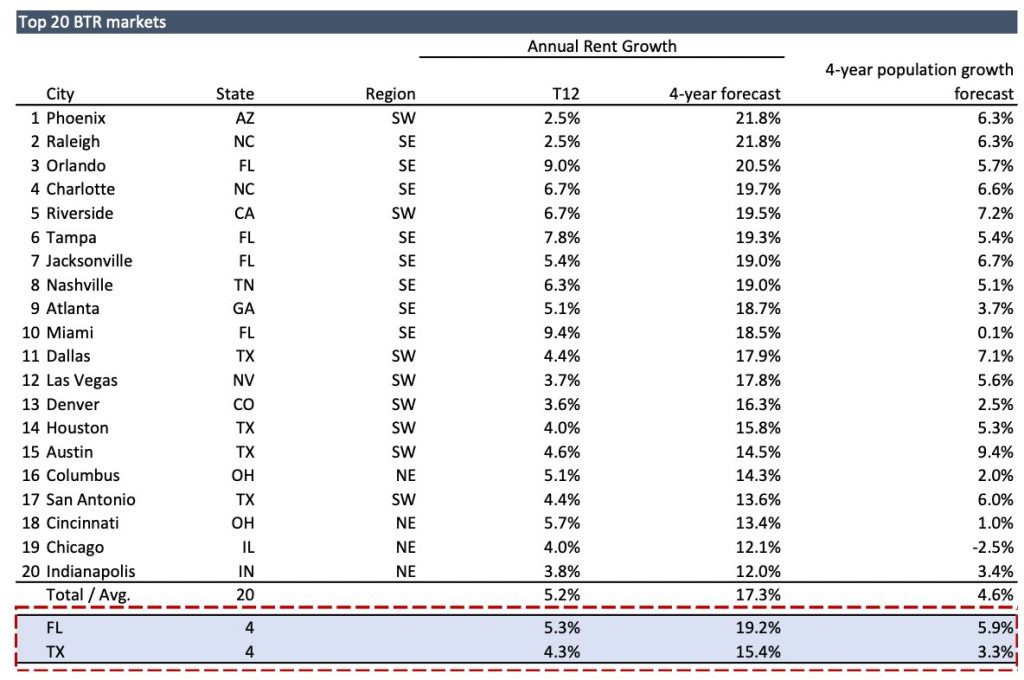

The Southeast and Southwest markets are currently the highest growth areas in the BTR sector, propelled by robust population forecasts. 80% of the top 20 BTR markets are located in these regions, underscoring their dominance. Florida and Texas alone account for 40% of these top-performing markets.

This growth is not only driven by favorable economic conditions but also by the demographic shifts that see more people migrating to these states for better opportunities and living conditions, with rent growth forecasted to reach 15-20% over the next four years in these markets.

Institutional investments

Like renters, institutional capital has flocked to the BTR space via joint ventures with (or acquisitions of) BTR developers and home builders.

Some notable acquisitions and joint ventures include:

- Blackstone Real Estate Income Trust (BREIT) acquired Tricon Residential for $3.5 billion, in part for its pipeline of $1 billion in single family development projects (2024)

- Quarterra (the multifamily arm of Lennar), Invitation Homes, and Centerbridge Partners announced a joint venture to develop and acquire more than $4 billion in single family assets (2024)

- JPMorgan Chase and American Homes 4 Rent launched a $625 million joint venture to build approximately 2,500 single-family rental homes in high-demand markets (2023)

- Alpaca Real Estate announced a $300 million strategy to develop a portfolio of over 1,000 new construction rental homes (2024)

While most institutional capital is on the sidelines waiting for interest rates to drop or stabilize—or a wave of distressed opportunities to hit the market—BTR has been an exception with ongoing institutional capital demand.

BTR Communities in 2030 and beyond

In the coming years, the overarching value proposition for renting over buying single family homes will likely continue to strengthen. There are billions of institutional dollars waiting to invest in single family homes as soon as interest rates stabilize or drop. This will be a tailwind to single-family home prices, potentially magnifying the affordability issues discussed earlier.

But we also believe BTR community offerings will diversify geographically and socioeconomically to include homes and amenities that cater to higher-end consumers.

Expanding beyond the Sunbelt states

To date, BTR investment has primarily been a Sunbelt phenomenon. BTR investment has been relatively limited in the Northeast, Midwest, Mountain West and the Pacific Coast due to stricter regulations (especially around density), higher land costs and stronger homeownership cultures. And most of the population growth—and the need to house it—has been in Sunbelt States.

But the appeal of BTR communities—maintenance-free living, amenities, and a sense of community—are not just appealing to Southerners, but to a broad spectrum of the population. So as the macro tailwinds for rental housing continue to trend, and investors seek to diversify their portfolios, BTR will naturally move into these other markets.

Developers like Avilla Homes have begun moving into Colorado and New Jersey to capitalize on the demand, while groups like Steinbridge have plans to expand into Boston, New Jersey, Philadelphia, Richmond, Baltimore and Washington, D.C. via public-private partnerships.

Also, as remote work becomes more prevalent, the demand for flexible living arrangements in desirable locations will increase.

Selina Tulum, a coliving community that may serve as a blueprint for future BTR vacation communities

So we also expect BTR communities to expand into vacation hotspots to provide more people the option to transition between primary and secondary residences.

Upscale rental communities

Just as apartment buildings range from luxury to affordable housing, there will likely be similar diversification in the BTR space. The trend has already begun with developments like Christopher Todd Communities on Camelback in Phoenix.

Christopher Todd Communities on Camelback in Phoenix offers its residents resort style amenities, luxury clubhouse, dog parks, walking trails and more

In the future, expect to see more communities designed for specific demographics of renters, such as dog owners, digital nomads, and wellness enthusiasts. These niche communities will offer tailored amenities and services that cater to the unique needs and lifestyles of their residents.

For example, communities for dog owners might feature extensive dog parks, pet grooming facilities, and pet-friendly social events. Digital nomad communities will prioritize high-speed internet, co-working spaces, and networking opportunities to support remote work and foster professional connections. Wellness-focused communities could provide access to fitness centers, yoga studios, organic cafes, and wellness workshops.

Tech and innovative financing advancements

Technological advancements will also play a significant role in shaping BTR communities.

Smart home technologies, including automated lighting, climate control, and security systems, will become standard, enhancing energy efficiency and tenant convenience. ESG initiatives will be deeply integrated into community planning, with solar panels, electric vehicle charging stations, and sustainable building materials becoming common features.

A futuristic rendering of a sustainable rent-to-own community

Also, innovative financing alternatives such as rent-to-own programs will offer tenants pathways to homeownership, broadening the appeal of BTR communities and providing additional financial flexibility.

This is a key yield-enhancement strategy being explored at Alpaca Real Estate, where a percentage of homes in ARE’s BTR communities will be offered “for sale” to renters, allowing renters to contribute their rent payments toward a future downpayment on the home.

Innovations like rent-to-own financing and smart technology will not only attract financially and environmentally conscious tenants but also contribute to the long-term sustainability and resilience of the communities for a wide range of rental consumers.

Ultimately, these rental benefits, coupled with the macro homeownership challenges faced by millennials and Gen-Zers, could shift the American Dream for the better. Instead of sinking one’s life savings into a single asset, future generations can embrace lifestyle flexibility, portfolio diversity, and access to really nice communities of single family homes for rent.

This article was originally published in Thesis Driven and is republished here with permission.