“Bitcoin’s too volatile!”

“It’s a bubble – a scam even!”

“It doesn’t have any value; it’s not backed by anything!”

As a systematic trading developer in the crypto space for a little under three years, I’ve heard all sorts of narratives surrounding Bitcoin and the crypto market as a whole. From its wasteful energy consumption to its single use case for criminals, these narratives are spoken by those who haven’t fully appreciated the financial innovation this asset class is driving. Invented by the pseudonymous figure Satoshi Nakamoto, Bitcoin’s creation was both a response and a solution to the financial crisis of ’08, offering a decentralised, fixed supply, globally accessible, fully transparent, peer-to-peer monetary system, backed by the most secure computer network ever built, and is separate from the traditional financial system that relies so heavily on accruing more debt to resolve crises of liquidity and solvency.

In this article I’d like to take a macro-orientated outlook by providing a global perspective on this new technology. With Bitcoin comes this strange idea of digital ownership thanks to the blockchain, a disruptive business model expanded upon by all other cryptocurrencies. Network participation now also requires owning a stake in the network, a concept at the heart of “Web3,” and a notable change from “Web2” platforms like Facebook, where only shareholders saw financial gains. This time, the user is the shareholder.

Often misunderstood as a short-term hedge against inflation, Bitcoin more precisely serves as a hedge against currency debasement, a direct outcome of monetary policy, where central banks, cornered by the need to stimulate economies or pay off rising interest on national debt, resort to expanding the money supply, and consequently devaluing the wealth of everyday savers.

As a 27-year-old living in London, I rarely worry about the stability of the UK’s monetary system, untouched by the hyperinflation or systemic corruption plaguing many countries. Let’s imagine, for a moment, I grew up in Zimbabwe, Venezuela or Argentina. The truth is that my living standards would greatly depend on the daily prices of various food staples. If I didn’t substantially improve my wages year on year, the longer I held my savings in the local currency, the poorer I would become. This is a reality that much of my generation experiences, ignorant to the fact or not, and one of the very reasons that crypto adoption is fastest among the developing world.

It is my belief that the developed world typically sees Bitcoin as a high risk, speculative investment or a store of value at best, while much of the less developed world slowly begin to realise the benefits this new asset class brings. It’s no surprise to me that the top three countries ranked in Chainalysis’ Global Crypto Adoption Index in 2023 were India, Nigeria and Vietnam. But let’s take El Salvador as an example, whose government was the first to adopt Bitcoin as legal tender in September 2021.

According to the latest figures from the World Bank, 23.7% of El Salvador’s GDP comes from personal remittances; funds that individuals working abroad typically send back to their families. Taken from the same source, the global average remittance fee sits at around 6%, with transactions taking an average of one to 10 days to settle. However, the average fee to transfer Bitcoin internationally is around $1.50 and takes an average of just 10 minutes to settle. The difference with Bitcoin is that transaction fees are primarily determined by the data size of the transaction and the network’s current demand for block space, not the transaction’s monetary value. In other words, fees do not scale with the amount being transferred. So, you can imagine the amount of time and money saved using Bitcoin for cross-border payments.

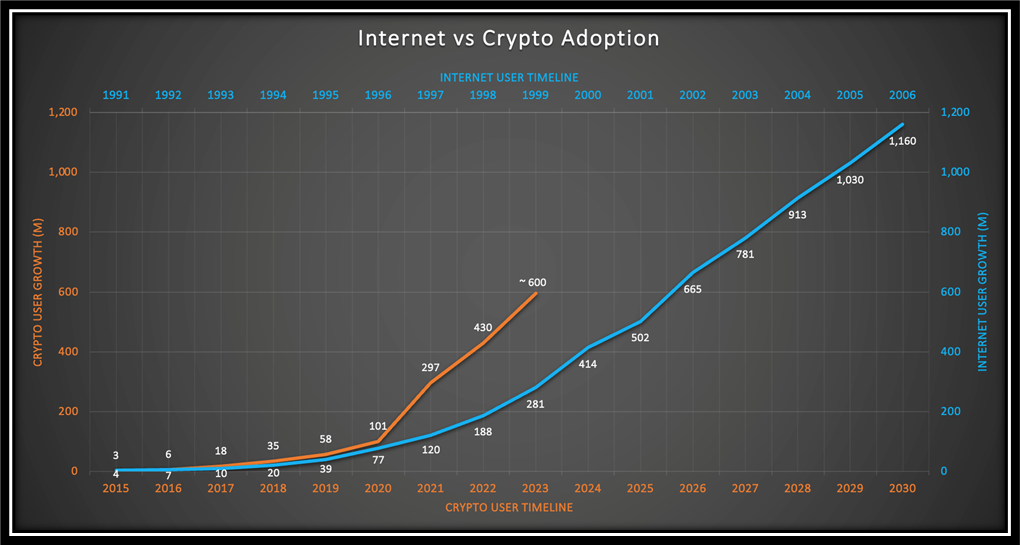

But that’s just El Salvador. What if I told you that despite a significant downturn in 2022 that witnessed crypto prices plummet by 80%, global adoption actually increased by over 40% in the same year? The momentum in crypto adoption continued in 2023 too, with the user base expanding to approximately 600 million. At this pace, the asset class is poised to break the one billion user barrier as early as 2025, a landmark achieved much faster than the internet.

With Bitcoin’s finite supply, resistance to control, peer-to-peer architecture, and accessibility by all 8 billion people via the simplicity of a basic phone and an internet connection, it is empowering individuals worldwide. The Venezuelan shopkeeper can now safeguard her earnings from hyperinflation, the Nigerian freelancer can receive international payments seamlessly, bypassing local banking restrictions and costly fees, the Ukrainian refugee can relocate his wealth across borders without concerns over theft or transportation logistics, and the South Sudanese farmer can store his wealth while dollar transactions are illegal and the local currency is debased via corruption of its central bank.

Nearly 1.4 billion people globally lack traditional banking services, yet they now stand on the cusp of a financial revolution, with the potential to engage with arguably the most sophisticated monetary system ever conceived, offering true financial sovereignty for the first time in history.