The silent gold rush that could reshape the world economy.

For the first time in history, gold went above £2,000/oz yesterday.

This is a huge landmark in the decline of sterling.

Of course, nobody in the UK echelons of power is talking about it.

We are, however, because it matters. Who is buying so much gold that price keeps going up? Why are they buying? There are hugely significant developments taking place in Asia that have the potential to reshape the global financial order.

This bull market is not like previous bull markets. It’s not driven by retail buying. What’s driving it is far more significant than that.

Clowns to the left, cretins to the right

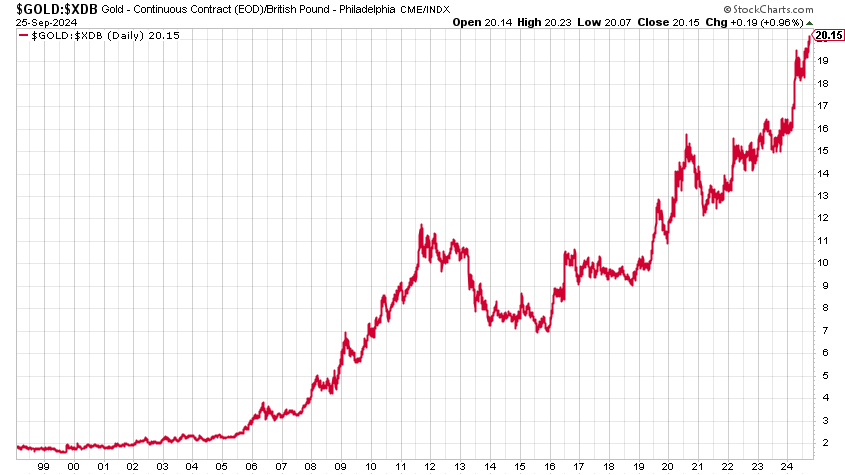

Here is gold in pounds since Gordon Brown sold ours in 1999. It’s quite something—over ten times higher! What a clown.

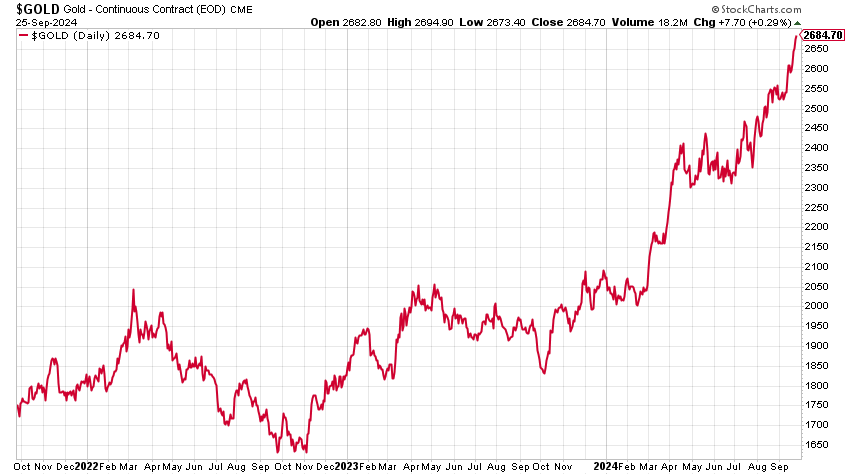

Meanwhile, in other currencies, gold continues its march. Here it is in dollars, the preferred benchmark, over the past three years. This is proper bull market stuff.

I know I have said this a million times, but I really urge you, if you haven’t already, to diversify out of sterling—indeed any form of fiat money—and use gold as your savings vehicle.

The gold price action is telling us something.

The way this government is going—it’s proving almost as rudderless as the Tories were, and in record time—sterling could have real problems, and soon.

To my knowledge, not one influencer in the Labour Party, over the course of its conference this week, mentioned stewarding the currency, protecting its value, or any of that stuff. Just as every government before it has, they will use sterling devaluation to compensate for their deficit spending.

The pound is only holding up in the forex markets because the Bank of England did not cut rates last week, when the Federal Reserve and the ECB have gone into a rate-cutting cycle.

Perhaps, more significantly, no one in the Labour Party is discussing what is happening in Asia. Central banks are buying gold in huge quantities. They are no longer waiting for the price to pull back before making their purchases.

Perhaps most significantly of all—they are not reporting all their gold purchases. It is happening on the quiet.

De-dollarisation is happening in front of our very eyes

The implications for the West are huge. But, despite the geopolitical significance, this issue is nowhere close to the Labour radar.

This goes back to early 2022 and the Russian invasion of Ukraine when the US confiscated Russia’s US$300 billion. Most of the rest of Asia looked at that and thought, “we need to de-dollarize.”

China, as we know, has quietly been reducing its holdings of US Treasuries. It now holds $777 billion in US Treasuries, which is about 10% of the US national debt held by foreign entities. This compares to 22% in November 2013. That is quite the reduction.

China has also, as we know, been accumulating vast amounts of gold.

Analyst Jan Nieuwenhuijs calculates that China has bought 1,600 tonnes of gold since Covid. I think the number is higher. That is on top of the 370 tonnes it mines annually—and most of that mining is state-owned.

I was having dinner with a VIP Chinese investment banker last night. I asked him about the Chinese mentality and de-dollarisation. “It is a matter of pride,” he said. China does not want to be beholden to the US. Global reserve currency status is a goal. There has never been a global reserve currency that did not start out backed by gold.

For now, it continues operating by its doctrine, “we must not shine too brightly,” but all the while it is accumulating gold and reducing its dollar dependency.

But it is by no means the only country doing this.

Saudi Arabia was “caught” a fortnight ago secretly buying 160 tonnes of gold in Switzerland—kudos to Jan Nieuwenhuijs for the scoop.

“One thing is for certain,” says Jan. “Saudi Arabia owns much more gold than it wants the world to believe.”

This is significant because Saudi Arabia was such a key player in establishing the petrodollar in the early 1970s after the US came off the gold standard, enabling the dollar to retain its status as the global reserve currency.

Saudi Arabia could be quietly repositioning itself as an ally of the next global superpower. It could also, as we shall see, be at the heart of a new global payments system.

This article was originally published in The Flying Frisbee and is republished here with permission.