With the election over and JPow cutting interest rates, many are hopeful that 2025 will see the floodgates open for the real estate capital markets, releasing the dry powder (currently at ~$400 billion) that has been sitting on the sidelines for the better part of two years.

But a lot has happened beneath the surface in 2024 that will shape how and where this capital flows—and from whom.

In the past 12 months, the largest asset managers have only gotten larger. And with groups like Ares now trading at 50x EBITDA, the largest firms are actively buying up smaller managers to realize immediate accretion and further their economies of scale.

Fortunately for these smaller funds, innovations in technology have allowed them to unlock retail capital at scale like never before. Juniper Square, a leading investment management software, has 200,000 high-net-worth individuals actively investing on its platform—with average commitments of $275,000.

Separately, the Odyssey Index’s inclusion of alternative real estate asset classes—like SFR, data centers and life sciences facilities—reflects growing investor demand for diversification and stable income sources, driving increased capital allocation to these sectors at both the institutional and retail levels. And with the continued evolution of infrastructure needs driven by AI, e-commerce and electronic vehicles, the size, scale and variety of alternative asset classes is poised for continued growth.

So where does this take us? This letter breaks down five trends we see on the horizon based on these macro shifts, specifically:

1. Increased consolidation of Asset Managers

The asset management industry is experiencing a notable trend toward consolidation, as institutional investors such as pension funds, sovereign wealth funds, endowments, and foundations increasingly concentrate their real estate allocations among a select group of larger managers—driven largely by the desire for streamlined operations and enhanced risk management.

Consequently, large asset managers are actively acquiring smaller and mid-sized firms to expand their portfolios and bolster market share. For example, in October 2024, Brookfield agreed to acquire European logistics real estate firm Tritax EuroBox for $1.44 billion, underscoring the trend of larger firms absorbing specialized entities (in this case, warehouses and distribution centers) to diversify and strengthen their portfolios. Similarly, Ares recently announced it will double its assets through the acquisitions of GLP International in a transaction valued at $3.7 billion.

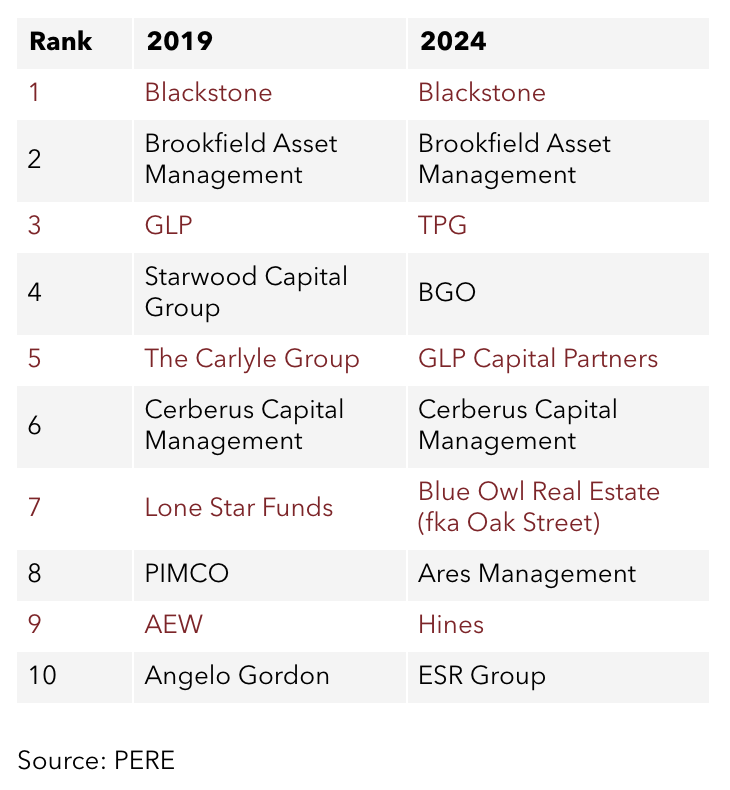

Half of the 10 largest managers in 2019 have fallen off the list over the past five years, surpassed by groups who have grown via M&A

This consolidation is further fueled by the high valuation multiples of leading asset managers—which can range from 20-50X EBITDA—incentivizing these firms to pursue acquisitions that can provide immediate accretion and enhance economies of scale.

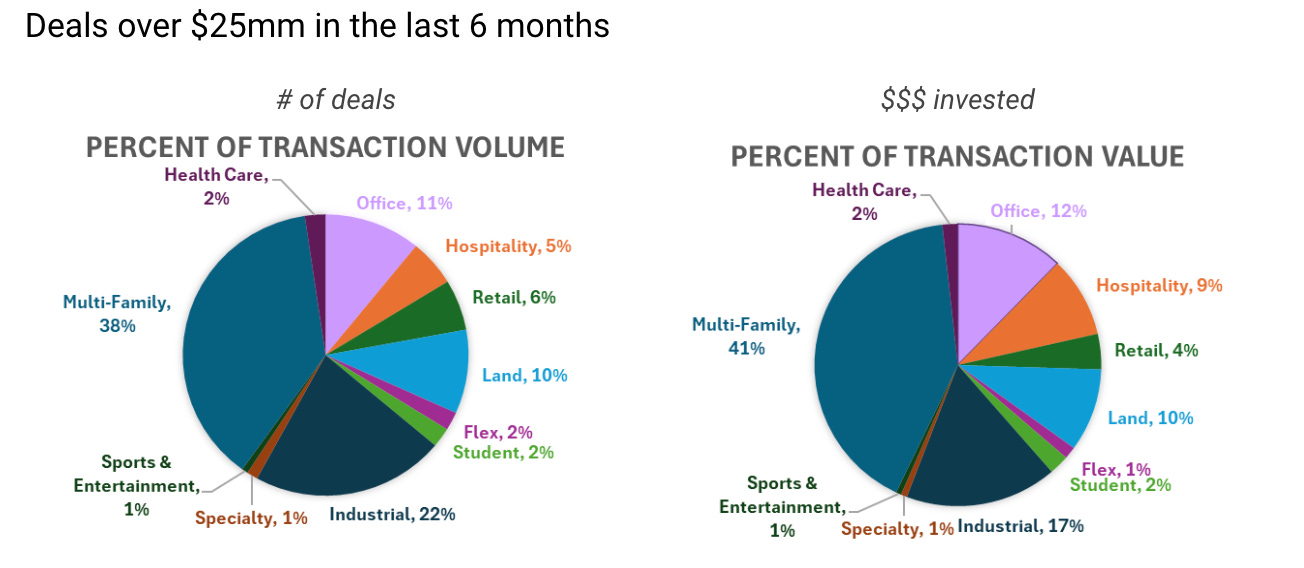

Additionally, larger asset managers are demonstrating a preference for capitalizing on more substantial transactions, leveraging their resources to undertake deals that smaller funds can’t execute.

2. Increased investment in alternative sectors

The hunt for yield and risk diversification is pushing investors toward alternative real estate sectors, prompting a wave of capital into asset classes once considered niche. As traditional markets become increasingly dominated by massive asset managers, smaller funds and operators are finding it difficult to compete for core and core-plus properties. This has led to the rise of a new crop of managers, eager to differentiate themselves with higher-yielding and more dynamic strategies.

Alternative sectors (data centers, life sciences, BTR, IOS, etc.) have been capturing a growing portion of the total invested equity in real estate—currently around 15%.

A maturing landscape of specialized sectors is making this shift possible. For instance, single-family build-to-rent (BTR) housing has become a sought-after asset class, driven by surging demand for flexible living options. Data centers and industrial outdoor storage (IOS) continue to attract investor interest as critical components of the digital economy and supply chain infrastructure, respectively. Meanwhile, even more niche strategies are gaining traction: like growing demand for surf parks designed for affluent outdoor enthusiasts or hubs that cater to the rapidly expanding electric vehicle (EV) market.

These alternative investments not only offer the potential for higher returns but also align with the changing infrastructure and lifestyle demands of today’s economy. As a result, both established players and emerging managers are capitalizing on this momentum, reshaping the real estate investment landscape in the process.

3. Support for Emerging Managers

Large institutional LPs are continuing to invest in new real estate investment managers through dedicated emerging manager programs, with high-profile initiatives from institutions like CalPERS and Texas Teachers leading the trend.

These programs provide capital and support from institutional investors to new or young investment firms, enabling them to scale and establish credibility while diversifying the institution’s investment portfolio and getting them access to promising funds early, often before these firms become more established and expensive to invest in.

Anecdotally, we’ve seen a growing number of young executives at top PERE firms quietly exploring opportunities to launch new ventures to fund earlier stage real estate operators and their platforms, filling the gap between traditional opportunistic investment strategies and venture capital.

4. Entity-level investments

A growing trend in real estate capital markets is the acquisition of GP stakes and the rise of platform investing. This strategy has been increasingly adopted by large LPs and PERE funds (such as Madison International and Almanac) aiming to achieve better alignment with operators and secure a say in strategic decisions. By investing directly at the GP or entity level, institutional investors can shape and influence the deployment of capital, gaining a level of control and insight not possible through traditional fund commitments.

Other vehicles that have been growing are GP or co-GP funds, which also assist GPs with their cashflow needs in exchange for a share of their economics.

For operators, these partnerships open doors to significant pools of capital and support, often leading to accelerated growth and operational enhancements. A common structure involves investors taking a minority equity stake in the real estate company itself, alongside provisions for governance rights and preferred return thresholds. In turn, the operators benefit from committed, flexible capital at the company and property level—including equity and debt structures—that can be deployed across a range of projects. For a deeper dive, check out this webinar.

Traditionally, platform investments have focused on more mature, well-established sponsors with proven track records and stable cash flows. However, a new wave of investors is beginning to target earlier-stage groups with “incubation” or “seed” equity capital, aiming to scale promising operators from the ground up. Firms like ReSeed and Cloudland are at the forefront of this trend, providing strategic funding and mentorship to nascent real estate platforms.

5. Expansion of retail/HNW/family office capital access

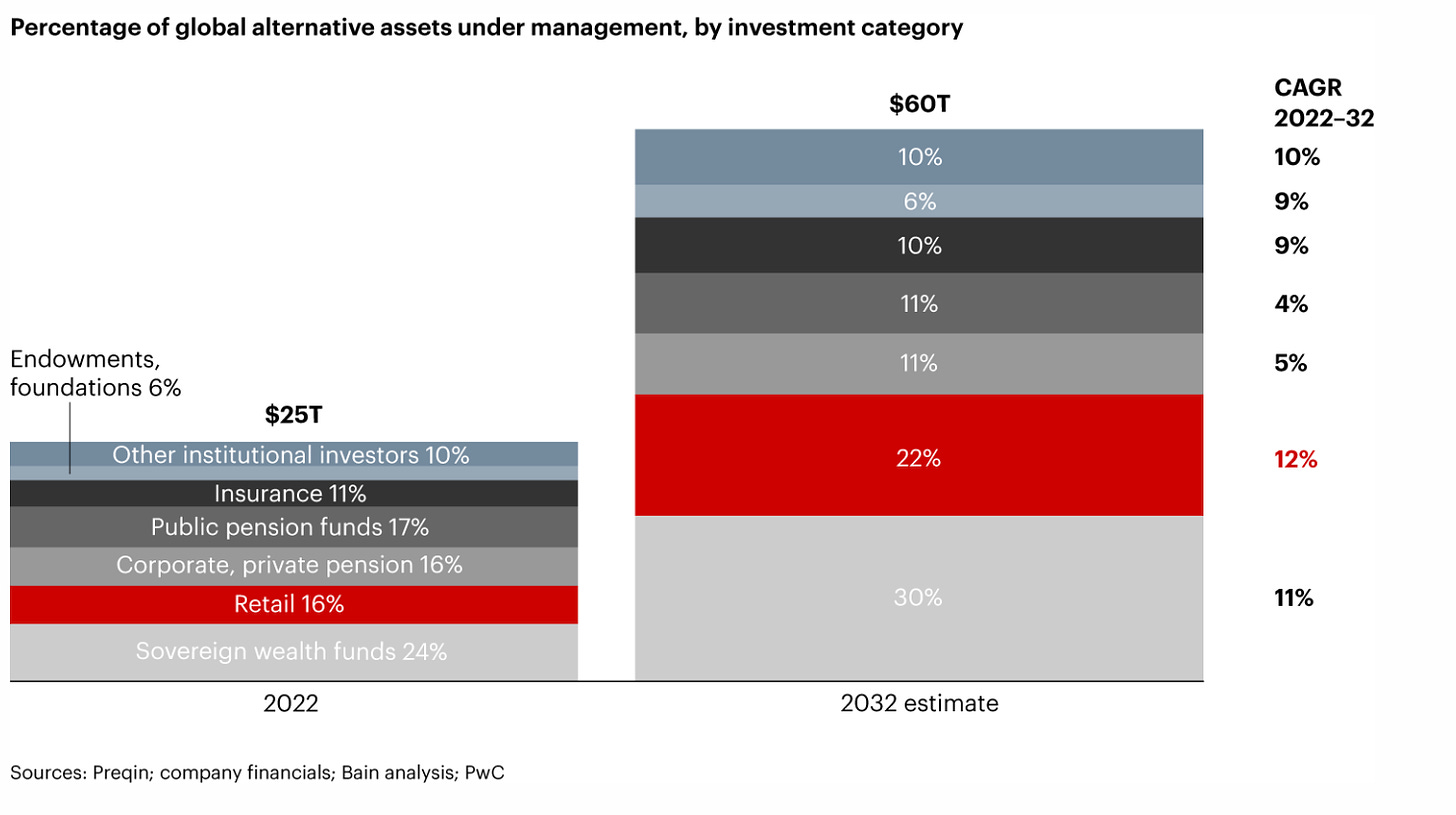

The democratization of real estate investment is well underway, as retail investors now have unprecedented access to opportunities through RIAs, PWMs, family offices, and increasingly through digital investment platforms.

(Source: Bain)

Capital flows into private markets are being driven by a growing number of HNWIs seeking to diversify their portfolios, which has been enabled by advances in financial technology which have greatly improved the transparency and efficiency of investing in real estate, making it easier for a broader range of investors to participate.

For sponsors and operators, tapping into this retail capital at scale comes with significant advantages, including better fee structures and enhanced control over fundraising efforts. By leveraging content marketing and social media, real estate firms can distribute their investment offerings widely, engaging investors who previously may not have had access to these types of deals.

Platforms like Juniper Square and CrowdStreet have capitalized on this trend, providing streamlined, user-friendly tools for both investors and sponsors, ultimately reshaping the landscape of real estate capital markets and fostering more direct connections between operators and retail investors.

To gain a sense of scale, there are over 38,000 private funds and SPVs managed on Juniper Square. These vehicles include over 1 million investment positions held by over 650,000 LPs who have invested over $1 trillion of equity to date.

Wrapping up

2024 has laid the groundwork for significant shifts in the real estate capital markets, setting the stage for an interesting year ahead.

From the consolidation of asset managers and the rise of alternative investment sectors to the strategic partnerships with emerging managers and the democratization of capital access, these trends reflect an industry adapting to new economic realities and investor demands.

We’re looking forward to covering the ride ahead (and looking back on this letter in December of ‘25)!

This article was originally published in Thesis Driven and is republished here with permission.