In the wake of Trump’s return to Executive office we have witnessed “financials” record sizeable moves. These have involved super-charging trends seen ahead of the frenzied electioneering and, in some cases, reversing what had come before; with markets for debt, equity and currency – in its formal and especially crypto-pseudo types – all affected in their own ways. And whilst certain of these moves can and most certainly will extrapolate, I am convinced that within a relatively short time, others will come to be seen as head-fakes.

It is with a mind to separating genuine from eventual regretful capital market moves, that I wanted to consider the question “What with time will follow from the US election, for the UK”? In formulating an answer, one must step back from mere bilateralism. For the reality is that coming to any informed conclusion regarding how the UK “comes off” from a Trump II, requires a wider perspective of where growing nations place the UK in regards their own ambitions, before and after, they have put Trump’s “United” States in his place. And none stamping their authority upon “US all”, MORE than CHINA.

I never doubted that regardless of who had shockingly taken the Oval Office, the world would have continued ITS GREAT economic ROTATION. A rebalancing that is, in which the UK, and regardless of its own political shift, CANNOT FAIL TO see, more wealth coming into its fiduciary and physical assets, and more human capital too.

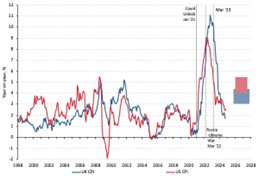

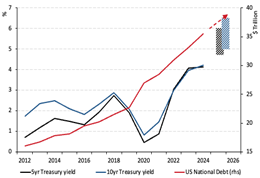

Chart 1: Five-year Gilts v five-year Treasury yields, with forecasts

Chart 2: UK and US CPI inflation, with forecasts

Source: Bloomberg, ONS

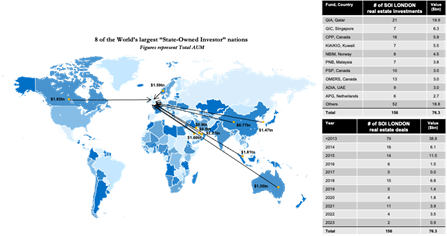

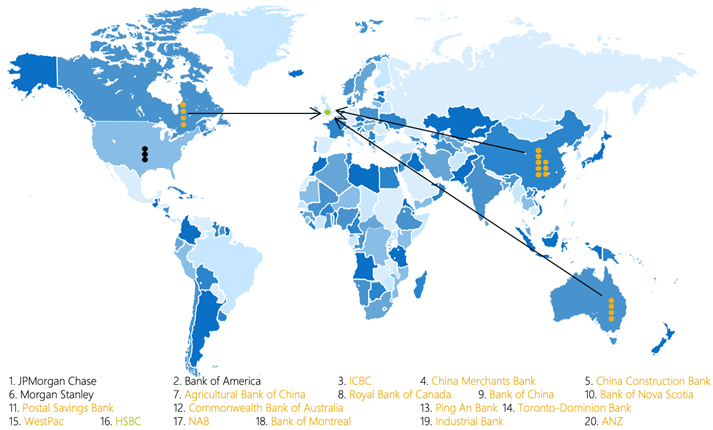

On the theme of formal people flows, please do not be surprised by those high profile and very mobile types, who publicly made clear their considerable disquiet at the return of America’s 45th President as its 47th, announcing they are on the move. And be no less shocked when these identify the likes of LONDON and DUBLIN as their most liked trans-Atlantic relocation preferences. Even if these critical types fail to move as threatened, be in no doubt that as new behemoths emerge around the world and across a range of financial and business service sectors, their search for a secondary operational hub will be reduced to one name – LONDON (See MAP 2).

So, if you are involved in selling or renting prime residential in the UK capital or for that matter commercial space, be prepared for enquiries from financially well-endowed human capital spanning the fields of tech, media, entertainment, finance and beyond. If you are in recruitment, be ready too, for these types retaining your business services, for their own business hiring needs. Let me move back to contentious politics.

There will no doubt be those reflecting on this year’s respective electoral shifts, concerned that the newly installed UK Government will bloodily knock heads with a reappointed US big head, to whom it has said very “unpleasant” things. That elements within the ruling Labour Party, travelled across the Atlantic to actively campaign for the losing Democrats seems not to auger well. Well, to this concern I would point first to the 47th President’s proud Scottish lineage, and his predecessors equally as boastful anti-Anglo Irishness. And point second to the rather choice words the President’s VP once said of him. Bygones and all that.

Regardless of Trump’s personal stance regarding us, this piece aims to shows that neither UK’s real economy nor its public finances, are hostage to the US; well, certainly not in the highly strung way, they once very much were. No longer so closely connected that is, because the place the US holds in the Global Economy has been much altered by the arrival onto the world stage of so many nations that, since the turn of the Millenium, have become very well-endowed economically and financially. The most sizeable transformation has of course come in CHINA, WHOSE ECONOMY and State Savings IN SO rapidly expanding, HAVE in no SMALL WAY, lifted a great many other NATIONS in their mercantilist, commercial and financial fortunes. And PLEASE BE IN NO DOUBT, the foremost Europe beneficiary has been the UK.

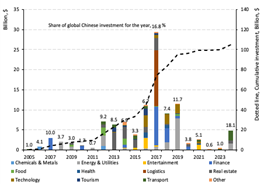

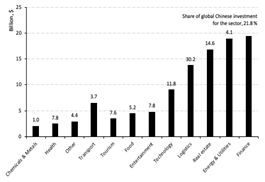

The UK has not only enjoyed the benefits of direct – and often controversial – engagement with China (see Charts 7 and 8), but so many varied iterative advantages, doing so as other beneficiaries of China’s growth (not least Australia and Canada), have benefited the UK in turn (see Map 1).

Map 1: UK Investment Outlook, $Trillions waiting in the wings

Source: Global SWF Tracker

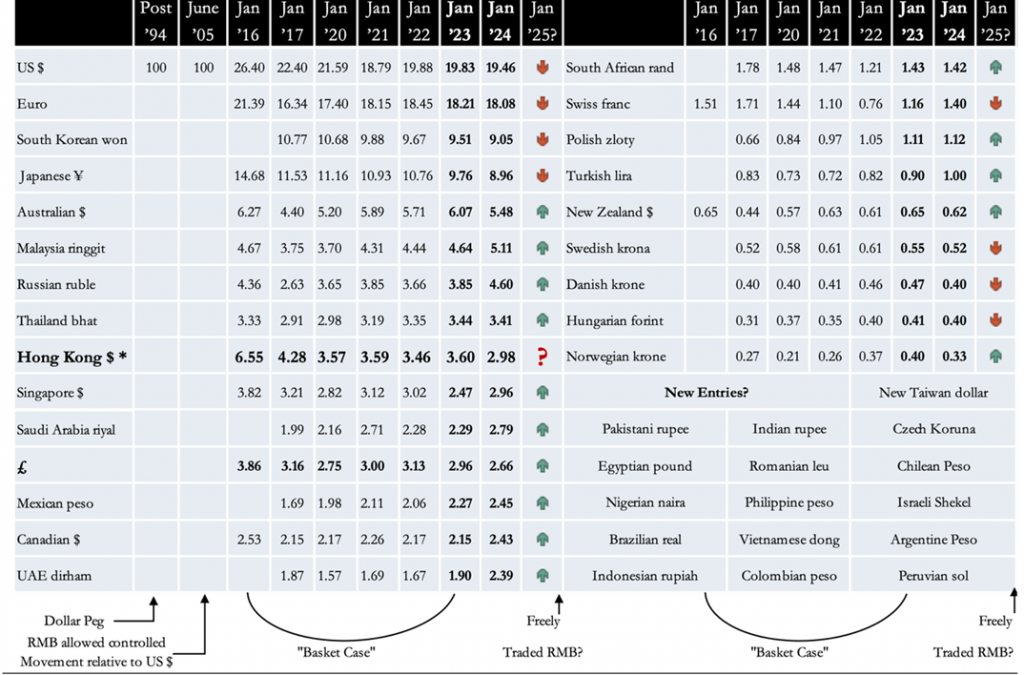

Let us please turn to Table 2. This presents how over recent years Beijing has been painstakingly developing the management of the yuan. And within this developing nature one notices just how out of proportion to their populations, the weights Beijing has given to the dollars of Australia, Singapore, New Zealand, Canada, and the enigmatic Hong Kong dollar. We see too how Norway’s krona features, and of course our very own sterling. The issue here is that Map 1 and Table 2 are NOT CONNECTED BY COINCIDENCE. Not only does China have its sights on saving in UK real and monetary matters, but it has its eyes too on nations that look in turn to the UK to send PART of their sovereign savings. I for one expect Table 2 to see a change from January that will favour the UK if not directly, then certainly as those gaining China’s currency attention, look ever so favourably upon the UK, as an established safe place to save.

One cannot over emphasis how relatively new Map 1 and Table 2 are in the global financial and economic order. An ever developing new world order in which the United States economy and its currency, are being ever more disintermediated from (research which looks closely at the US economy Post Trump II, will follow from this piece).

I will pause here for a moment of UK introspection.

In the wake of coming to office its new Government wasted no time “uncovering” an annual £20 billion black hole in UK public finances. It is a mindful gap that has subsequently been so much more revised higher it was used to warrant Rachel Reeves delivering a highly unpopular maiden Budget; one it has been claimed was more austere than had been seen for a considerably long time. That the Public sector did rather well out of Reeves was largely missed in the press narrative and so too the Austerity Budgets from 2010. I digress.

The Chancellor justified her much tightened tax policy on the grounds it was essential to begin the up to ten-year process of getting closure on the UK’s “huge public sector fiscal hole”. To press home the need to tackle the annual hole in the UK’s public finances, Reeves pointed to how our national debt had topped 100% of our GDP. Alarming numbers so it would seem. Or are they?

I have long argued why the ratio of DEBT to GDP is wholly inappropriate in gauging how perilous or not, the UK’s national leverage happens to be. Suppose as a perfectly sensible alternative we adopt the LTV convention of considering the UK’s national debt relative to its net asset value. By doing so we have a £2.7 trillion numerator against a denominator of c£12 trillion (which itself is a low ball) or ratio of no more than 22.5%; lowly enough then to calm the nerves of even the most cautious hawk towards the UK’s State’s covenant.

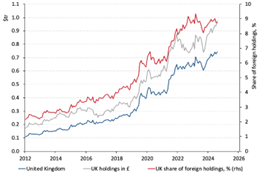

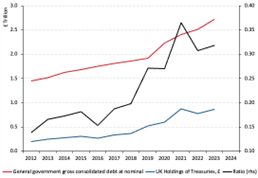

Let me pull the US, back into the UK picture, by considering how large an amount of America’s federal debt, the UK State is NOW sitting lucratively upon (see Chart 4).

Chart 3: £ per $, with forecast, yes, a recent head-fake

Chart 4: UK Treasury holdings, in $ and £, and a share of the US debt

Source: Bloomberg, Federal Reserve

Chart 4 shows that allowing for the current cable rate (Chart 3) and present dollar yields (Chart 6), the UK State has a notional c£700 billion saved in the US Treasury market. Of course, each move higher in the dollar against the pound (as of late), means that ceteris paribus, “our” £700 billion, goes up. It is also true that rising Treasury yields (as they have of late) eat into the UK States mark-to-market wealth saved in the US.

Cutting then to the chase, if this paper’s (contrarian?) predictions of 1) the pound strengthening against the dollar (Chart 3), and 2) US Treasury prices falling (see Chart 6) are proven correct, the UK State will see the savings it has in US State paper becoming ever less valuable. Of course, were the reverses to come to pass the UK’s savings are safely placed in the US. One can here draw upon game shows where the contestant is offered the chance to take her winnings, or risk them in the pursuit of an even bigger prize. DO WE FEEL CONFIDENT/LUCKY?

Chart 5: UK State debt, Treasury holdings in £ and ratio

Chart 6: US Treasury five and 10-year yields v US Fed debt

Source: ONS, Federal Reserve, Bloomberg

Some economic thoughts on yet more airhead numerical rubbish, given airtime by the BBC

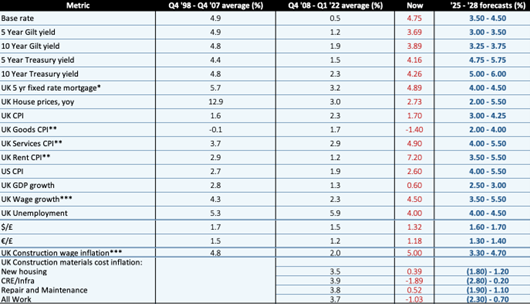

I would like to brief address a recent “academic study from Sussex University” claiming that were Trump to force a 20% tariff onto imports from the UK, this would see our economy suffer a £22 billion export decline, and 0.8% hit to GDP. I will as quickly address as easily dismiss such nonsense. That the sectors most exposed were cited as “fishing, petroleum, and mining, which could see exports fall by around a fifth.”, should have been enough of a warning to the BBC that the “report” was unworthy of the airtime and printed space, it was afforded. It is after all absurd to claim such extremely niche sectors are meaningful in UK exports overall, let alone those that go to the US. So casting aside BBC NONESENSE, let me direct attention to Table 1. This provides a factual past and present, as well as controversial set of “futures”, for a raft of UK – and instance of US – economic and capital measures, some of which are fully graphs in Charts 1-3.

Table 1: UK and select US past, present and forecasts

The reality is that Trump’s trade beef is with none other than China. A China that for the past twenty plus years has enjoyed considerable trade surpluses with the US. AND A China that is NOW in a far stronger position TO DEAL WITH TRUMP’s TARIFFS THAN when HE IMPOSED THEM FIRST TIME AROUND. For in the years since then Table 2 has been under construction. And this author at least is convinced that January 2025 will introduce another column of currency change that will dilute even more the US dollar from Beijing’s reckoning, whilst raising the weights of, and adding new space for, the sovereign currencies of nations with whom THE UK economy can only draw strength.

Chart 7: Chinese investments to Britain from 2005

Chart 8: Chinese investments to British sectors from 2005

Source: American Enterprise Institute and Heritage Foundation, China Global Investment Tracker (2005 to HY2024)

Table 2: The changing way the PBOC has managed the RMB, % weighting in Yuan management basket with forecasts

Source: CFETS

Map 2: The world’s largest banks by market cap in 2030? All in need of a sizable UK secondary hub

Source: Bloomberg