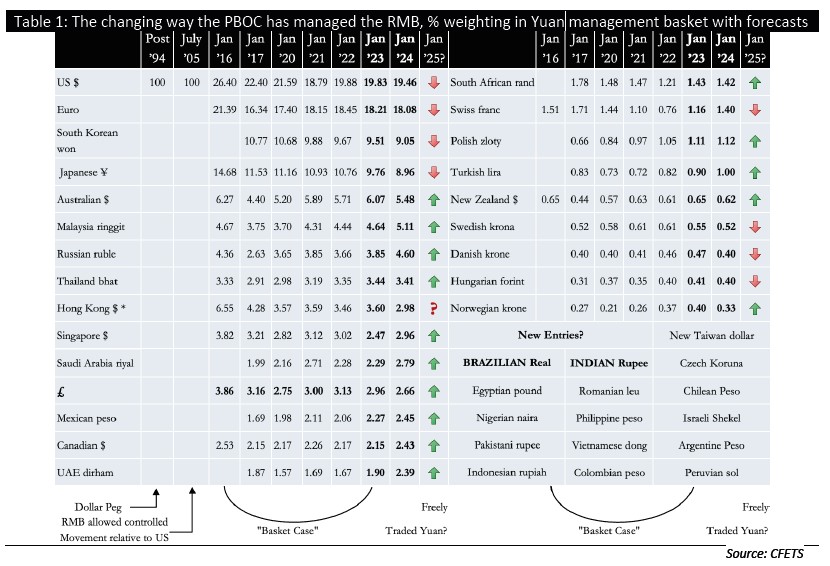

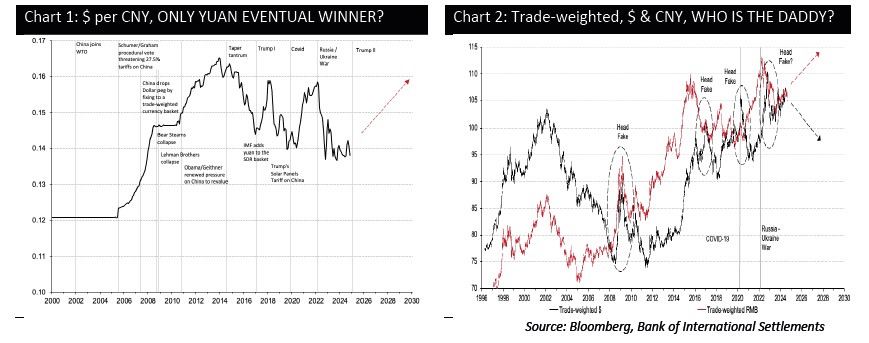

Whatever the “global economy” happened to look like in “their time”, there have always been nations/City States, determined to expand & become overarching dominant mercantilists/capitalists. And each of the FX’in disruptors of the day, knew THEY COULD ONLY trump if their currency gained dominion at the expense of the “old order”. And as tired as the latter had become, with a currency long over-minted & debased, it never gave up its crown lightly. Well, the global economy finds itself at just such a time of tussle. A fierce FX’in battle for monetary dominion that is and thankfully WILL NOT, play out as so many before, alongside a bloody military tussle. As for when this figurative battle for new currency supremacy begins, well it already has – see Table 1 & charts 1 & 2.

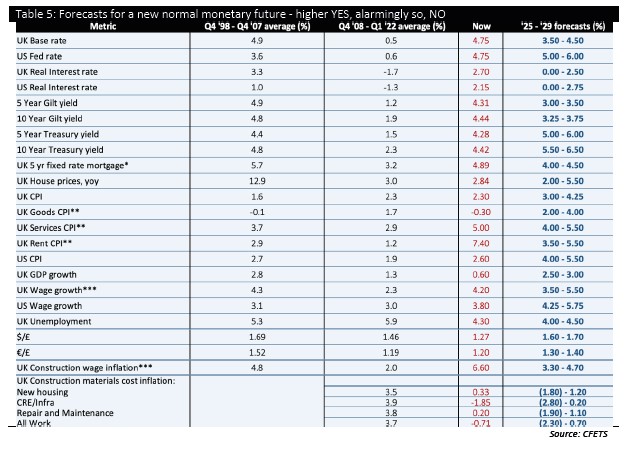

As we enter THE NEW YEAR – or at least the way we in the west record time, I consider it highly likely Beijing will alter the constellation of currencies it manages its yuan within. And though this has been adjusted in 7 of the last 9 Januarys, I would maintain the NEXT few new year’s celebrated on the watch of the incoming President, will involve more significant monetary shifts than ANY before.

Now, China happening to FX’in act the month Trump is (re)installed as US President, could well be described as mere happenstance; an event likely had Biden won a second-term, or Harris her first. Yet, what makes me confident BIG FX’in change will begin SO SOON into the new Presidential term is the far from small hand (sic) a renewed Trump is having in accelerating matters. He has after all, resumed his well-thumbed script criticising China for FX’in its yuan to make the dollar less competitive. By way of a fierce threat to force a fixing of this, Trump has promised sizeable NEW tariffs, UNLESS the dollar is released downwards; nothing new here you say. Yet, Trump is ALSO threatening “The BRICS” – of which “cabal”, China is the de facto capo – with tariffs, if they DARE TRY TO create their own currency order, sans the dollar. No, I also can’t see the consistency in these demands; for one will ensure the other.

That neither Brazil nor India appears in the table below, tells me one of two things. The whole ‘new BRIC currency order story’ is entire FICTION. OR, from January, China will MAKE IT REAL BY ADDING the Real & Rupee to Table 1. If the latter comes to pass, notable elements of Table 1 MUST be hollowed out. And if China is indeed set to alter Table 1, why shouldn’t we expect the HKMA to take the opportunity to adopt its OWN new currency management order, one rather conveniently, resembling the PBOC’s YUAN?

Sure, you’ve heard it all before

Sure, “dollar detractors” have long been ridiculed, as stale-bears. And yes, there are large graveyards filled with dollar and Treasury bears, with many plots only recently dug awaiting the burial of those who have the temerity/stupidity to short the dollar. This time next year we will see who is still standing and who is lying. See too, to which heights crypto currencies stand, or have fallen from. I digress.

The height at which the dollar currently stands must be considered in context. The context of a long history over which other special specie and then special “mere” fiat units, seemed unassailable. So much so that money remained so stubbornly linked to them that when they did fall, they took down the fortunes of all those that had stuck by them.

Before getting ahead of ourselves with what awaits, let’s please set the backdrop.

One can claim, with justification, that the vote for its 47th President, has left the United States as starkly divided as when it elected him first, then his successor, and far further in its short history the 16th. Of course, what constituted “The United States” back in 1860 was so different to it in 2024. Far different too, how other nations, close to home and afar, have come to rely upon the US. Depend, that is, not only as a military power, but dominant mercantilist and monetary force.

Crucial in the transformation the US has undergone in its comparatively short existence, has been the ever-GREATER role PLAYED by the dollar in the way nations with open-economy’s work; or certainty that is, did until relatively recently. For we are NOW in a commercial world not merely so very much altered since the second half of the 19th century, but ever so much different from as recently as the turn of the Millenium. One can even claim that when the US FIRST elected THIS President, the global economy was SO very different, to what we see on his return to Executive Office.

Having risen to a position of seemingly unassailable mercantilist and monetarist strength, the US must now contest with a China that wasn’t meaningfully important as recently as twenty years ago, and different too, from what it was a ‘mere’ whilst back in 2017.

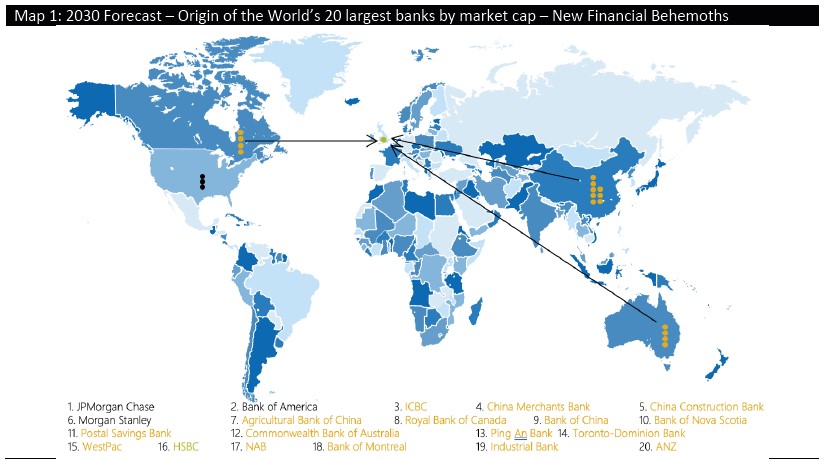

True, as a mercantilist in fields such as automotive, aerospace, extractive, constructive, and even many areas of electronics and technology, China lags brands and marques from the United States, Europe and Japan. Yet, though China does not just yet figure in these areas anywhere close to proportionally to its population, a time is fast approaching when IT WILL competitively rival US, European & Japanese corporates and their banking behemoths (see Map 1).

Let me be clear. The direction I see the PBOC TAKING from January 2025, with be a continuation of a LONG MARCH that began close to 20 years ago, but one performed at a much more rapid pace. Here’s a potted history.

TWENTY EVENTUAL YEARS FOR THE YUAN DOLLAR

Back in June 2005, we saw a draft of the Graham-Schuber Bill reach the Senate; yes, those very much politically polarised men, joined-up against China. Their bill threatened Beijing with 27.5% waterfront tariffs, unless it allowed the yuan to move upwards relative to the dollar. In response we saw an 11th hour concession (see graph 1). Beijing’s retreat was NOT however a repeat of the dollar rout made 20 years earlier by Tokyo, when it happened to be in Washington’s competitive crosshairs. What followed then was the PLAZA ACCORD, a multi-national effort that unleashed the yen to rise spectacularly (or a disorderly fall in the dollar), and in so doing, sowed the seeds of so

much that would go wrong within Japan, and trigger real economic shocks, well beyond it. Those events are not however for this piece to consider. Let me continue.

Unlike Tokyo’s miscalculation twenty years earlier (when the yen “roofed it”), what Beijing gave Washington in 2005 was a very measured appreciation (see chart 1). This continued until the GFC struck, at which point Beijing rather sensibly reacted by repegging the yuan to the dollar. From 2011 Beijing felt confident it could once more loosen-up (see chart 1 again). Then from 2015 monetary matters reversed, triggered by the TAPER TANTRUM. Since then the general direction taken by the yuan relative to the dollar would appear to be generally downwards. Indeed, inspecting chart 1, it would be all too easy to claim that far from buying the c0.14$ that it does at the moment, the

CNY will be lucky to afford barely 0.12$; a far cry then from the 0.16$, I predict will be the very least case by 2030.

We MUST NOT however misunderstand current currency MATTERS.

What was witnessed from 2014 and indeed ARE still seen to this day, is Beijing very carefully CONTROLLING the yuan dollar exchange rate. It is doing so to ensure the FX’in rate conforms within the managed two-dozen strong currency system constructed in Table 1. The simple arithmetical fact is as the dollar has moved HIGHER or LOWER against the other fiats Beijing controls the yuan relative to, so the PBOC has managed the yuan LOWER or HIGHER to the dollar.

So, yes, the dollar has recently been gaining ground against the yuan (chart 1). It has done so however as the dollar has moved up against so many existing fiats in Table 1, and others than will very soon be part of it. What we have then in chart 1 is a dance between the dollar and yuan carefully choreographed by China, involving a now two-dozen strong ensemble cast (as per chart 2).

Please be in no doubt, amongst these dancers performing in Table 1, a casting change is looming. What we are likely to see from January is existing cast members given new roles (some demoted, as others are granted a higher billing). This will be part of new performers being added (see Table 1 again).

My contention then towards what awaits Table 1, as soon as January 2025, is this. Beijing will employ the first expansion of its CFETS coverage since January 2017, doing so by most notably adding to the cast the BRIC’s of India’s Rupee and Brazil’s Real. This can only however be achieved if the weights currently held by the dollar, yen and very possibly the won & euro are lowered. But to be clear, the most significant dilution will be to the dollar.

What of confounded pound in all this?

Though sterling has been represented in Table 1 ‘from its beginning in January 2016’, its weighting of 2.66% is down from the original 3.86%. So then, not a good sign for sterling? Well, not quite.

To those convinced the pound will be amongst those currencies in the CFETS table set to be demoted, I say this. With its already low weighting, there isn’t much to gain in taking any of its strength away so as to distribute to existing and new constituents to the CFETS troupe.

One can even argue that given the UK’s burgeoning economic and commercial engagement with China, sterling needs at least its existing weighting, if not for that matter, more to be added. Indeed, if India’s Rupee is to be added to Table 1, and possibly that of Pakistan and Nigeria’s Naira, their Commonwealth links to the UK should warrant sterling holding its share, or even gaining some.

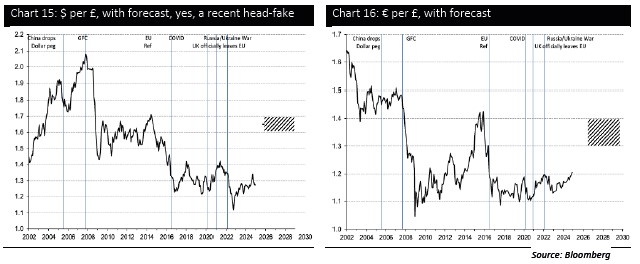

Less we forget the other Commonwealth nations of Australia, Canada, New Zealand, Malaysia, South Africa and Singapore are already in Table 1. And these will most likely GAIN collective weight, something which must surely be positive for sterling (charts 15 and 16)? [that the Commonwealthers’ of Malta and Cyprus are within the eurocurrency, is more a small albeit intriguing curio].

A TAIWANESE TALE

There will be those curious as to why on earth I could even suggest the New Taiwan dollar would appear as a potential CFETS addition. Well, here’s the deal, Table 1 has been created by Beijing with China’s commercial selfinterest in mind. The fact is that currencies within it do not join voluntarily, but get inducted, whether they like it or NOT. Inducted too whether the nation they are attached to, has cordial territorial and good historic relations with China, or chilly ones, viz. Japan. And quite frankly, given its extremely close mercantilist links with China, Taiwan is a natural candidate for induction. Indeed, getting cemented into Table 1 is where all BRICS, and those aspire to be

within that “growth group”, want to be, why not Taipei?

A RECAP ON CHINA’S CAPITAL POSITION

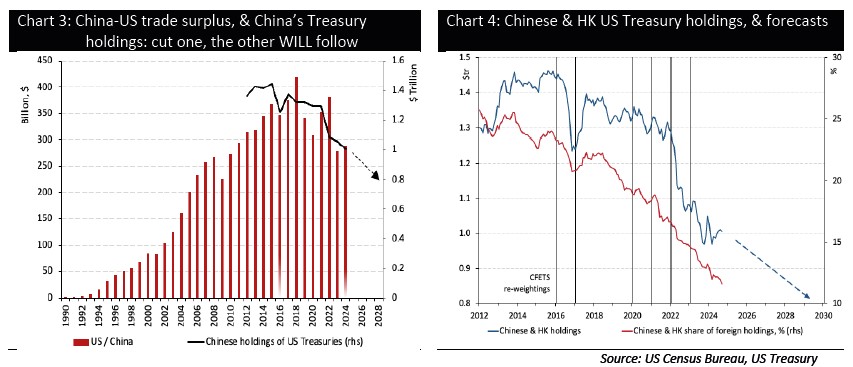

To be clear, Over the years since China’s – long awaited – acceptance into the World Trade Order, the US economy and its currency has served it well. After all the United States has delivered to China consistently large current account surpluses (chart 3), with which Beijing has:

- Funded the building-out of its ever-greater domestic economy, and,

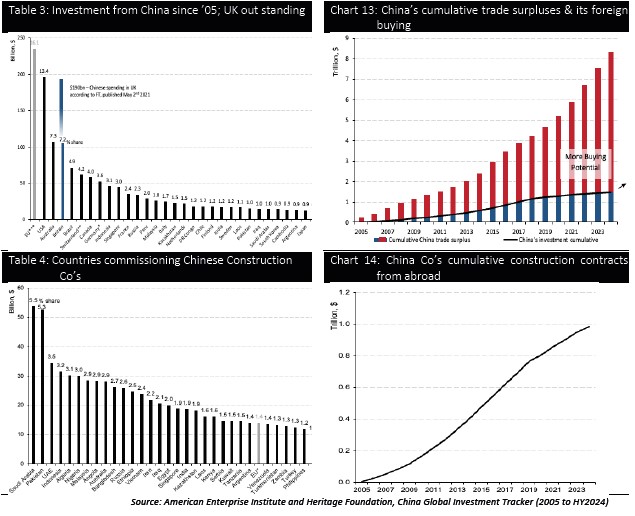

- Bought the valued assets in a great many other nations, that are home to what China’s economy needs to expand at pace, and yet (see table 3),

- Still managed to recycle a significant – vendor finance – part of its current account surplus into the US Treasury market (see again chart 3 and 4).

For its part, the dollar has long shouldered the role as sole numeraire for the world’s bulk extractives, commodities, and raw foodstuffs, as well as the “bulk destination” for global savings. It has long too been the means of exchange for so much bilateral trade between nations for which it is not the currency of either! The dollar has also been a

strong buttress to absorb pressure through those all too frequent episodes when uncertainty descends upon the global economy, and capital flies to the “safety of the greenback” (see charts 1 and 2).

All the above accepted, and for all sorts of pressing reasons, January could easily SEE CHINA ushering in HUGE CHANGE TO HOW IT MANAGES ITS CURRENCY. Please be in no doubt, if Beijing does act it can only come at the dollar’s expense. To be clear, even had the US Presidency been decided differently, the prediction that Beijing is likely to unveil a new currency constellation timed for the same month of the 2025 inauguration, would have been decidedly the same. True, China could conceivably bide its time and continue to act in adjusting Table 1 as it has thus far, in a way that attracts little notice; after all, have YOU noticed and/or cared about THE CREATION of Table 1?

Why China’s lightning striking the dollar, will not be immediately heard in the Treasury market

There will be those asking, “If the FX’in shocking predictions in this piece are to be believed, what will be the reality in terms of global economics?” Well, to answer I will employ an axiom in basic physics: light travels much faster than sound. We hear and see this fact whenever we witness a firework exploding, then having to wait for the boom, or seeing lightening, and then waiting to hear the thunder. The rule is to count the seconds between the two, then divide by 5, and one can establish the distance away in miles, the firework display, or storm happens to be. So, what is my point?

When we SEE China NEXT ACT (January 2025?), i.e. the lightening, we should not expect to hear the thunder FROM ITS ACTIONS, for some time. Do not see that is, the effect on those China has acted upon for more or less: better or worse. As for the gap in time between sight and sound, well whilst this may not be measured in minutes, days or even weeks and months, IT WILL HAPPEN, for one MUST follow the other.

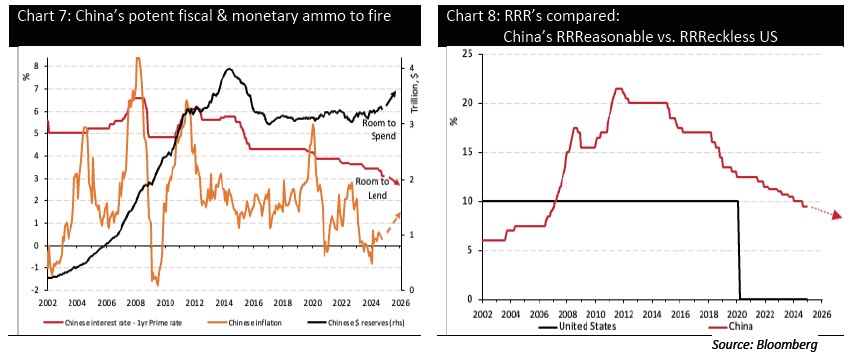

Continuing the metaphor. A firework is at its loudest AFTER IT HAS ACTUALLY GONE OUT. And with this in mind be in no doubt that there will be those making loud noises over how ‘sound’ the US TREASURY market is, sometime after it has gone out – or rather CHINA has largely gone from it (see charts 4, 9 and 10)

But why BUY THIS STORY NOW?

IF BIG CHANGE IS COMING, what gives me cause to believe ‘25 will the year, and not ‘26, ‘27, ‘28 or for that matter once Trump has gone in ‘29? Indeed, why doesn’t Beijing simply respond to Trumpian tariffs by pushing its currency even lower against the dollar (as we appear to be seeing in chart 1)? Acting that is in defiance of my PREDICTION in chart 1, and in imitation of what happened from ‘18, as Trump entered the second year of his “first term”.

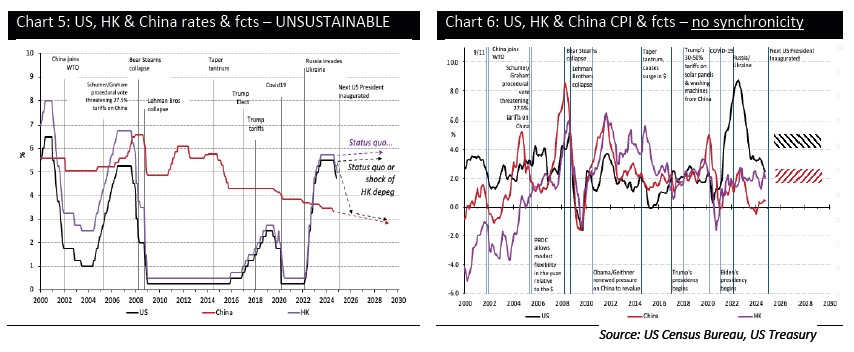

What makes timing so pressing NOW, is that so much has changed since Trump was last in office. Covid has come and gone and left large parts of the developed world financially weaker. It has also left the developing world so much more in need of a new “Capitalist”. For Europe, Ukraine has only added (sic) to it negativity. Across in Asia, Japan continues to descend into mere nothingness, compared that is, to the economic titan it was as recently as 1990. Even closer to home, China is watching as the Hong Kong dollar’ tethering to the US dollar has become an economic burden to its SAR, and as such untenable. And what better time to make major changes to Table 1 than coincident

to Hong Kong moving to a managed floatation, which rather ‘conveniently’ could use precisely the same system as China’s YUAN? (see charts 5 and 6).

Let us step back and peer at the world looking to where and what China has acquired around it, Table 3 (with so much unspent capital still to be deployed, chart 13). Here we see Brazil ranking highly as a destination of China’s capital, and yet its Real is not in Table 1. We also see India represented, but as with Brazil’s real, no place for the rupee in Table 1. Well, this is the whole point of this piece. Though the real and rupee are not in Table 1 JUST YET, and this MUST CHANGE. For that matter Table 3 tells us that Indonesia’s rupiah should very soon appear in Table 1, and potentially the peso of Peru and currencies across Indochina, and heck why not the Pakistani rupee et al? and if these are adding, the weighs for A NUMBER OF THE existing members of Table 1 MUST COME DOWN.

Turning to Table 4 we see just how much wealth across the world is being directed at China’s construction companies so they can do the hard work of building out what are for the most part, developing nations. Of all the other valuable things that Tables 3 and 4 tell us, they give us a candidate list for Table 1.

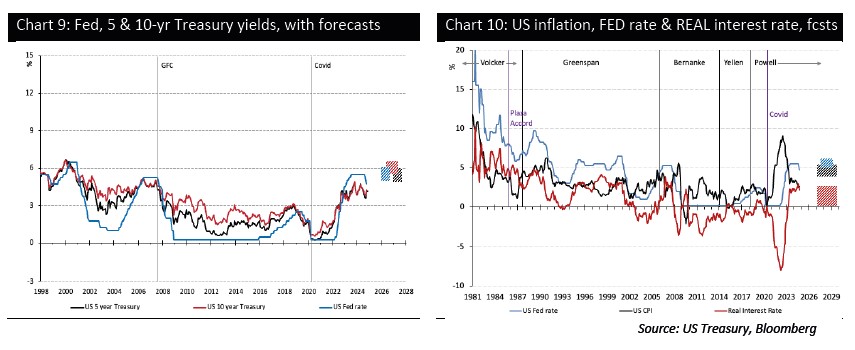

A casual inspection of inflation rates in the US and Hong Kong show how ABSURD it is that Hong Kong follows US monetary policy (charts 5 and 6 and Table 2). For although a rather summary way of making the point, the correlation between the consumer price inflation recorded since 2000 in Hong Kong with the US has been c30%, compared with

c68% between Hong Kong and “The Mainland”. Truncate to more modern times from 2010, and the figures are – 14%, YES NEGATIVE, and 51%. QUITE ABSURD then for Hong Kong to imitate US monetary policy.

The reality is that since its inflation picture does not AT ALL NOW resemble that of the US why should HK continue to track US borrowing rates that more expensive than in China? For with US rates higher than those in China so too are those of Hong Kong (see chart 5). And as such Chinese capital has been able to enter a Hong Kong real estate

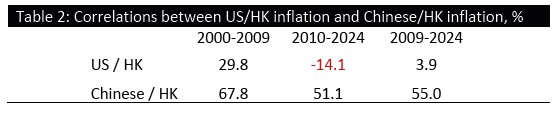

market struggling under the burden of excessively high real rates. To put things bluntly the absurdity of following US monetary policy is allowing China to monetarily take over Hong Kong, ON THE CHEAP. As for the idea China is descending into a period of ‘Japanification’, because its inflation is so very low (chart 7), this is nonsense. China has

capitalised on the war in Ukraine to buy ever so cheap resources from Russia et al (Russian oil via India?). Please be in no doubt, as US interest rates remain elevated, because of Trumpian inflation, those in China can and will ease. And as they do, economic matters in China can only improve, whilst pressure in Hong Kong to break the peg will only increase. And for that matter please look at chart 8. Between China and the US, whose banks NOW have the greatest capital buffers?

WHAT OF THOSE CHINESE DOLLAR BONDS ISSUED IN SAUDI?

I come now to Beijing’s very recent and very publicised and commented upon, decision to issue dollar denominated bonds in a Kingdom of the Western Gulf. To some this SAUDI act RUBBISHED ALL THAT THIS PAPER STANDS FOR: that the Yuan is poised to strengthen against the dollar. After all the China I claim will seek ever growing currency dominion, has recently opted to “subjugate” itself to paying back bonds in the dollar, as if it were say, the serial distressed sellers OF their own currencies PAPER DEBT, such as Turkey, Nigeria, Argentina et al! Surly then what we saw in SAUDI with China doing a “Turkey” suggests THIS paper is MERE RUBBISH?

Well, here’s the deal. If China is indeed set on strengthening its currency against the dollar (see again charts 1 and 2), well then issuing debt in the latter makes VERY CANNY monetary sense. Makes a great deal of sense, even if the dollar-debt is sold at a higher coupon than on yuan-sovereign bonds. With time we will course see if this new paper should have carried the warning to its buyers of caveat emptor.

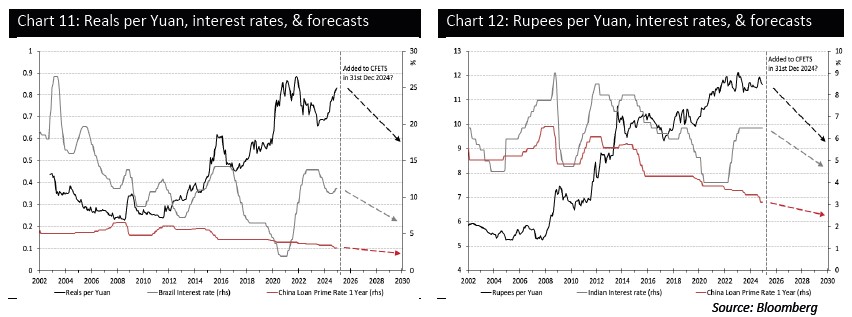

As for adding Brazil’s real and India’s rupee to Table 1, this would be welcome to both nations. It would mean after all, them getting ever more of China’s capital, sure lifting their currencies in the process, but resulting too in a welcome lowering of their interest rates (charts 11 and 12).

Will China Yuan-day allow a free float?

This short piece has charted China’s eventful 20-year currency management journey from July 2005. It considered why the yuan was jolted up slightly from its strict dollar peg, albeit thereafter managed to remain within a narrow daily range around a “dollar fix” (chart 1). It chronicles how from January 2016 – a year before Trump’s first inauguration – the yuan began to be managed within a constellation of twelve currencies. A new system in which whilst the dollar and its affiliates were allocated the largest “single” weighting, it was still well below half.

Table 1 also captures subsequent rebalancing and additions to the constellation. Chart 2 in turn in turn shows how changes to Table 1 have contributed to movements in the yuan’s trade weighted level; trade weightings are not the same of course, as the weights in Table 1. Included in Table 1 are my suggestions on which new currencies might be added, as well as how the weightings of existing components could be expected to change.

Now one cannot speculate on what awaits the yuan’s management without asking whether a day will dawn when it is allowed to find its levels in a freely floating way? Well, of course such a day will come, but to be clear not for the foreseeable future.

Rather than cry foul at how the PBOC has and will continue to manage its currency, we should all be grateful for its past, present and continued ‘interferences’.

To be clear, given China’s considerable current account surplus (see chart 3 and 13), if the yuan were allowed to find its own level, one would expect it to follow an appreciating path steeper than we have seen thus far in its tradeweighted level, please see chart 2 once again. A path even more inclined in the yuan which would almost certainly fuel inflation in all those economies that have become heavy consumers of Chinese exports and of course dampen their appetite for its goods.

As noted elsewhere adding India’s Rupee and Brazil’s Real to Table 1 would allow these nations to enjoy BOOSTED sovereign capital transfers from China. The latter would hardly be unwelcome given Brazil and India have tended to have interest rates that stubbornly persist (see charts 11 and 12). Remain higher that is, than were those in authority in both nations more accommodating in allowing in outside capital. Their self-serving motives for not being so, more than justifying a dedicated piece.

Anyway, the point of this short section is simple enough to summarise.

We should look upon the evolution of Table 1 as being for the greater good of the Emerging World, diluting the importance to it of the woefully overprinted dollar. The simple fact is that changes to Table 1 cannot fail to spur on moves away from the dollar in how the world trades, prices and saves: yes, all the basics of what a currency needs to do if it is to replace the dollar. And please be in no doubt, those looking for the dollar’s successor, mustn’t be KIDDED into thinking it will be Bitcoin, for there is only YUAN POSSIBILITY.

SUMMARY

As we enter THE NEW YEAR – or at least the way we in the west record time, I consider it highly likely Beijing will alter the constellation of currencies it manages its yuan within. And though this has been adjusted in 7 of the last 9 January’s, I would maintain the NEXT few new year’s celebrated on the watch of the incoming President, will involve MORE significant monetary shifts than ANY before.

Now, China happening to FX’in act the month Trump is (re)installed as US President, could well be described as mere happenstance; likely had Biden won a second-term, or Harris her first. Yet, what makes me confident BIG FX’in change will begin so soon into the new Presidential term is the far from small hand (sic) a renewed Trump is having in accelerating matters by returning to his well-thumbed script criticising China for FX’in its yuan to make the dollar less competitive. By way of a threat to force a fixing of this, Trump has promised sizeable NEW tariffs unless the dollar is released downwards; nothing new here you say. Yet, we also have Trump threatening “The BRICS” – of

which loose cohort, China is the de facto capo – with tariffs, if they dare TRY create their own currency order, sans the dollar. No, I also can’t see the consistency in these demands; for one will ensure the other.

That neither Brazil nor India appears in the table below, tells me one of two things. The whole ‘new BRIC currency order’ story is entirely hollow. OR, From January, China will fill the Real & Rupee into Table 1. If the latter comes to pass, then notable elements of Table 1 must be hollowed out. And if China is indeed set to alter Table 1, why shouldn’t we expect the HKMA to take the opportunity to adopt its OWN new currency management order, one rather conveniently, resembling the PBOC’s YUAN?

Research Disclaimer:

Important Disclosure Statement from QuantMetriks Research

This document is issued by QuantMetriks Research Limited solely for its clients. It may not be reproduced, redistributed or passed to any other person in whole or in part for any purpose without written consent of QuantMetriks Research. The material in this document is not intended for distribution or use outside the United Kingdom. This material is not directed at you if QuantMetriks Research is prohibited or restricted by

any legislation or regulation in any jurisdiction from making it available to you.

This document is provided for information purposes only and should not be regarded as an offer, solicitation, invitation, inducement or recommendation relating to the subscription, purchase or sale of any security or other financial instrument. This document does not constitute, and should not be interpreted as, investment advice. It is accordingly recommended that you should seek independent advice from a suitably qualified professional advisor before taking any decisions in relation to the investments detailed herein. All expressions of opinions and estimates constitute a judgement and, unless otherwise stated, are those of the author and the research department of QuantMetriks Research only, and are subject to change without notice. QuantMetriks Research is under no obligation to update the information contained

herein. Whilst QuantMetriks Research has taken all reasonable care to ensure that the information contained in this document is not untrue or misleading at the time of publication, QuantMetriks Research cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. This document is not guaranteed to be a complete statement or summary of any securities, markets, reports or developments referred to herein. No representation or warranty either expressed or implied is made, nor responsibility of any kind is accepted, by QuantMetriks Research or any of its respective directors, officers, employees or analysts either as to the accuracy

or completeness of any information contained in this document nor should it be relied on as such. No liability whatsoever is accepted by QuantMetriks Research or any of its respective directors, officers, employees or analysts for any loss, whether direct or consequential, arising whether directly or indirectly as a result of the recipient acting on the content of this document, including, without limitation, lost profits

arising from the use of this document or any of its contents.

This document is provided with the understanding that QuantMetriks Research is not acting in a fiduciary capacity and it is not a personal recommendation to you. Investing in securities entails risks. Past performance is not necessarily a guide to future performance. The value of and the income produced by products may fluctuate, so that an investor may get back less than he invested. Investments in the entities and/or the securities or other financial instruments referred to are not suitable for all investors and this document should not be relied upon in substitution for the exercise of independent judgment in relation to any such investment. The stated price of any securities mentioned herein will generally be the closing price at the end of any of the three business days immediately prior to the publication date on this document.

This stated price is not a representation that any transaction can be effected at this price.

QuantMetriks Research and its respective analysts are remunerated for providing investment research to professional investors, corporations, other research institutions and consultancy houses. QuantMetriks Research, or its respective directors, officers, employees and clients may have or take positions in the securities or entities mentioned in this document. Any of these circumstances could create, or be perceived as creating, conflicts of interest. QuantMetriks Research analysts are not censored in any way and are free to express their personal opinions. As a result, QuantMetriks Research may have issued other documents that are inconsistent with and reach different conclusions from, the information contained in this document. Those documents reflect the different assumptions, views and analytical methods of their authors. No director, officer or employee of QuantMetriks Research is on the board of directors of any company referenced herein and no one at any such referenced company is on the board of directors of QuantMetriks Research.

QuantMetriks Research is an appointed representative of Messels Ltd which is authorised and regulated by the Financial Conduct Authority. Residents of the United Kingdom should seek specific professional financial and investment advice from a stockbroker, banker, solicitor, accountant or other independent professional adviser authorised pursuant to the Financial Services and Markets Act 2000. This report is

intended only for investors who are ‘professional clients’ as defined by the FCA, and may not, therefore, be redistributed to other classes of investors.

The content of this report is covered by our Policy of Independence which may be viewed at www.QuantMetriks.com

The performance history of research recommendations over the last 12 months is available to clients on request.

Analysts’ Certification

The analysts involved in the production of this document hereby certify that the views expressed in this document accurately reflect their personal views about the securities mentioned herein. The analysts point out that they may buy, sell or already have taken positions in the securities, and related financial instruments, mentioned in this document.