Keep an eye on the export controls. They are the key.

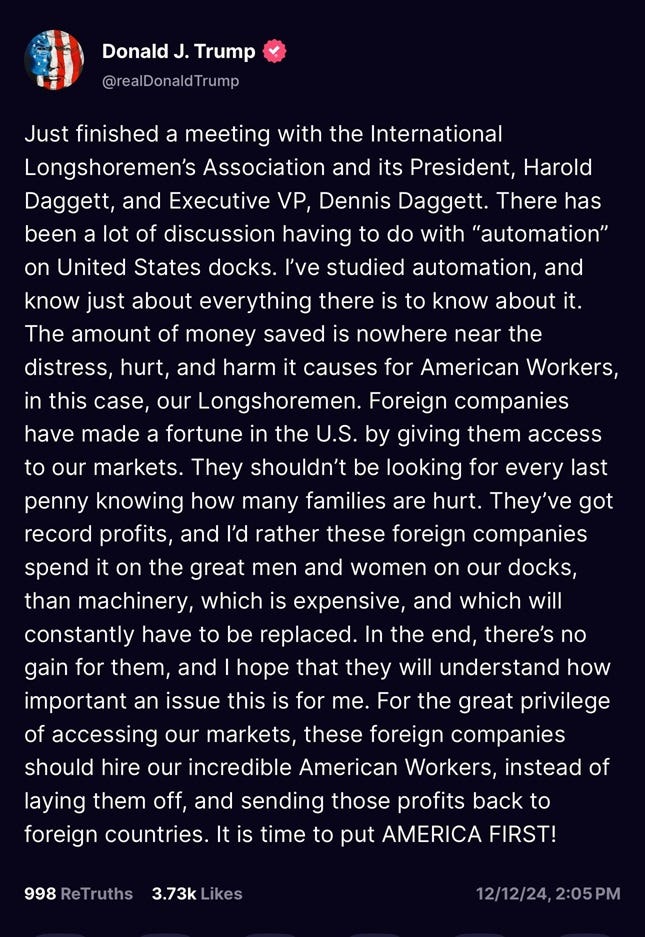

Trump isn’t even President yet, and already some people are starting to realize that they didn’t get quite what they hoped they were voting for. During his campaign, Trump promised angry consumers that his policies would “rapidly drive prices down” and “bring your grocery bill way down”. Unsurprisingly, Trump has now equivocated on that promise, declaring that “it’s hard to bring things down once they’re up.” Conservatives hoped that Trump would crack down on the trans movement and stand up for a traditional view of gender, but now he says he doesn’t “want to get into the bathroom issue” and that he wants “to have all people treated fairly”. Many technologists hoped Trump would be a friend of technology and a foe of inefficient unions, and yet now Trump is condemning automation and siding with the longshoremen’s union:

And so on. This shouldn’t come as a surprise to anyone, of course — we’ve had almost a decade to watch Trump make promises and break them. Everyone knows that Trump follows his own whims, impulses, and personal interests, and that what serves as his ideology is actually just a set of instincts and vague ideas that cobbled together on his own while watching too much CNN in the 1990s. If you projected your hopes and dreams onto Trump when you pulled the lever, well, I guess that’s on you.

All in all, I’m not too worried about the state of the United States right now. Our economy is robust; even if Trump re-accelerates inflation by running big deficits and messing with the Fed, it probably won’t be catastrophic. Our society is slowly calming down from a decade of unrest. Climate change is a threat, but it’s mostly being caused by other countries, so even if Trump cancels green energy subsidies it’ll have only a marginal effect on the planet. A lot of long-term chronic concerns, like inequality, are certainly worth addressing but not as immediately urgent as we made them out to be in the 2010s. Trump may throw Ukraine under the bus, and though this would be a terribly immoral and reprehensible thing to do, it also won’t result in a direct threat to the U.S.

And yet there’s one big exception, which is the threat posed to the U.S. by the People’s Republic of China. China has the capacity to defeat the U.S. in any extended conventional war, thanks to its domination of global manufacturing; soon, it may have the capacity to defeat the U.S. and all of its allies combined. At that point, what China does to the U.S. will be limited only by what China feels like doing to the U.S.

And I think it’s clear that what China’s current leaders want is to reduce the U.S. to a second-rate power, so that there’s no chance it will threaten their hegemony or their freedom of action in the future. This is what some people argue the U.S. did to Russia after the Cold War. And communist China is not nearly as nice a country as the U.S. was in the 1990s.

The economic and political consequences for the American people would be, to put it mildly, pretty negative.

The only way I see to prevent this outcome, other than simply praying that China somehow collapses or that the Chinese are some sort of uniquely passive and mild people who won’t really do any of the things their leaders say they want to do, is to reduce the manufacturing gap between the U.S.-led alliance and China. Biden made some strides toward this during his term in office, reviving U.S. manufacturing somewhat with his industrial policies, and implementing stringent and wide-ranging export controls on the Chinese chip industry.

The big question is whether Trump will continue the effort to (partially) catch up to China in manufacturing, or whether he will scrap it. This might seem like a stupid question, since Trump talks quite a lot about how his tariffs on China are going to restore American manufacturing. But you shouldn’t believe this story, for several reasons.

The first is that Trump’s tariff threats, like his promise to bring down grocery prices, may be mostly bluster. During his campaign, he promised 60% tariffs on China; now, he has apparently reduced the number to 10%. That is a pretty small amount, and exchange rate appreciation will easily cancel it out.

The second is that Trump’s tariffs on U.S. allies will actively hurt the effort to match China in manufacturing. Currently, Trump is threatening only 10% tariffs on China, but 25% tariffs on Mexico and Canada. This is hopefully just bluster and theater (in which case we should ask how an economic approach relying heavily on bluster and theater will help the U.S. catch up to China in manufacturing). But if it’s for real, it will hurt U.S. manufacturing, by making imported components more expensive. Remember that creating a large common market outside of China is one of the essential strategies for matching the Chinese manufacturing juggernaut; U.S. tariffs on Mexico, Canada, and other allies work directly against that goal.

But the biggest danger of Trump’s tariffs, I think, is that they could give Trump political and rhetorical cover to basically abandon the effort to resist Chinese power. Tariffs, along with aggressive rhetoric, give Trump the appearance and reputation of a China hawk. That sterling reputation could allow him to basically gut America’s nascent resistance to China, without suffering much of a political hit. Just as “only Nixon could go to China” in the 1970s, we might find that only Trump could sell us out to China in the 2020s.

Why do I think Trump might do that, when he was generally very hawkish toward China in his first term? Several reasons.

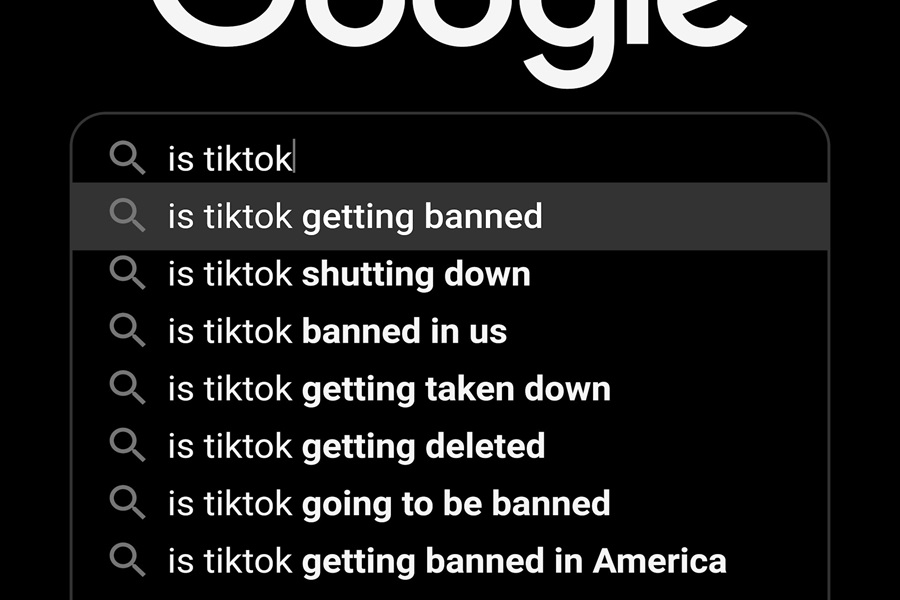

First of all, he’s already talking about accommodating Chinese power in a number of ways. Even though Trump called for a TikTok divestment in his first term, he turned against the bipartisan TikTok divestment bill in 2024 in a surprise reversal.

The Information has reported that TikTok altered its algorithm to favor Trump and the GOP. Trump also may have been swayed by financial contributions from Jeff Yass, a billionaire with a large stake in TikTok.

Next, during his campaign, Trump denounced the bipartisan CHIPS Act — the most important and (so far) successful single policy that America has done to shore up its industrial base in over half a century.

In other words, the main reason to think Trump might sell American interests out to the CCP is that he’s already talking openly about doing it.

On top of that, it’s likely that some of Trump’s advisors favor an accommodative approach toward Chinese power. Although Trump has appointed some hawks like Marco Rubio to his administration, his most important advisor and confidant — at least, for now — is Elon Musk. A recent story in the Financial Times detailed Musk’s deep business connections with China — connections that he would be loath to lose in a conflict:

“The world’s richest man has deep connections to top Chinese Communist party leaders, and is in the middle of lobbying Beijing over important decisions for his $1tn electric vehicle business, Tesla…Tesla has received billions of dollars in cheap loans, subsidies and tax breaks from the Chinese government. The carmaker is highly dependent on its Shanghai factory, the biggest in its global network, for not only selling to the country of 1.4bn people but also exporting its China-made cars to other parts of the world. Musk’s Chinese suppliers, especially in batteries, are also crucial to the company’s global manufacturing operations, including in the US…

“‘Musk is not only vulnerable to Beijing’s pressure given his extensive business interests in China, he also seems to genuinely enjoy close relationships with China’s authoritarian leaders,’ [Yaqiu Wang of Freedom House] says. ‘This dynamic creates ample opportunities for the CCP to influence Trump’s China policy.'”

Vivek Ramaswamy and Tulsi Gabbard have also both called for the U.S. to accommodate Chinese power in Asia, with Tulsi even going so far as to denounce Japan’s rearmament in the face of Chinese aggression.

So although it doesn’t seem certain that Trump will roll over for the Chinese Communist Party, it certainly seems like a real possibility.

So how will we know? With Trump, there’s always a lot of bluster and theater. On top of that, it’s hard to tell whether Trump really believes that tariffs will be effective in restoring American manufacturing, or if they’re just a smoke screen. Meanwhile, Congress will probably fight hard to keep the CHIPS Act and the TikTok divestment bill.

But there’s one big important thing Trump could do to sabotage America’s effort to stand up to Chinese power. He could cancel the export controls that the Biden administration placed on the Chinese semiconductor industry. Removing export controls wouldn’t require executive action — Trump could just do it whenever he wanted. And because the policy is not really in the limelight, there probably wouldn’t be a popular backlash to its cancellation. So export controls are pretty much a pure test of Trump’s China policy — if he keeps them, it’s because he wants to stand up to China, and if he cancels them, it means he doesn’t.

And make no mistake — China really, really wants those export controls gone. Despite early wailing and gnashing of teeth over Huawei’s creation of a 7nm chip, the U.S. export controls have almost certainly been very effective in slowing down China’s chip industry. Here are just a few pieces of evidence about how effective the controls have been:

- SMIC, the Chinese foundry company that created the 7nm chip, was rumored to be advancing quickly to 5nm. But the company has reportedly delayed its 5nm release until at least 2026. This has left SMIC’s customer Huawei in the lurch, relying on technology that’s fast becoming obsolete.

- Even SMIC’s 7nm process, hailed as a catastrophic failure for export controls, is actually not achieving good yields, and is reportedly having reliability issues. This is probably hurting Huawei’s production of leading-edge phones.

- In the last five years, over 22,000 Chinese semiconductor companies have reportedly shut down. Some of this is almost certainly due to export controls.

- Huawei’s own chip production is probably suffering as well, with very low yields. The low yields are probably a result of having to rely on older, outdated equipment, due to export controls.

- Meanwhile, Chinese companies are pessimistic about their ability to keep up with leading-edge chipmakers without access to the latest chipmaking tools from the Netherlands, the U.S., and Japan. This is expected to have deep ramifications for the AI race between the U.S. and China.

In other words, export controls are doing what they’re designed to do. They’re not killing China’s chip industry, but they’re slowing it down in important ways, and letting the U.S. retain its technological edge. What’s more, the Biden administration constantly strengthened the controls, plugging loopholes even as China fought to come up with new workarounds. In fact, the outgoing administration released one more very strong update to the export controls on December 2, denying China many of the best cutting-edge AI chips.

These export controls are working, and they’re absolutely crucial if the U.S. is going to maintain any kind of a military-technological edge over China. Chips are the foundation of all modern weaponry, from missiles to drones to satellites to advanced fighter jets. And AI itself, which depends on advanced chips for training and inference, is rapidly becoming an essential weapon of war. When autonomous drone swarms hit the battlefield, AI will become even more crucial to the military balance.

The U.S. probably cannot out-manufacture China, even with all the tariffs and industrial policies in the world. America needs to retain a technological edge to balance out its productive weakness — an advantage in quality to balance out its deficiency in quantity. Semiconductors are that edge. If Trump cancels the export controls, it will mean he’s destroying America’s best chance to keep its weapons ahead of China’s weapons.

Now, Trump might not do this. After all, Trump was the one who started the trend of using export controls against China in his first term (targeted at a narrow range of Chinese companies). But recall that Trump dropped the export controls against China’s ZTE, reportedly as a personal favor to Xi Jinping. Congress scrambled to keep the controls in place, but they failed.

Trump’s second term could see a repeat of that episode. Trump might cancel America’s semiconductor export controls, possibly as some kind of deal for China dropping its own far less formidable export controls on drone batteries and various metals — or maybe just for no reason at all. Perhaps Trump is beyond needing reasons to do things.

But in any case, if Trump does cancel export controls, it will be the strongest possible signal that his administration wants to abandon any attempt to stand up to Chinese power. Don’t be fooled by tariff theater — this is the real test.

This article was originally published in Noahpinion and is republished here with permission.