In real estate, Impact Investing is a small but rapidly growing concept attracting socially-conscious investors. Ever since the Global Financial Crisis, the twin aims of doing good by a community whilst still delivering an attractive financial return have been compelling. And real estate is the ultimate impact asset class, given its ability to affect real positive change both locally and measurably.

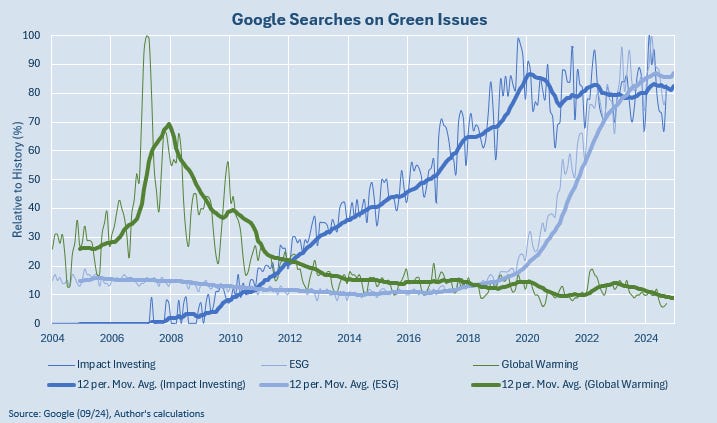

But is Impact Investing susceptible to the winds of change? By way of example, the term Global Warming has been rightly replaced by the more holistic but also more ambiguous Climate Change, and yet the latter has not captured the public’s attention in the same way. And in the current era of identity politics, an entrenched political divide has resulted in pushback against the findings of environmental scientists.

Perhaps Impact Investing only represents a phase which will run its course within a few years, as its advocates lose interest? This author thinks that this will not be the case; not only because society’s problems will probably still exist in the future, but for other reasons that you may not have considered before. It is those I explore in this article.

“Plus ça change, plus c’est la même chose”, Jean-Baptiste Alphonse Karr

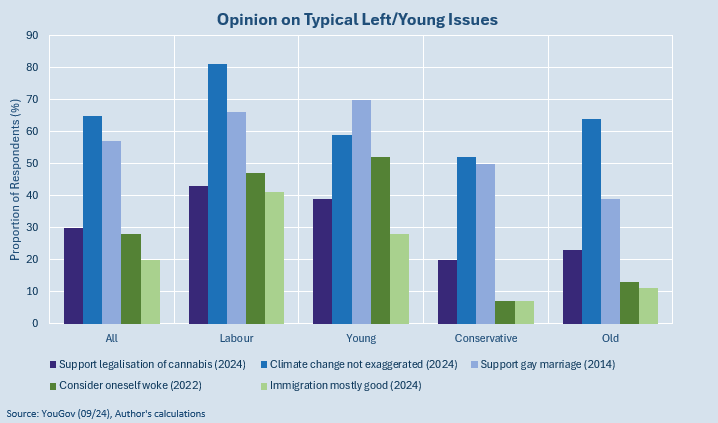

An evening in the company of friends or family quickly reveals stark differences in views on politics, society and related matters. As illustrated by the opinion surveys below from the UK, these divides are often down political party lines or by age group. But are these differences entrenched or do they change over time?

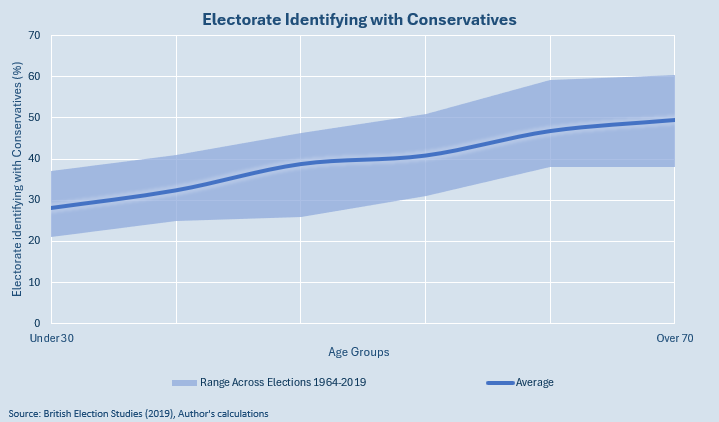

Data from elections going back to the 1960s supports the stereotype that we become more conservative in our views as we get older. Over the generations, older people in the UK have consistently identified more with the Conservative party than their younger counterparts. The implication is that we move from left to right on the political spectrum over time.

The primary reason given is that, as we age, we become more resistant to change and prefer what we came to know and understand during our formative years. It is familiar and comforting – and of course hindsight bias is a factor too. An alternative theory is that we start off in life idealistic and ready to change the world, but eventually become jaded and cynical as we realise that we cannot.

So, that’s answered our question then, right? If we move to the right as we age, and conservatives are typically less natural and vociferous supporters of green and social issues, then Impact Investing could feasibly fade away as the current crop of young social justice warriors grow up and lose faith.

But it is not that simple. The catalysts for Impact Investing may have initially been accelerating climate change and growing social inequality, but its drivers are more intrinsic than that.

“For the times they are a-changing”, Bob Dylan

In his 2009 book Drive, Daniel Pink gives us a history lesson on human motivation, before offering his own evidence-based view of what drives us today. The initial motivator for Homo Sapiens and their ancestors was simple; it was survival, as it still is for all wild animals.

Once the agricultural and industrial revolutions had permanently shifted humans’ relationship with nature, the need to efficiently produce food and goods gave rise to another form of motivation. The reward & punishment approach is neatly captured by the idiom the carrot & the stick. Using these to motivate 9-to-5 factory workers, for example, was hugely successful in the 19th and 20th centuries.

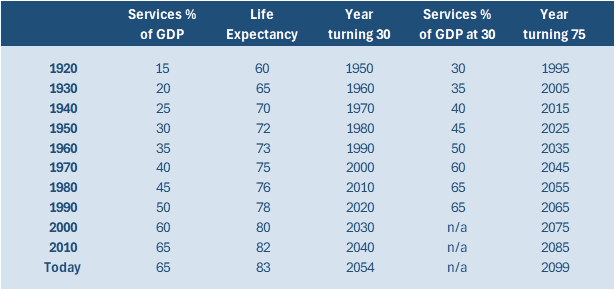

The trouble is that this remains the primary system used to this day in the corporate world, and it is no longer fit for purpose. This is because most countries have evolved away from manufacturing towards more creative services. Today, the service industry represents 65% of the world’s nominal GDP, compared to just 15% a century ago.

The result is that, for many of the Silent Generation and Baby Boomers, their formative working years – let’s say below the age of 30 – were influenced by the carrot & stick of routine production. It is no surprise that, as the leaders of the late 20th century businesses, they employed the same management techniques with which they grew up.

But the world was rapidly becoming a different place. The creative minds growing up and working in the services sector that has dominated developed countries since the 1980s were wired differently. Through a number of examples, Pink shows how not only could the stick sometimes inadvertently be demotivating, but remarkably often the carrot was too.

“The purpose of life is a life of purpose”, Robert Byrne

The carrot that is fair remuneration in the corporate environment is important, and the stick that is financial punishment can also be effective in society. But Pink uses numerous studies over many decades to show that people are now more concerned with the satisfaction of achieving a long-term intrinsic goal than the external reward (or punishment) of accomplishing a short-term extrinsic goal. Their true motivation comes from gaining autonomy over tasks, mastering a skill, and having a sense of purpose. Let’s each of these in more detail:

- Autonomy is the desire to have control over one’s own work and decisions. The freedom to choose how we invest our time and resources aligns with a broader sense of responsibility toward the environment and society. It is about making deliberate choices that reflect personal values, rather than being driven by profit alone. People can choose not only what they invest in, but also why – an important distinction when it comes to Impact Investing.

- Mastery is the drive to improve and excel at something meaningful. We are naturally motivated to get better at tasks we find engaging and challenging, often at the expense of a higher reward available from other tasks. As a result, the personal attachment that many young (and, speaking for myself, middle-aged) people feel to the problems that Impact Investing looks to solve, should endure or even strengthen over time. Mastery of a given skill or subject matter takes consistent engagement over a long period of time.

- Purpose may be the most powerful in explaining the durability of Impact Investing. It is, after all, by definition a strategy centered around purpose. It taps into a deep human need to leave the world better than we found it, if not for our children or for our own legacy, then for our sense of duty. Purpose-driven individuals are more focused on the lasting impact of their work than on short-term rewards.

As today’s workers and tomorrow’s leaders, the generations that have grown up with creative services rather than dogmatic industry as their principal influence will carry forward their way of thinking, managing, and motivating.

Indeed, we are already seeing this across the corporate world. Modern companies looking to attract the best talent frame their philosophies and roles in terms of equality, flexibility, responsibility, and empowerment. For some familiar acronyms that encapsulate these, you need look no further than CSR, DEI, ESG, PPP, PRI, SDG, SRI, and of course WFH.

“I’d come this close to having an impact on the world”, Limitless

Despite their widespread acceptance today, I am fairly certain that the nomenclature will change going forward:

- As I said at the start, we no longer use the phrase Global Warming, and the term Impact Investing had only recently been coined when Pink wrote his book.

- The acronym ESG has become ubiquitous in recent years, but many are now wondering whether grouping these three quite different pillars has been more unhelpful than helpful to their cause.

- A new term seems to appear almost on daily basis, as the investment landscape and our understanding of it matures. For example, one of the most recent terms to enter the conversation is Natural Capital (see Magic money tree: Natural Capital reimagined).

Whilst I do not believe that Impact Investing will fade away, I am also not suggesting that it will not evolve over time; elements may be cyclical or of heightened relevance in today’s society.

What I am instead arguing is that the intrinsic way that humans are wired to live, work and play invest is perfectly aligned with Impact Investing and its related investment strategies. And for that reason, I see them enduring well into the future.

This article was originally published in My R.E. Education and is republished here with permission.