As UK Government deadlines approach, the topic of Energy Performance Certificates (EPCs) has featured more prominently in industry commentary. Some in the sector may have sensed a hint of reprieve when the government issued its 48-question public consultation on the “Energy Performance of Buildings regime” in December 2024. However, there is no mention of a revision of deadlines so far, and as things currently stand, the targets of EPC C or above by April 2028 and EPC B or above by April 2030 remain – affecting lending, occupier demand and buyer demand for lower-rated buildings.

EPCs issued in 2024

In the 2024 calendar year, 75.8 million sqm (815.5 million sq ft) of UK non-domestic real estate had a new EPC issued. These are caused by builds, sales, leases, or voluntary assessments. 15.4 percent were designated EPC A+ or A; 38.8 percent were designated EPC B; 27.5 percent were designated EPC C. The remaining 18.3 percent were designated EPC D or lower.

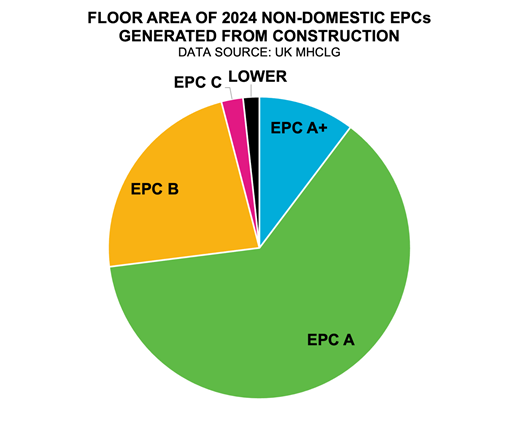

2024 EPCs issued due to construction activity

Although more than 4 percent of the 7.5 million sqm (80.3 million sq ft) of floor space issued with an EPC due to construction activity in 2024 received a rating of EPC C or lower, the vast bulk of it (more than 95 percent) rated EPC B or higher. This very much suggests that the market is pricing in the promise of the stricter mandates of the coming years. But is the market moving quickly enough?

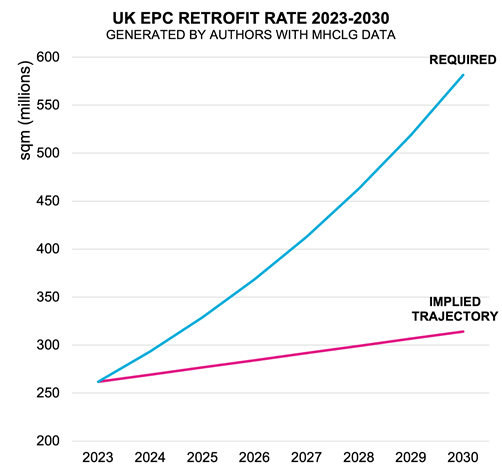

Retrofit en masse

In 2023’s summer issue of The Property Chronicle, Baum, Graham and Jia cited a Centre of Cities report in their analysis of the stranded asset risk facing UK commercial real estate, indicating that around 45 percent of the total non-domestic floor area in the country sat inside a sub-EPC C building. UK Government data indicates that there was 581.5 million sqm (6.3 billion sq ft) of rateable non-domestic real estate in 2023, suggesting around 261.7 million sqm (2.8 billion sq ft) of sub-EPC C floor space that year. Assuming a steady 7.5 million sqm (80.7 sq ft) of non-domestic real estate is built or rebuilt in the five years to March 2030, 224.4 million sqm (2.4 billion sq ft) of non-domestic real estate remains unimproved. This 224.4 million sqm of assets represents the stranded asset tsunami facing the UK CRE sector. The annual rate of change would need to increase sevenfold to reach the 2030 target (without accounting for the proportion of construction EPCs commissioned for new builds).

Can the construction sector handle this?

Construction labour shortages have already brought into question whether the UK Government can realise its homebuilding ambitions. Therefore, ramping up EPC retrofits sevenfold in commercial real estate at the same time isn’t going to be a simple undertaking. It is for this reason that it will be a necessity to take a bird’s eye view of commercial real estate portfolios to identify the most cost and carbon-effective retrofit programmes. This includes the stock of non-domestic assets beyond the attention-grabbing hero projects of central London and Manchester.

Diminishing marginal impact of retrofit

In energy efficiency projects, the relationship between investment and carbon savings is rarely linear. Early-stage, simpler interventions, such as LED lighting replacements, intelligent energy controls or HVAC optimisations often deliver the highest environmental returns per pound spent. An oft-cited example includes the identification and optimisation of heating and cooling systems running concurrently, unnecessarily consuming street blocks’ worth of annual energy within a singular commercial building. Another is the accelerated adoption of photovoltaic panels on otherwise underutilised outdoor surfaces. This has been made possible by the year-on-year cost decreases per kWh of installing and harvesting renewable energy. However, once the high impact, lower cost interventions have been achieved, marginal environmental improvements come with a hefty price tag: for instance, high-performance glazing may reduce energy loss by a further 10 percent, but cost five-to-eight-times the cost per kWh saved in comparison to basic weatherisation.

Putting every penny to work to 2030

With consumer activism entering the commercial real estate sector in the form of “green premiums”, the sector has leaned in on high-profile hero projects with “excellent” scores of various formats. But if we are to maximise every penny spent to reduce the environmental footprint of non-domestic assets between now and 2030 (and beyond), we will need to think beyond the attention-grabbing hero projects. With the amount of work to be done in the timeframe required to do it, we propose taking a top-down approach to identify and deliver the most effective and impactful retrofit programmes at the scale of portfolios instead of individual assets.