And that’s unfortunate, because the alternative is much worse.

- ADP blames soft jobs on “uncertainty,” but the data mostly says otherwise

- slow hiring is the trend, not a sudden turn—look at the trends yourself!

- there’s really only one “uncertainty” signal, but the rest is just headwinds, same as they ever were

- if uncertainty were the problem, that’d be nice, because then there’d be an easy fix

- there’s good stuff to root for though, and other reasons for cautious optimism

Soft jobs probably has nothing to do with “policy uncertainty” (and that’s too bad)

You might have heard that job growth was weaker than expected.

The headline, for many, comes straight from ADP’s chief economist:

Soft hiring (and soft spending) all “might” be attributable to “policy uncertainty,” aka the Mad King.

The implication, of course, is if there were more certainty, then we’d be back to all cylinders firing.

But that’s mostly nonsense. Look, I have little doubt that “will he / won’t he” of tariffs is causing some serious headaches for firms—headaches that may even impact hiring decisions at the margins. Certainty is a pretty important condition for longer-term planning, no doubt.

But it’s also abundantly clear that the slowdown in hiring, the lack of labor market breadth, and the softness in hiring intentions is not a recent thing. “Where does job growth come from?” has been an urgent question for well-over year, for anyone willing to notice that a “tight” labor market (playing catchup) is not necessarily a “strong” one.

Tough market for new- and re-entrants? Yeah, that’s not a new trend either.

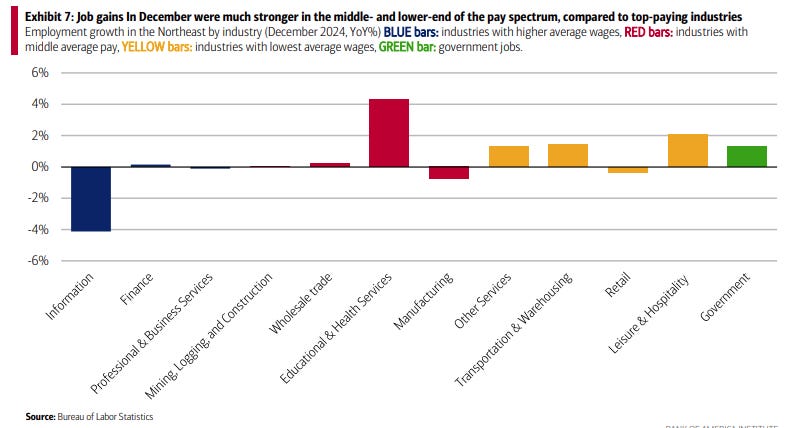

White Collar Stagnation, and the fact that job-growth has been concentrated in the lower- and middle-income professions? Also, old news. Take the Northeast specifically, which has been taken a slow-and-steady approach (in contrast to the burning highs and lows of the Sunbelt):

December job gains all spiked in the usual low- and mid-paying categories . . . while the higher paying stuff (in Blue) was flat or negative.

Must be the “policy uncertainty” causing the Information workers to lose their jobs.

No. That hiring would continue to soften is far more likely to be downstream of whatever’s been causing it to soften for the last couple of years, rather than some new “policy uncertainty.” The fact is that the economy is structurally weak (and deficit-driven growth, ain’t growth). Anyone who says “Trump inherited a strong economy” just isn’t being straight with you.

Again, uncertainty is probably not helping, and may very well be hurting, but don’t let it distract you from the longer-term trend.

Slow hiring growth is the trend, not a sudden turn

Don’t take my word for it though. Look at the longer-term trend.

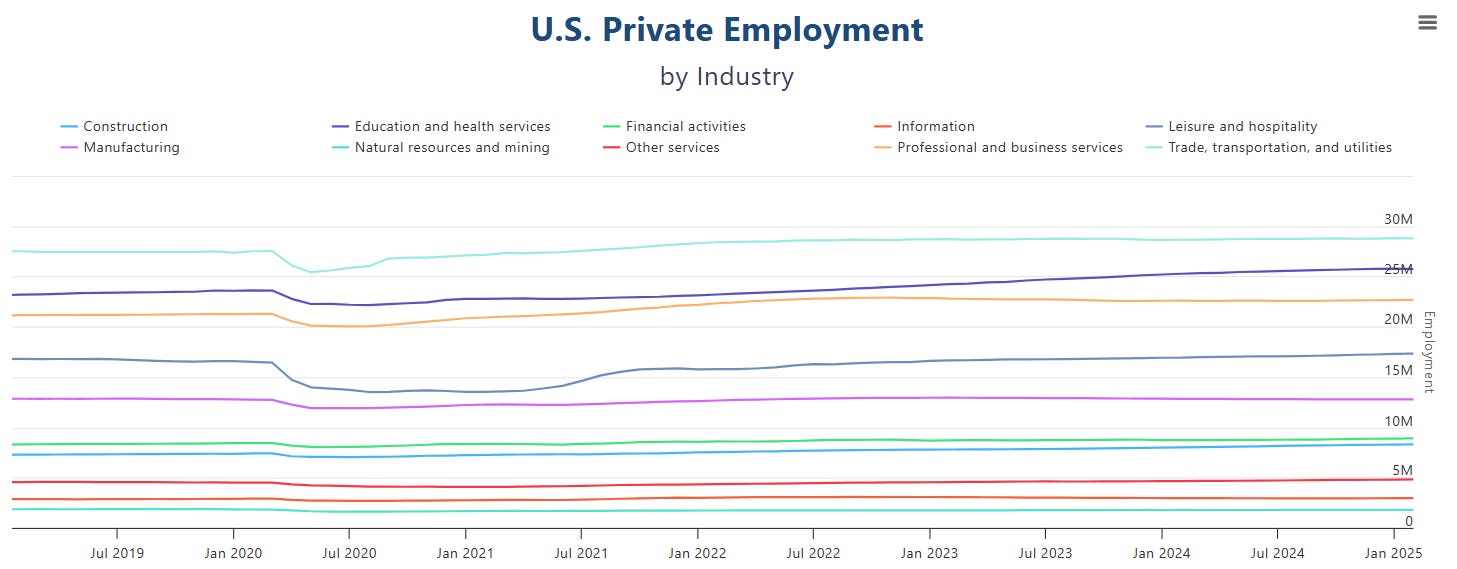

Take the longer series of total payroll count, and apply the eyeball test. What does it say?

Payroll growth has been pretty flat for the most part, for a while now.

Other than “education and health services,” and a little bit of “leisure and hospitality,” it’s not really the most inspiring growth story.

Of course, we already knew that Healthcare Makes All the Jobs, so this is no surprise.

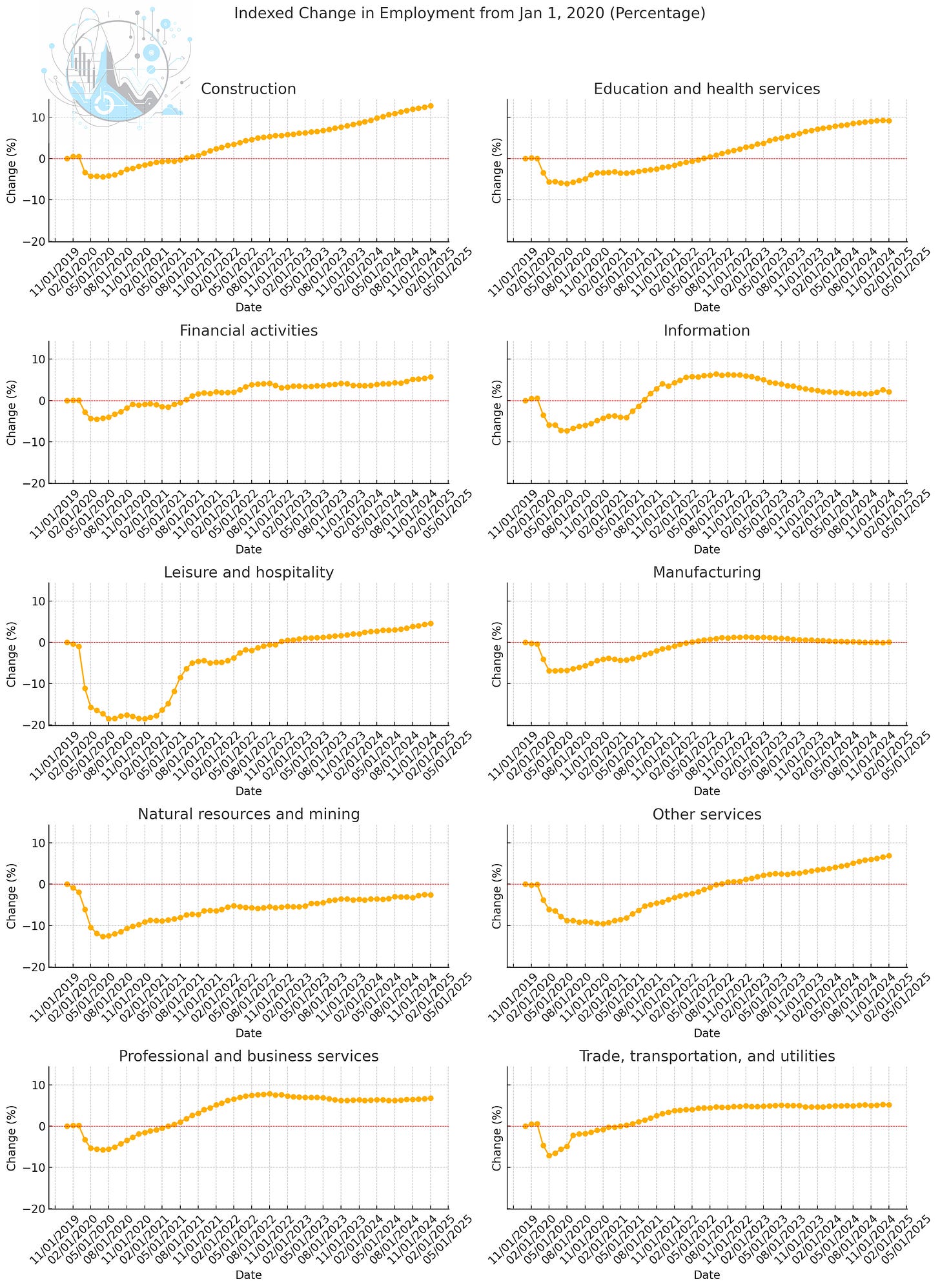

Indexed to Jan. 2020, payroll growth looks like this:

Of the really big categories:

- Trade & Transportation hasn’t budged in forever

- Professional & Business services hasn’t budged either

- Education & Health Services has been the rocketship, but that started rolling over back in August

- Leisure and Hospitality looks pretty decent, and actually added 41K to payrolls this month

I mean, the only sector that arguably appears to have take a very recent turn for the worse is Information. Most of the other smaller categories are again flat, or even rising.

So, does that really look like some big drop-off in hiring because of “policy uncertainty?” Not to me it doesn’t.

Trade, I get, but healthcare? And why did Leisure payroll grow?

This is the monthly body count for payroll growth:

Trade was the big loser, and surely that could be attributable to uncertainty over trade, at least in theory.

Again, not the hottest series to begin with, but at least it makes sense that trade and transportation could suffer as a result of “policy uncertainty.” It could also be weather and seasonality too, but tariffs are plausible.

But even we stipulate that trade payrolls contracted because of Tariffs, how does one explain healthcare? Why would healthcare be worried about tariffs? (And conversely, Construction, Manufacturing and Leisure, all did pretty great).

Is Healthcare contraction DOGE-related? That could be, I guess. But again, it was rolling over back in August.

Nah . . . “policy uncertainty” isn’t the prime mover here.

“Policy uncertainty” would be a more comforting excuse than secularly slowing growth

Look, it’s way too early to declare Armageddon.

This MoM stuff is noisy, the data itself is noisy, and there is plenty of reason to think that middling growth will continue, and if it’s kept our heads above water up until now, it will continue to do so, going forward. At least until AI-gains begin to kick-in in earnest (and who knows, maybe it already is).

Plus, the flipside of a little unemployment and/or slack in the labor market (which really wouldn’t show up in the data until later) is that there are actually some new people to hire.

But, you’re kidding yourself if you think the recent lumpiness is is tariff-related, in the main. I mean, that would be nice, because an easy problem lends itself to an easy fix.

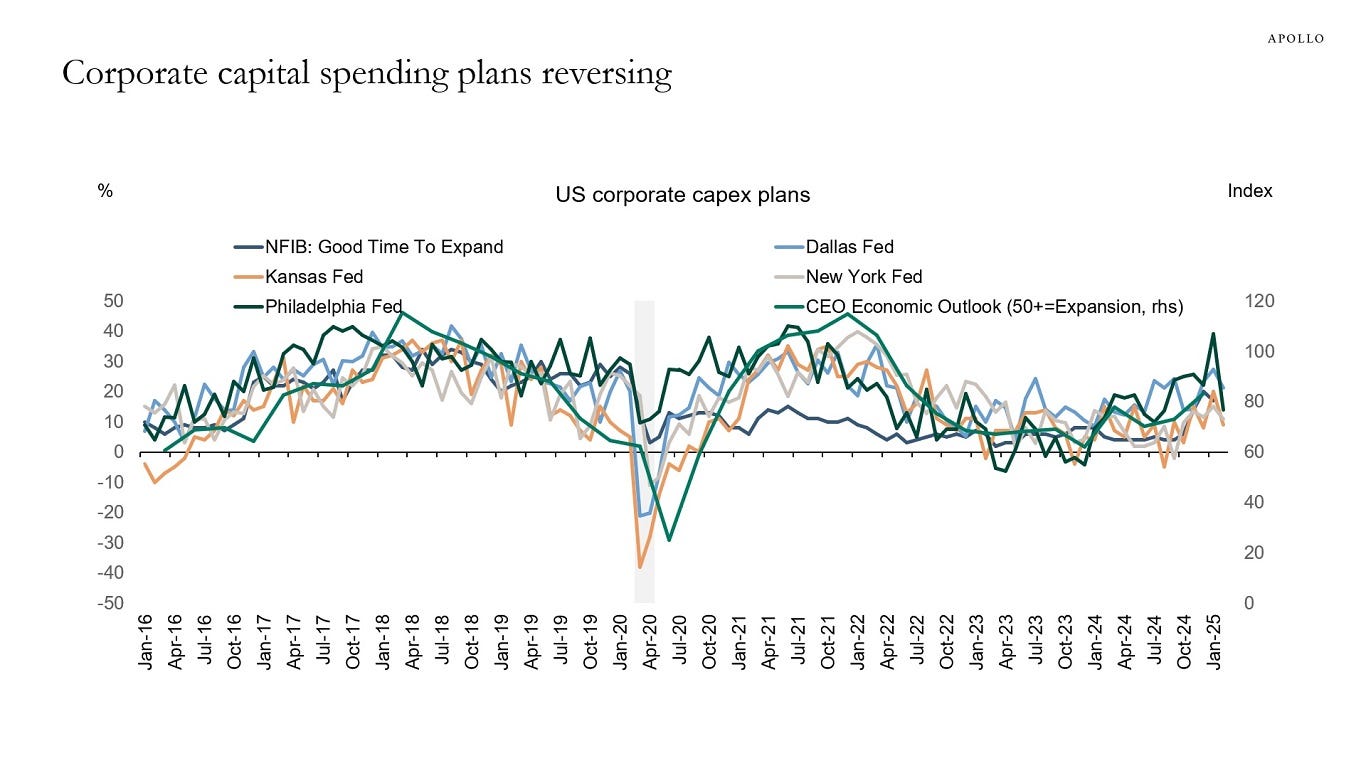

If there’s one tariff-y-related negative signal, it’s this:

Surveys say that capex intentions have fallen of late.

I generally regard the ISMs as very soft anecdata (for better and for worse), so I’m not going to start putting a ton of stock into it now. But, if everyone was really gung-ho CapEx away, and suddenly they’re not because “uncertainty,” then I would change my thinking some.

The reality is that there are some headwinds that have been brewing for a while.

Wage growth has slowed with the labor market (shocker), and so spending will stay cautious. Likewise, profit growth (off the low baseline of 2023) probably can’t continue accelerating quite as quickly as it has. And for a market priced-to-profit growth, all the risk is to the downside.

Add a price/investment pain from tariffs (such that they’re ever implemented) and a little extra DOGE-unemployment? Those will definitely add some near-term drag to economic activity, but it’s a straw on the camel’s back.

Longer-term, yeah, it’s a problem that the twin pillars of the “firing on all cylinders” economy are, in fact, unsustainable: “growth by acquihire only” and deficit-funded rotation to the National Nursing Home. If you kick-out those pillars (as we must), then there’s going to be some pain . . . but it’s a question of pain now v. even more pain later.

Reasonable minds can disagree, but kicking the can down the road so an even bigger problem is someone else’s to deal with (“delaying the pain trade”), is not axiomatically the correct course of action.

In the meantime, root for AI and semaglutides, and really root for DOGE, because supply-side reforms are the lowest-hanging fruit we’ve got.

Plus, doing more with less, is definitely a thing. And who knows, is it really so hard to believe that without ready access to cheap foreign goods (or cheap foreign labor), that we can’t figure out how to efficiently make some more things ourselves?

At the very least, if you can bring yourself to root for a great (and wildly expensive) transition to “sustainable” energy, why not root for making stuff here?

This article was originally published in The Random Walk and is republished here with permission.