Sometimes it feels that waiting for the capital market recovery is like waiting for Arsenal to win the League. Each of the last two seasons we have started with high hopes in our young side and gone on to score the most points in our Premier League history only to be pipped at the post by Man City or Liverpool. And this is a bit what it feels like writing this article at the start of 2025, with much the same messaging as at the start of 2024: hoping for more rate cuts and something like a normalization of credit markets but suffering the capital market equivalent of Bukayo Saka’s torn hamstring – bond yields back up to the high-4s in the USA and UK.

So what’s the message I want to leave you with? The message is “Be Positive But Realistic”. Arsenal is going to qualify for Champions League and have another great season. We beat Man City 5-1 with a wonder goal from a kid who has yet to sit his AS Levels. (See figure 1). Arsenal is not going to win the Premier League. And that’s okay.

Be Positive But Realistic. Remain calm. Adopt the Zen Buddha pose of Myles Lewis-Skelly. Real estate capital markets will recover in 2025 but there will be no free lunches from our central banks. Real estate will deliver strong income-driven returns but we probably won’t get strong rental growth or yield compression.

We will attract capital so long as we pivot to sectors that offer a compelling income return relative to fixed income, and drive NOI growth through operational excellence.

But we won’t have any more QE-era yields in the 2s. And that’s okay too. Underlying this “Positive But Realistic” view is the macro thesis that we are entering a new era of monetary conditions which are far less helpful for real estate investors.

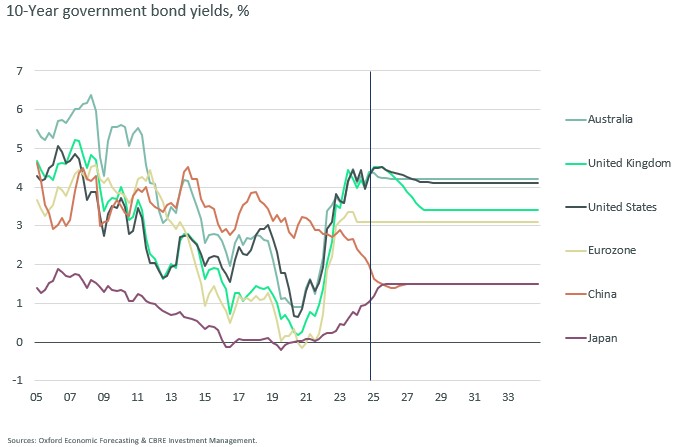

Sticky inflation driven by poor demographics, shrinking labour forces, increased trade frictions, and increased commodity price volatility will in turn lead to higher for longer interest rates. Added to this, we now have the bond markets pricing sovereign risk properly and demanding a return on their investments in our debt. We haven’t seen that since the early 2000s.

So, it comes as no surprise that the bond markets have come to Jesus and are grinding higher as they incorporate this New Normal into their pricing and are hovering in the mid-4s in the UK and USA and the mid-2s in Europe.

So much for “survive to 25”. Maybe it’s just “survive 25”? On our forecasts, investors in the US and Australia shouldn’t be looking to the bond markets for much relief.

In the UK our case for a return to a risk premium closer to that of the Eurozone is in question. And even in the Eurozone, we think 10-year government bond yields will trend at just above 3%. (Figure 2.)

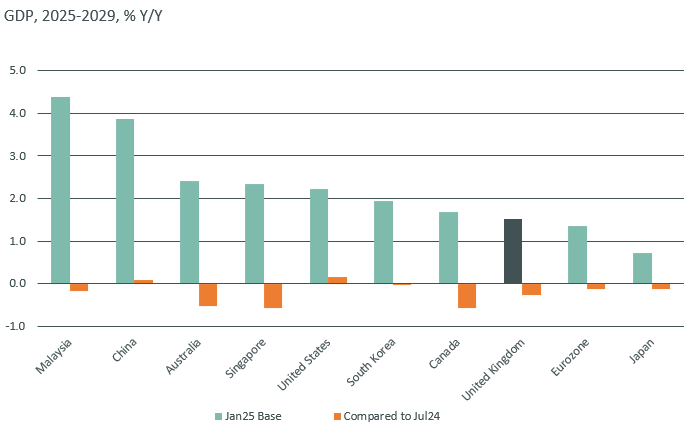

Unfortunately, the real economic outlook is also pretty lacklustre in Europe. We are forecasting five-year annual average GDP growth of 1-1.5pc and have pulled down those forecasts since last summer. (Figure 3.)

Figure 3 Source: Oxford Economic Forecasting & CRBE Investment Management

Figure 4

The burden of public debt, weak consumer and business confidence, and still high real costs of borrowing have limited growth momentum. By contrast, we have actually pushed *up* our forecasts for US growth on the near-term supply-side boost from deregulation.

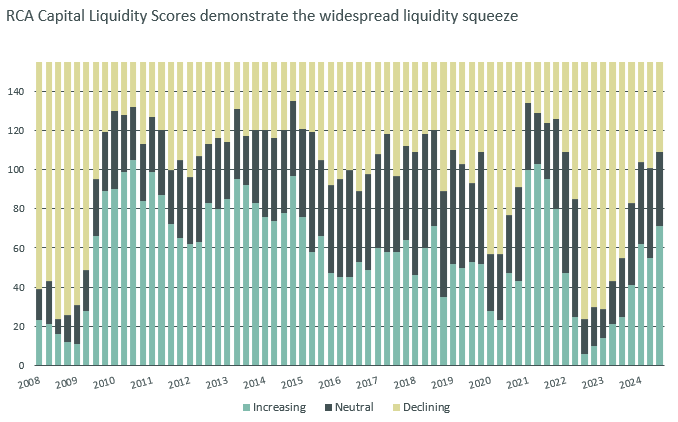

And how does this play out for real estate markets? Well the good news is that for most of the sectors that we actually want to invest in, leasing markets have held up well and transaction yields have troughed out. Market liquidity is also picking up nicely. Figure 4 shows that of the top 155 global markets monitored by Real Capital Analytics, only 46 saw liquidity lower than trend in Q4 2024. This is the least negative result since Q2 2022. But we have to be “positive but realistic”. That block of yellow markets will not fully shrink until debt markets normalize. And as I have just argued we are not expecting bond yields to be of dramatic help. And banks (and investors) are still dealing with impairments on their balance sheets.

Figure 5 Source: CBRE Investment Management, forecasts as of 12, 2024

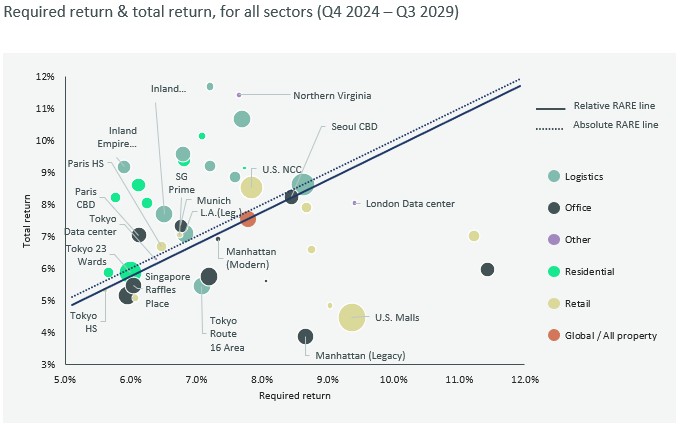

All of which is deeply frustrating as we are forecasting unlevered institutional quality five-year average annual total returns at anywhere from mid-6s in Asia Pacific to just over 8pc in the UK. To be clear, these are incredibly punchy numbers, as should be expected after a savage capital market repricing. These forecast returns are c100 bps HIGHER than the long-run average in real terms – this is historically super-normal.

Within those regional averages we can do even better by picking the right sector-market combinations. Figure 5 shows a finer-grained view of where we can find relative value in the real estate market today. We show our forecast total returns on the vertical axis and our estimate of the required return on the horizontal axis. The required return is a combination of the local risk-free rate, our estimate of the required risk premium reflecting illiquidity, opacity and volatility, and our forecast of NOI growth. Basically, any segments above the diagonal line offer relatively good value, and those below look expensive.

As has typically been the case over the past decade, logistics looks good value – especially the modern logistics segments. Resi also looks good value though lower yielding. But what’s striking is that we are now getting retail segments that look good value and offer an attractive income return. By contrast, even if we just isolate modern, smart amenitised office, that still doesn’t quite get to our fair value line.

Accordingly, when it comes to shaping our portfolios, we will be focusing on acquiring US NCC and selected European retail that has proved resilient and retains its customer relevance. We look for locations and formats with high and resilient occupancy and a compelling leisure offer.

We will also continue to look for residential formats and locations that address the structural undersupply of good quality, affordable homes for low-middle income workers in major cities in all major developed markets.

But when it comes to logistics, we are now tactically and strategically neutral overall. This is because we believe that there is an emerging issue around functional obsolescence of older assets that cannot economically be retrofitted to deal with modern customer requirements. As a result, we want to continue to ruthlessly weed out assets that are over a decade old and to develop or own assets that meet tenants evolving needs: e.g. floorplates that can handle robotic packing and greater density; and rooves that can handle solar; closed loop EV.

The problem is that my scatter chart shows what offers relative value ONCE you have decided to invest in real estate. And the over-riding reason why we are “positive but realistic” about the pace and magnitude of this capital market recovery is that the competitive landscape has become harsher. In a world where government bond yields are higher for longer, and corporate bonds are providing a premium over those, real estate is going to have to work far harder for allocations. And this is a large part of why I suspect that 2025 will be the year of the Retail Comeback.