Connecticut-based developer Juan Salas-Romer writes a first hand account of his conversion of a historic office building into apartments.

In 2014, I stepped into a building that had stood the test of time: The Palladium. More than just bricks and mortar, it was a relic of an industrial revolution that reshaped America.

Built in 1855 as the Young Men’s Institute, it was intended serve as a hub for intellectual and cultural exchange in New Haven, Connecticut. Under Oliver Winchester, a trustee of the Institute and founder of Winchester Firearms, it became a gathering place for the city’s leading minds. Winchester’s innovations revolutionised warfare and manufacturing, mirroring the ingenuity that defined New Haven’s industrial boom—home to Eli Whitney, who pioneered interchangeable parts, and Charles Goodyear, who transformed the rubber industry. The building later housed the New Haven Palladium newspaper, a powerful voice for emancipation.

By 2014, the Palladium had evolved into an office and retail space in New Haven’s 9th Square, a district on the rise. My company was growing, and we were paying a premium for flex office space. The Palladium felt like the perfect opportunity—not just to locate our office but to generate rental income while positioning us for future growth. Zoned for mixed-use, it also allowed residential conversion by right—a rare advantage offering long-term adaptability.

But potential does not mean easy. What if it could be more than just an office? What if we could maximise its potential?

Today’s letter will dive into what it takes to convert an office into apartments—the opportunities, the financial math, and the challenges that can make or break a project.

At the time of acquisition, the Palladium Building was a fully leased office and retail property.

Understanding the space: How the building was used

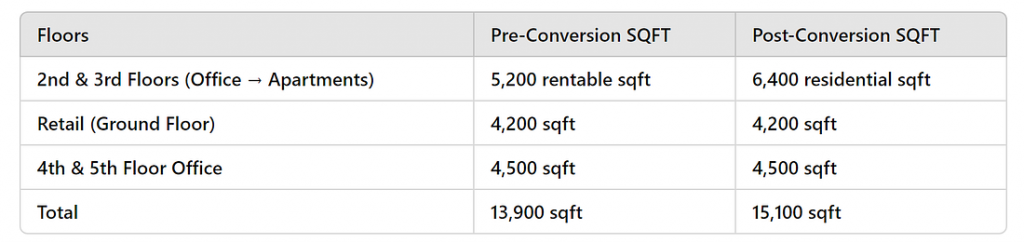

At the time of acquisition, the Palladium Building was a fully leased office and retail property. Here is how the space was divided:

Pre-conversion layout

• 1st Floor (Retail – 4,200 sqft): Stable, long-term tenants providing consistent rental income.

• 2nd & 3rd Floors (Office – 5,200 sqft of rentable space): A mix of small office tenants. Our business operated from the third floor until we moved to the 4th floor prior to starting the conversion.

• 4th & 5th Floors (Office – 4,500 sqft total): Entirely leased to a healthcare startup, which lease accounted for about 70% of the total office rental revenue.

At the time of purchase, the building was bringing $154,380 dollars in Net Operating Income.

The turning point

For the first few years, our strategy was to operate the building as an office investment while using part of it for our own company.

But in 2017, the healthcare startup occupying the 4th and 5th floors announced they were leaving.

This was a major blow to our revenue but also an opportunity—without them in place, we could finally consider a residential conversion for the 2nd and 3rd floors.

We moved our office to the fourth floor and began conversion in 2018.

The incentives

Our initial plan for the second and third floors was to develop twelve small studio apartments, each averaging 500 square feet. A key driver of the decision to convert was the stark price-per-square-foot difference between apartments and office space in downtown New Haven.

At the time, Class B office space rented for an average of $18 per square foot annually on a triple-net basis. This meant that for 1,000 square feet, the total rent would be:

1,000 sq. ft. × $18 = $18,000 per year.

In contrast, newly remodelled or newly constructed apartments commanded $3.40–$3.90 per square foot per month. Using a midpoint of $3.60, the annualised rent equated to:

$3.60 × 12 months = $43.20 per square foot annually. 1,000 sq. ft. × $43.20 = $43,200 per year.

In other words, apartments generated 2.4× the rental income per square foot compared to office space. The financial incentive for developers was clear—if redevelopment costs remained within a profitable range.

The advantage became even more compelling when factoring in vacancy rates. Office vacancies were approximately 12%, while apartment occupancy was higher, with vacancies at 5% or less. Additionally, apartments traded at lower cap rates than office buildings, further increasing the property’s value post-conversion.

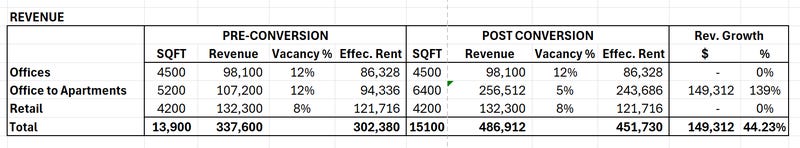

Another key advantage was the ability to increase the rentable area post-conversion. The current 2nd and 3rd floors had a nice layout but inefficient space utilisation. Of the 7,500 square feet available, only 5,200 square feet were rentable. Through reconfiguration, we were able to unlock more rentable space, further improving the project’s financial outlook. Here is the breakdown:

We were able to increase the 2nd and 3rd floor rentable area by 23%.

The challenges

Our research on apartment rent comps suggested that our units could rent between $1,750 for studios and $2,200 for one-bedrooms. For twelve apartments, we expected a gross revenue of $259,200, compared to just $107,200 from the office space at the time—a 142% increase.

But as we started designing, we ran into major hurdles:

• Window placements restricted the number of liveable units.

• Plumbing retrofits became costlier than expected, forcing layout changes.

• HVAC constraints required reallocating condenser spaces.

• Fire codes and egress issues altered our first plans.

Ultimately, we ended up with 10 units averaging 640 sqft. While we had fewer units than planned, total gross revenue still reached $256,512, calculated as:

$3.34 per sqft × 640 sqft × 10 apartments × 12 months = $256,512

Cost overruns and infrastructure issues

Installing the sprinkler system turned into one of the most complex and costly challenges of the entire project. Retrofitting an older building meant navigating outdated infrastructure, tight spaces, and structural limitations that weren’t designed for modern fire suppression requirements.

We had to reroute piping through thick masonry walls, install a dedicated water pump to ensure adequate pressure for upper floors, and coordinate across multiple trades to meet fire code compliance—all while minimising disruption to existing tenants.

What seemed like a straightforward upgrade quickly became a logistical nightmare, adding unexpected delays and costs to the project.

The project ended up costing 34% more than expected and was completed five months behind schedule.

Building the loft and kitchen module

The financial impact: Before and after

We bought the Palladium Building for $1.98 million in 2014. In 2018, we invested $1.395 million in capital improvements, bringing our total investment to $3.375 million.

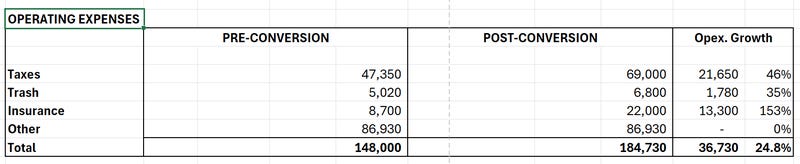

Revenue went up by 44.23%. But as the revenue increased, so did the expenses.

Operating expenses went up by almost 25%.

• Taxes increased by 46%

• Trash costs rose by 35%

• Insurance skyrocketed to a whopping 153%

Valuation analysis

Despite cost overruns and delays, this project was still a success due to the increase in NOI as well as the lower cap rate of multifamily assets.

Total Investment (Acquisition + Renovation): $3.375M

• NOI Before Conversion: $154,380

• NOI After Conversion: $267,000

• Pre-Conversion Valuation (@ 7% Cap Rate): $2.2M

• Post-Conversion Valuation (@ 6% Cap Rate): $4.45M (Lower cap rates as >50% revenue coming from apartments)

Equity Gained: $1.075M ($4.45M – $3.375M)

Challenges aside, the project still paid off!

Kitchen

Studio

The feasibility checklist for office-to-apartments conversions

Before diving into an office-to-apartment conversion, make sure you check these key factors—trust me, it’ll save you plenty of headaches! (If I only knew then what I know now).

Check local zoning laws and building codes—do you need a variance or special permit?

• Research density limits, unit size minimums, and parking requirements.

• Determine if the city offers incentives for conversions, such as tax credits or relaxed zoning rules.

Check floor plans for natural light issues.

• Residential units require access to natural light—do window placements allow for legal bedrooms?

• Deep floor plates can lead to dark interior spaces, making conversion costly or impractical.

• Consider if existing window sizes and spacing will meet residential code requirements.

Evaluate plumbing, HVAC, and mechanical systems

• Plumbing: Does the building have enough risers and drainage capacity for multiple kitchens and bathrooms?

• HVAC: Can the existing system be adapted, or will new units (like PTACs or split systems) be needed?

• Electrical: Can the system manage increased residential power demands (kitchens, laundry, heating)?

• Fire sprinklers and egress: Will you need fire-rated corridors, additional sprinklers, or an upgraded stairwell?

Assess the structural integrity and layout

• Older buildings may need reinforcements for new walls, flooring, or load-bearing adjustments.

• Open office layouts can be easier to convert than buildings with heavily segmented spaces.

• Identify asbestos, lead paint, or outdated materials that may require expensive remediation.

Analyse accessibility and elevator requirements

• Residential buildings often have different ADA compliance rules—will you need new ramps or elevators?

• Are there enough elevators for residents’ daily use versus previous office traffic patterns?

Evaluate ceiling heights and utility space

• Standard office buildings often have higher ceilings, which is good—but do you have space for mechanicals, ductwork, and insulation needed for apartments?

• Check floor-to-floor heights to ensure proper soundproofing and residential conversion feasibility.

Ensure the property has a low enough purchase price to make it viable

• Compare office vs. residential rent PSF in the market—does conversion offer enough of an upside?

• Assess vacancy risk and whether the office market will rebound (or if conversion is the best play).

Factor in tenant buyouts or lease expirations

• Are there existing office tenants on long-term leases? Buying them out could be expensive.

• What’s the vacancy rate? If it’s too high, lenders may be reluctant to finance the project.

Build a generous contingency

• Unexpected costs will arise—budget at least 20-30% over first estimates.

• Prepare for longer-than-expected approval and construction timelines.

• Find backup financing in case construction costs escalate.

View from the loft – 16ft ceilings allow for an additional bedroom loft (90 sq ft)

The future of real estate is adaptive

The real estate landscape is changing—and those who adapt will thrive. Office-to-apartment conversions aren’t just about repurposing buildings; they’re about redefining value in an evolving market.

Demand for housing is soaring, while many office buildings struggle to stay relevant.

Cities are incentivising conversions, creating new opportunities for forward-thinking investors.

The best investments aren’t always the obvious ones—they’re the ones that unlock hidden potential.

This project proved that with the right strategy, market insight, and execution, even an aging office building can be transformed into a high-value, future-proof investment.

—Juan Salas-Romer

This article was originally published by Thesis Driven.