In my last article for The Property Chronicle, I gave an overview on:

- The definition REITs (Real Estate Investment Trust)

- The reasons to invest in REITs as an alternative to physical real estate investment

- The Benefit and drawback on investing in REITs

In this article I will discuss Singapore REITs Index.

REITs Index

Investors should understand the overall market sentiment before making an investment decision. One of the basic rules is to avoid investing during market downturns as the stock price can go lower even though it looks cheap and undervalued.

On top of individual REITs counters, retail investors also need to be aware of the Overall Market Sentiment by looking at the Singapore REITs Index. This index is akin to the Straits Time Index (STI) which has 30 component stocks representing the Singapore stock market. There are currently two Singapore REITs indices to represent the Singapore REIT Market, namely the FTSE ST REAL ESTATE INVESTMENT TRUST (FSTAS8670) and SGX S-REIT Index.

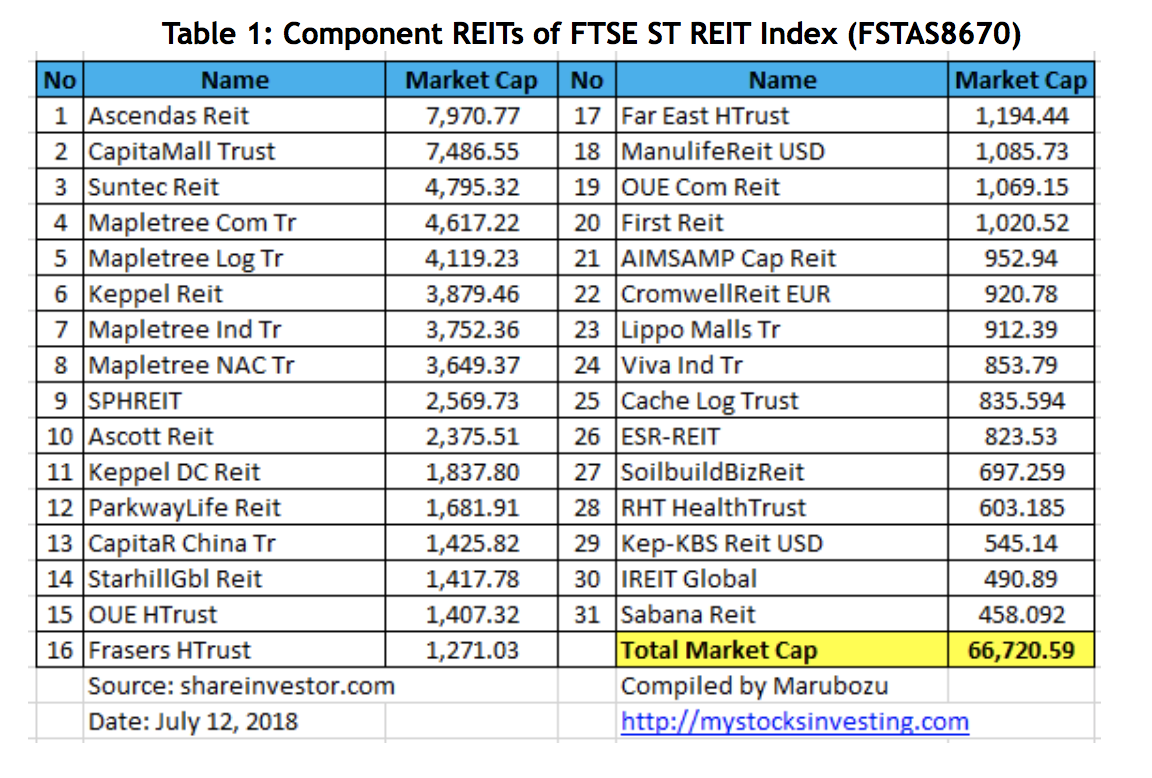

FTSE ST REAL ESTATE INVESTMENT TRUST (FSTAS8670) is the most commonly used index as it has the longest history. This FTSE ST REITs Index consists of 31 REITs and Real Estate Business Trusts in Singapore (see Table 1 below).

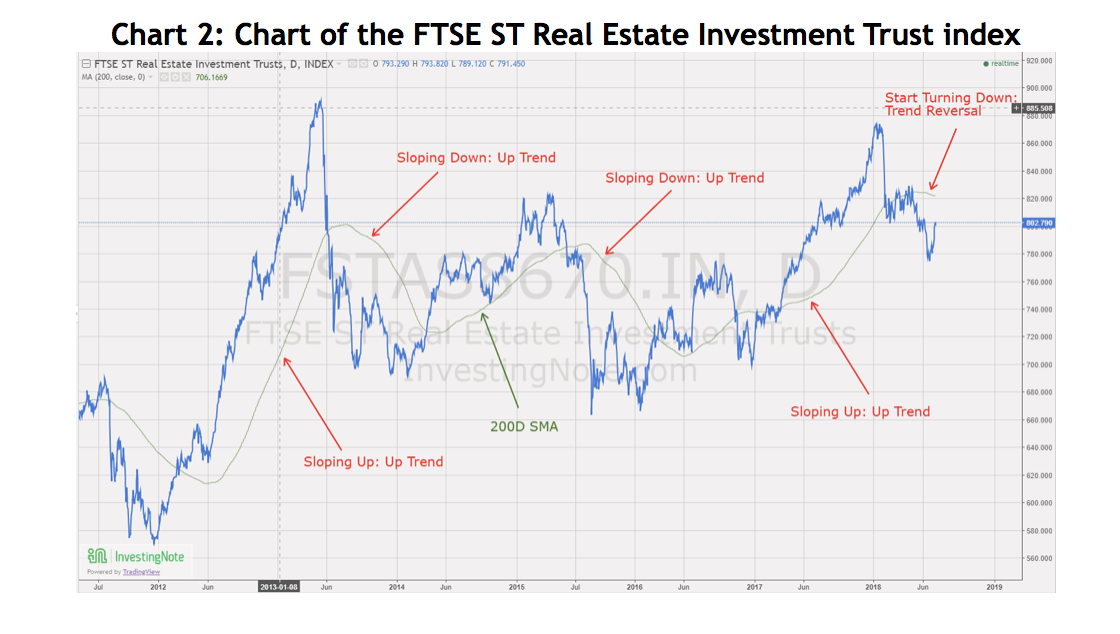

Chart 2 below shows the FTSE ST Real Estate Investment Trust Index (FTSE ST REIT Index) is trading around the 802 level. The index price is represented by the Blue line. The Green Line is the 200D SMA (200 Day Simple Moving Average), which represents the average of the past 200 Days Index Closing Prices. We can use this long-term trend line (representing one year) to identify the trend. When this 200D SMA line is sloping up, we classify it as an Uptrend. When the 200D SMA is sloping down, we classify as Downtrend. The Index (Blue Line) tends to stay above the 200D SMA (Green Line) when the Index is on an uptrend. If the Index price (Blue Line) goes below the 200D SMA (Green Line), the Index is said to reverse to a downtrend. At 802, the current FTSE ST REITs Index has just started the down trend because it is below the 200D SMA. Investors have to pay attention when this 200D SMA starts sloping down because it is a confirmation of down trend. Retail investors have to be cautious when investing in a down trend because invested capital can shrink if the price goes lower.

Chart 2 below shows the FTSE ST Real Estate Investment Trust Index (FTSE ST REIT Index) is trading around the 802 level. The index price is represented by the Blue line. The Green Line is the 200D SMA (200 Day Simple Moving Average), which represents the average of the past 200 Days Index Closing Prices. We can use this long-term trend line (representing one year) to identify the trend. When this 200D SMA line is sloping up, we classify it as an Uptrend. When the 200D SMA is sloping down, we classify as Downtrend. The Index (Blue Line) tends to stay above the 200D SMA (Green Line) when the Index is on an uptrend. If the Index price (Blue Line) goes below the 200D SMA (Green Line), the Index is said to reverse to a downtrend. At 802, the current FTSE ST REITs Index has just started the down trend because it is below the 200D SMA. Investors have to pay attention when this 200D SMA starts sloping down because it is a confirmation of down trend. Retail investors have to be cautious when investing in a down trend because invested capital can shrink if the price goes lower.

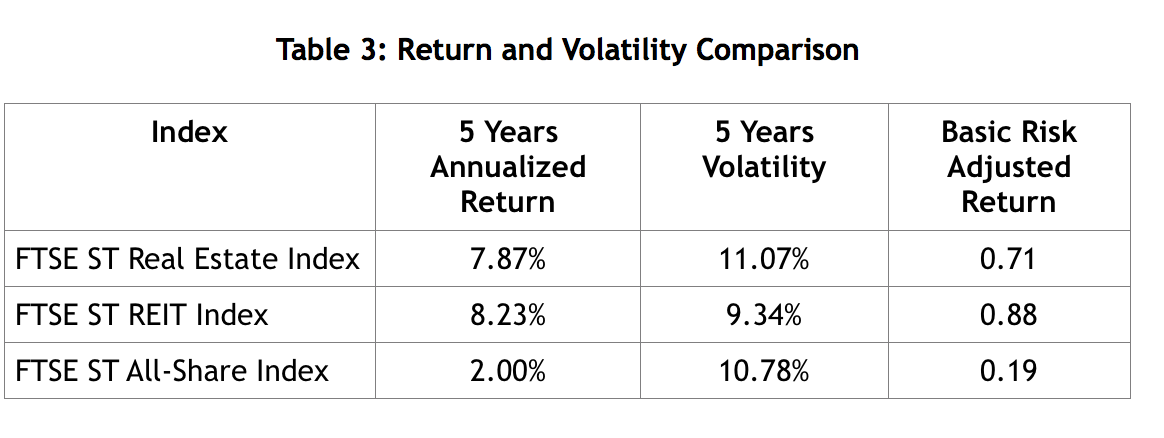

As an equity investor, we need to factor in the volatility of the underlying asset instead of just purely looking at the annual return. Based on Table 3 below, FTSE ST REITs Index have better Return / Volatility Ratio (basic Risk Adjusted Return) than FTSE ST Real Estate Index.

Another Singapore REIT Index to track the Singapore REITs Sector is SGX S-REIT Index. The SGX S-REIT Index was established in 2015. It is a free-float market capitalization-weighted index that measures the performance of stocks operating within the REIT Sector. The Index is also diversified across types of property assets. The Global Industry Classification Standard (GICS®) is applied by SGX StockFacts to help define the different sectorial foci within the REIT sector.

Constituents of the SGX S-REIT Index are diversified by property type in addition to location. More than half the trusts have property assets located outside Singapore, mostly around Asia. This includes countries such as China, Hong Kong, Vietnam, Japan, Indonesia, South Korea, Philippines and Malaysia.

To be eligible for index inclusion, the industry group of the trust must be classified as a Real Estate Investment Trust by the Thomson Reuters Business Classification (TBRC). This means the SGX S-REIT Index is not solely made up of the REITs that are governed by the Collective Investment Scheme, but can include Business Trusts and Stapled Trusts, both of which are governed by the Business Trusts Act.

SGX S-REIT Index consists of 32 SGX S-REIT Index constituents, 25 are REITs, five are Stapled Trusts and two are Business Trusts (Ascendas India Trust and Croesus Retail Trust). The 25 REITs make up 89.4% of the SGX S-REIT Index, while Stapled Trusts make up 7.7%, and Business Trusts comprise 2.9%. The SGX S-REIT Index is rebalanced periodically.

REITs and Stapled Trusts not currently included in the index are as follows:

- BHG Retail REIT

- Fortune REIT

- Keppel DC REIT

- Saizen REIT

- Ascendas Hospitality Trust

Summary

I am tracking the Singapore REITs market sentiment every month using FTSE ST REIT Index as this index has the longest history and I can see the market trend clearly. The REITs market trend is important to give me a clear idea about conditions for me to manage my clients REITs advisory portfolios.