Please allow me to skip a fuller introduction of myself – time is short, your time valuable, and article word counts understandably limited.

First, thank you for including me in The Property Chronicle. I am honored and humbled to share my weekly articles about the world of U.S. Real Estate investing, with a new and important audience. (Please read my bio for my background and accomplishments about which I am proud.)

This initial article appeared in a somewhat longer version on July 4, 2018, and was admittedly, patriotic.

I believe the “American Dream” is not limited to our shoreline. And I want to share, in this piece, some of what makes this dream a reality for millions of people – not just inside our borders.

My life has been dedicated in the arena of Commercial Real Estate – as a developer (right out of school), as an multi-year investor, and now, for nearly a decade writing on the topic, as author of several books, on numerous websites (and now here!), as editor of a monthly subscription newsletter at Forbes, and for select companies and private clients as a REIT consultant and advisor.

REIT?

Real Estate Investment Trust.

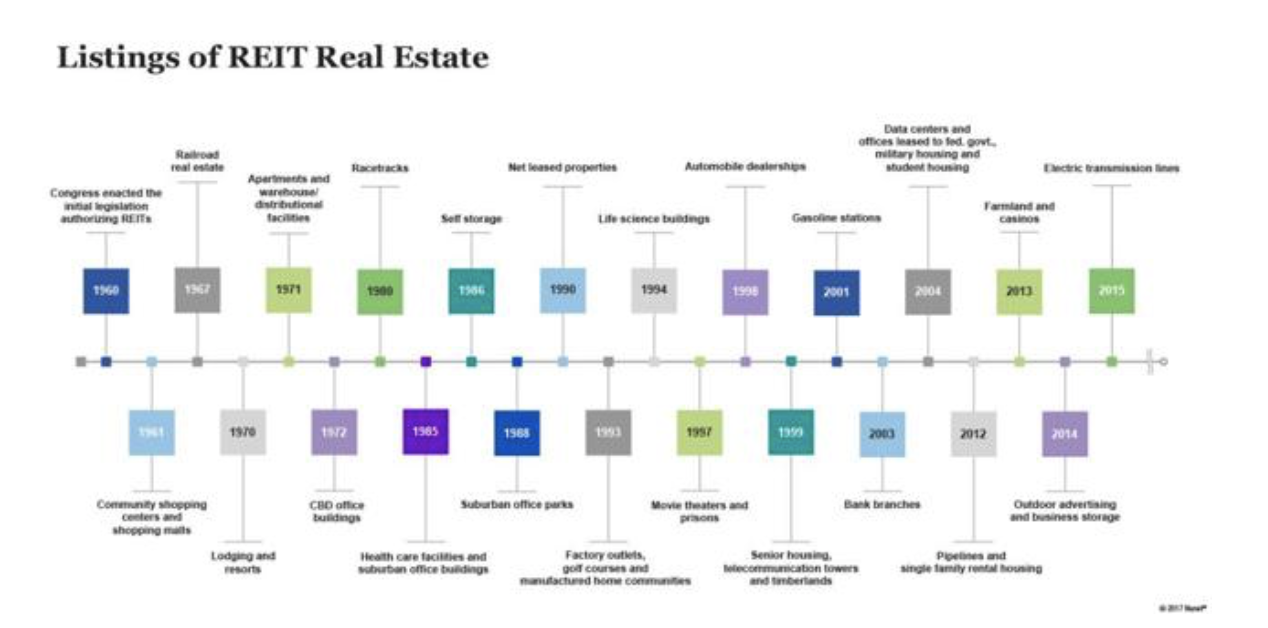

In the U.S., REITs were established by the Congress in 1960 to give all investors, especially small investors, access to income-producing real estate. Since then, the U.S. REIT approach has flourished and served as the model for more than 35 countries around the world. (My book, The Intelligent REIT Investor is now available in China.)

On Sept. 14, 1960, President Eisenhower signed legislation that created a new approach to income-producing real estate investment – in which the best attributes of real estate and stock-based investment are combined. REITs, for the first time, brought the benefits of commercial real estate investment to all investors – benefits that previously had been available only through large financial intermediaries and to wealthy individuals.

The REIT approach to real estate investment has been refined and enhanced over the years. REITs in the U.S. and increasingly around the world now regularly provide investors the opportunity for meaningful dividends, portfolio diversification, valuable liquidity, enviable transparency and competitive performance.

Investors have responded to this investment opportunity. Nearly six decades after their creation, the U.S. REIT industry has grown to a $1 trillion equity market capitalization representing nearly $3 trillion in gross real estate assets, with more than $2 trillion of that total from public listed and non-listed REITs and the remainder from privately held REITs. That growth led, in part, to the creation of the new Real Estate headline sector in the Global Industry Classification Standard in 2016.

Source: NAREIT

Since their creation in 1960, REITs have grown in size, impact and market acceptance. The creation of headline real estate sectors – populated mainly by REITs – in leading industry classification standards underscores the growing importance of REIT-based real estate investment in the equities marketplace.

In addition to the core “food groups” – retail, office, apartments, and industrial – the REIT sector has expanded into a collection of property sectors and sub-sectors, including data centers, cell towers, prisons, hotels, self-storage, healthcare, net lease, student housing, single family residential, energy, billboards, and casinos.

REITs have historically produced a track record of strong performance. The industry’s track record has resulted in a broader acceptance among institutional investors, financial advisors and retail investors.

Although REITs were held back in Q1-18 amid heightened short-term sensitivity to interest rates, they have outperformed the broader stock market for four consecutive months.

My published REIT recommendations (in my newsletter) are based on my assessment of prospects for economic growth, supported by a continued upturn in the business cycle, and continued job growth amid one of the broadest global expansions on record (with added fuel from $200 billion in U.S. tax cuts for 2018).

You could say that REITs were created for this very purpose: to allow “plain old regular people” to have a real stake in the future, and especially (borrowed from “America the Beautiful”), from REIT to shining REIT.

Here are just a few of the ideas I’m giving my readers, to help their personal balance sheets get stronger and grow – at a great time to buy a piece of America. Look at these, and other investments, always, with your due diligence as a priority.

Healthcare Trust of America (HTA): Strong medical office demand, excellent balance sheet (BBB rated), diversified across operators and markets, good management team & alpha-generating development, mispriced in the market, and dividend of 4.37%.

Tanger Factory Outlet (SKT): They have no malls, a most profitable brick/mortar channel, disciplined CEO, diversified tenant base, fortress balance sheet (BBB+) with ample free cash flow (low payout ratio), and exceptional dividend growth history (24 years in a row), now at 5.88%

Ventas, Inc. (VTR): They’re the Best-in-Class Operators, with a highly-rated CEO, low cost of capital, scale-advantage, healthy balance sheet (BBB+), pivoted away from skilled nursing “just in time,” looking for M&A deal, and yielding 5.47%.

Ladder Capital (LADR): Commercial mortgage REIT lender, internally-managed, best-in-class dividend growth record, smaller deals than its peers (so more effective), with strong insider ownership and extremely hands-on CEO, dividend 7.73%.