Victorian bankers rarely wrote mortgages. As a contemporary bankers manual explained: ‘house or shop property, even of a superior class, is not a desirable security…on the grounds of its uncertainty of sale’.(1) Until the 1980s, UK clearing bank assets mainly comprised commercial bills of three months maturity or less, short-term advances, and short-dated government securities. Mortgages remained the preserve of the building societies. Bank liabilities were dominated by retail deposits, mostly interest-free and mostly payable on demand. Short-term assets were therefore ‘matched’ against short-term liabilities. Nor did the banks compete on deposit rates or borrow in wholesale markets. By 2007, however, the eve of the Global Financial Crisis, mortgages comprised around two-thirds of bank assets. These long-term assets were funded increasingly in wholesale markets, with Northern Rock sourcing just 22 per cent of its liabilities from retail depositors before being taken into public ownership.

Liability management

The London clearing banks emerged after the 1833 Bank Charter Act removed the Bank of England’s monopoly on joint-stock banking within a 65-mile radius of London. After a period of intense rate competition, the new banks fell in with the private bank practice of paying zero interest on current accounts. They continued to pay interest on deposit accounts, but from the 1850s increasingly observed the ‘Town Deposit Rate’ that fluctuated with Bank Rate. The banks did compete on the convenience of their branch networks and the provision of services, but it was considered bad form for one bank to solicit customers from another. A wave of amalgamations left the ‘Big Five’ (Barclays, Lloyds, Midland, National Provincial and Westminster) dominant by 1919, further reducing competitive pressures. With a cartel in operation, and no further clearing bank mergers until 1968, the structure of British banking remained stable. As the Bank of England explained: ‘our banking system in 1955 was not very different from what it had been fifty years before, in respect of the range of facilities offered and the way in which they were provided. By 1983 it had become a lot different’.(2)

The catalysts were innovation and deregulation. In 1953 local authorities were freed from the requirement, in place since WW2, that borrowing should come from the Exchequer. They entered the ‘parallel’ money markets where holders of large deposits could obtain higher rates than the clearing banks, constrained to offer the cartelized 7-day rate (regardless of maturity), could offer. Local authorities were joined by the hire purchase companies, themselves freed from controls in 1958, seeking to finance loans to increasingly affluent consumers for goods such as motor cars and televisions.

Accompanying these domestic developments was the growth of the Eurocurrency markets. With Regulation Q capping the rates US banks could pay on domestic dollars, and US current account deficits increasing their international supply, London bankers seized the opportunity to borrow offshore dollars. They were encouraged by the authorities, keen to maintain the City as the leading market for international capital as sterling declined in importance. The wholesale markets became even more attractive after 1966 when the UK authorities sanctioned another American innovation, the negotiable certificate of deposit. CDs enabled borrowers to access medium-term funding while allowing investors to monetize those deposits in the market before maturity.

Asset management

Bankers are dealers in borrowed money. It is imperative, therefore, that they hold enough cash to meet customer withdrawals. As custodians of the payments system, banks also need liquidity reserves of assets that can be monetized quickly. Until the 1980s, these mainly comprised commercial bills, Treasury bills, and money at call with the Discount Houses. The traditional bank asset, however, is the short-term loan to businesses or persons. These generally took the form of overdrafts. While overdrafts are legally repayable on demand, thus conforming to the short-term nature of bank balance sheets, they tend to be rolled over for long periods, thus taking on the appearance, if not the legal reality, of medium to long-term finance. The key, however, was to avoid locking up financial resources.

The reforms introduced under the guise of Competition and Credit Control in 1971 transformed British banking. With the cartel abolished, banks began managing their liabilities in the wholesale markets while extending loan maturities, such that by 1976 nearly half of advances had an original maturity of more than two years. Maturity transformation gathered pace in the 1980s when, to encourage finance for increased home ownership, the Thatcher government encouraged the banks to tear up the longstanding gentlemen’s agreement that they would not compete with the building societies for primary mortgages. The 1986 Building Societies Act triggered consolidation amongst the building societies, and allowed mergers between societies and the banks.

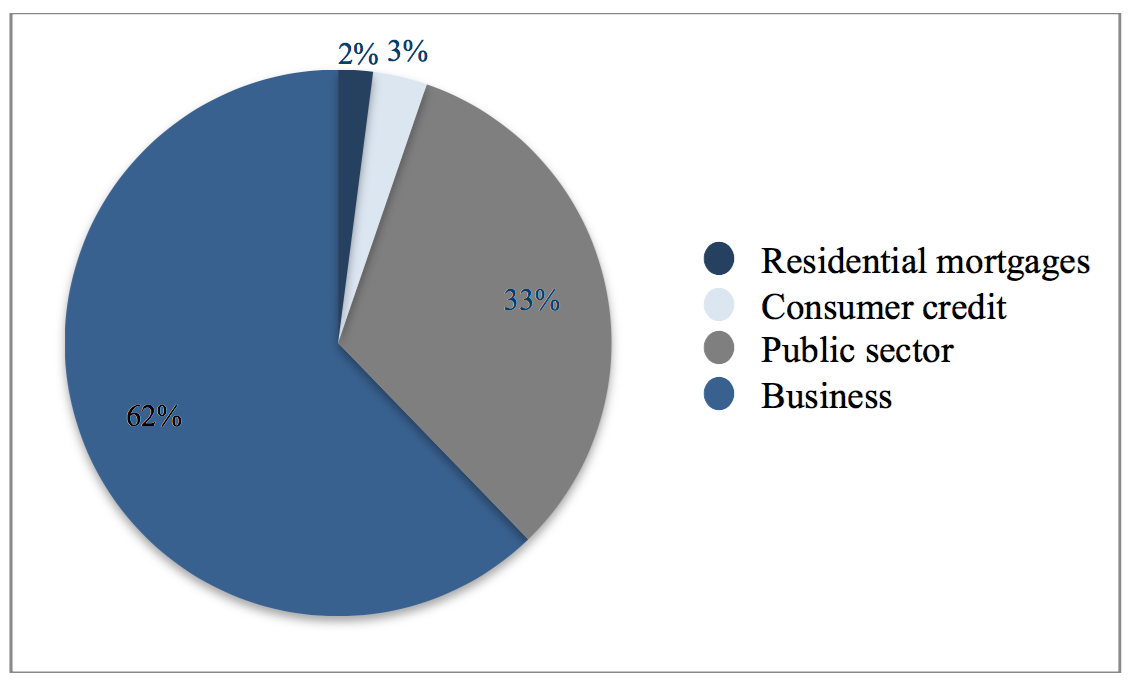

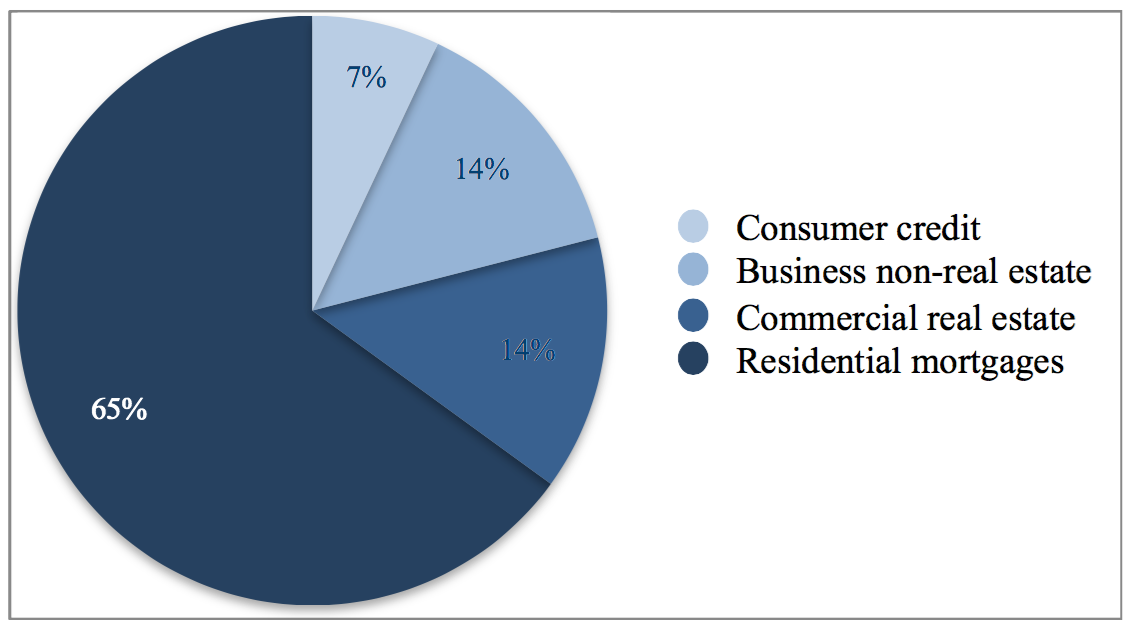

As Figures 1 and 2 show, after barely featuring in 1971, mortgages dominated bank balance sheets by 2012.

Figure 1. Clearing bank assets in 1971

Figure 2. Clearing bank assets in 2012

Source: Bank of England.

The Victorian principle that short-term deposits should be matched against short-term liabilities, challenged by the growth of the parallel and Eurocurrency markets, was destroyed by the mortgage market revolution. The resulting maturity transformation received academic justification in 1983, with Diamond and Dybvig arguing that deposit insurance would mitigate runs on banks with mismatched balance sheets.(3) In September 2007, UK retail deposits were guaranteed up to £31,700. This did not stop customers queuing outside branches of Northern Rock to withdraw their deposits when the bank’s troubles became public.

In 2011, the Vickers Commission, appointed to review British banking in the wake of the Global Financial Crisis, cited Diamond and Dybvig as it concluded:

"Banks are able to fund illiquid assets with short-term, liquid liabilities…The production of liquidity in this fashion is socially valuable because it allows savers to withdraw funds when they want, rather than when the investments they ultimately fund pay off."(4)

This new orthodoxy runs counter to the principles that underpinned a century of British banking stability from the 1870s to 1971. It would be surprising if the new orthodoxy survives that long.