For a while we have been interested in the relationship between global M&A (Mergers and Acquisitions) activity and CRE (Commercial Real Estate) investment. Strong M&A activity is highly correlated with strong CRE investment levels.

The latest data shows that the value of global M&A is approaching the market level of 2007(1). A 30% year-over-year increase through the first three quarters of 2018 (totaling US$3.1 trillion) puts M&A transaction value just 7% below the same period of 2007. Given the current momentum, 2018 may eclipse 2017 as the best year ever for corporate consolidations.

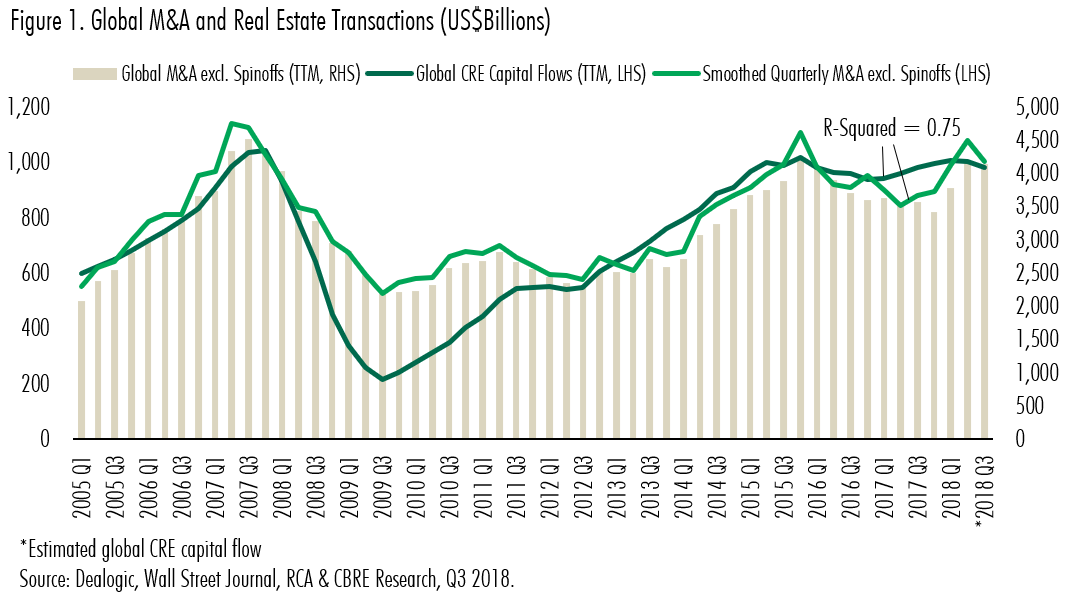

Figure 1 exhibits the global volume of M&A and real estate transactions in TTM (Trailing-Twelve-Month) values with a smoothed trendline of quarterly M&A(2).

R-Squared, which measures the degree to which a dependent variable can be explained by one or more independent variables, reaches 0.75 between real estate transactions and the smoothed quarterly M&A. It implies that 75% of the variance in the real estate capital flows can be explained by the smoothed level of global M&A. The correlation is particularly helpful in predicting the volume of real estate investment, which typically lags M&A activity by three or four quarters (denoted by the dark green line).

The data suggest that CRE investment will remain strong and will possibly increase, for at least the next couple of quarters.

There may be no direct link between corporate M&A, but there are a number of quite strong associations:

- Corporate consolidations happen when earnings are strong, the confidence is high, and the cost of capital is low. Strong earnings also benefit real estate by boosting investment, hiring and demand for space. Confidence and low cost of capital boosts demand for capital assets of all types. Is it right to talk about a low cost of capital as the ten-year treasury yield is expanding? We think it is because, equity risk premia are falling as are commercial loan spreads.

- Not all, but at least some, M&A activity is fueled by an underlying real estate play. It has been estimated that 40% of the assets of stock market quoted companies are in fact real estate. One of the benefits of investing in real estate is being able to unlock value that is hidden by stale valuations or inappropriate corporate structures.

- While the real estate sector accounts for a relatively small share of global M&A activity, it surpassed its pre-crisis record in 2017(3). The trend has continued in 2018, fueled by retail REIT takeovers, including the US$16 billion merger of Unibail-Rodamco and Westfield, and the US$15 billion acquisition of GGP by Brookfield. We also note that growth in entity transactions has been an important driver of global real estate capital flows, which, in turn, are highly correlated with the overall M&A activity.

Therefore, we expect the buoyancy in global M&A to be mirrored in global real estate investment levels. In a period of interest rate normalization, it is important to notice this associated evidence of asset market demand.