The Singapore REIT sector has broken down from a consolidation pattern and starts a down trend. Let’s look at the technical analysis and fundamental analysis for the Singapore REIT sector in this month’s update.

Technical Analysis of FTSE ST REIT Index (FSTAS8670)

The FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreased from 802.97 to 767.98 (-4.36%) as compared to the last post on Singapore REIT Fundamental Comparison Table on Oct 1, 2018. The REIT index broke down from a Symmetrical Triangle, a consolidated pattern, to continue the bearish down trend with minimum index target of 740.

Currently the index is trading in a very bearish mode with all 3 moving averages trending down. More down side is expected although the FTSE ST REIT Index has dropped close to 13% from the peak. Based on the current chart pattern and trend analysis, the trend for the Singapore REIT sector (short, mid and long term) is DOWN! The REIT index will be capped by the immediate resistance at about 775. Based on the past chart pattern, 50-Days Simple Moving Average (blue line in the chart) can be served as a reliable trend indicator.

FTSE ST REIT Index (FSTAS8670)

Fundamental Analysis of 39 Singapore REITs

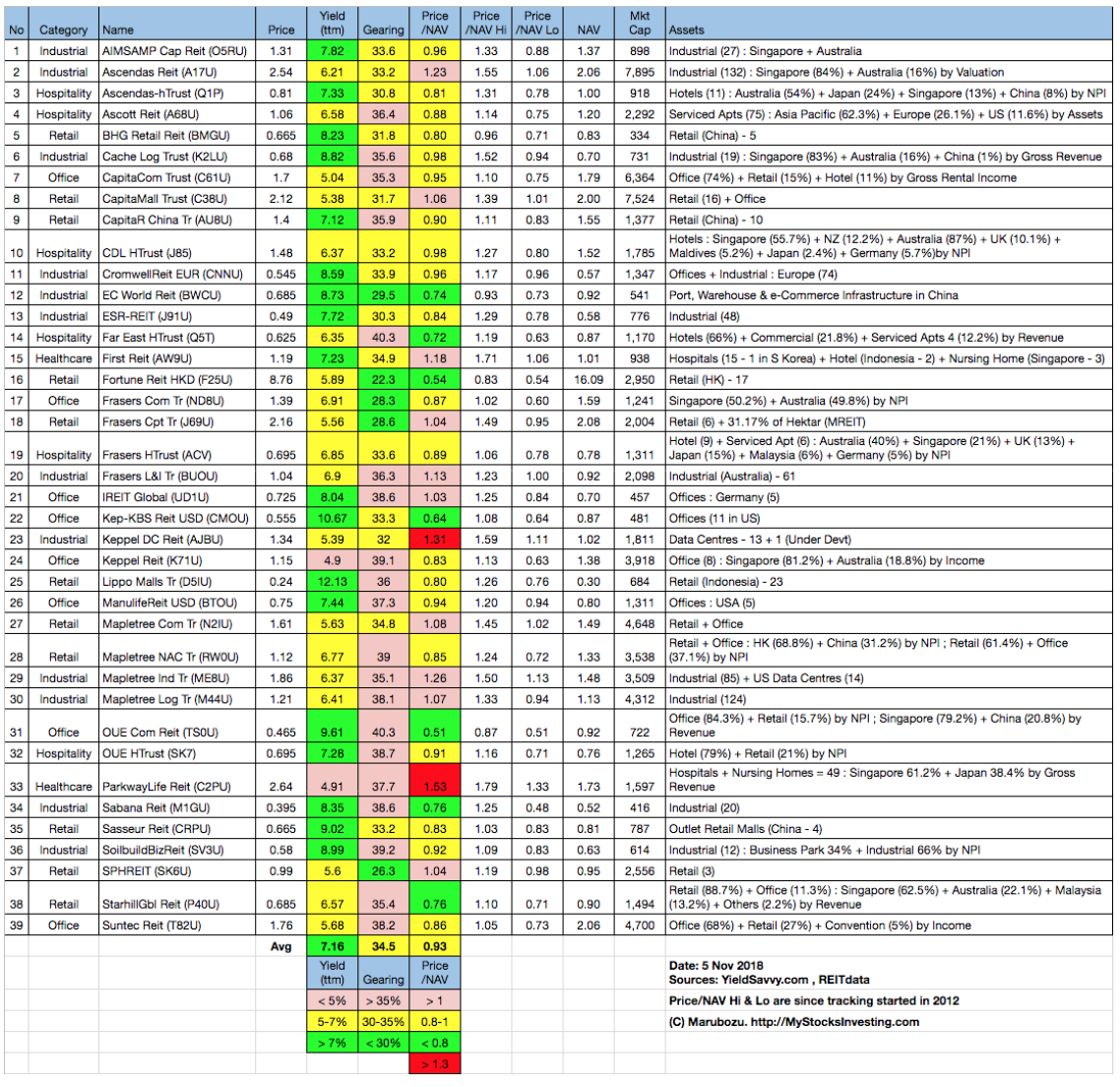

The table below shows a compilation of 39 REITs in Singapore as of Nov 2018 with colour coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio. This gives investors a quick overview of which REITs are attractive enough to have an in-depth analysis. The number of Singapore REITs have reduced from 40 to 39 compared to last month’s table as VIVA Industrial Trust is removed, after the trust merged into ESR REIT.

Singapore REIT Fundamental Comparison Table Nov-2018

Summary of Singapore REITs Table (Nov-2018) compared to Oct 2018 Singapore REITs Table

- Price/NAV decreases from 0.99 to 0.93 (Singapore Overall REIT sector is under value now).\

- Distribution Yield increases from 6.77% to 7.16% (take note that this is lagging number). About 46% of Singapore REITs (18 out of 39) have Distribution Yield > 7%.

- Gearing Ratio reduces slightly from 34.6% to 34.5%. 20 out of 39 have Gearing Ratio more than 35%. In general, Singapore REITs sector gearing ratio is healthy. Note: The limit of gearing ratio for REITs listed in Singapore Stock Exchange is 45%.

- The most overvalued REIT is Parkway Life (Price/NAV = 1.53), followed by Keppel DC REIT (Price/NAV = 1.31), Mapletree Industrial Trust (Price/NAV = 1.26) and Ascendas REIT (Price/NAV = 1.23).

- The most undervalued (base on NAV) is OUE Comm REIT (Price/NAV = 0.51), followed by Fortune REIT (Price/NAV = 0.58), Keppel KBS US REIT (Price/NAV=0.64), Far East Hospitality Trust (Price/NAV = 0.72), EC World REIT (Price/NAV = 0.74) and Starhill Global REIT (Price/NAV = 0.76).

- The Highest Distribution Yield (TTM) is Lippo Mall Indonesia Retail Trust (12.13%), followed by Keppel KBS US REIT (10.67%), OUE Comm REIT (9.61%), Sasseur REIT (9.02%), SoilBuild BizREIT (8.99%), Cromwell European REIT (8.59%), EC World REIT (8.73%) and Cache Logistic Trust (8.82%).

- The Highest Gearing Ratio are Far East HTrust (40.3%) and OUE Comm REIT (40.3%).

Sector Comparisons for Singapore REITs

There are 5 general sectors in Singapore REITs:

- Retail Malls

- Commercial Office

- Industrial (Factories and Warehouses)

- Hospitality (Hotel and Service Residences)

- Healthcare (Hospital and Home Care)

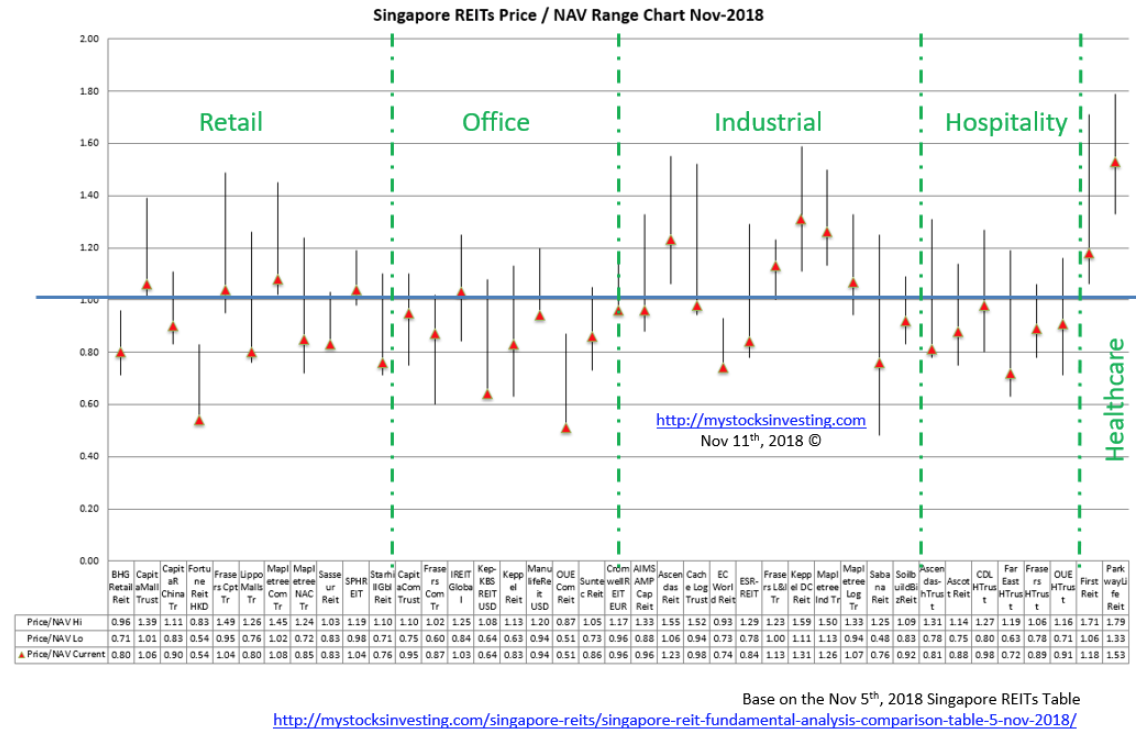

Chart 3 shows the Price/NAV comparison for all 5 REIT sectors. This chart will give an overview on the current REIT valuation compared to its historical value (the high-low range of Price/NAV) since I started tracking in 2012.

Singapore REIT Sector Comparison Based on Price/NAV

The red triangle indicates the current Price/NAV (November REIT table) and the shadow represents the historical high and low of Price/NAV. As seen from the chart 3, Retail, Office and Hospitality sectors are generally undervalued (Price/NAV < 1) and Healthcare sector is overvalued.

Fortune REIT, Lippo Mall Indonesia Retail Trust, Sasseur REIT, Keppel-KBS US REIT, EC World REI and Ascendas Hospitality Trust are currently trading near to the historical low Price/NAV since 2012. Using this Price/NAV range chart helps investors to identify the potential entry level for their Singapore REIT portfolio.

Summary

Fundamentally the whole Singapore REIT sector is undervalued now. The overall yield for Singapore REITs is getting more attractive (average yield of 7.16%). The last time we have seen Price/NAV = 0.93 and Distribution Yield of more than 7% was back in Dec 2015. You may compare the Singapore REIT Fundamental Comparison Table in Dec 2015 to see the similarity and you should be able to identify some attractive opportunities.

Yield spread (reference to 10 year Singapore government bond) has widened from 4.238% to 4.654%. DPU yield for a number of small and mid-cap REITs are very attractive (>8%) at the moment. Some big cap REITs are also getting more attractive in terms of valuation and distribution yield.

Technically, the REIT index is trading on the down trend and there is no sight of bottoming yet. It is expected more down side for big cap REITs because the FTSE ST REIT index is heavily weighted on the big cap REITs.

The risk premium is very attractive for small and medium cap REITs now. Investors can do some selective shopping when the down trend stop for those REITs.

Safe shopping on Singapore REITs!