With the benefit of hindsight, we have come to understand the true importance of China’s strategic policy interventions in 2009 and 2015. China’s reflationary actions had a material impact on the global economy. The question posed at a recent Halkin dinner was “Can China (still) reflate the world?” In the event of another global economic and financial downturn – an increasingly credible event – can the developed western economies rely on another burst of Chinese credit expansion to save the day?

Our speaker, economic and financial historian and global strategist Russell Napier, treated us to a no-holds-barred analysis of China’s financial and economic predicament. His conclusion is that China’s only route back to faster economic growth involves a devaluation of its currency, the RMB. China can reflate but only by devaluing its exchange rate and fuelling the forces of debt deflation in the global economy.

Since the late summer, China has changed tack on economic policy to permit a faster pace of credit expansion and more fiscal relaxation to bolster its softening economy. Russell reckons that the attempt by the People’s Bank of China (PBoC) to stimulate bank credit growth, as compared to shadow bank credit growth in the previous episode, will complicate matters further by boosting money supply growth. However, with a basic external balance – current account plus net long-term private capital inflows – close to zero, China must attract other net capital inflows (or suffer continuous depletion of its foreign exchange reserves) if it is to hold the RMB steady, whether in terms of the basket or against the US Dollar.

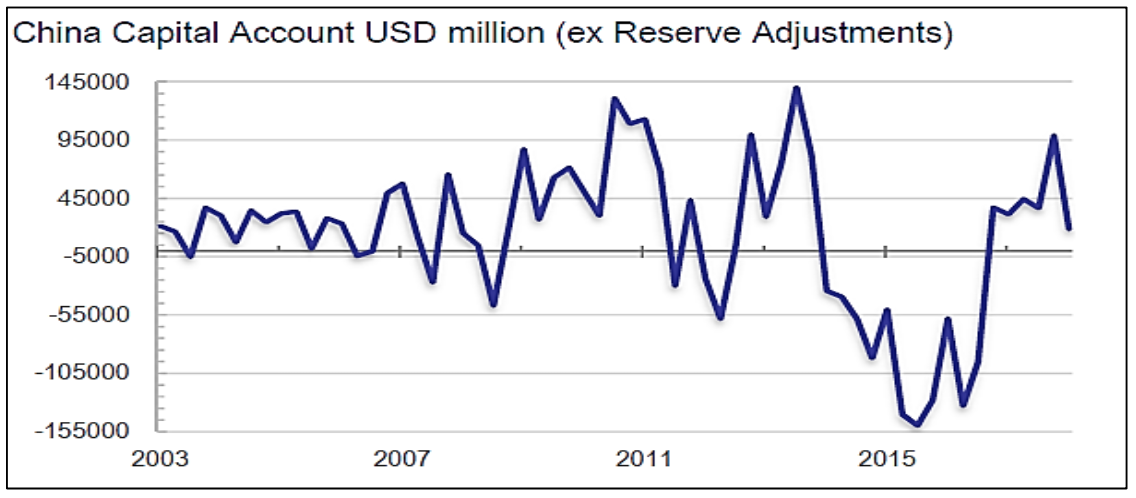

Russell argues that only a major and rapid improvement in the capital account balance – shown below – would stabilise the exchange rate, given that faster economic growth would tend to worsen the current account balance. Such a surge in net banking and portfolio capital inflows is conceivable, particularly if China’s bond and equity markets receive the weighting in the global indexes that the opening of China’s capital account suggests is appropriate. However, what are the chances of attracting these inflows ahead of a potential RMB devaluation?

Russell’s favoured scenario is a devaluation of the RMB that could arrive within the next 12 months, sending a deflationary impulse through the global economy as China reduces the US$ selling prices of its goods and undermines the external accounts of its highly-geared competitors. This would, in due course, be followed by greater domestic inflation. A more radical solution would be for China to float the RMB altogether, which would attract significant inflows of foreign capital that would help to establish China’s reserve currency status and challenge Dollar hegemony.

Meanwhile, Russell sees almost all emerging markets as a pain trade due to a US Dollar funding crisis and escalating debt service costs. He left us with a memorable definition: financial repression is stealing money from old people slowly.

(This article originally appeared in the Halkin Letter)

Russell Napier is author of Anatomy of the Bear: Lessons from Wall Street’s four great bottoms and has just written a foreword for a new edition of Extraordinary Popular Delusions and the Madness of Crowds.