Ben is a highly regarded residential property investment and development expert. He has a reputation for creating superior investment returns with a considered approach, borne out by the success of his own property portfolio.

In this column he will be giving his thoughts and commentary on the current market plus strategies and tips from other leading professionals in the residential investment field.

For decades, insurance companies, pension funds and large property companies (‘the institutions’) have been threatening to invest in the private rented sector (PRS). Finally after several years of dithering, they are now starting to enter the market in a big way via so-called Build to Rent. There are approximately 70,000 units built or planned across the UK and the number is growing rapidly with a reported further £10bn allocated to the sector. According to the British property federation a staggering 11,000 units are planned for greater Manchester alone, no doubt attracted by headline (past) gross yields. This is a welcome boost to the residential investment market, but is the right time and is it the right product?

Over the last few decades, the institutions have observed the exponential growth in the PRS market and with Build to Rent are focused on developing purpose-built, professionally-managed blocks. These will be jam-packed with onsite facilities, social areas, full management, all-inclusive bills etc. The aim is to take the buy-to-let sector to a higher level and, encouraged by the government to drive up standards, a new scheme is seemingly announced every week.

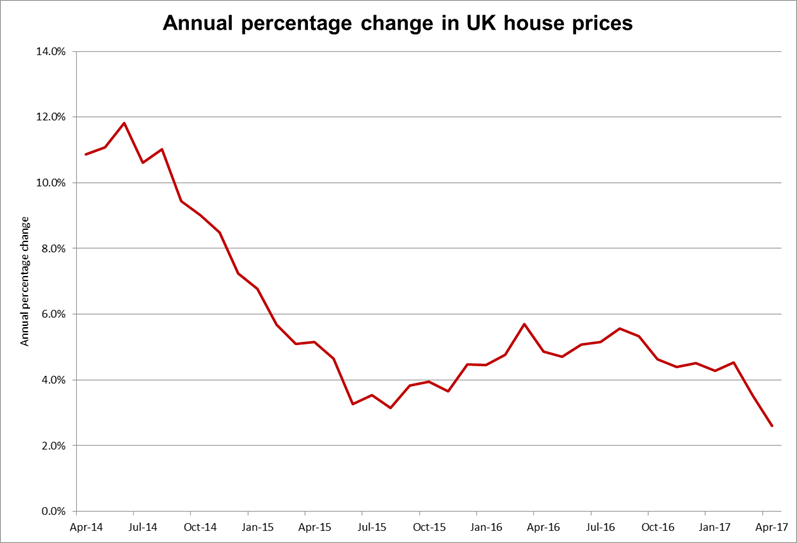

However the general market has recently caught a cold – capital values in London and the South East, after a lengthy bull run, are now static and declining in many areas (especially higher valued properties). Years ago Lucian Cook at Savills correctly predicted the ripple effect of recent price rises radiating from London out to the regions. Well, the ripple has now well and truly rippled and price rises are petering out. The party has just finished – never traditionally the best time to pitch up…

Chart data sourced from Nationwide

Not only are capital values starting to struggle, but rents are also static or declining in many areas.

Brexit and general economic/political uncertainty have weighed heavily on the rental market. The Conservative government has done a great job of hammering landlords over the last few years with additional stamp duty rates and the tapered removal of mortgage relief for higher earners. Some landlords will undoubtedly exit the sector, but the reality is most landlords have only one or two properties and approximately half have no mortgages: it is simply their pension or a useful income stream. Steeper property capital gains taxes going forward (another recent Conservative measure) will further dissuade them from selling up.

Naturally standards vary considerably across the rental sector, but the new institutional landlords are very, very much in competition with these existing landlords, even if they think they have a new and unique purpose-built product. The sheer size of the market (an estimated 5 million households rent in the PRS) and flexibility of assured shorthold tenancies mean it is effectively perfect competition in larger conurbations.

The institutions are mostly pitching their product at the top end of local markets. Branding and mod cons will indeed work for some professional tenants, especially in wealthy international economies like London, but regionally highly-paid professional tenants are frankly far fewer in numbers. This market here is in danger of rapidly becoming saturated and then there will be only one way to compete – lowering rents to fill the blocks. Having witnessed the attractive overall returns during the last few decades, the institutions have modelled both capital and income growth for their new investments, but in the short to medium term many of their own investors will face serious disappointment exacerbated by the current market slowdown.

Additionally, many of the institutional staff in this new Build to Rent sector are inexperienced or have filtered across from the commercial property sector. The residential property market is a very different animal to commercial – it’s a fast, fluid sector. Tenants are fickle and leases are short – it is very hard to get right. When both capital and income growth dry up and voids increase, this gets even harder.

I recently saw a PRS block in an uninspiring London suburb. They were asking £475pw for a studio flat. Brand new, lots of mod cons, all-inclusive and beautifully presented but… £475pw! It’s always worth remembering that you can rent a Victorian 3 double bedroom house down a neighbouring side street for the same figure (excluding utility bills). Call me a tight northerner (no objectors there Ben -Ed.) but if you are a typical professional tenant in your 20s or 30s and are looking to save money do you go for the traditional flat/house and get together with two friends spending £240pw each instead (with bills included)? Even if the house is a bit basic and not brand new, you’ll have the small advantage of £235 more every week in disposable cash.

Some institutional schemes will succeed over the long term, but a lot simply won’t. I believe the majority of British tenants will opt for the (much cheaper) mainstream letting market with foreign tenants or well-paid British ones opting for the upmarket institutional product. Some operators will go on to even bigger success by creating pan-European or global products and become effectively like Hilton Hotels – so whether in Prague, Berlin or London there will be a universal high standard. Corporates will do deals with these operators, benefiting from the flexibility to transfer staff globally to major centres.

A final problem area that may not be currently on the institutions’ minds is how they eventually exit the sector. Naturally their stated aim is long-term investment, but one day they may wish or need to sell up. The blocks they are creating are purpose-built rental developments, so unlike a traditional block of flats are a bit ‘freaky’ – they will not be easily broken up and sold off as individual units. The only exit for many will be selling their bespoke buildings to fellow institutions. However if they are all exiting the sector as quickly as they are currently piling in, they may have to take huge hits on price as there may be no buyers. For the amateur landlord with an individual unit, the exit is very easy: it’s to the general mainstream property market where even in tough times, there are always buyers.

Image (c) iStockphoto