“Education is the most powerful weapon which you can use to change the world.. ”

So much stuff going on.. it’s shaping up to be a very interesting weekend. But, let me start with a diversion…

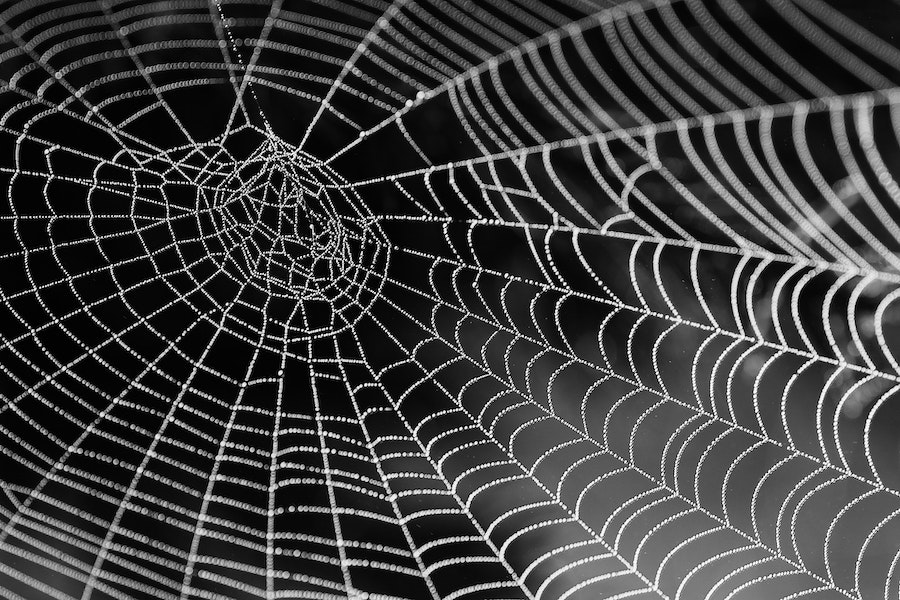

There is a story of the Great Scottish King – Robert the Bruce. Having been defeated by the English multiple times, his family captured and executed, (or in the case of his daughter, left suspended in an open cage thru the winter), his army was scattered, the clans turned against him, on his own and without any support – he was on the verge of giving up. As he contemplated a bleak future, he watched a spider struggle to construct a web in the dank cave he was hiding in. The beastie failed again and again.. Finally, Bruce reached his decision. If the Spider succeeded, he would carry on.

He went on to become Scotland’s greatest King.

Try, try, try again…? Perhaps Scotland will pull an unlikely win at Twickenham on Saturday? She-who-is-now-Mrs-Blain did warn me not to “bore everyone about Brexit…”, but needs must. Even though a No-Deal Brexit is ruled out in the short-run, where do we go from here?

Or, perhaps, Theresa May is set to surprise us all. She really doesn’t know when to give up. The scuttlebutt round Westminster is she’s going to take her Brexit agreement back to the House for a third time – and is currently scaring the Rees-Moog loonies with the threat of a long extension leading to NO-Brexit and second referendum, and the Remoaners with the threat of a short-extension leading to No-Deal Brexit. At least 70 Labour MPs want to avoid a second referendum and could, perhaps, vote with her.

Of course, my above simplistic analysis ignores the EU. “It is a very grand plan, but what about the Germans?” asked a famous Polish General in WW2… How the EU reacts to the likely request for an extension is going to be fascinating…

Meanwhile, there is a bit of a political stramash brewing in the US after a number of fund managers and “actresses” (heaven forbid) were arrested for fraudulently bribing universities to give their kids places. Some of my more “right of centre” US correspondents are full of righteous indignation that such obvious Democrats – on the basis the whole of Hollywood are goddam-lefty-commies – are dishonestly getting their kids opportunities they don’t merit. Bribery, criminal corruption, hidden influence, the haves and have nots. Oops… I think one of their heads just indignantly exploded.

But this is important stuff. Firstly, isn’t it obvious that any society with an ounce of common sense would make education the core of its development strategy? It’s the single most important factor likely to improve an economy and raise the prospects of its population. Yet, here in the UK, the government has seen fit to chain students to years of debt and penury for pretty average university courses? Its madness. In the States, its gone a step further – another way for the rich to raise themselves higher.

The fact the monied and the wealthy across US society think its somehow acceptable to pay-to-play for the top educational places and they advantages these confer for life, sums up a moral corruption and is yet another symptom of the entitlement and pernicious income inequality now at the core of the “Land of the Free”. As a chum told me yesterday: “its last stage empire” stuff. Its neither a Democrat or Republican thing – although it doesn’t help when the President is such a clearly negative role model. If its ok for the boss to lie and cheat… then what I do wrong?

(You could argue nepotism is the ultimate and absolute corruption – the rich ensuring the rich get the best of everything and deny deserving poorer folk places they’ve earned. But, where does guilt begin? What’s so different from those of us who paid over expensive school fees to give our kids the best chance in life? I could just about afford it. Single Parent in Brixton could not. My kids got a better start. Whether the Brixton kid now runs past them is entirely their responsibility now… )

Its stories like this that are stoking the inequality bonfire. If it burns out of control… then markets will have nothing to say as the global reset is pressed!

Meanwhile… in a Galaxy Far Far Away..

I will be eternally grateful if someone would translate the following into plain English: “new customer needs and market structures will force asset managers to adapt their value propositions and business models in order to remain vibrant and valuable.”

I know what I need from an asset manager: them to understand how much risk I’m willing to take with my meagre savings, make my money work as hard as it possibly can, and turn my pennies into squillions. I pay them fees to be clever.

I’ve taken that impenetrable line from a paper from a well known consultancy: “Industrial Evolution – Securing Profitable Growth in Tomorrow’s Asset Management Industry.” (There is a link to the paper on the Morning Porridge website.)

I eagerly opened it, looking for a serious market driven investigation into how pension funds will provide the returns we need for extended retirements when interest rates remain, essentially, the square root of nothing, while financial assets remain distorted and inflated by the pernicious and unintended consequences of QE, in a world where political uncertainty and the risk of wildcard populism is rising, and rising social inequality is threatening revolution and a global financial reset. More to the point, I want to know how my pension pot is going to fund my next 20 years of doing absolutely anything I want to do.. (mainly sailing and skiing…)

Instead, I found myself plodding through a sea of consultant double-speak. I scanned the report for interesting themes and came up equally baffled. I will remain ignorant of“Higher-demand investment strategies supported by strong product management and development”, of “Strong pricing policies”, “customised client experiences build with proprietary data” and the “strategic use of technology”. No doubt the BS merchants of the asset management world know exactly what these mean, and can wield them expertly in management meetings. But, I don’t think any of these strategies will make my pension pot bigger.

If new success metrics, well-articulated strategic choices, modernised operating models, cultural evolution and the usual crap about change, agile decision making, and project execution skills, will make my pension pot bigger – Excellent. Otherwise, I’d rather my fees are spent on smart investment decisions made by experts who understand markets and what they are doing, and why. In a market where most fund managers have less than 8 years tenure – and therefore just about understand how to identify when investment bankers are lying (clue – their lips move) – I seek out the smart ones who understand the real world and not what investment banks tell them. (A good example is Shard’s Rubrics AM credit fund – they got a strategy, it works and beats the herd!)

Out of time, back to the salt mines…