Summary:

With the number of BTR developments expected to increase by 180% in the next 6 years, is this a golden opportunity for developers? The REalyst takes a closer look, using the REalyse platform to find potential BTR hotsports.

Read Time: 3 minutes

Whether you’re selling deckchairs or houses, the success of any business is underpinned by demand. Right now in the UK residential property market there is more demand for homesthan there is supply. And a growing number of people demanding property are doing so in the private rental sector (PRS), which is set to represent over a quarter of UK households by 2021.

With demand comes opportunity. Many developers have started looking at Build-To-Rent (BTR) as a viable option and a strong alternative to building with the intent to sell. Not only are there financial benefits involved, but many tenants favour the BTR model, as they feel that a single company taking on full management offers a more secure way to rent.

A Different Type of Supply

BTR developments do pretty much what they say on the tin: they are private residential properties, which are designed for rent instead of sale. What started with large developments in larger cities like London and Manchester is now expanding to smaller houses and apartments across the whole of the UK.

The BTR format is proving popular with developers, who judge it to carry less risk than the ‘Build-To-Sell’ model. Developers can secure their exit strategy much earlier thanks to forward funding, thereby virtually guaranteeing their return on investment before even starting work on the project.

Using the Right Metrics

When it comes to finding a site for a BTR property, everything rolls back around to that keyword: demand. The primary aspect for developers is finding somewhere that offers the lowest chance for void periods, which is why major cities like London and Manchester still hold clout, despite the overall growing market.

The next point to take into account centres around the type of tenants that will live in the property. Those considered ‘family age’ and with a medium-to-high income are the primary target market. This demographic is also more likely to look at longer-term contracts of between three and five years – something that is becoming more familiar in the BTR sector.

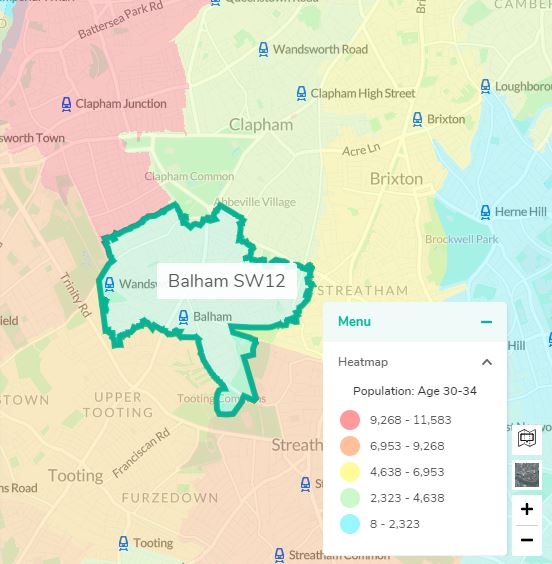

As an example, an area like Balham

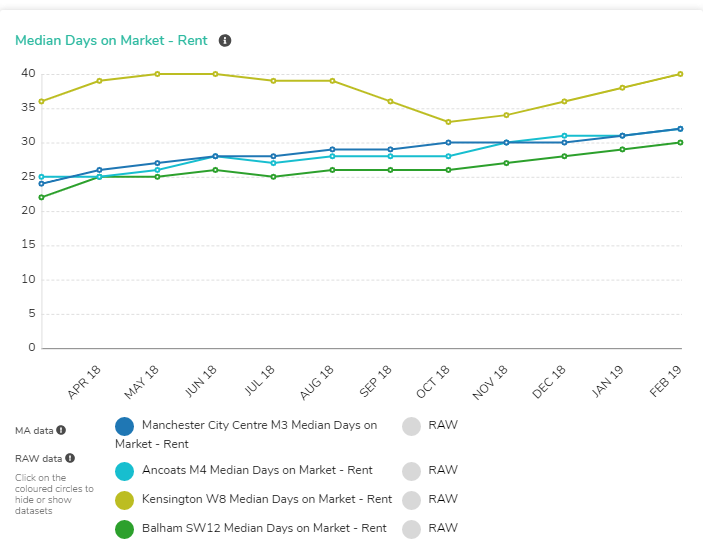

Better yet, the high percentage of rental properties has not dampened demand in the market, with such property spending comparatively fewer days on the market. Certainly when comparing the other postcodes in London and Manchester that have previously proved popular with BTR developers, Balham looks competitive.

It would appear, then, that the SW12 postcode offers the two main traits a BTR developer will look for before deciding on their next project.

What the Future Holds

An increasing number of people are being priced out of owning their own home, which means private renting has become the go-to option. With the number of BTR developments expected to increase by 180% in the next 6 years, developers have an opportunity to guarantee a return on investment and create a structure that offers a better service to the 21% (and rising) of the UK population renting property.