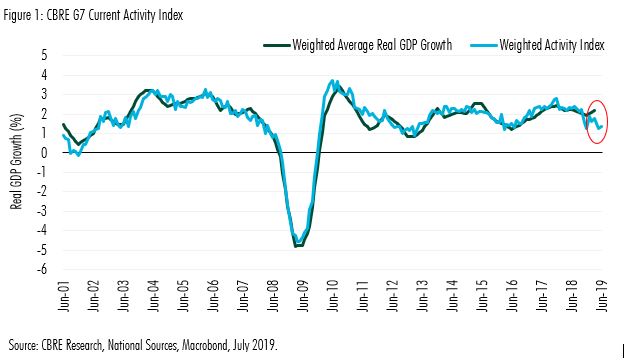

Figure 1 shows the CBRE ‘

The main developed economies (U.S.A., Canada, Japan, Germany, France, Italy, U.K.) known as the G7 have slowed sharply since the end of 2017. That deceleration appears to have ended, and there is no evidence of a drift into recession, but we should not expect rapid bounce back in activity. Most likely the developed economies will see sub-par growth for the next couple of quarters.

The Q2 GDP numbers, as foreshadowed by our own G7 indicator are likely to be weak.

The source of the slowdown is easy to locate. The central banks of America and China tightened monetary policy through 2018. The former to ‘normalize’ monetary policy and keep inflation in check, and the latter to bear down on the growth of leverage. As economic conditions worsened in the early part of the year, both institutions put policy into reverse and that has boosted equity markets. However, since then businesses have started to cut back on investment because they are unsure how the trade war will play out. If we add to this the current global decline in new car registrations, in part due to technical change, then we have serious and sustained headwind for the global economy.

It is not all bad! On the plus side, inflationary pressures are de-minimis, and central banks have indicated that monetary stimulation is available. In addition, the major economies continue to add jobs, albeit at a slower rate than before, and consumers remain confident. These factors lead us to believe that no recession is imminent.

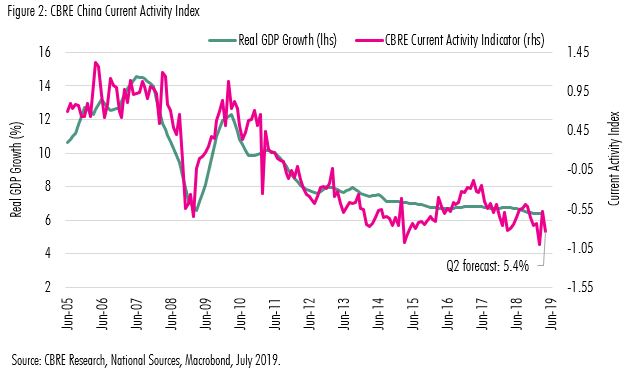

Nevertheless, risk levels remain elevated despite the recent stock market recovery. Figure 2 shows the CBRE ‘real time’ China economy tracker. Following a sharp slowdown at the end of 2018, related to policy tightening, China’s economy picked up in the first half of 2019. More recently, due to trade war effects, there seem to have been a renewed decline in activity. We do not think this will continue because of increasing levels of stimulus by the Chinese authorities, but stimulus in China may not be quite as effective as it used to be.

China, and the emerging markets which it

Whilst the global economy is not drifting into recession, it is weak, with specific weakness in the manufacturing sector. Monetary stimulus will help support activity, and the recent ‘truce’ in the trade war will also help. It is even possible to argue that the current weakness has ‘saved’ the global economy from a more serious slowdown in 2020 because it has put a stop to scheduled interest rates increase on the part of the U.S. Federal Reserve.

On the other hand, it is not easy to see where a pickup in activity will come from absent a more substantial easing of trade tensions. In fact, it has been hard to see anything other than continued sub-par economic activity. Unemployment is unlikely to rise, but the rate of job growth will slacken further.

What does it mean for real estate?

Figure 1 shows that there have been two previous meaningful slowdowns in economic activity in this current cycle. The first was associated with the financial crisis in the Euro Area, the second with the fall in oil prices which undermined non-defense capital expenditure in the U.S. and elsewhere.

In general, real estate has performed extremely well over the period, with some ebbs and flows

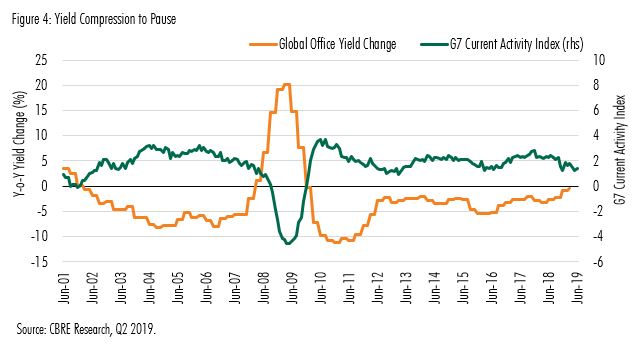

Figure 4 shows changes in our global composite office yield. Interestingly, in the last period of economic weakness, in 2016, yields compression increased, due to the fall in bond rates. We do not see further yield compression, but

In conclusion, capital value growth will ease for a while, perhaps even stall, but there will be no fall in values. Moreover, because of continued strength of the consumer economy, we don’t see a specific sector effect. If there is a downside it will be in the emerging markets and other economies linked to China.