Whilst many of us were baking in in the sunshine on bank holiday Monday, the Berlin Senate cooked up its freeze for residential rents in Germany’s capital. That rocked the sector on Monday, neutered by a dead cat bounce yesterday, and steady today. We make a few observations and highlight Vonovia:

- This is a draft proposal and it has been drawn up by one of the most strident advocates of rent control in Berlin (Senator Katrin Lompscher, Die Linke), so it should come as no surprise that it contains the strongest elements of rent control and even an absolute cap on rents that could be applied retrospectively. In other words tenants could apply for a rebate. And it is linked in some way to the age of the building which is complete nonsense and takes no account of refurbishment capex. Not only is this nonsense, it’s also against Federal law.

- So the proposed legislation is still being “negotiated” which will most likely continue through to the last day before it is put in front of the Berlin Senate on 15th October. Right now push for the most aggressive terms, but expect them to be watered down over the next month and a half. Saying it’s more severe than expected is an overreaction.

- This is primarily about politics and how to get re-elected, especially for Die Linke in Berlin – the only noteworthy stronghold it has in Germany. Others in the Senate have already asked for Lompscher to resign. But there’s no doubt we must expect this legislation to go ahead, albeit watered down from the draft proposal sent to the press on Monday.

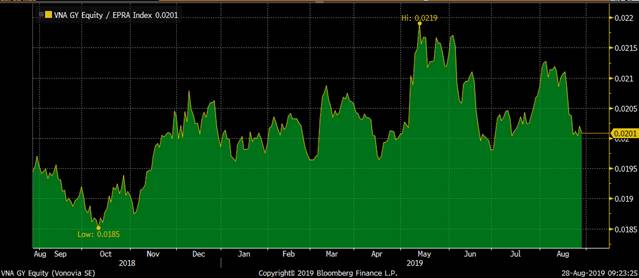

Secondly let’s look at Vonovia:

- Vonovia has quite reasonably come out and said they will anticipate the fall, not only in rental growth in Berlin but in the absolute level of rents. The company says it will take 10% off Berlin rent forecasts from the beginning of next year. Sensible planning by Vonovia and we agree that in terms of overall impact on rental income it will be in the range of 1 to 1.5%. So that’s about €20m to €30m compared to top line rental income in excess of €2bn a year.

- Vonovia has also said that consequently it will stop investing in its Berlin properties. This is significant on two fronts. Vonovia wants to send a warning message (along with other landlords) to the Senate – “be careful what you wish for”. If rents are capped at below economic levels, we won’t invest. Furthermore, the money Vonovia has invested in capex and refurbishment in Berlin is more than the amount it would lose from the proposed rent cap. Overall – it’s a zero sum game for Vonovia. In fact, because Vonovia has a diversified portfolio it can still utilise capex budgets in other regions. If the Berlin Senate doesn’t want our (shareholder’s) money, we’ll invest in Nordrhein Westphalia! And that perhaps in turn helps the (centre-right) CDU in those regions.

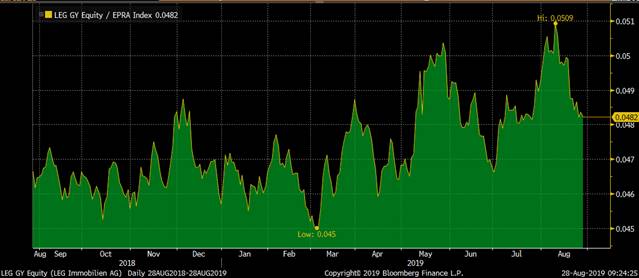

- Vonovia remains in a strong position with regards to Berlin. It could decide to “get out” altogether, but equally look at opportunistic bolt-on acquisitions. Nonetheless, it is very unlikely to bid for Deutsche Wohnen – at best it might look at the smaller listed Berlin landlord ADO Properties. Even that seems unlikely. Strategically this might in fact be the moment to swoop on LEG Immobilien, which has no presence in Berlin. Dt Wohnen is too weak to launch a counter bid and Vonovia can subsequently justify switching capex from existing Berlin properties to the new additions in NRW which would come in through LEG.

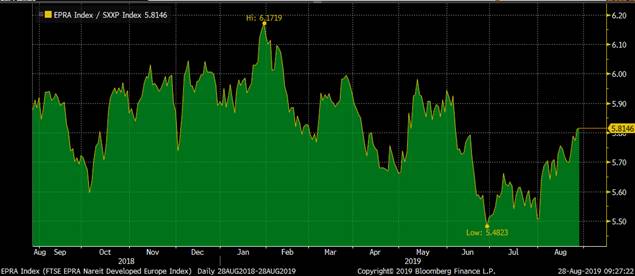

So, in the large to mid-cap German resi names we wish to highlight both Vonovia (VNA GY) and LEG (LEG GY).