Or is the whole financial orchard at risk?

In the past two months, four US banks – with combined assets of over $450 billion – have failed. Credit Suisse, the once venerable Swiss institution, also shut its doors for the last time. Yet equity markets are trading higher than they were before the onset of this banking crisis.

In 2007, Ben Bernanke, then Chair of the Federal Reserve (Fed), remarked that “the problems in the subprime [mortgage] market seems [sic] likely to be contained.”

His words aged badly – in fact, it was a central banker blooper for the ages.

Jay Powell, the current Fed chair, has not been quite so foolish. But, in his latest press conference, he strayed awfully close to the ‘bad apples’ position some market analysts have taken.

Silicon Valley Bank, Signature, Silvergate and now First Republic were all poorly run institutions, he argued, with highly concentrated customer bases and a large proportion of uninsured depositors. The US banking system, by contrast, is ‘robust’. Listen carefully and you can just about make out the quiet, but growing, chorus of voices making this case.

Despite US banks’ $2.4 trillion of reserves, the banking system could soon be stressed by a lack of high quality liquid assets.

In one sense, the system is robust. The crippling doom loop between the banks and the real economy we saw in 2008 is unlikely to feature in the coming recession: the global systemically important banks (G-SIBs) are in good shape. But the absence of a life-threatening heart attack is an odd benchmark for judging success.

We worry about something different – a violent liquidation in financial markets, partly independent of developments on Main Street. There are two obvious triggers.

First, there is the danger of an air pocket in markets when investors expect central bankers to step on the monetary accelerator, but instead the latter keep their feet firmly on the brake. High and persistent inflation has moved the monetary policy goalposts. In this cycle, central banks cannot react promptly and aggressively to signs of idiosyncratic stress in corners of the financial system. Only when market dynamics pose a systemic threat will central banks be able to override the political (and intellectual) constraints they currently face.

Second, there is the threat posed by the contraction of the Fed’s balance sheet – in particular US banks’ reserve accounts at the Fed. Despite US banks’ $2.4 trillion of reserves (about 10% of system assets), the banking system could soon be stressed by a lack of high quality liquid assets. This stress could spill over to the broker-dealers at the heart of the collateral-intensive leverage-providing financial ecosystem. And, if these balance sheets cannot flex, market liquidity could evaporate suddenly, when fear of recession starts to become a reality.

After 15 years of cheap money and permissive central banks, there are still plenty of naked swimmers yet to be exposed by the ebbing liquidity tide.

The drain on reserves is a function of two forces: active sales of US Treasury bonds and agency MBS, up to $95 billion per month; and flows to money market fund (MMFs) accounts (from US bank deposits) which are parked at the Fed’s overnight reverse repo facility.

We’ve been worried about these dynamics for some time. Now the recent wobbles in the US regional banking sector have accelerated the flow of funds from banks to MMFs, reducing the supply of liquid reserves available to the banking sector. But they have also increased banks’ desire to park cash at the Fed, because supervisors will be less comfortable with banks meeting liquidity rules by holding long-duration ‘risk-free’ bonds, as many now do in scale. Equally, the strongest banks have probably become more reluctant to recycle their excess liquidity, skewing the distribution of reserves further away from smaller lenders facing funding pressures.

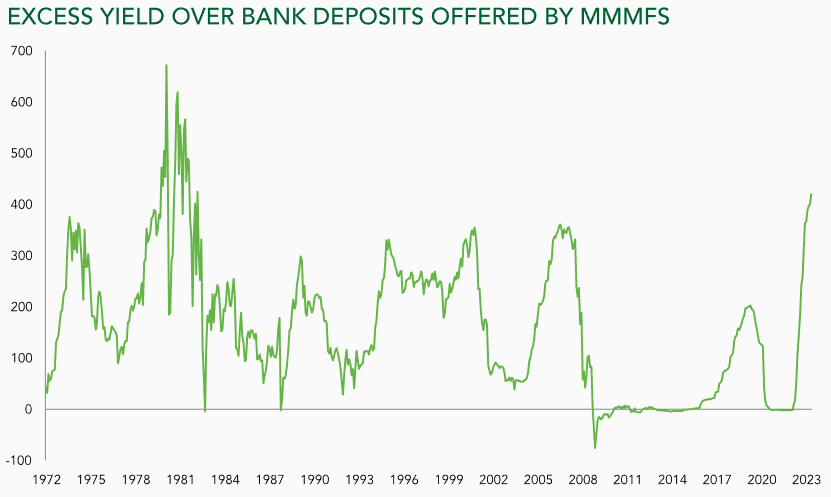

There is no magic number for bank reserves at the Fed where chronic discomfort turns into acute banking system stress. Dollar money markets malfunctioned in autumn 2019 when reserves fell to $1.4 trillion, about 8% of total bank assets. Maybe then, there is still some runway ahead, but we doubt the Fed is aware how little room for manoeuvre it has. The incentive to move funds out of banks into MMFs is greater now than at any point in four decades (see chart above). And given the lags suggested by previous hiking cycles, we are now at the point where deposit flight should accelerate. A history, one might add, that predates the era of social media and mobile banking – two technologies which have fundamentally altered the dynamics of bank runs.

This is not 2008. The worry is not excessively leveraged systemically-important banks that could bring down the system. But after 15 years of cheap money and permissive central banks, there are still plenty of naked swimmers yet to be exposed by the ebbing liquidity tide. Many already have been, but this bear market has, to date, been remarkably orderly. It is now time to brace for its next, more violent phase.

This article was originally published in Ruffer and is here republished with permission.